Stock Market SPY Price Probability Forecast 2010

Stock-Markets / Stock Markets 2010 Feb 28, 2010 - 05:29 AM GMTBy: Richard_Shaw

In markets, anything can happen. Events in particular can cause quantum shifts in sentiment, real economic prospects, and valuation levels. However, absent discontinuities in ambient information, the probability of various prices being attained can reasonably be estimated using the Black-Scholes model.

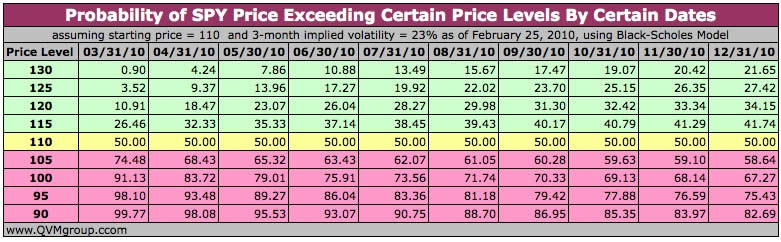

This table indicates what that model says are the probabilities of the price of SPY exceeding various threshold prices by month-end for each remaining month of this year.

The input assumptions were a current price of 110 and a volatility of 23% (based on the approximate current 3-month S&P 500 options implied volatility), projected from February 25, 2010.

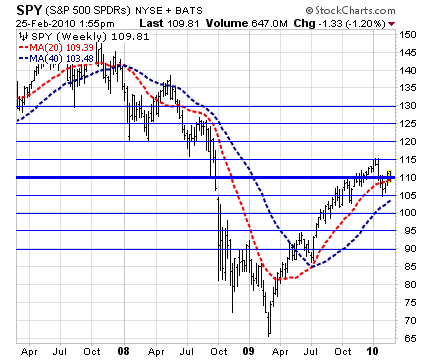

The price thresholds in the table are marked by horizontal blue lines on this price chart of SPY.

Our own view of the short-term situation is negative. We exited all equity positions in January, and will not return until a renewed upward price trend is visibly evident, and the macro-economic picture is less foreboding.

Holdings Disclosure:

As of February 25, 2010, we do not have current positions in any securities discussed in this document in any managed account.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.