Gold and Silver, Correction/ Colsolidation

Commodities / Gold and Silver 2010 Feb 27, 2010 - 06:32 AM GMTBy: Sol_Palha

"See it big, and keep it simple." ~ Wilferd A. Peterson

"See it big, and keep it simple." ~ Wilferd A. Peterson

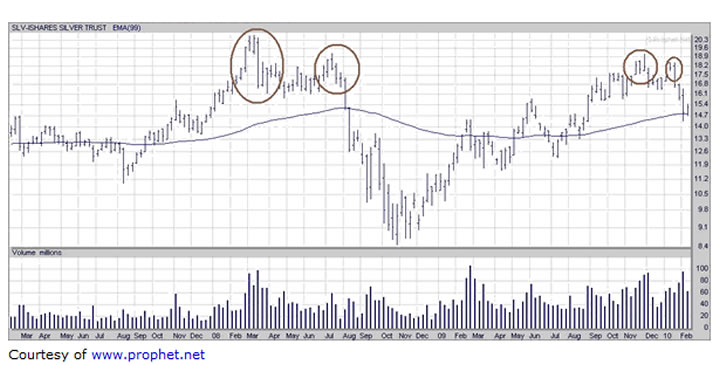

From high to Low Silver has dropped over 24%. From high to low Gold has so far shed only roughly 12%. Silver also did not take out its 2008 highs when Gold went on to put in a series of new all time highs. This is another massive intra market negative divergence signal and yet another reason to suggest that Gold could correct/consolidate for several months. On a positive note gold has held up remarkably well in the face of a very strong rally from the dollar. If it continues to hold up like this, then when the dollar rally finally fizzles out, one can expect gold to literally explode upwards.

The breakdown in silver could be an early warning signal of what lies in store for Gold in the short term time frames. Taking the longer term perspective, this rapid move down in silver indicates that when the next buy signal is generated in the precious metal's sector, that Silver will most likely be the top performer. Remember all dogs have their day in the sun. Palladium the leading dog clearly illustrated this point as it took the number one spot in the precious metal's sector in terms of performance for the past 12 months; we were strongly pounding the table on this underdog from late 2008 to early 2009.

Courtesy of www.prophet.net

The above chart clearly illustrates Silver (poor man's Gold) inability to trade to new highs in Dec and Jan of this year, while Gold surged to put in a series of all time new highs. This is a double negative for not only has silver not even come close to taking out its all time high, but it could not even test or take out the highs it put back in March 2008. Silver moves much faster on a percentage basis than Gold does so this action indicates that something is out of sync in the Gold markets at least in the short to intermediate time frames.

Silver has now become the dog of the precious metal pack and according to the dog theory it will have its day in the sun.. When the time is right we will issue a strong buy for this metal. In the short to intermediate time frames though, it would be wise to wait before deploying any new money as Silver is indicating that all is not well in this sector.

Note that Gold has issued multiple intra market negative divergence signals, if it had issued one only then we would not pay too much attention to this development. Gold, however, has flashed several very strong intra market negative divergence signals, the strongest one was flashed by the dollar; the dollar refused to trade to new lows when Gold went to put in a series of new highs. Instead the dollar was actually trading roughly 4% higher from its previous low, when Gold put in a new all time high.

Conclusion

In the short to intermediate time frames, the precious metal's sector is still expected to correct/consolidate. Gold, however has held up remarkably well in the face of a strong dollar. Given the strength of the dollar one would have expected Gold to have pulled back a lot more than it has done so far. If this pattern in Gold persists then it very strongly indicates that once this rally in the dollar comes to end, Gold is going to literally explode upwards. On a percentage basis though silver is expected to perform a lot better than Gold in the next leg up.

Random musings

SEC's curbs on short selling a waste of time

The rule puts in a so-called circuit breaker for stock prices, restricting short-selling of a stock that has dropped 10 percent or more for the rest of a trading session and the next one. The new curbs take effect in about 60 days but stock exchanges have six months after that to implement them. Full story

The above rule will only serve to delay the inevitable and could actually worsen the situation. For example, let's say a former high flyer disappoints the street with its earnings report. Normally, the stock is bid up in anticipation of blow out earnings, but now the earnings come in lower than expected, so say the stock drops 20% in one day, but short sellers are now cut out of the game. Like a dam, the pressure will build up and a day later when the short sellers can jump in, it might cause the stock to drop more than 10% and so forth. This effect could go for a longer period of time than if normal market forces were allowed to play out. When one is forbidden from doing something the desire to the opposite increases twice fold; the more one is prevented from doing something the more one wants to do it. Thus this rule is just a silly piece of legislation that will not really achieve much in the long run. In the short run, it might provide the illusion that it has the effect of stabilizing the markets.

"I keep the telephone of my mind open to peace, harmony, health, love, and abundance. Then, whenever doubt, anxiety, or fear try to call me, they will keep getting a busy signal and soon they'll forget my number." ~ Edith Armstrong

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2010 Copyright Sol Palha - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.