China Tries to Avoid Stock Market Bubble by Tightening Bank Lending

Stock-Markets / Financial Markets 2010 Feb 13, 2010 - 05:23 AM GMTBy: Frank_Holmes

China sees a bubble ahead and is trying to avoid it – is that such a bad thing?

China sees a bubble ahead and is trying to avoid it – is that such a bad thing?

Isn’t this what we expect Ben Bernanke and the Federal Reserve to do here at home – take clear and decisive action to drain off excess liquidity in the economy before inflation takes hold?

The People’s Bank of China did just that after it saw that 1.4 trillion yuan ($204 billion) worth of bank loans were issued in January, more than the total loaned in the three previous months combined.

For all of 2010, the target loan amount is 7.5 trillion yuan, so it’s easy to see why the government might want to slow the pace a bit.

Forbes’ online headline was “China Tightens the Screws,” but let’s have a little perspective.

Barclays Capital predicts that the 0.5 percent increase in bank reserve rates (from 16.5 percent of deposits to 17 percent) will remove 300 billion yuan from the Chinese economy. That’s only 20 percent or so of the amount loaned in January.

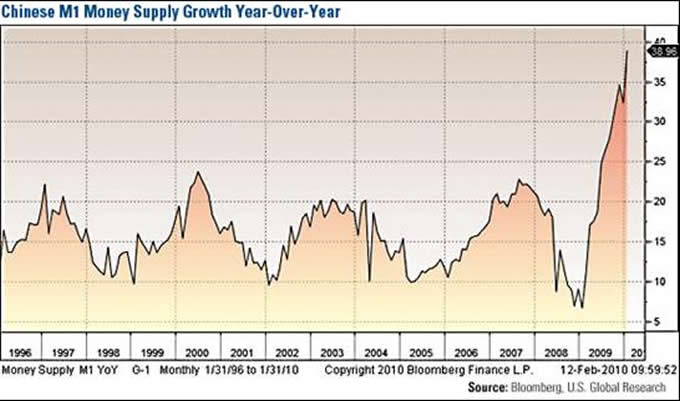

And it’s not like cash is going to dry up – the People’s Bank plans to increase the nation’s M2 money supply by 17 percent this year. January’s M1 money supply report showed a 39 percent increase (chart above). Not exactly a screw-tightening.

China’s CPI rose 1.5 percent in January, which is not extreme, and the chart above from BCA Research shows that real estate prices in terms of per-capita income had not entered a bubble phase as of year-end. But perhaps the more telling number was wholesale prices – up 4.3 percent year over year and more than double the increase seen in December. This signals that higher inflation at the consumer level could be around the corner.

Markets are taking a hit based on this news – this shows how important China has become to the world economy. It surpassed Germany as the top exporting country by value at $1.2 trillion, and in January its exports were up 20 percent compared to a year earlier. Even better, its imports were up 85 percent year over year.

What we may actually have is a classic bull market in the making – one that climbs the proverbial wall of worry, which suggests that investors buy on corrections. The table below shows the standard deviation (sigma) over 10 years for the main stock markets in mainland China and Hong Kong. The weekly sigma for the Shanghai A-share market is plus or minus 5 percent, while its normal quarterly swings can be nearly 25 percent up or down.

It’s nearly impossible to pick exact tops and bottoms – adding to core positions after any correction greater than one sigma is a safer and more prudent way to invest.

Beijing is tending to its economy so it performs over the long term. This is central to its goal of social stability through economic prosperity, and it seems to be working – millions of households join China’s middle class every year.

We all know what can happen when an asset bubble grows huge and then bursts – we’re still recovering from 2007-08.

China is a long-term growth story, and how well it manages that growth will have an impact on all of us. A little caution now should be seen as preventative maintenance, and we all know that when we’re talking about cars or economies, that’s a good thing.

Follow U.S. Global Investors on Twitter ;@USFUNDS. Become our fan on Facebook.

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.