Stock Market 600 Point Crash.... Up

News_Letter / Stock Markets 2010 Feb 25, 2010 - 12:06 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

February 21st, 2010 Issue #12 Vol. 4

Stock Market 600 Point Crash.... UpDear Reader Headline grabbing title? The U.S. Fed raised the discount rate for overnight funding from 0.5% to 0.75% last Thursday evening which sent the financial blogosphere into a frenzy of anticipation of a sharp drop in stock prices the following day.... The Dow closed UP 9 points. The current stock market rally has retraced 600 points or 67% of the decline that followed the January 19th peak of 10,729 to stand within touching distance of the bull market high. The velocity of the current uptrend in terms of price and time is precisely on par with the velocity of the downtrend off of the January high, which was one of the most anticipated and one could say delayed downtrends since the birth of the stocks stealth bull market. Everyone including bulls, bears and those yet to make their minds up clearly could understand one thing if nothing else that the run up in stocks to above 10,500 had lifted stocks into the most overbought state thus far which required a significant reaction lower. For bulls the expectations were for a significant correction that at least targeted a retracement to 10k. For bears the realisation was that this had to be it! It must be now (although never), that the bear market had now resumed its third leg lower. The actual price action in terms of the forecast for 2010 as evidenced by 3 impulse swings so far of 2 down and 1 up, is inline with that for a volatile trading range for the first half of the year. Which does confirm my view as per the forecast for 2010 that the first half of 2010 is going to see a stock market behaviour greatly differing from that which we have seen during the past 10 months i.e. one exhibited by much greater price volatility within a very wide trading range, which is good for traders and a good for those seeking to accumulate off of the lows. Another important point to consider is that the anniversary of the birth of the stocks stealth bull market is on 6th March 2010, this again suggests to me that despite stocks being so close to their bull market peak, stocks may in actual fact make an important LOW on this date. Pulling all the strings together, the implications of the analysis are that : 1. Market volatility is very high - That the character of the market has changed and traders / investors need to realise this, which one could say implies less predictability during the first half of 2010 as impulse swings are much shorter in time and more frequent. 2. That the downtrend targets a LOW on or near the anniversary date of the bear market low of 6th March 2010. 3. That the target for the correction is for a move to between 9,500 and 9,800. The low of 9,835 implies price wise it could have occurred, but time wise it has not i.e. requires more downside time to dissipate the overbought state. 4. That despite the very strong rally to 10,412 from 9835 we have unfinished business on the downside. 5. Downside technical targets are between 10,050 and 9,800. 6. Upside Resistance is at 10,700. 7.That the forecast trend for the first half of 2010 is for a volatile trading range, prior to the Dow end of year target high of 12,500. The above implies that we are likely to see a downtrend into the bear market low anniversary time window that straddles 5th and 8th March 2010 that targets a low in the region of between 10,050 and 9,800, which would in effect generate a double bottom chart pattern. It is tough to call a market downtrend BEFORE it has even begun, but that is what the analysis implies, off course where trading is concerned one DOES NEED to WAIT for entry triggers, which should become evident early next week.

For more on the stocks stealth bull market see my NEW FREE Inflation Mega-Trend Ebook, 100 pages of in depth analysis and precise concluding forecasts across the financial markets. David vs Goliath ? - NEW Financial Market Ebook's

Download your FREE ebook's whilst you can, and draw your own conclusions. Source and comment here : http://www.marketoracle.co.uk/Article17396.html Your stock index trading analyst. By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

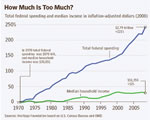

By: Nadeem_Walayat The Inflation mega-trend continues to manifest itself, this was no better illustrated then this weeks UK inflation data which shows that CPI has doubled from 1.9% to 3.5% in just 2 months! This gold analysis for 2010

By: Clive_Maund We sidestepped the recent C-wave decline in the sector, in particular the plunge in silver, scaling back positions the day before it began, and as we now know the PM sector has followed the script set out in the Marketwatch update of the 19th January to the letter.

By: Fresbee The latest 30 year bond auction have been disappointing with some already terming it as a failure. This is an opportune time to analyse the trends in bond markets. There is almost a pall of gloom across the many who understand bond market mechanics and we will try to break down two of the most important auctions: 30 year and 10 year auctions, to see the trend and patterns in results. Quoting from Reuters on the latest 30 Year auction:

By: John_Mauldin The news is somewhat "All Greece, All the Time," but most of the pieces miss the more critical elements, and in today's letter we will look at what I think those are, as well as at the important point that Greece is a precursor of a new era of sovereign risk. Plus, we glance at a few rather silly recent comments from economists. It will make for a very interesting discussion.

By: Jim_Willie_CB The subprime debt issue of 2007 blossomed into a global credit crisis. Likewise, the Dubai sovereign debt issue will blossom into a global sovereign debt crisis in similar pathogenesis. The start and end points are located in the Untied States and Untied Kingdom. With the global climax come disruption, restructure, and chaos. The subprime mortgage problem was grossly under-estimated.

By: Michael_Hudson Prof Michael Hudson and Prof. Jeff Sommers write: World Economic Crisis: Latvia’s Neoliberal Madness - While most of the world’s press focuses on Greece (and also Spain, Ireland and Portugal) as the most troubled euro-areas, the much more severe, more devastating and downright deadly crisis in the post-Soviet economies scheduled to join the Eurozone somehow has escaped widespread notice.

By: David_Galland One year and five months ago — armed with a 92-page white paper and 59,000 petitions — we warned Congress about the grave danger of government bailouts.

By: William Hester There is some debate about whether the recession is over. The National Bureau of Economic Research (NBER), a non-governmental organization made up of economists, has a committee that meets and decides after the fact when recessions begin and when they end. Martin Feldstein, the former president of the NBER, focusing on the job market, said last November that "the current downturn is likely to last much longer than previous downturns ... We will be lucky to see the recession end in 2009."

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.