The ABCs of ETFs Investing, The Pros and Cons of Different ETF Funds

Companies / Exchange Traded Funds Feb 19, 2010 - 02:49 PM GMTBy: Marin_Katusa

By Marin Katusa, Casey’s Energy Opportunities : Why invest in a fund, a cluster of stocks, rather than the stocks themselves? The reasons are twofold.

By Marin Katusa, Casey’s Energy Opportunities : Why invest in a fund, a cluster of stocks, rather than the stocks themselves? The reasons are twofold.

First, a fund provides cheaper diversification for those investors with smaller amounts of capital. Buying each component of a fund spreads out your risk in the same way, but you can rack up significant brokerage fees in the process.

The second reason is true for most investors across the board: some funds can get you into sectors that otherwise present significant hurdles to play. Examples include the commercial real estate sector or the convertible bond sector, since regular retail investors would be hard pressed to purchase a commercial building or to participate in a convertible debt financing.

Many different types of funds beckon to investors now, and knowing how they work will help you maximize your gain from them. We’ll highlight three to set up the fourth: open-end funds, closed-end funds, hedge funds, and the one we like now to balance risk and reward, exchange-traded funds (ETFs).

Open-End Funds

How they work. Most mutual funds advertised and sold right now are open-end funds. An open-end fund does not restrict the amount of shares that can be issued or redeemed at any time. Usually, at the end of each trading day, additional shares will be created or redeemed in relation to the fund’s net asset value (NAV), the fund’s total asset less its total liability. An investor who wishes to buy or sell units of an open-end fund deals directly with the fund itself, rather than other investors.

Open-end funds can either be “passive” or “active.” A passive open-end fund allocates its holdings according to the S&P 500, Russell 2000, or some other index. The fund manager attempts to track the index as closely as possible. In contrast, an active open-end fund will attempt to beat the index it’s tracking by timing the market or selectively choosing the companies within a sector. In reality, most fund managers for mutual funds these days are not even human – they are algorithms that pick stocks.

Advantages. Open-end funds can be found everywhere, are readily accessible, and straightforward to understand. In fact, if you walk into a major bank, they can likely offer you several open-end funds depending on your risk tolerance and the sector of your choice. Choosing a fund manager that delivers positive excess return (also called “alpha”) may provide consistent, market-beating performance. Finally, the reinvestment of returns without incurring additional transaction costs could be beneficial for small investors.

Disadvantages. Mutual funds (both open-end and closed-end) tend to have higher expenses than ETFs, money taken out of your investment each year. For a passive open-end mutual fund that tracks the same index as an ETF, it’s often cheaper to purchase the ETF instead. For one thing, mutual funds tend to have more trades compared to an ETF, which makes the tax bill larger – costs that are passed on to fundholders. Also, with an active open-end fund, an investor is paying for the expertise of the fund manager (or in most cases, the stock-selecting computer) on top of the diversification benefits the fund is providing.

Open-end funds may have minimum purchase requirements as well as restrictions on the number of times that the fund can be bought or sold within a period of time. In a time of tremendous panic, many investors could sell their fund holdings, leading to a liquidity crisis for the fund and potentially large losses, as the fund sells as much holdings as possible to pay back its fundholders.

Closed-End Funds

How they work. Like the open-end variety, closed-end funds start with an amount of money that they then use for investments. The main difference here is that a closed-end fund issues a limited amount of shares at the beginning and no more for the life of the fund. After the initial offering by the fund, new investors would need to buy the units of the fund from other investors via the secondary market.

Thus several closed-end funds are traded on exchanges – though they’re not to be confused with ETFs, however much fund companies have occasionally tried to market them as such. For one thing, closed-end funds are often actively managed, whereas ETFs are most often passively managed. Secondly, ETFs need to disclose their holdings continuously, whereas closed-end funds can disclose holdings as infrequently as every quarter.

Lastly, ETFs tend to trade at or around their NAVs, a feature often not the case for closed-end funds. In fact, a closed-end fund could deviate quite far from net asset value. Since by definition it can’t create more shares, the unit price at any given time reflects its assets but also expectations of its future performance – that is, investor demand.

Advantages. Units of closed-end funds traded on an exchange can be bought or sold at any time, with neither trading restrictions nor minimum investment requirements. Compared to active open-end funds, closed-end funds tend to have a slightly better expense ratio because they are rarely advertised. And since closed-end funds do not deal directly with investors, they’re less vulnerable to a "run on the bank" situation than an open-end fund.

Disadvantages. Since most closed-end funds are active, they tend to have a higher expense ratio than ETFs or index funds. However, the bigger problem for a closed-end fund is the fact that the unit price on the exchange is often not in line with its NAV. An investor looking to buy into such a fund first needs to perform the due diligence; he must determine the appropriate discount or premium to apply to the NAV to come up with a target price. That’s not easy for the average investor.

Another feature to look out for is that since active funds are constantly rebalancing in an effort to time the market and to improve risk-adjusted returns, your portfolio allocation may be shifting without your knowledge. For that matter, this is also true of actively managed open-end funds. Both can lead to poor risk management.

Hedge Funds

How they work: Like the funds we’ve already talked about, hedge funds take a collection of money and purchase assets with it. However, hedge funds can only be offered to qualified individuals with a net worth of over US$1,000,000 or income of over US$200,000 per year. This structure allows hedge funds to purchase and use investment vehicles that a traditional fund, whether open- or closed-end, cannot – leverage, derivative contracts, short selling, and the like. This flexibility allows hedge fund managers to pursue investment strategies outside the bounds of traditional “long-only” funds. Hedge funds are highly deregulated compared with mutual funds.

Advantages. Hedge funds can have some of the highest returns in all of Wall Street. An example would be John Paulson’s hedge fund that bet against Lehman Brothers in 2007, returning more than US$15 billion to his investors in just one year. Moreover, hedge funds can get investors into sectors that even mutual funds cannot enter, such as distressed securities, options, and other more exotic derivatives.

Disadvantages. Hedge funds can be highly risky, especially depending on the sector and strategy of the fund. Also, hedge funds generally prefer to work in secrecy and drop the cloak of confidentiality around their trades, so fund holdings are usually disclosed once a quarter at most. Hedge fund units are highly illiquid, and holders won’t receive their investments until the fund dissolves, which could be several years. In addition, some hedge funds also charge a very high expense ratio – especially the ones with strategies that involve more trading and more leverage, such as a fixed-income arbitrage hedge fund. Hedge funds also face the same portfolio allocation risk as actively managed open- and closed-end funds.

Exchange-Traded Funds (ETFs)

How they work. ETFs, too, hold a collection of assets: stocks, bonds, commodities, futures contracts, derivative contracts, and others among them. The fund manager then creates or redeems new shares as necessary based on the assets and available cash in the fund at the time. Large institutional investors and ETF specialists can deal with the fund manager directly to create or redeem these shares, generally in large quantities by delivering “baskets” of the underlying asset held by the ETF. For example, if the ETF were based on U.S. Treasury bills, an ETF market maker could purchase more shares from the ETF fund manager by delivering an amount of T-bills to the ETF, and vice versa if they wished to redeem shares from the ETF. The participation of these institutional investors and ETF specialists ensures an ETF will trade around its NAV per share. If the ETF trades at a price significantly higher than its NAV, these “market makers,” as we call them, would take the opportunity to sell the ETF and buy the baskets of assets to create more ETF shares for profit without risk. This action, known as arbitrage, exerts a downward pressure on the ETF’s price to meet its NAV. Conversely, prices that drop below the NAV get a bump upward when arbitrageurs buy to take advantage of the riskless profit.

Advantages. In addition to their inherent tracking of NAV, ETFs have some of the lowest expense ratios among all the funds. They typically charge about 0.25% to 1% per year and sometimes as low as 0.07%, in contrast to the 1.0% to 1.5% of the average mutual fund. May not sound like much, but it can add up significantly in the long run.

Another advantage of ETFs is that they can be traded like any other security, which means they can be shorted and investors can purchase options on them – a flexibility that experienced investors in particular appreciate. Finally, the holdings of ETFs are announced at the beginning of each trading day, which lets you know exactly what you own at any time. As we said, most other funds generally disclose their holdings much less often, such as once per quarter Disadvantages. ETFs have no trading restrictions, and their simplicity can lure investors into overtrading and high transaction costs. One needs to keep strategy in mind. If you’re starting with less capital but thinking long-term, the usual mutual fund strategy – making a small initial investment and regularly adding to it – can work against you with an ETF.

Due to the transaction costs, a higher-expense mutual fund could actually outperform an ETF in the short run. ETF investments are best made with several large chunks of capital, rather than many small ones.

Potential Pitfalls of ETFs

The combination of high investor interest and the advent of more and more exotic ETFs that cover virtually every imaginable sector is giving rise to several risk factors with which you should become familiar. Among them:

- Closed-end funds posing as ETFs. Many closed-end funds, trying to catch the ETF bandwagon, have relabeled their funds with the words "ETF" in their names. These funds may look the same and also trade on exchanges, but they’re not ETFs. Compared with a closed-end fund, ETFs generally have more transparency, better tax implications, and lower expense ratios.

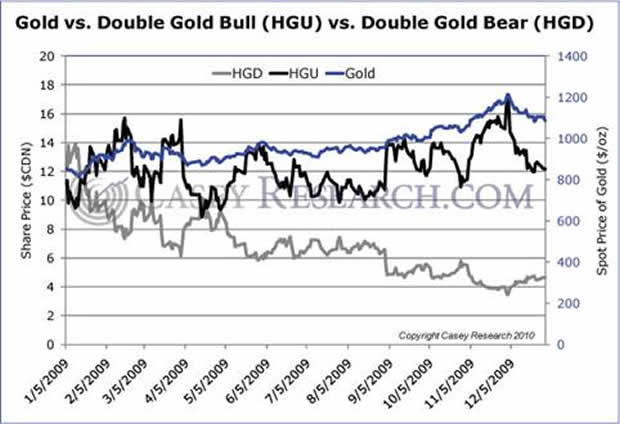

- Leveraged ETFs. Leveraged ETFs are funds that track 200% or even 300% of an index's daily returns by using options and derivatives. The key word here, however, is "daily," which means that over the long run, these ETFs may not truly mimic the price action of the underlying asset as well as they should be. Case in point: the price of gold vs. the leveraged gold bull ETF vs. the leveraged gold bear ETF:

If you had bought spot gold in the past 12 months, you’d be up 27%. In contrast, the Horizon BetaPro Gold Bull (T.HGU) would have garnered you only 9%, and the Horizon BetaPro Gold Bear (T.HGD) would have shaved you a disastrous 62.5%.

In an environment where there is no clear trend for the underlying index of the ETF, leveraged ETFs based on the index will suffer. This means even if you bought both the bull and the bear, you are at risk of losing money. This effect would only compound if you were buying a triple-leveraged fund. Unfortunately, leveraged funds are a necessary evil when you want to bet against an index or a commodity, since there does not exist a "bear" ETF with high enough liquidity that does not leverage.

- Tracking error. Similar to the leveraged-fund example above, some ETFs do not actually track the underlying commodity or index as well as we may believe. You’ll find this most often with commodity ETFs, which often track not the actual physical commodity but the futures.

Consider the United States Natural Gas Fund (UNG), which has risen about 12% between mid-November and mid-December. Nice. But in the same time frame, the Henry Hub spot price for natural gas rose 110%, frustrating many investors who thought they would reap much higher rewards. What was the cause of such discrepancy? The UNG uses swaps and Henry Hub futures to proxy actual natural gas. While the spot price was shooting up 110%, the Henry Hub futures price only rose 16%. So before you buy, be sure to know exactly what the ETF is tracking.

In Casey’s Energy Opportunities, Marin Katusa and his team provide a solid education in all things energy… and beyond. For just $39 per year, you can become a veritable expert and profit from the prudent investments they recommend.Click here to find out more…

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.