Interest Rate Yield Curve Steepest In History, Is it Different This Time?

Interest-Rates / US Interest Rates Feb 22, 2010 - 03:17 AM GMTBy: Mike_Shedlock

Curve Watchers Anonymous is once again taking a look at the yield curve looking for economic clues. Here are a few charts to consider.

Curve Watchers Anonymous is once again taking a look at the yield curve looking for economic clues. Here are a few charts to consider.

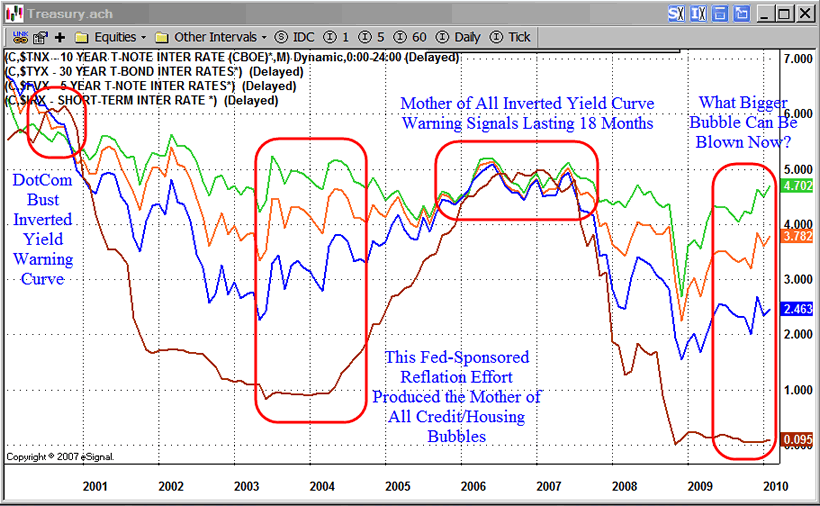

Yield Curve Timeline from 2000-2010

Green: $TYX - 30 Year Treasuries

Orange: $TNX - 10 Year Treasuries

Blue: $FVX - 5 Year Treasuries

Brown: $IRX - 3 Month Treasuries

Area 1: Inverted Yield Curve Signals Pending DotCom Bubble Burst

Area 2: Fed Reflates Holding Interest Rates at 1% for 18 Months Fueling Mother of All Credit/Housing Bubbles

Area 3. Yield Curve Tight for Two Full Years, Inverted on and off for 18 Months. This was the Mother of All Warning Signals. Few Paid Attention. Bernanke Said "No Recession Coming. No Housing Bubble to Bust"

Area 4. Fed Reflates, Cutting Rates to Zero.

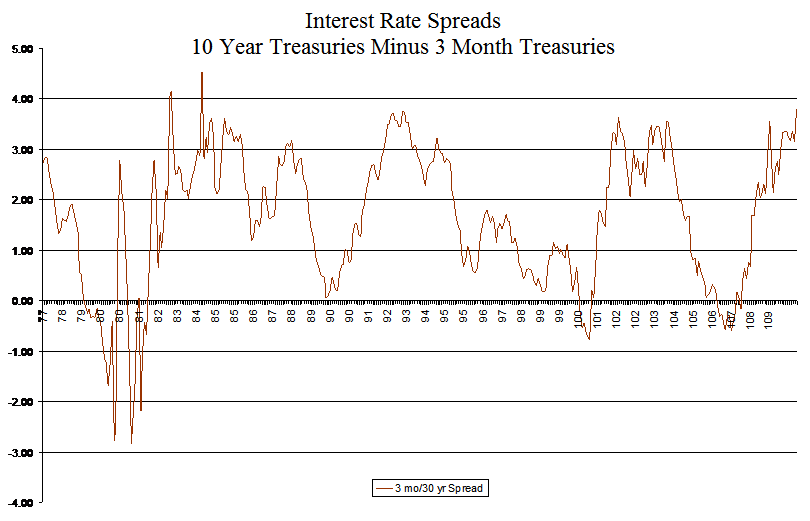

Interest Rate Spread 1977-2010

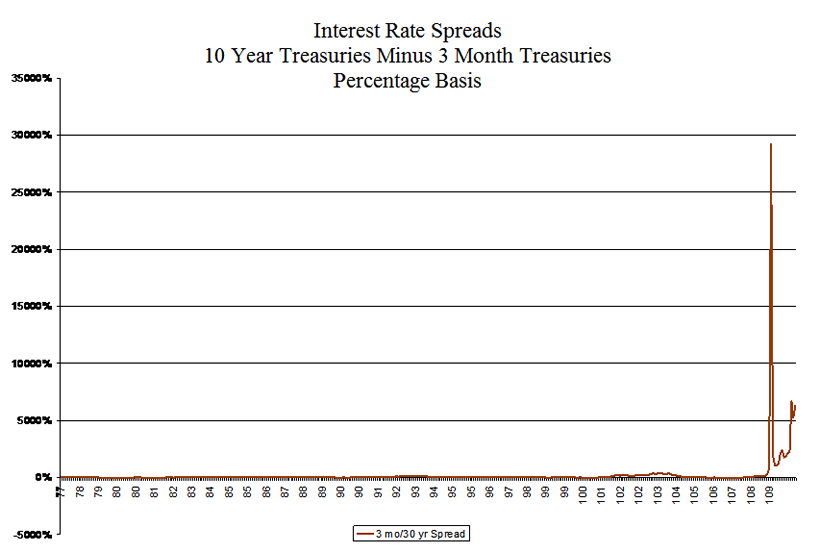

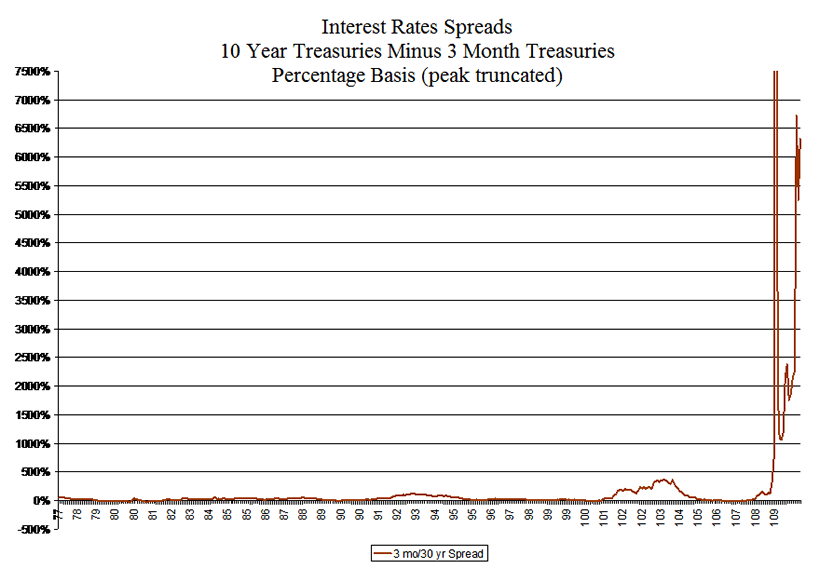

Interest Rate Spread 1977-2010 Percentage Basis

Interest Rate Spread 1977-2010 Percentage Basis Detail

The first chart above I produced in eSignal. The next three charts are courtesy of Jay Matthews at Velocity Capital.

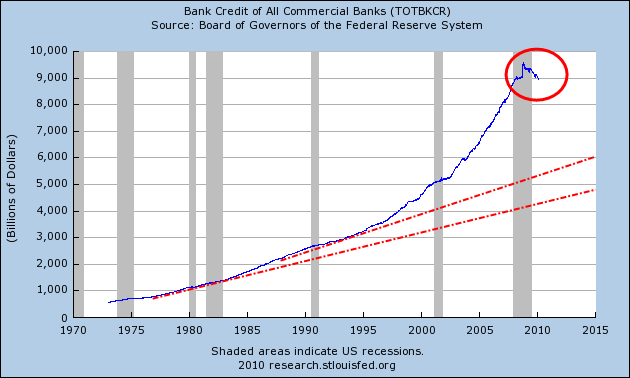

Credit Not Expanding

Under normal circumstances with a steep yield curve, banks would be willing to borrow from the Fed at close to zero and lend at prime or higher.

Yet we know that banks are reluctant to lend (more accurately businesses are reluctant to borrow) as mentioned many times, most recently in As Credit Contracts, Keynesian and Monetarist Clowns Snipe at Bernanke.

Total Bank Credit Drops At Record Pace

What has everyone excited is the dramatic turn down in bank credit at commercial banks.

From the Telegraph article ... David Rosenberg from Gluskin Sheff said lending has fallen by over $100bn (£63.8bn) since January, plummeting at an annual rate of 16pc. "Since the credit crisis began, $740bn of bank credit has evaporated. This is a record 10pc decline," he said.

Total Bank Credit Of Commercial Banks

In contrast to Keynesian and Monetarist clowns, I am not horrified by that drop. I am horrified by the parabolic rise that preceded it.

That credit is plunging is a good thing, not a bad thing. A much needed deleveraging is in progress. The question now is: Will Bernanke have the courage to see this [policy normalization] through or not?

This Is Not 2003-2006

Unlike 2003 through 2006 where credit expanded rapidly in housing followed by another year of massive amounts of commercial real estate lending, the Fed's efforts to reflate have done next to nothing.

This is what happens in a deflationary cycle where the problem is too much debt and too many malinvestments. As many as several hundred banks are likely to fold, and most of the rest are capital restrained.

Those banks that are not capital restrained, are playing FDIC Friday Lotto rather than make individual small business loans.

"A California Banker" writes ...

Hello Mish

After our phone conversation last week, I thought of one more important banking tidbit you might want to share with your readers.

If you’re a bank with a relatively healthy balance sheet with adequate capital, (like us)you want to maintain surplus capital in order to stay on the FDIC’s list of banks they can transfer the loans and deposits from a failed institution into.

This is a home run for the acquiring bank and far more of an instant benefit than any new lending.One thing Bernanke did accomplish with record setting liquidity and various swap arrangements was to free up the corporate bond market such that corporations were able to roll over debt. This gave a new lease on life to corporations that would otherwise have failed. A detrimental side effect is that overcapacity is still rampant and a much needed cleansing cycle did not occur.

However, there are fresh signs of stress in junk bonds with spreads widening significantly in the last month. High grade corporate spreads are widening as well.

Moreover, corporate spread widenings are international, not just a US phenomenon. Please see UK Business lending Falls At Record Pace; UK Mortgage Lending Drops 32% to 10 Year Low; Bundesbank Fears Second Wave of Credit Crisis; Party's Over for details.

Is It Different This Time?

In the US, with unemployment close to 10% and no driver for jobs (neither housing nor commercial real estate is going to make a strong comeback here), extreme caution is warranted.

Just because the market went on to rally with a steep yield curve in 2003 is no reason to believe it will do so again.

The fundamentals now are very different. Boomer demographics are different. Consumer attitudes towards debt are different. Bank attitudes towards risk are different. Debt levels are different. Hiring patterns are different. Credit conditions are different.

Is this a "It's Different Now" argument?

Nope. This is actually an "It's the Same argument". To make a valid comparison it is important to pick the correct reference point. Credit conditions and consumer attitudes are what is most important and those are very similar to the credit bust in Japan and the Great Depression.

Those focused only on the steep yield curve are making the wrong comparisons or missing the more important comparisons. Moreover, given that banks are not lending, and that Fannie Mae, Freddie Mac, and the FHA are the housing lenders of only resort, additional yield curve steeping will further depress the already deeply stressed housing and commercial real estate sectors.

Those who think the steep yield curve guarantees the economy will soon be humming are in for a rude awakening. In the aftermath of a deflationary credit bust, credit conditions, debt levels, and attitudes are far more important than a steep yield curve, and those conditions are god awful.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.