Stock Market S&P 500 Bearish Black Cross Lurking?

Stock-Markets / Stocks Bear Market Feb 17, 2010 - 06:51 AM GMTBy: Andrew_Butter

My view on the S&P 500 is that right now it is 28% undervalued but it will keep on being undervalued until all of the detritus from the past seven years of fiscal insanity get’s cleared out. So basically it’s going to drift sideways for quite a long time with it’s value determined roughly by the ratio of nominal GDP divided by the yield of the 30 Year Treasury.

My view on the S&P 500 is that right now it is 28% undervalued but it will keep on being undervalued until all of the detritus from the past seven years of fiscal insanity get’s cleared out. So basically it’s going to drift sideways for quite a long time with it’s value determined roughly by the ratio of nominal GDP divided by the yield of the 30 Year Treasury.

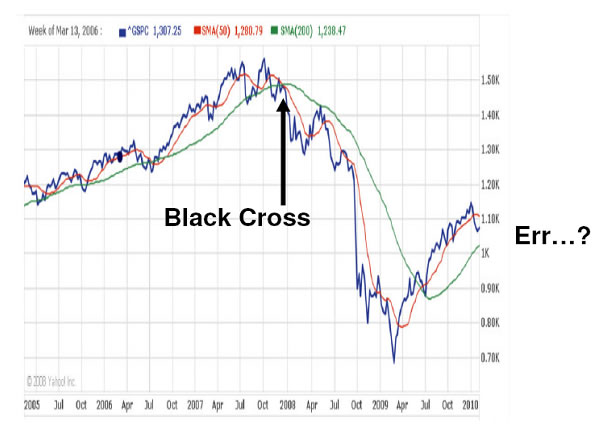

So when I saw a piece on Minyanville about Black Crosses, specifically that the juxtaposition of the 200 Day Moving average and the 50 Day Moving average, it got my attention.

I admit that my I am rather suspicious of many of the rules of thumb about reading the tea-leaves on stock markets, much of which looks like so much mumbo jumbo to me, but anyway the idea is when the 50 Day Moving Average (going down) crosses over the 200 Day Moving Average (going up), that’s the signal there is going to be a humdinger of a bust.

Mmm…I had a look, checked out the S&P 500 and the SSE, seemed to work OK although it’s a bit of a lagging indicator so by the time one hits you are selling on a really fast falling market; so it’s presumably a good idea to keep an eye on the road ahead. This is what it looks like:

Anyway, that was their story, which is that one’s coming!!

SO WATCH OUT!!!

I dunno…I’m not an expert but it didn’t look like there is one imminent right now on the S&P 500.

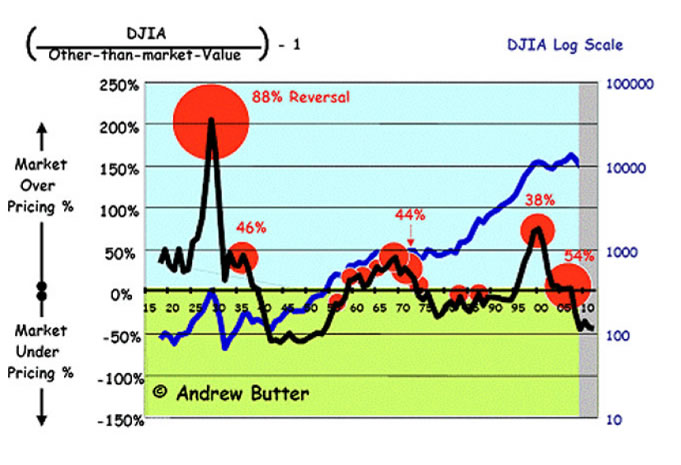

My take on the S&P is somewhat unusual in that I look at a valuation done using International Valuation Standards and compare that to the price, historically there is a pattern where the disconnect between what IVS calls “Other Than Market Value” (that’s what the price “ought to be” if there wasn’t what they (and George Soros) call disequilibrium, goes in waves.

This is a chart on that I put out in May 2008:

Looking back I notice I changed my mind a bit since then about where the “fundamental” is but anyway just for illustration.

My point then, and still is, that historically at least, it looks like you tend not to get a big reversal when the market is under-priced which is what happens after a bubble, unless the price drifts up to above about 15% to 20% (max) undervalued (now it’s about 28% according to me).

So perhaps I’m blind, but I don’t see any great excitement coming up in the immediate future, at least until the S&P gets to about 1,200 to 1,300, if it does that there would be a risk of a 10% to 15% (max) reversal.

One caveat is if nominal GDP starts to go seriously negative, which I doubt because although I can believe the Fed isn’t that good on generating real GDP growth, in the event they will be able to make up for that by creating inflation which is their speciality (not that they have managed to create much recently but you can tell they are itching to do that).

The big danger would be a rise in the 30 Year Treasury yield, which in my view is pretty unlikely that it’s going to go up much (I’m in a minority on that too), but if I’m wrong on that then that would drive the “fundamental” down in which case the danger of a reversal would increase.

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe; currently writing a book about BubbleOmics. Andrew Butter is managing partner of ABMC, an investment advisory firm, based in Dubai ( hbutter@eim.ae ), that he setup in 1999, and is has been involved advising on large scale real estate investments, mainly in Dubai.

© 2010 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.