Stock Market Investing, We’re All Speculators Now

Stock-Markets / Stock Markets 2010 Feb 17, 2010 - 09:49 PM GMTBy: Doug_Wakefield

As I watch the drama of the financial markets and consider the enormous impact they have on every aspect of our daily lives, I am amazed by the vast difference of opinions held by the public. Now, I don’t mean the financial press or the press in general; what I am talking about is our basic understanding of the very financial world that we have grown to take more for granted with each passing day.

As I watch the drama of the financial markets and consider the enormous impact they have on every aspect of our daily lives, I am amazed by the vast difference of opinions held by the public. Now, I don’t mean the financial press or the press in general; what I am talking about is our basic understanding of the very financial world that we have grown to take more for granted with each passing day.

This ditty is intended for those with an open mind, whether they are running a billion dollar hedge fund, debating the legislative agendas of our nation, looking for jobs, or reevaluating their investment strategies after the meltdown of 2008. It all seems to come down to one question, about which many of us may have deluded ourselves: “Does the public invest in the financial markets, reflecting their beliefs about our collective futures, or are we all really speculators, looking for the big payout, regardless of the words we sign off on before handing our money over to be managed?”

From my experience over the years, when your average person talks about “the market,” they are usually referring to the Dow Jones Industrial Average. So, as we attempt to answer this question, let’s look at the almighty Dow.

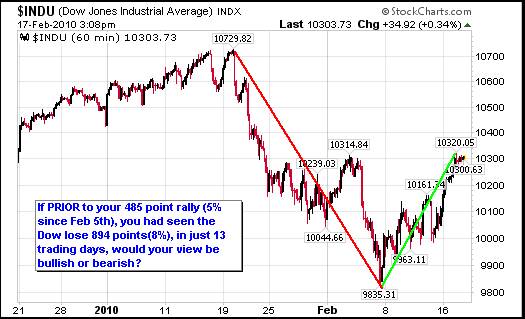

With no understanding of high frequency program trading, those looking at the sideways move in the daily chart above, might conclude that “investors” are somewhat confused about the market. But, those who’ve read articles like Forbes, “The New Masters of Wall Street,” produced in September 2009, know that the financial markets of today do not run the same way they did ten or twenty years ago. To wit, consider the futility of fundamental analysis, when computers trade the vast majority of shares in our markets each day.

“Even as financial markets collapsed last year, high-frequency traders collectively enjoyed $21 billion in gross profit, according to Tabb Group. On the NYSE, daily volume surged 43% through June from a year earlier to 6.2 billion shares; high-frequency traders are believed to account for 50% to 70% of the activity and similar proportions in electronic futures and options markets.”

Now stop. Read that last phrase again out loud. “…high-frequency traders are believed to account for 50% to 70% of the activity and similar proportions in electronic futures and options markets.” Unreal, don’t you think?

As we try to fathom how dramatic a departure program trading has taken us from prior periods in our financial markets, the number of trades that can be executed in a second might prove helpful.

“Some high frequency traders are sending out 1,000 orders a second.”

Again, I ask, “Is this investing or speculating?” As we contemplate the profound impact program trading has on our markets, after a year like 2008, we will want to try to figure out whether these speculators will drive prices higher or lower.

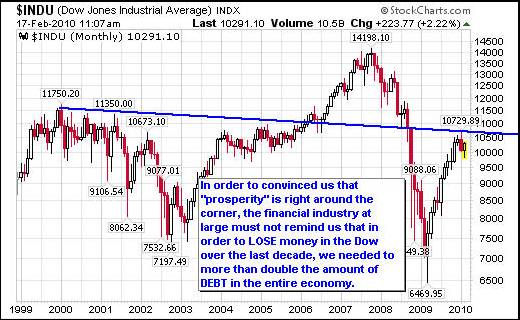

If you’re like me, it may be difficult to get your head around a mechanism that places 1,000 trades per second. And yet, as the two charts above reveal, without more information, up or down price moves tells us nothing about the long-term health of any entity. So, if we want to gain a better perspective of our current juncture, we can start by taking a longer view of the Dow.

The Chart Store produced a report titled, “Credit Market Debt,” showing total U.S. debt from 1952 to the fall of 2009. In shows that in 1999, total US debt stood at 25.7 trillion. As of their latest (September 30 2009) update, that number stood at 52.6 trillion. Clearly, this will never be paid off. In light of all of this, once again, I ask, “Are we investors, or are we really speculators, hoping that the perpetual debt machine can keep up the illusion that we are investors?”

Doug Wakefield

President

Best Minds Inc. , A Registered Investment Advisor

3010 LBJ Freeway

Suite 950

Dallas , Texas 75234

doug@bestmindsinc.com

phone - (972) 488 -3080

alt - (800) 488 -2084

fax - (972) 488 -3079

Copyright © 2005-2010 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.