The Real Cause of Hyperinflation

Interest-Rates / HyperInflation Mar 01, 2010 - 09:40 AM GMTBy: Jordan_Roy_Byrne

In his weekly letter, John Mauldin concluded that we have not experienced hyperinflation (despite massive Fed “printing”) due to the fact that the money multiplier has fallen and fallen below 1.0. This means that for each additional $1 added to the monetary base, the money supply is changing by less than $1. In other words, banks are not lending and so the velocity of money is declining.

In his weekly letter, John Mauldin concluded that we have not experienced hyperinflation (despite massive Fed “printing”) due to the fact that the money multiplier has fallen and fallen below 1.0. This means that for each additional $1 added to the monetary base, the money supply is changing by less than $1. In other words, banks are not lending and so the velocity of money is declining.

This is correct as to why we don’t have REFLATION.

There is an important difference between REFLATION and HYPERINFLATION.

Reflation occurs when inflationary policy is successful. Examples of this include 1933-1937, 2003-2007 and to some degree, 2009. In a reflationary period, Commodities outperform everything, including Precious Metals.

Mauldin and many others make the assumption that hyperinflation can’t occur without some kind of economic demand. It is the mainstream theory that money has to make its way into the economy (via bank lending and then business investment or consumption) for price inflation to occur.

The private sector or even the Federal Reserve isn’t the root cause of hyperinflation. Hyperinflation occurs when a country’s bond market breaks. In other words, the sovereign nation is no longer able to fund itself. Its bonds fall (yields rise) to the point where the government has to print money or default. Rising interest rates cause the interest payments to consume too much of the overall budget. The government or central bank then begins to print money to fund its deficit. Then the citizens start to consume, knowing the currency is rapidly losing value. Demand has nothing to do with the cause or the onset of hyperinflation.

Why didn’t Japan have hyperinflation in the 1990s? It didn’t have to monetize its debt. It had the internal savings to be able to finance its budget. The same thing is true with the United States in the 1930s. Even though we devalued the currency, the bond market remained strong into the early 1940s, thus preventing runaway inflation.

The catalyst for severe inflation globally is the breaking of many bond markets. The UK, Japan and the US won’t be able to finance their budget gaps without monetization. The budget deficits are now larger and they come at a time of reduced global liquidity and reduced tax revenues. Global monetization will lead to severe inflation.

The other point to make about severe or hyperinflation is the fact that it doesn’t come about steadily. The preconditions and causes are all the more subtle as hyperinflation occurs suddenly or dramatically.

Will we have real hyperinflation in the US? I don’t believe so but I believe we will have severe inflation. We are fortunate to have the largest and most liquid bond market. At the very least, other nations are more likely to see their bond markets break ahead of the US.

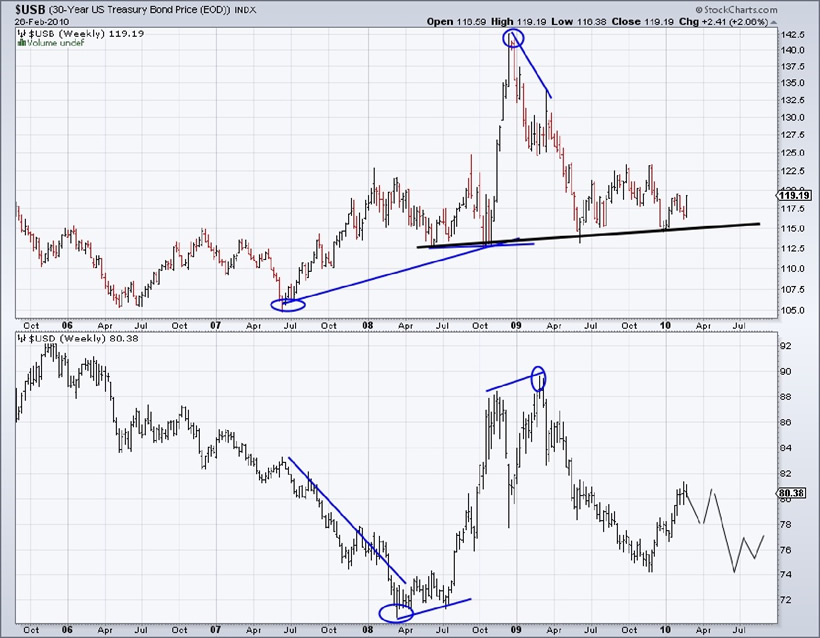

As we take a look at the 30-year Treasury, it is important to note that Treasuries have been leading the US dollar. Treasuries rallied in 2007-2008 as the greenback fell to a new low. Eventually, the greenback turned. Treasuries peaked in December 2008 and fell considerably. The dollar peaked in March and fell quite a bit. The action in the Treasury market will determine the action in the buck.

As we close, it is important to note that Precious Metals and the shares outperform during times of credit stress. Notice how well they performed in 2001 and 2002 as well as at the end of 2008 and early 2009? When the banks start lending and the money moves into the economy, then you will want to be invested in Commodities more so than Precious Metals.

The credit crunch is now affecting governments as they took on private sector debts and ramped up their spending. Deflationary forces, which affected the private sector, are now plaguing the public sector. The inability of various sovereign governments to be able to finance their obligations is what will drive severe global inflation. It is not bank lending or rising velocity of money. Those things are secondary and more pertinent to Reflation.

If you would like some guidance on how to profit and protect yourself from the coming events, then consider taking a 14-day trial to our premium newsletter at the link below.

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.