British Pound Falls Against Gold On Fears of New Sterling Crisis

Commodities / Gold and Silver 2010 Mar 02, 2010 - 07:57 AM GMTBy: GoldCore

Gold range traded between $1,115.00/oz and $1,120.00/oz before closing marginally lower at $1,117.40/oz in US trading. It reached as high as $1,120.00/oz in Asian trading earlier this morning. In early European trading, gold rallied to a weekly high, trading at $1,121.80/oz and in euro and GBP terms, gold is trading at €828/oz and £749/oz respectively.

Gold range traded between $1,115.00/oz and $1,120.00/oz before closing marginally lower at $1,117.40/oz in US trading. It reached as high as $1,120.00/oz in Asian trading earlier this morning. In early European trading, gold rallied to a weekly high, trading at $1,121.80/oz and in euro and GBP terms, gold is trading at €828/oz and £749/oz respectively.

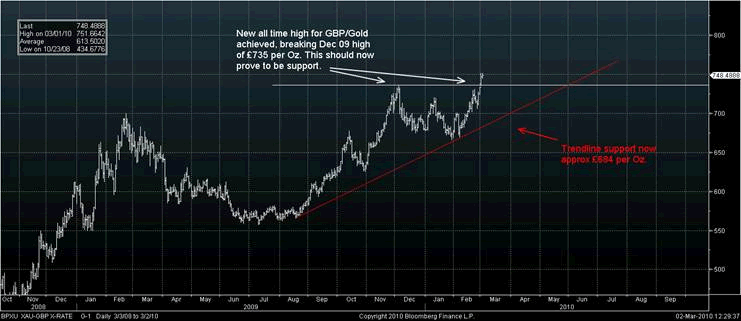

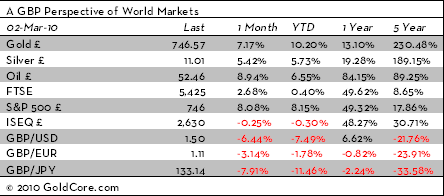

Sterling gold has reached new record nominal highs over £750/oz as concerns of a sterling crisis have seen sterling fall versus most major currencies and gold. Sterling's previous record nominal gold high was on the 3rd of December 2009 at £735/oz (inter day) and £731.59/oz (London AM fix). Sterling has fallen by more than 7% against gold and 6.4% against the dollar in the last month. Since the start of the year sterling has fallen by more than 10% against gold and by some 7.5% against the dollar (see Performance Table below).

Sterling's fall is due to fears of an election stalemate between Labour and the Conservatives and the realisation that whoever wins the election, there will have to be severe fiscal measures (in terms of cutting spending and raising taxes) in order to steady the ship that is UK Plc. UK government deficits are high and rising and this is causing concern in bond and currency markets about how these significant deficits will be funded.

There is growing doubt as to whether there will be sufficient international appetite for the scale of government debt to be issued in the coming months and years. Markets fear that the UK government will be forced to create more sterling in order to buy their own government bonds and that quantitative easing and debt monetisation may continue for longer than expected. The Bank of England continuing to punish savers with near zero percent interest rates at 0.5% while inflation appears to be looming is also contributing to concerns about a new sterling currency crisis.

Given the degree of macroeconomic risk facing economies internationally and the unprecedented fiscal and monetary responses, we are likely to see further volatility in currency markets and there is a the real risk of an international currency crisis.

Gold's finite currency credentials should continue to lead to continuing very robust investment demand , particularly from central banks, which should see gold continue to eke out gains versus the major currencies.

Silver

Silver range traded this morning in Asia from $16.33/oz to $16.50/oz. Silver is currently trading at $16.43/oz, €12.18/oz and £11.02/oz.

Platinum Group Metals

Platinum is trading at $1,554/oz and palladium is currently trading at $440/oz. Rhodium is at $2,575/oz.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.