U.S. 1800 Bank Failures Financial Tsunami on Horizon

Economics / Credit Crisis 2010 Feb 21, 2010 - 08:45 AM GMTBy: Fresbee

CalculatedRisk predicts 2010 to account for more number of failures than 2009 but lesser than the peak of 534 in 1989.

CalculatedRisk predicts 2010 to account for more number of failures than 2009 but lesser than the peak of 534 in 1989.

My prediction is the FDIC will close more banks in 2010 than in 2009 (more than 140), but fewer banks than in 1989 – peak of the S&L crisis (534 banks).

I do not disagree. But I think there is a need to understand how deep the rot is and how long before we see stabilization.

Unemployment and Bank Failures

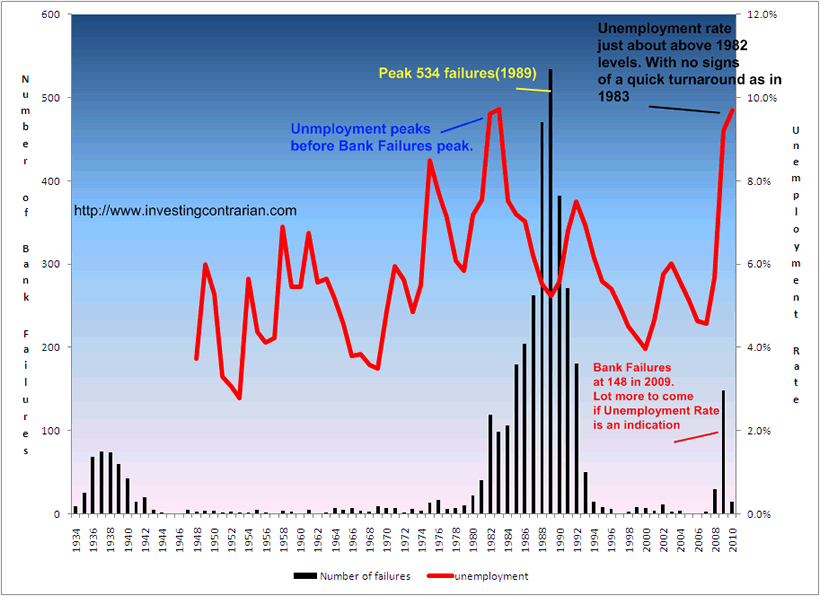

A study into historical relation between the Saving and Loan crisis of 1982 to 1989 and unemployment rate, reveals that Bank failures take years to peak after Unemployment rate has peaked. Unemployment rate peaked in 1981 and steadily fell after that. At the same time, Bank failures mounted with nearly 2000 banks brought to their knees in about 6 years with 1989 accounting for nearly 534 of them.

The graph above explains that we can clearly be prepared for a flurry of Bank failures beginning 2009 and stretching well into 2015. I am a lot more bearish than most FDIC analysts who have looked at individual bank lists and just forcasted over 600 banks to be on the list to failures. Calculatedrisk maintains an updated list of Problem Banks at 617 as of Feb 19 2010. Latest release from FDIC:

The Unofficial Problem Bank List increased by a net of 12 institutions this week with 15 additions and 3 removals. However, aggregate assets fell by about $500 million to $329 billion.

Removals include two of the four institutions that failed on Friday — La Jolla Bank, FSB ($3.8 billion) and Marco Community Bank ($138 million). It appears that the other failures — George Washington Savings Bank, and The La Coste National Bank were not subject to any formal enforcement action.

The other removal was Hiawatha National Bank ($45 million) as the OCC terminated a Formal Agreement in April 2009 but waited until this month to disclose the termination.

Among the 15 additions are National Bank of Commerce, Superior, WI ($573 million); The Farmers National Bank of Prophetstown, Prophetstown, IL ($410 million); and The Farmers National Bank of Buhl, Buhl, ID ($386 million), which is the first appearance of an Idaho-based institution on the list.

As anticipated in the February 5th commentary, Palm Desert National Bank came back on the list this week as the OCC issued a Consent Order after terminating a Formal Agreement.

The Year 2009 that was

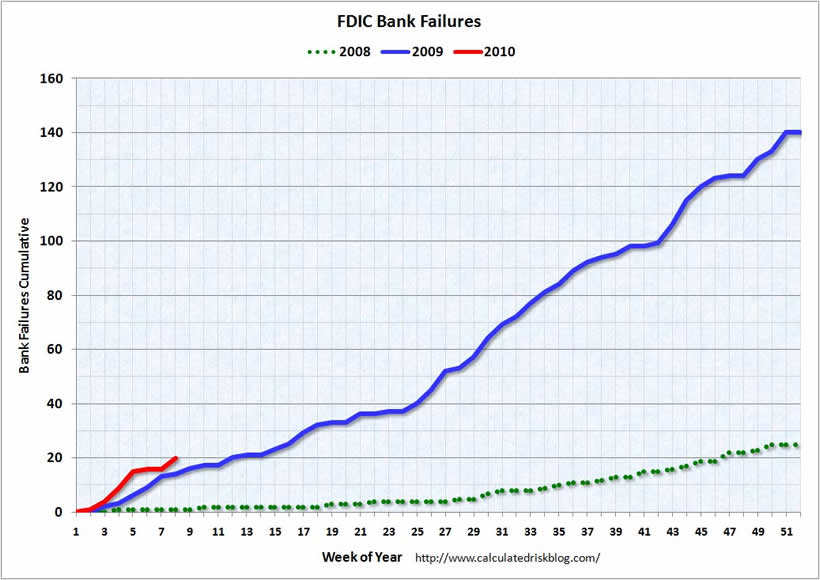

2010 began with a whimper for Bank Failures as the first week almost gave us the illusion that maybe and just maybe, the problem might just have solved itself as zero failures were reported. It was never going to be that easy, was it?

As the graph (courtesy friends at calculated risk), shows, a few weeks into 2010, the number of failures curve has already picked up steam and we see the red curve blasting away. I personally expect at over 200 failures this year and that is a conservative figure.

The Real Story

The question that keeps bogging most analysts, is how ugly is the FDIC problem going to be? Well my view is that it is going to be far more ugly than when Lehman went down. And this time not even God will want to help the system. (Colloquially borrowing Paulson words from the book “TOO BIG TO FAIL” as he spoke to Thain about selling ML to BofA)

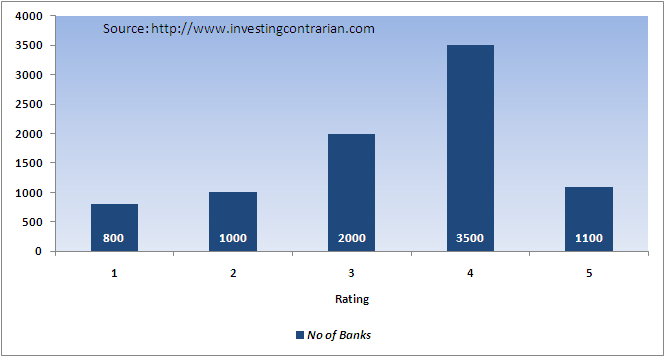

I did download balance sheet numbers of over 8400 Banks and went over the assets and liabilities of these banks. Bankrate maintains a rating on each of these banks which I found to be extremely sound and independent.

The bank rates 1800 banks as star rated 1 and 2 which potentially means they are in trouble and will be stretched at some point soon. I believe when they are stretched there is very little chance of coming out safe and hence one can safely assume they will go belly up. The good news though is a majority (6000) of 8400 banks are still in good shape even with unemployment rate at 9.7% averaged annually, that is, TILL NOW!

The ratings are maintained with certain assumptions concerning unemployment rate and any further deterioration will weaken even the better banks.

The list of the 8400 banks can be obtained at bankrate.com

The Cost = $ 1 Trillion (Atleast)

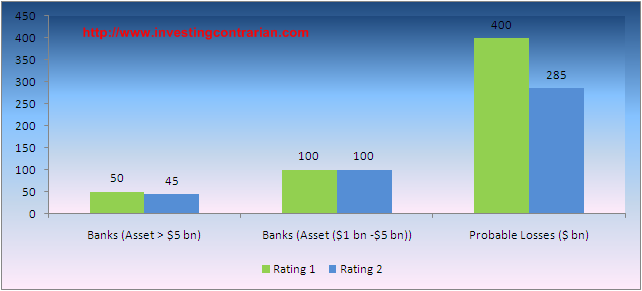

And that brings us to the most important part of the discussion. What will be the cost of solving this one? $ 1 Trillion.

Due to lack of time and bandwidth, I did a quick estimate of all banks with rating 1 and 2 and with assets larger than $1 billion. The graph below shares our theory on the ground reality. Nearly $400 billion of losses from star rating 1 banks and $285 billion from star rating 2 banks. These does not include banks with assets less than $1 billion nor do they incorporate any further deterioration of labor markets. Thus one can easily assume a figure closer to $ 1 trillion as the coming FDIC Bailout.

FDIC is staring into a black hole that is far more worse than the Lehman crisis as this can potentially shake not just the capital markets but the entire economy in a few hours time. Once we have 600, 700 and 800 banks going bust in an already weak economy, nothing can stop a bank run on the remaining safer institutions. People who have seen the S&L crisis of 1980s might just wonder that what is the big deal? Government will guarantee those deposits. Nothing to worry. Well that would have been fine if not for over $ 3 trillion of contingent liabilities that government carries in guaranteeing the GSE. There is very little headroom in talking more bailouts.

My greatest fear is that FED as usual is sleeping and completely oblivious to the massive tsunami of banking failures that are approaching. While some analysts have given credit to the FED for raising the discount rate, I think they will need to lower that again once the entire weight of FDIC failures comes upon them. The economy may be showing signs of some growth in headline numbers due to inventory stocking which is purely a china style stimulus spend rather than core economy improving, the bank health has only worsened in 2010.

The Timing of Bank Run

That is the Trillion dollar question. No one knows when. But the signs and stresses in the system are getting painfully accentuated and it does give me the feeling that we will have soon have a rupture in the system as some large banks with over $50 billion in assets starts to feel the heat.

FED will need to announce another bailout. QE 2.0. Stay Tuned.

2010 will be the beginning of some major FDIC shocks. Just when markets thought things had sorted itself out.

Source :http://investingcontrarian.com/global/us-1800-bank-failures-tsunami-on-horizon/

Fresbee

http://investingcontrarian.com/

Fresbee is Editor at Investing Contrarian. He has over 5 year experience working with a leading Hedge fund and Private Equity fund based out of Zurich. He now writes for Investing Contrarian analyzing the emerging new world order.

© 2010 Copyright Fresbee - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.