Impact of Greece Debt Crisis and Bailout Talk on the Stock Market

Stock-Markets / Stock Markets 2010 Feb 12, 2010 - 12:51 PM GMTBy: Graham_Summers

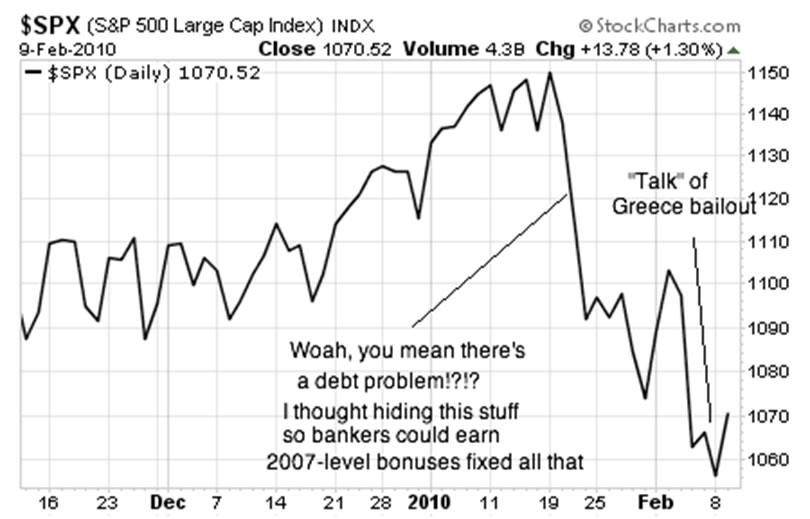

So let me get this right… Stocks start to collapse because Greece’s fiscal problems come to surface (problems I might add that have been obvious for months). But then, there is talk of a potential bailout (not an actual bailout, just “talk”) and stocks erupt higher again.

So let me get this right… Stocks start to collapse because Greece’s fiscal problems come to surface (problems I might add that have been obvious for months). But then, there is talk of a potential bailout (not an actual bailout, just “talk”) and stocks erupt higher again.

Is this how simpleminded the entire financial world has become? That stocks rally (people get bullish) because someone (a country this time) might get bailed out? So when the UK gets bailed out… or the US has to be bailed out (by Martians or some non-Earth dwelling organism since no country on the planet could bail us out) the S&P 500 will be trading at 10,000?

Let’s be totally blunt here. The fiscal policies/ bailouts/ stimulus plans of the world’s central bankers have fixed nothing. Zero. Nada. Nothing. Why? Because shoveling garbage debt from the private sector onto the public’s balance sheet DOESN’T pay off the debt or fix the debt problem.

It’s really quite simple. I’m not sure why the expert economists and pundits don’t understand this. Using this logic (shift debt around, but don’t pay it off or default on it) you could easily argue that the best way to deal with moldy cheese in the refrigerator is to hide it under the kitchen sink. Sure the fridge looks better, but pretty soon the entire kitchen stinks. And the cheese keeps getting moldier.

That’s’ the situation facing Greece, Portugal, Spain, Dubai, Italy, Ireland, the UK, the US, and basically everyone on the planet. DEBT. It stinks. And moving it around doesn’t make it (or the interest payments) go away.

No, there are truly only three solutions to a debt problem:

- Pay it off

- Default

- Inflate it away (a variation of #1)

“Pretend it’s not there” and “move it around and pray the economy recovers before it becomes an issue” are not solutions. They are illusions. The illusion that everything is under control. The illusion that trillions of dollars is NOT a problem. The illusion that Ben Bernanke and the world’s central bankers (NONE of whom saw this coming and ALL of whom perpetuated policies that created it) can somehow fix the situation.

Folks, the world’s bankers haven’t solved the Crisis. The fact that we’re now talking about bailing out entire countries should make this obvious. What’s next? Continents? The entire planet Earth?

At some point this belief “that bailouts will work” will smash into a wall. It may actually already be occurring. The markets didn’t even take out initial resistance in any meaningful way yesterday. Sure, we had an explosive open and massive rally on bailout rumors around noon. But even then the market cooled and closed below resistance.

If a Greece bailout emerges, don’t let it fool you. Spain, Portugal, Ireland and Italy are all in trouble (as is the UK and US for that matter). Any rally or positive spin that comes from a Greece bailout (if it happens) will be short-lived. The fact that we’re only in February and already the sovereign defaults are lining up should tell you how this year is likely going to turn out.

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.