The Dollar Nears it's Cyclical Ides of March

Stock-Markets / Financial Markets 2010 Mar 02, 2010 - 05:28 AM GMTBy: Bob_Clark

The indexes closed near the high of their monthly range. The S&P and the Nasdaq have been out performing the Dow.

The indexes closed near the high of their monthly range. The S&P and the Nasdaq have been out performing the Dow.

The transports were very strong Friday making new highs for the recent rally. The long term interest rates fell hitting levels last see two months ago, as bond prices also closed near monthly highs. You know a rising tide is lifting all boats when bonds rally, indicating a slowing economy and transports rally suggesting more products being moved and sold. Clearly the market smells a change in money flow.

Even the dollar closed at it's highs, this must be hurting the Chinese exports to Europe etc. after they benefited so strongly from their yuan/dollar peg during the dollar weakness. At a time when countries around the world want lower currency values so they can export their way out of debt, it is clear the upward revaluing of the dollar is an impediment.

The metals fought their way back up to close with small gains or losses for the month and near the top of their ranges as well. The bullish sentiment is coming back into some of the gauges such as the investor's intelligence.

It goes to show, if you throw enough money at something, it will increase in value. Correlation still rules.

I received an Email from a reader which made me realize that because I am skilled at calling the market and because these Emails are sent everyday the focus can narrow down somewhat. Exacerbating this, is the fact that we have been going sideways since October in many markets. The purpose of the advisory is to help people reduce risk and stay with the bigger trends. So if you are a "buy and hold investor" keep in mind that when I make short term calls, that it may not be applicable to your investment planning and strategy.

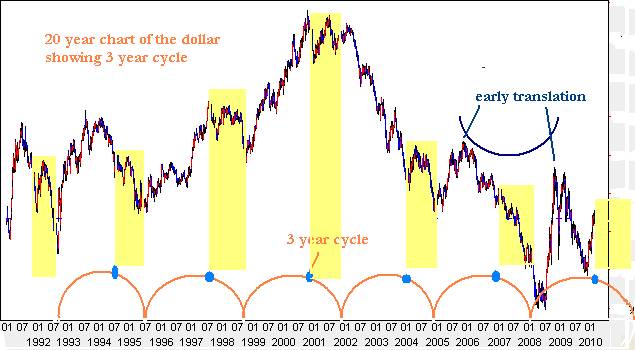

US$...below I have inserted a chart of the dollar going back 20 years. In it I have inserted the 3 year cycle which you see is very consistent. Notice that the next year plus time zone in the 3 year cycle has not been kind to the dollar over the last 20 years. It is possible that the pattern has changed and we have started a major up trend in the dollar that will cause the 3 year pattern to fail or give a late translation but we can't bet on it yet. If the normal pattern is still in force then it has bullish ramifications for stocks and the metals over the next year. It is still too early to call a top in this rally but keep this chart in mind.92

SPY...notice we really have not done much in the last 4-5 months. It has been a traders market lately and buy and holders are getting frustrated. I think this is a rest stop more than a turning point. Remember we are approaching the one year anniversary of the march low and the stock market may give us a dip in the early March time frame to acknowledge it. It would be nice to see the bullish sentiment back off one more time, it is the only thing making me nervous right now. If we are going to get a c leg down in this correction we need to do it soon. I am trading both sides of the market as we try to get traction.

SPY...notice we really have not done much in the last 4-5 months. It has been a traders market lately and buy and holders are getting frustrated. I think this is a rest stop more than a turning point. Remember we are approaching the one year anniversary of the march low and the stock market may give us a dip in the early March time frame to acknowledge it. It would be nice to see the bullish sentiment back off one more time, it is the only thing making me nervous right now. If we are going to get a c leg down in this correction we need to do it soon. I am trading both sides of the market as we try to get traction.

XIU...no chart...The xiu is is being buoyed by the commodities and the U.S. stock indexes. It seems to have made a good low but it too could be influenced by the psychology of a March low as well.

GLD...if we are going to go up in gold we need to to see some convincing buying over the next week. A wave C down in the stock indexes will put a damper on this rally but for now I am bullish because of the seasonals and the chart. Buy dips as long as last weeks low is intact, and when I say buy the dips I am not recommending short term trades, sit tight and see what happens. We should see 117 but use a stop loss.

SLV...remains in a bullish mode as well, what I said about gld applies here but because of the commercial positions as show in the latest Commitment of traders report (posted on my blog), I favor slv over gld. Again, buy dips as long as last weeks low holds. Look for 18 if it does.

We have moved our stop up to 14.90 on original positions bought at 14.45 which is a long term trade

GDX...because markets are so correlated, gold stocks will be at risk of a March c wave in the general indexes, just as the metals are but seasonal factors remain positive for a while. A failure now would call the bigger cycles in the metals into question. The juniors I follow are lagging which is a worry.

TLT...I put in a chart of the yield ($TYX) tonight instead of the bonds themselves to show how rates have dropped. Rates need to keep falling to help our cause on the metals. The markets seem to be smelling a fresh round of quantitative easing not yet visible.

Like the dollar chart above we are fast approaching the time when the metals and their stocks turn and make seasonal yearly lows. We must remain aware of the possibility that we fail in an attempt to breach recent highs and defend against a sell off with well placed stop loss protection. The same logic applies to the markets in general. The fed for some reason has been letting the M2 money supply shrink and if this continues it will be hard to press all markets higher.

This week should either see a high water mark for price or we pop. Beware the ides of March or at least be aware of it.

Bob Clark is a professional trader with over twenty years experience, he also provides real time online trading instruction, publishes a daily email trading advisory and maintains a web blog at www.winningtradingtactics.blogspot.com his email is linesbot@gmail.com.

© 2010 Copyright Bob Clark - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.