Gold Strength Due to Risk of International Monetary Crisis

Commodities / Gold and Silver 2010 Feb 17, 2010 - 08:28 AM GMTBy: GoldCore

Gold rose another 3% in US trading yesterday to finish the day at $1,119.35/oz. It has since moved upwards to as high as $1,123.50/oz Asian trading so far this morning. Gold is currently trading at $1,118.00/oz and in Euro and GBP terms, gold is trading at €815/oz and £711/oz respectively.

Gold rose another 3% in US trading yesterday to finish the day at $1,119.35/oz. It has since moved upwards to as high as $1,123.50/oz Asian trading so far this morning. Gold is currently trading at $1,118.00/oz and in Euro and GBP terms, gold is trading at €815/oz and £711/oz respectively.

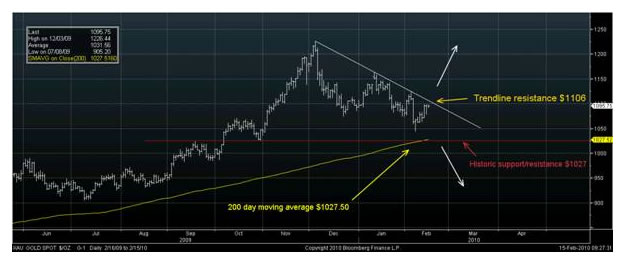

Technically gold is looking healthier again and has broken above the 50 day and 100 day moving averages and trend line resistance identified (see Chart). While the fear that gripped markets last week regarding a European sovereign default have abated, warnings regarding the long term viability of the multi currency union, long dismissed, are now being taking more seriously. The crisis in the Eurozone and the recent sharp fall in the Euro show clearly why a small allocation to gold remains important

Also being questioned is the notion that gold’s strength is purely a function of dollar weakness or Euro strength. This is erroneous as seen with the recent surge in the price of gold in Euro terms. While there is indeed a long term inverse relationship between the dollar and gold, there can be periods of dollar strength and gold strength and this is when gold rises strongly against other international currencies.

A clear example of how gold can rise significantly in dollars even if the dollar only falls marginally in value was seen between July 2005 and May 2006. During this period gold rose from a low of $418/oz to over $730/oz or some 74%. During the same period the dollar did not strengthen materially. The dollar was trading at 1.22 to the Euro in July 2005 and at 1.28 by May 2006 for a small fall of some 5%. Similarly, the US Dollar Index only fell from around the 89.0 level to 86.0 during the period. Gold surged in value by 74% in dollar terms and by similar amounts in other currencies despite the dollar only gradually weakening over a period of months. Gold rose from below €400/oz to nearly €600/oz during the period despite the Euro strengthening against the dollar.

This clearly shows that gold’s price performance is not predicated on dollar weakness per se rather it is the weakness of international currencies and fiat currencies in general that is the real driver of the gold price. And concerns about the debasement of currencies through zero percent interest policies, quantitative easing and massive fiscal deficits will likely lead to gold remaining strong in all fiat currencies for the foreseeable future.

SILVER

Silver range traded this morning in Asia from $16.18/oz to as high as $16.32/oz. Silver is currently trading at $16.20/oz, €11.77/oz and £10.26/oz.

PGM’s

Platinum is trading at $1,550/oz and palladium is currently trading at $437/oz. While rhodium is at $2,500/oz.

News

· Stocks posted their biggest daily percentage gain in three months on Tuesday after strong revenue from drug maker Merck and regional manufacturing data instilled confidence in the economic outlook. European markets also rose following new plans by European Union leaders to push Greece to get its budget under control. European officials gave Greece one month to prove it can cut its deficits. Debt problems in European countries including Greece, Portugal and Spain have been a major factor behind weakness in global stock markets in recent weeks.

· Oil prices hovered above $77 a barrel Wednesday in Asia after surging the previous day amid expectations a growing U.S. economy will fuel increased crude demand. Benchmark crude for March delivery was up 37 cents at $77.38 a barrel at midday Singapore time in electronic trading on the New York Mercantile Exchange. The contract rose $2.88 to settle at $77.01 on Tuesday.

· A record drop in foreign holdings of U.S. Treasury bills in December sent a reminder that the government might have to pay higher interest rates on its debt to continue to attract investors. China reduced its stake and lost the position it's held for more than a year as the largest foreign holder of Treasury debt. Japan retook the top spot as it boosted its Treasury holdings. The Treasury Department said foreign holdings of U.S. Treasury bills fell by a record $53 billion in December. That topped the previous record drop of $44.5 billion in April 2009.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.