Gold Technical Analysis, EUR/GOLD Breaks Above €800/oz

Commodities / Gold and Silver 2010 Feb 12, 2010 - 05:41 AM GMTBy: GoldCore

Gold was up 1.58% yesterday, closing at $1093.90/oz after having achieved a new session high of $1094.80/oz. It was flat in Asian trading but has given up some of yesterday's gains in European trading. Gold is currently trading at $1,080.80/oz and in euro and GBP terms €796.19/oz and 691.09/oz respectively.

Gold was up 1.58% yesterday, closing at $1093.90/oz after having achieved a new session high of $1094.80/oz. It was flat in Asian trading but has given up some of yesterday's gains in European trading. Gold is currently trading at $1,080.80/oz and in euro and GBP terms €796.19/oz and 691.09/oz respectively.

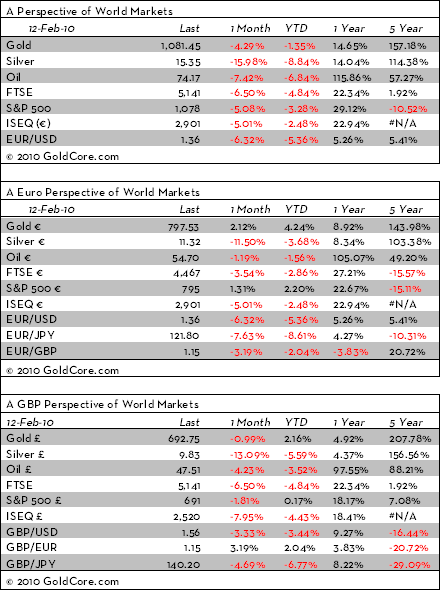

News that economic recovery came to a shuddering halt in Germany, Italy and Eastern Europe in the final quarter of 2009 will do little to ease concerns about the euro. The slowdown in growth in Germany surprised markets and in conjunction with the risk of Greek and southern European contagion has led to the euro falling again in world markets. The vagueness of the EU plan to help Greece has not helped matters and has seen European equity markets fall sharply after early gains. The euro has fallen particularly against the dollar and gold and gold rose to over €800/oz in euro terms this morning. euro gold started the week at €780/oz and is up 4.2% so far in 2010 (see A Euro Perspective of World Markets below).

Euro gold's record high of €812.70/oz reached nearly a year ago in March 2009 could well be challenged if the euro continues to come under pressure (see Bloomberg EUR/Gold Chart below). This seems very likely given the degree of economic problems facing the eurozone. Breakouts from falling wedge patterns often result in sharp follow through movements and a weekly close above €812/oz could see us quickly move to challenge psychological resistance at €850/oz.

The euro may fall more against gold than against the dollar given the growing fiscal challenges facing the US. Indeed, the commonly accepted notion that the dollar remains a safe haven currency will likely be increasingly questioned in the coming months as the poor and deteriorating US fiscal position (as seen in continuing trade deficits and growing budget deficits) leads to a reevaluation of the dollar's safe haven status. Particularly as President Obama is likely to try and inflate away the massive US long term liabilities.

As ever gold thrives on financial, economic and monetary uncertainty and there is plenty of that in the world today.

Silver

Silver rose 2% yesterday and is currently trading at $15.38/oz, €11.34/oz and 9.83/oz.

Platinum Group Metals

Platinum is currently trading at $1,504/oz, palladium at $414/oz and rhodium at $2,340/oz.

News

Oil prices were back above $75 in Asian trade today, but have given up those gains and fallen to $74.14. The market is being affected by concerns that the European Union's pledge to help Greece deal with its crippling debt crisis lacked details and about concerns about falling economic growth in Germany, Italy and Eastern Europe. New York's main futures contract, light sweet crude for delivery in March, was trading at $73.09 a barrel. Brent North Sea crude for April delivery was down to $72.86 a barrel.

Investor jitters was helped by news of Chinese monetary tightening. On the eve of the nation's week-long Lunar New Year holiday, Beijing revealed it was raising banks' reserve requirements by another 50 basis points in order to rein in loose lending.

The International Monetary Fund (IMF) has again made offers to assist Greece after yesterday's EU summit failed to result in concrete proposals. EU Finance Ministers will meet in Brussels on February 15 and 16 and will be expected to produce more substantive results. However given the poor financial position of the IMF and most EU member states it is difficult to see how they can magic away the huge fiscal challenges facing the eurozone.

Gold's supply side remains constrained and South Africa, the world's third largest gold producer, saw gold mine output fall 8.8 percent in December in volume terms. SA was the world's third-largest mine producer in 2008 with output of 233.3 tons. Despite the rise in gold prices seen in recent years, the production of gold internationally continues to fall which is bullish.

Data Today

U.S. retail sales for January. (1330 GMT)

Reuters/University of Michigan Surveys of Consumers for February. (1455 GMT)

U.S. business inventories for December. (1500 GMT)

U.S. ECRI weekly index of economic activity. (1530 GMT)

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.