Nine Shocking Forecasts for Stocks, Gold, Economy and Financial Markets for 2010-2012

Stock-Markets / Financial Markets 2010 Mar 01, 2010 - 08:27 AM GMTBy: Martin_D_Weiss

We have just ended an online video conference to brief investors on major events that could forever change your future.

We have just ended an online video conference to brief investors on major events that could forever change your future.

We made nine new predictions to pinpoint, as accurately as possible, how and when that future is likely to unfold.

We showed how to build — or rebuild — an entire portfolio with a disciplined approach that gives you the specific percentages to put into each major asset class right now — stocks, gold, commodities, bonds, and currencies.

And unlike any of our prior events, we took questions from a live audience.

Here’s the transcript …

Nine Shocking New Predictions for 2010-2012

With Martin Weiss, Richard Mogey and Monty Agarwal (Edited Transcript)

Martin Weiss: The forecasts we made last year are striking at an accelerating pace, as three new and dangerous crises have raised their heads:

First, the White House has announced federal deficits that are far worse than any prior estimates — $1.6 trillion for 2010 … $1.3 trillion for 2011 … and continuing massive deficits for the entire decade.

This is already sending shock waves of fear throughout the globe. It has prompted Moody’s to issue a stern warning about America’s credit rating. And it’s raising the specter of a global collapse in long-term sovereign debt. In a moment, we’ll take a look at the enormous implications this has for your finances and investments.

Second, global investors are attacking. They’re scanning the globe for the weakest links — the countries with the biggest deficits — and they’re dumping that country’s assets. First, they attacked Greece. Then they attacked Portugal and Spain.

Inevitably, they will also unleash their fury on the one country in the world with the biggest deficits of all: The United States of America. And in a moment, we’ll see how these attacks now threaten every dollar you have saved and invested.

Third, we have an unprecedented crisis of confidence among U.S. taxpayers and investors. For the first time in our lives, millions of U.S. citizens are taking to the streets in protest — openly rebelling against Washington! Millions of Americans are fed up with bungling politicians, bureaucrats, and bankers.

Investors are saying:

“You tricked me once — into buying tech stocks with no earnings; those stocks crashed and cost me a bundle. You tricked me twice — into buying real estate and that cost me even more.

“Now, I’m madder than hell and I will never trust Washington or Wall Street ever again! I must have an objective scientific, unbiased way to protect myself and make money.”

So, the questions we must address now are twofold:

- How can you know, with confidence, which asset classes offer you the greatest profit potential moving forward?

- How can you create a bullet-proof portfolio that gives you world-class profit potential no matter what Washington and Wall Street do next?

For the answers, I turn to the Foundation for the Study of Cycles, a nonprofit research think tank, founded 70 years ago in the wake of the Great Depression.

This Foundation was sponsored by the head of the Smithsonian Institute, by the chairman of the Carnegie Institution, by the founder of the National Bureau of Economic Research, and by the founder of Fidelity Investments. Former President Hoover and former Vice President Charles Gates Dawes also supported the Foundation.

Since 1940, the Foundation for the Study of Cycles has studied the recurring patterns of history — cycles.

Since 1950, it has identified cycles that predicted — well ahead of time — nearly all major market turns in stocks, bonds, and commodities.

And since 1971, when the gold standard and fixed exchange rates ended, it has done the same for foreign currencies and gold.

Joining us today is Richard Mogey, Research Director of the Foundation.

|

Richard, you are the Research Director of the Foundation and have been with them for many years.

Richard Mogey: Twenty-two years!

Our research is based on the simple fundamental principle that all of nature — and most of history — is driven by regular cyclical patterns.

Martin: But identifying those cycles is not so simple.

Richard: No. We have sorted through historic data going back 5,000 years, and we have put together data series on most major markets going back at least 300 years.

Martin: And back in the 1960s, long before Microsoft and PCs, you used Fortran programs on mainframe computers to find the most critical cycles for each major market — all of which you’ve published, starting a half century ago.

Richard: Yes. And you asked me recently how accurate the Foundation’s cycles have been in forecasting stocks, gold, etc.

Martin: But to answer that question, you didn’t have to recreate hypothetical scenarios or engage in 20/20 hindsight.

Richard: No. I just went back to the archives of our printed publications. They were all published in real time. I have them right here.

Martin: Great. So what’s your answer?

Richard: The Foundation’s cycles have accurately identified nearly every major shift in market direction … in every one of these asset classes … in advance … since 1971.

|

Martin: We’ll look at those in a moment. But right now, let’s focus on the main questions readers are asking on our blogs: What are the major market turns ahead? And how can investors build a sturdy portfolio designed to convert those market turns into wealth?

Richard: I will answer the first question. But I am a scientist — not an investment analyst. So I’m not the right person to answer the second question.

Martin: Which is why I’ve also invited Monty Agarwal to join us. Monty has run three global hedge funds, and he has done so without a single losing year. He has just written a book on what the hedge funds have done wrong — and what they must do to get it right.

|

Monty Agarwal: Martin, the key is to buy the right market research. And of all the Doubting Thomases in the world, I am probably one of the most skeptical. I always conduct my own personal due diligence before I buy anything. You’ve asked me to analyze the Foundation’s research, and I’ve done so with great interest.

The Foundation’s accuracy rate is far superior to any other approach I’ve ever seen. Its work is not perfect, of course. There are a few misses. But the Foundation’s cycles pinpointed, well ahead of time, the onset of the giant bull market that began in 1980.

Martin: You’re talking about the stock market.

|

Monty: Yes. The Foundation predicted the timing of the Crash of ‘87. It predicted the timing of the bear market of 2000-2002. It predicted the market’s rise through 2007. And it nailed the top of the market prior to the big plunge in 2008 …

Richard: which, by the way, was a market call we published in Barron’s online.

Martin: Is this the Barron’s article where you called the big plunge in 2008?

Richard: Yes.

Monty: Not many people caught that decline, let alone to the month.

Plus, in March of 2009, the Foundation’s cycle work anticipated an intermediate rally.

Prediction #1 Starting this year, most U.S. stocks are likely to fall in a zigzag pattern for nearly three long years!

Richard: And now, we have a new signal. Most U.S. stocks are likely to go down. And they are likely to fall — in a zigzag pattern — for nearly three long years.

Monty: In the past, almost every recession and bear market in this country delivered solid values to investors. We saw price-earnings ratios (P/Es) in single digits. We saw great stocks selling for five or six times earnings. But this time, the government was so panicked, it never let that happen. And now P/Es are already back up again to grossly overvalued levels.

Richard, you’re talking about giant swings. For a long-term buy-and-hold strategy, those swings are a disaster. But with a more flexible strategy, they can generate giant profit opportunities — in both directions.

Martin: Can you be more specific?

Monty: Go back 10 years and assume you had been following the Foundation’s cycle research before 2000. You could have sidestepped the Tech Wreck that destroyed so much wealth. Plus, you could have pulled out a 37 percent profit from that decline. Then, if you followed its research in 2003, you could have moved back into the S&P and come out with a 146 percent gain from 2003 to 2009.

Martin: What about more recent years?

Monty: Same pattern. If you had used its research published before 2008, instead of the wipe-out losses that most investors suffered, my data indicates you could have made a 37 percent profit. And in 2009, based on the Foundation’s call for an intermediate rally, you could have made another 42 percent profit.

Martin: And going forward?

Monty: Do not expect a similar pattern.

Martin: Why not?

Richard: Because if our cycle work is even halfway right, conditions will change, and investors could make as much — or more — money in other asset classes.

Martin: Instead of stocks?

Richard: Gold! Never before in the history of civilization have we seen a world power like the United States with its finances in such disarray as they are now.

Martin: We’ve seen world powers rise and fall — from Rome to Spain to Britain. And we’ve seen them incur big debts after their decline.

Richard: Yes, but now we have a country that is both the dominant world power and the world’s largest debtor at the same time. This is a massive force that could propel the price of gold.

Martin: When and how far?

Prediction #2Gold will skyrocket far higher than $2,000 per ounce by the end of 2011.

Richard: By the third or fourth quarter of 2011, the price of gold should be far higher than $2,000 per ounce.

Martin: Why is this so shocking?

Richard: Because it’s going to happen in the midst of a sinking stock market and economy.

Monty: I don’t think that should come as such a surprise, either. In the last few years, despite two big stock market declines and despite the worst recession since the Great Depression, gold quadrupled in value.

No one knows for sure what the future will bring. But I would take the Foundation’s gold forecast very seriously.

Its cycle work predicted the great bull market in gold of the 1970s.

It predicted gold’s downturn starting in the 1980s.

And it would have got you back into gold in 2001 … urging you to hold on ever since.

Richard: This has been — and should continue to be — one of the greatest profit opportunities of all time.

Martin: We have a question on this that’s very relevant …

Audience: My name is Elizabeth and I am from Fort Lauderdale. My question is: Much has been talked about gold, but what is your opinion on investing in silver?

Richard: In terms of timing, it never ceases to amaze us how closely all precious metals track gold — not only silver, but also platinum and palladium. The differences are strictly an issue of how far each metal rises or falls. Between now and 2012, there will be periods when silver and other metals do better than gold. But when all is said and done, you will find that gold is, by far, the single best performer because of its value as a hedge against the dollar.

Martin: What’s behind this cycle in gold?

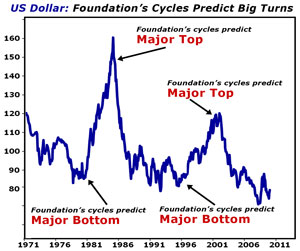

Richard: It parallels the cycles in the U.S. dollar. And for the dollar — or for proxies of the dollar — we have cyclical data going all the way back to 1680.

|

Martin: Before the dollar even existed!

Monty: I have scrutinized the Foundation’s dollar research just as closely as its stock market research.

Its cycles predicted the dollar’s plunge from 1971 to 1980 … the dollar’s surge peaking in 1985 … the dollar’s decline bottoming in 1992 … the dollar’s rally through 2001 … and then, the big plunge since.

Richard: And now, the dominant cycle in the dollar is forecasting the next major move.

Prediction #3 The U.S. Dollar Index will begin to sink in 2010 and will not hit bottom until early 2012.

Richard: A major, new dollar decline, beginning in the third quarter of 2010 and ending in early 2012.

Monty: Currencies are not a beauty contest. They’re an ugly contest. And among many ugly currencies, the dollar usually wins the prize — as the ugliest.

Richard: The real decline in the dollar — and all currencies — will show up more clearly in the doubling of the value of gold we just talked about. Measured against gold, the dollar’s purchasing power will fall by half or more, depending, of course, on the intensity of the global selling that hits the greenback.

Martin: What about oil and other commodities?

Prediction #4 Most commodities will not make new, all-time highs!

Richard: Oil will not return to its all-time highs. Unlike gold, it is driven less by currency disasters and more by consumer or industrial demand. And we simply do not see high demand being sustained through this period.

Martin: So it would be a mistake to overinvest in commodities right now.

Monty: I agree.

Martin: Most commodities won’t surge because …

Prediction #5 The U.S. economy will suffer a severe double-dip recession in 2011!

Richard: Because the U.S. economy will sink into another recession.

Martin: Similar to the recession of 2009?

Richard: Probably worse!

Martin: Again, the timing question: When?

Richard: Not right away. Our cyclical data on GDP and on consumption points to a material improvement in the U.S. economy through the first two quarters of 2010.

But starting in the second half of 2010, GDP growth will start to sink fast and we could see negative growth by the beginning of 2011. The worst period for the economy will hit in the fourth quarter of 2012.

|

Monty: You don’t have to look very far to see the reasons: You have unemployment holding at extremely high levels. You have scarce capital, with lending to households and corporations drying up. You have consumers, businesses, and now even governments strapped for cash.

Martin: That’s an understatement! Look at what’s happening in Greece, Spain, Portugal, and even the UK — and that was despite all the stimulus and bailouts …

Monty: No! Because of all the money they’ve spent on bailouts!

Martin: Right.

Monty: Remember. These are no longer just private banks or automakers going under. They are entire countries!

Martin: Plus, you don’t have to connect many dots to see the consequences of a recession. Right now, the Obama administration says the 2010 federal deficit will be $1.6 TRILLION. Care to guess what the government forecast was for this same deficit back in 2008?

Monty: A lot less, I presume.

Martin: Mike Larson looked back at the forecast made by the Congressional Budget Office (CBO) just two years ago, in 2008. The CBO predicted that the U.S. deficit for this year — for 2010 — would be $249 billion. Now, it’s coming in at $1.6 TRILLION, or over six times more than they forecast.

Monty: They didn’t expect the deep recession that struck in 2009.

Martin: Much like they’re not expecting a double-dip recession to strike next year! My point is that, just like their forecast was dead wrong for this year, it could be dead wrong again in coming years.

Prediction #6 The U.S. budget deficit will surpass $2 trillion in 2012!

Look at 2012! For that year, the Obama administration is making some aggressively optimistic assumptions for the U.S. economy and forecasting a deficit of $828 billion. Instead, with the economy sinking, it could be over $2 TRILLION!

Monty: Some people may think these huge blunders merely reflect the government’s forecasting errors. But it’s much more than that. Politicians know they’re rigging the numbers. And they’re swearing on a stack of Bibles that it’s an honest estimate.

Prediction #7 Bond prices will plunge because of out-of-control deficits and a sinking dollar!

No matter what, the big risk is that global investors will sell U.S. dollars wholesale. And they can’t sell them in a vacuum.

Along with the dollars, they also have to sell the assets where they’re holding the dollars — especially long-term Treasury bonds. So you could see a massive plunge in bond prices.

Martin: Translate that into bond yields.

Monty: You’ll see a major spike upward in yields. That could give investors a huge buying opportunity to lock in those higher yields for years to come — provided, of course, price inflation does not run rampant and the U.S. government is still a safe bet at that time.

Richard: The U.S. government — and, indeed, America — faces a great historic test: A test of our power — and our willpower — as a nation.

Martin: Please explain what you mean by that with respect to cycles.

Prediction #8 2012 will be the year of maximum turmoil in markets and peak tension in society!

Richard: The great test for our country — an Armageddon of sorts — will come in the year of maximum turmoil in the financial markets, the time of peak tension in society: 2012.

Martin: I assume this has nothing to do with the movie by that name, based on ancient forecasts.

Richard: Of course not! We’ve had 2012 pegged as the year of the “Perfect Storm” since 2002.

Martin: What’s the basis of the perfect storm?

Richard: A convergence of cycles! We have the dollar cycle, stock market cycles, consumption cycles, and GDP cycles all bottoming in this same approximate time frame — between late 2011 and late 2012. Plus, 2012 is also smack dab in the middle of a sweeping transition already under way in our longest term and probably most important cycle of all.

Martin: Which is?

Richard: The 500-year geopolitical cycle. We’ve mapped it all the way back to 670 BC. It is a broad, far-reaching shift in power, wealth, and money — from East to West, or, as is the case now, from West to East.

Martin: We’ve talked about that before.

Prediction #9 2012 will bring a massive wealth shift from old fortunes that are destroyed to new ones that are created!

Richard: Yes, but I want to add that we’re not only talking about a power shift from West to East. We’re also talking about a major wealth shift from old fortunes that are destroyed to new ones that are created … from countries, companies, and families that were dominant for many decades to new ones that replace them on the other side of this massive upheaval!

Martin: Provided they are well prepared ahead of time.

Monty: And provided they use reliable signals with prudent risk control. No matter what you invest in or how you invest, the real possibility of losses is something you always have to be aware of.

Martin: Yes! On our blog, though, many readers tell us they make decisions largely based on gut, which implies not only analysis, but also intuition — and emotion. They admit that, more often than not, that’s their basis for deciding how much to invest in each asset class and when.

What would be your standard allocation to those five asset classes, based on your analysis of the Foundation’s work?

Step 1 Diversify Across All FIVE Asset Classes

Step number one is to diversify across all FIVE asset classes — stocks, precious metals, other natural resources, bonds, and currencies.

Martin: Years ago, it would have been virtually impossible for the average investor to do that. You’d need a lot of money or you’d have to take a lot of risk — with futures, in the currency markets.

Monty: Today, all five of these asset classes are readily available to average investors through hundreds of exchange traded funds — ETFs.

Martin: And, of course, you can also choose from thousands of mutual funds, tens of thousands of individual stocks, hundreds of thousands of bonds.

Monty: Yes. But this step alone — diversification — puts you heads and shoulders above investors stuck in stocks or bonds alone.

Audience:The subject is diversification. The more I hear that, the more it bothers me. Because that tells me that if I am investing in, say, five different major areas, I will probably have four losses and only one win.

Monty: Let me address that by telling you how Wall Street works. Wall Street touts diversification as if it were a panacea. But their notion of diversification is spreading your money among several different U.S. stock sectors. That’s not going to work because nearly all stocks are linked in some way. In a truly diversified portfolio, stocks are just ONE of five asset classes.

Martin: Plus, Wall Street still seems to assume we’re back in the 20th Century when bull markets were long in duration and bear markets were short. That’s not the case today.

Step 2 Take Advantage of DOWN Markets!

Monty: That’s the key to step number two. In today’s era, especially as we head toward 2012, if you want to make money, you must not rely exclusively on up markets. You must also take advantage of down markets.

Martin: That also used to be very hard for the average investor to do. You had to sell short.

Monty: Not anymore! In every one of the five asset classes, ETFs are readily available whether you want to profit from rising prices or falling prices. You never sell stocks or commodities short. Your goal is strictly to buy them low and sell them high, like any ordinary stock.

Step 3 Diversify Dynamically!

Step number three is to diversify dynamically. Don’t just keep a fixed amount of money in every asset class all the time. Sometimes, you’ll want a lot more; sometimes, a lot less.

For example, if the Foundation’s signals say gold is going to greatly outperform stocks and bonds, you may need to double the percentage of the portfolio in gold. Or let’s say we see a major decline coming in long-term bonds. You’ll probably want to clear out of long-term bonds entirely.

Step 4 Periodically Rebalance Your Portfolio!

The next step is to periodically rebalance the portfolio. Hypothetically, let’s say you go ahead and double the gold allocation from 10 to 20 percent. Then, let’s say gold itself doubles in value. You could find yourself with 40 percent of your portfolio value in gold.

Martin: That’s a good problem to have.

Monty: Yes, but you still have to DO something about it! You can’t sit back passively while a major market move — up or down — upsets the balance in your portfolio. That’s where periodic rebalancing comes into play. You sell on strength and you buy on weakness. But you do so intelligently. Not based on a whim.

Step 5 Risk Protection

Step five is risk protection.

Martin: Don’t you get a good measure of risk protection with the broad diversification across the five asset classes and with the portfolio rebalancing?

Monty: You do. But for an additional layer of risk protection, you also need stop-loss mechanisms. If you’re wrong about a particular stock, bond, or ETF, you have to set a clear limit on how far you’re willing to be wrong. If it surpasses that limit, you need to get out right away.

Plus, let me say one more very important thing: I respond promptly to major market turn signals. And I don’t shift just small amounts of funds. Gradual, incremental shifting is the right thing to do in a conservative, slow-moving model portfolio. But that’s not what I do, especially when I have clear, strong signals like these we’re getting from the Foundation. When I get a major signal, I move, and I do so very quickly.

Martin: Assume you used the Foundation’s signals and your five steps for building a portfolio. Please share with us now what the results could have been.

|

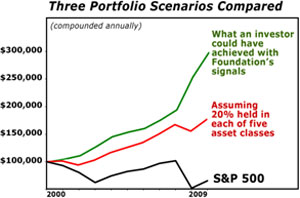

Monty: Let’s say you started at the beginning of 2000 with $100,000.

The black line on this chart shows the results you would have achieved simply by buying and holding the S&P. Result: You would have lost $14,000.

Martin: And that’s despite tying up your money for 10 years, despite all of Washington’s efforts to save the economy.

Monty: Correct. Now, assume you took this one step further. You blindly invested 20 percent in each of the five asset classes we’ve been talking about. No intelligence. No change. That step alone could have transformed a 14 percent loss into a 61 percent gain.

Martin: The red line in the chart.

Monty: Right. But it’s the green line that I want you to focus on. It shows what happens when we add the intelligence from the Foundation and the simple steps I just talked about. In this scenario, instead of a 14 percent loss, you could have seen a 111 percent gain. While investors in the S&P 500 were losing $14,000, you could have made $111,000.

Martin: That’s past. What about the future?

Monty: What happens in the next 10 years will inevitably be different from what happened in the last 10 years. That’s all the more reason you must not lock yourself into a blind, fixed allocation that cannot adjust to changing conditions.

Martin: Please also show us your analysis going back further in time, including all kinds of market conditions.

Monty: Sure. Overall, since 1971, our approach could have multiplied your money more than 25 times over — enough to turn $100,000 into more than $2.5 million. That’s four times better than the S&P 500.

Moreover, since 1992, we’re talking about 18 consecutive winning years, in a wide range of conditions — in inflation and deflation, in bear markets and bull markets, during economic booms and busts. All with no debt! No options. No leveraging.

Martin: Don’t you like leverage?

Monty: I do in other circumstances. But in this program, I assume none whatsoever. If you can achieve relatively rapid and consistent growth without leverage, why be greedy?

Martin: What would be the standard amounts you would allocate to each asset class?

Monty: I would allocate 30 percent of the money to the asset class “stocks,” with a very substantial allocation to inverse ETFs to profit from a decline in stocks.

Martin: What about bonds?

Monty: 10 percent, mostly short term.

Martin: Gold?

Monty: 15 percent.

Martin: Energy and other commodities?

Monty: Also 15 percent — but carefully selecting the commodities most likely to benefit from growth in major emerging markets.

Martin: What else?

Monty: The last asset class is currencies. That’s very important and has a very clear long-term trend. I’d bet against the dollar with 30 percent of my money — but not in the euro or any country with oversized deficits.

Bear in mind that some major new forces are now ready to hit markets. So these allocations may change pretty significantly when I release them.

Audience: With the declining value in the dollar, what are the best currencies to invest in?

Monty: The currencies I would pick are the currencies that benefit from the growth in the emerging markets. For example, I like the Aussie dollar and the Canadian dollar.

Audience: I understand that the Foundation has a great track record and an impressive history. My question is: Why haven’t we heard of you before?

Richard: For 60-plus years, we have been studying cycles without any marketing. We are terrible at marketing. But I think we are great scientists.

Martin: Thank you, Richard. And thank you, our viewers, for joining, and have a great day!

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.