U.S. Treasury Bond Market Auctions Results This Week

Interest-Rates / US Bonds Feb 26, 2010 - 01:36 AM GMTBy: Fresbee

We hereby summarise the bond auctions this week which held another record breaking amount as nearly 150 billion were auctioned between 3 months to 7 year duration. The overall Bid/cover has been very healthy at 2.9 and even with Chinese spat going on, Indirect bidders have been significant with their presence albeit at a lower level of participation.

We hereby summarise the bond auctions this week which held another record breaking amount as nearly 150 billion were auctioned between 3 months to 7 year duration. The overall Bid/cover has been very healthy at 2.9 and even with Chinese spat going on, Indirect bidders have been significant with their presence albeit at a lower level of participation.

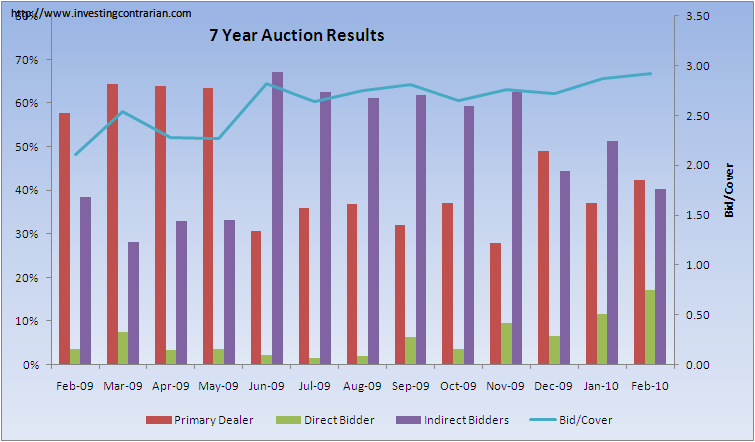

7 year Auctions:

Results were very strong for the Treasury’s monthly 7-year note auction where the large $32 billion size failed to water down coverage which came in at 2.98 for the highest rate since the coupon’s February 2009 launch. In another sign of strength, the auction stopped out at 3.078 percent, about 1/2 basis point below the 1:00 bid. Dealers ended up buying a lot of the issue, taking down 45 percent. Indirect bidding was light, at a 40 percent takedown, and is only partially offset by a record direct takedown of 17 percent. The high direct takedowns in recent auctions, including this one, are likely to increase talk that buyside accounts are bypassing dealers. Treasuries showed little reaction to the results which cap another weak of heavy, and successful, Treasury borrowing.

The bid/cover ratio curve seems to be indicating very high demand led by Primary dealer network. Indirect Bidders were lower as a class of bidders compared to last auction at 40%.

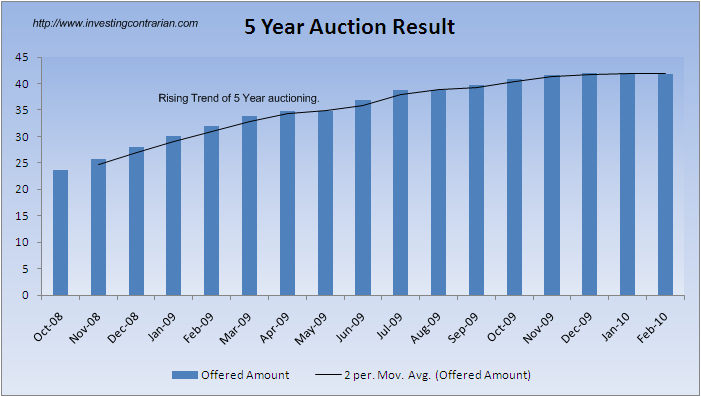

The offerred amount continues to be at record levels.

5 Year Auctions:

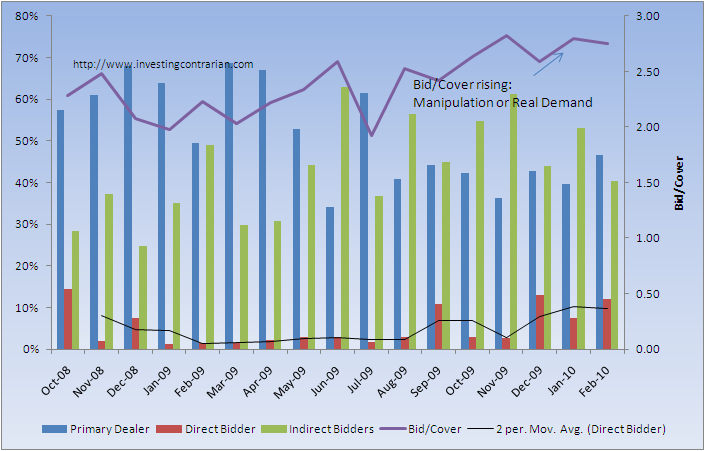

Non-dealer bidding was on the light side at the 5-year Treasury auction, a contrast to yesterday’s strongly bid 2-year auction. Bidding was sloppy for today’s $32 billion auction, which stopped out at 2.395 percent for a 2 basis point tail. Indirect bidders took down 40 percent of the auction vs. a 50 percent average. The drop-off was offset in part by an increase in the direct takedown to a double-than-average 13 percent. But dealers were today’s story, taking 47 percent of the auction vs. 40 percent in January’s offering. Treasuries showed no significant reaction to the results. The Treasury will auction $32 billion of 7-year notes tomorrow.

The offered amount has been continuously rising with latest offering at a record shattering $41 billion. The 5 year bonds account for nearly 400-500 billion of bonds auctioned annually. To the obvious question whether there will be demand for such massive amounts of bonds, my personal take is that as long as currency imbalances remain, bond demand will be sludge along.

The results have been captured above with bid/cover rising at a fast clip. The bid/cover rise has been coinciding with the rise in direct bidders which definitely is not a healthy sign.

Others/Short duration:

After the disaster last auction seen in 30 Year and 10 Year bonds, todays results are attached

- 3 Month Auction

Primary bidders took 43%, Direct bidders took 17% while Indirect Bidders took a healthy looking 40% of the $26.3 Bn auctioned. The yield went 0.1% and bid/cover ratio of 4.04 which can be considered a very strong auction.

- 6 month Auction

Primary bidders took 47%, Direct bidders took 19% while Indirect Bidders took a cautious 33% of the $23.9 Bn auctioned. The bid/cover closed at 4.29 which kept a strong lid on the yield at 0.19%

- 30 Year TIPS

Primary bidders took 51%, Direct bidders took 6% while Indirect Bidders took a cautious 42% of the $7.9 Bn auctioned. The bid/cover closed at 2.45 while yield remained at 2.229%.The decline in direct bidders is source for some comfort but we are still concerned with the losing bid/cover ratio.

All in all todays auctioned TIPS and bonds were far more healthier than seen in recent times.

Conclusion

We continue to be neutral to bearish on US bond auctions but no where as bearish as some others who have called for a complete collapse of the bond markets. We believe as long as currency imbalances remain, US bond market will have demand and avoid “continuous” collapse which is a way to say that there may be occasional speed bumps but over a longer period of time, FED should be able to manage the sales till H1 2010 post which we need to analyse the developing situation.

To sum up: One thing is for sure, not everything is well with the bond auctions into 2010 but it is still too early to call for a collapse of bond markets.

Our last analysis on Bond markets indicated that we are in a structural decline in appetite of US treasuries. Read Here

Source: http://investingcontrarian.com/global/bond-auctions-results-this-week/

Source for data: Treasury Direct, FED, Haver Analytics, Reuters Knowledge, Bloomberg

Fresbeehttp://investingcontrarian.com/

Fresbee is Editor at Investing Contrarian. He has over 5 year experience working with a leading Hedge fund and Private Equity fund based out of Zurich. He now writes for Investing Contrarian analyzing the emerging new world order.

© 2010 Copyright Fresbee - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.