The Axis of Greed, The Nature and Structure of the Economic Elite

Politics / US Politics Mar 01, 2010 - 03:36 AM GMTBy: Global_Research

David DeGraw writes: This is the third-part of a six-part report. Part one can be viewed here, part two here.

David DeGraw writes: This is the third-part of a six-part report. Part one can be viewed here, part two here.

“The money powers prey upon the nation in times of peace and conspire against it in times of adversity. It is more despotic than a monarchy, more insolent than autocracy, and more selfish than bureaucracy. It denounces as public enemies, all who question its methods or throw light upon its crimes… As a result of the war, corporations have been enthroned and an era of corruption in high places will follow, and the money powers of the country will endeavor to prolong it’s reign by working upon the prejudices of the people until all wealth is aggregated in a few hands and the Republic is destroyed. Abraham Lincoln

U.S. Elite

Institutions:

Federal Reserve

Business Council

Bilderberg Group

Conference Board

Brookings Institute

Advertising Council

Heritage Foundation

Trilateral Commission

Business Round Table

Chamber of Commerce

Federal Trade Commission

Council on Foreign Relations

American Petroleum Institute

American Enterprise Institute

American Bankers Association

Pharm Research & Manufacturers

Public Relations Society of America

American Psychological Association

Project for a New American Century

Securities and Exchange Commission

Committee for Economic Development

National Association of Manufacturers

Carnegie / Ford / Rockefeller foundations

Military / Media / Prison Industrial Complex

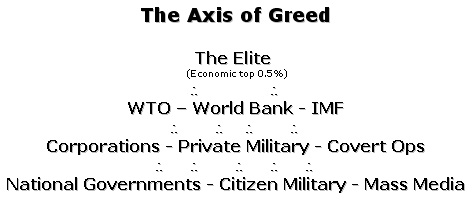

I don’t view the Economic Elite as a small group of men who meet in secrecy to control the world. They do feature elements of conspiracy and are clearly composed of secretive organizations like the Bilderberg Group - this is not a conspiracy theory, this is a conspiracy fact - but as a whole the Economic Elite are primarily united by ideology. They’re made up of thousands of individuals who subscribe to an ideology of exploitation and the belief that wealth and resources need to be concentrated into the fewest hands possible (theirs), at the expense of the many.

That being said, there are some definite lead players in this group and it is important that we are not too vague and expose the individuals who publicly lead them. Focusing on the fundamental structure of the US economy, we have people like Hank Paulson, Tim Geithner, Ben Bernanke, Robert Rubin, Larry Summers, Alan Greenspan, Lloyd Blankfein, Jamie Dimon, John Mack, Vikram Pandit, John Thain, Hank Greenberg, Ken Lewis, John J. Castellani, Edward Yingling and Tom Donohue.

In total, the Economic Elite are made up of about 0.5% of the US population. At the center of this group is the Business Roundtable, an organization representing Fortune 500 CEOs that is also interlocked with several lead elite organizations. Most Americans have never heard of the Business Roundtable. However, in my analysis, it is the most influential and powerful Economic Elite organization.

“The Business Roundtable joined the Business Council at the heart of both the corporate community and the policy-formation network and now has the most powerful role…. The Roundtable’s interlocks with other policy groups and with think tanks are presented [below].” G. William Domhoff, Who Rules America?

The Roundtable’s first year of operation was 1972, which coincided with the beginning of the CEO salary explosion, and has been the driving force behind the unprecedented concentration of wealth since their inception. Their dominance over the US economy and government is unparalleled. Their members are a Who’s Who of everything that is wrong with our economy. Here is a partial list of some of their lead members:

——-Lloyd C. Blankfein, Goldman Sachs

——-James Dimon, JPMorgan Chase & Co.

——-James P. Gorman, Morgan Stanley

——-Vikram S. Pandit, Citigroup, Inc.

——-Brian T. Moynihan, Bank of America

——-Brendan McDonagh, HSBC

——-Robert W. Selander, MasterCard Incorporated

——-Kenneth I. Chenault, American Express Company

——-Rupert Murdoch, News Corporation

——-Glenn A. Britt, Time Warner Cable Inc.

——-Philippe Dauman, Viacom, Inc.

——-Jeffrey R. Immelt, General Electric Company

——-Brian L. Roberts, Comcast Corporation

——-Steven A. Ballmer, Microsoft Corporation

——-John T. Chambers, Cisco Systems, Inc.

——-Randall L. Stephenson, AT&T Inc.

——-Ivan G. Seidenberg, Verizon Communications

——-David G. DeWalt, McAfee, Inc.

——-Steven R. Loranger, ITT Corporation

——-Paul T. Hanrahan, AES Corporation, The

——-Riley P. Bechtel, Bechtel Group, Inc.

——-W. James McNerney , Boeing Company, The

——-Rex W. Tillerson, Exxon Mobil Corporation

——-Marvin E. Odum, Shell Oil Company

——-John S. Watson, Chevron Corporation

——-James J. Mulva, ConocoPhillips

——-John B. Hess, Hess Corporation

——-James E. Rogers Duke Energy Corporation

——-J. Larry Nichols, Devon Energy Corporation

——-Ronald A. Williams, Aetna Inc.

——-David Cordani, CIGNA

——-Jeffrey B. Kindler , Pfizer Inc.

——-Angela F. Braly, WellPoint, Inc.

——-John C. Lechleiter, Eli Lilly and Company

——-Edward B. Rust, Jr., State Farm

——-Andrew N. Liveris, Dow Chemical

——-James W. Owens, Caterpillar Inc.

——-Ellen J. Kullman, DuPont

——-Edward E. Whitacre Jr., General Motors Company

——-Michael T. Duke, Wal-Mart Stores, Inc.

The Business Roundtable is the most powerful activist organization in the United States. Their leaders regularly lobby members of Congress behind closed doors and often meet privately with the President and his administration. Any legislation that affects Roundtable members has almost zero possibility of passing without their support.

For three major examples, look at healthcare and financial reform, along with the military budget. The healthcare reform bill devolved into what amounts to an insurance industry bailout and was drastically altered by Roundtable lobbyists representing interests like WellPoint, Aetna, Cigna, Pfizer, Eli Lilly and Johnson & Johnson. Obama and Congress are trying to please the Roundtable with a bill that supports their interests. This led to the dropping of the public-option put forth in the House bill. However, when it came to finishing the bill, Roundtable members began to walk away from the process. That’s the real reason why the reform bill has stalled. Obama will be meeting with the Roundtable on February 24th, in hopes of getting healthcare reform back on track. After that meeting, he will then hold a bipartisan healthcare meeting with members of congress.

Also being addressed in Obama’s upcoming meeting with the Roundtable are issues concerning financial reform. Almost every aspect of financial reform has been D.O.A. thanks to Roundtable lobbyists representing the interests of Goldman Sachs, JP Morgan, Morgan Stanley, Citigroup, Bank of America, HSBC, Master Card and American Express. They even pushed to make sure Ben Bernanke was reconfirmed as the head of the Federal Reserve and they have also guided Obama into focusing on deficit reduction, now that their member companies are healthy again and making record profits after receiving trillions in government subsidies. The Roundtable played a pivotal role in the appointment of Hank Paulson, formerly the CEO of Roundtable member Goldman Sachs, who replaced Roundtable member John Snow as US Treasury Secretary. The Roundtable also strongly lobbied on behalf of current Treasury Secretary Tim Geithner and White House National Economic Council Director Larry Summers. Although there has been recent talk of Geithner being replaced at the Treasury, the lead choice to replace him is Jamie Dimon, Roundtable member and CEO of JP Morgan Chase.

The drastic rise in military spending is also a result of Roundtable lobbyists pushing the interests of large military companies like Boeing and Bechtel, along with the largest oil companies like ExxonMobil, Shell, Hess and Chevron.

The Roundtable tells politicians what they want done, and the politicians do it. At times, Roundtable members even write the laws themselves. On financial reform alone, those representing Wall Street firms gave “$42 million to lawmakers, mostly to members of the House and Senate banking committees and House and Senate leaders.” During the 2008 election cycle, they gave $155 million: $88 million to Democrats and $67 million to Republicans. Keep in mind, this is the spending on just their financial reform initiative. When it came to health reform, they gave even more.

When it comes to getting elected, over 90% of the time the candidate who simply spends more money on their campaign wins the election. The Roundtable and politicians recognize this fact, so the overwhelming majority of current elected officials relied heavily on campaign funding from Roundtable members, including President Obama.

Shortly after Obama’s inauguration he held a meeting with Roundtable members at the St. Regis Hotel. The president of the Business Roundtable is John J. Castellani. Throughout the first nine months of Obama’s presidency, Castellani met with him at the White House more than any other person, with the exception of Chamber of Commerce CEO Tom Donohue. If you look at the records of people who have spent the most time with Obama in the White House, other than these two, another frequent visitor is Edward Yingling, the president of the American Bankers Association.

These organizations - the Business Roundtable, Chamber of Commerce and the American Bankers Association - along with the Federal Reserve, a secretive quasi-government private institution, form the center of the Economic Elite’s power structure. Since the bailout, the Federal Reserve has been working closely with private firm BlackRock. Due to this relationship, BlackRock has emerged as the world’s largest money manager and now manages more assets than the Federal Reserve. They also “manage many of the Treasury Department’s big investments.”

On a global level, you have economic institutions like the World Trade Organization (WTO), the International Monetary Fund (IMF) and the World Bank, and international treaties like NAFTA. These organizations already form a de facto world government that has rights beyond our constitutional rights and national sovereignty. If the WTO makes a ruling that goes against US law, the WTO ruling supersedes US law and wins out.

Here is how Global Exchange explains these global institutions:

“The World Trade Organization is the most powerful legislative and judicial body in the world. By promoting the ‘free trade’ agenda of multinational corporations above the interests of local communities, working families, and the environment, the WTO has systematically undermined democracy around the world…. Unlike United Nations treaties, the International Labor Organization conventions, or multilateral environmental agreements, WTO rules can be enforced through sanctions. This gives the WTO more power than any other international body. The WTO’s authority even eclipses national governments.

[World Bank and International Monetary Fund (IMF)]

When the Bank and the Fund lend money to debtor countries, the money comes with strings attached. These strings come in the form of policy prescriptions called ’structural adjustment policies.’ These policies—or SAPs, as they are sometimes called—require debtor governments to open their economies to penetration by foreign corporations, allowing access to the country’s workers and environment at bargain basement prices. Structural adjustment policies mean across-the-board privatization of public utilities and publicly owned industries. They mean the slashing of government budgets, leading to cutbacks in spending on health care and education…. And, as their imposition in country after country in Latin America, Africa, and Asia has shown, they lead to deeper inequality and environmental destruction.”

In addition to dominating our political and economic system, the Economic Elite have already created their own private military. Their private military is now more powerful than the US military. As mentioned earlier, private mercenaries now outnumber US soldiers and receive the lion’s share of military spending.

Corporations like SAIC, Blackwater, Bechtel, Raytheon and Halliburton are composed of the most elite worldwide intelligence and military officers. These are the highly profitable and powerful entities that the Economic Elite turn to when national militaries and intelligence agencies - like the CIA, FBI or other government run entities - can’t get the job done.

For instance, SAIC, a “stealth company” that most people have never heard of, is considered to be the brains of the entire US intelligence apparatus, more powerful than the much more popularly known CIA, NSA and FBI - all agencies that SAIC is deeply intertwined with. I urge you to research SAIC to get a crash course in how the true power structure functions. You can start by reading an excellent investigative report by Donald L. Barlett and James B. Steele titled, “Washington’s $8 billion shadow.”

The Economic Elite dominate US intelligence and military operations. Other than the obvious geo-strategic reasons, the never-ending and ever-expanding War on Terror’s objective is to drain the US population of more resources and further rob US taxpayers, while using our tax money to create a private military that is more powerful than the US military.

I think any logical person can see the ominous implications of having such a vast and powerful private military and intelligence complex, created for and used, in secrecy, by the Economic Elite. Outside of the blatant economic policy attacks, heavily armed and sophisticated covert powers led by small groups of Economic Elite are now a serious risk and present danger.

In conclusion, these economic and government policy forming organizations, along with their private military and intelligence corporations, form the core of the Economic Elite power structure.

“I think one has to say it’s not just simply a matter of capturing people and holding them accountable, but removing the sanctuaries, removing the support systems. Paul Wolfowitz

By David DeGraw

David DeGraw is a frequent contributor to Global Research. Global Research Articles by David DeGraw

© Copyright David DeGraw, Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.