This is Where Smart, Rich Investors Will Buy Silver

Commodities / Gold and Silver 2010 Feb 11, 2010 - 02:50 PM GMTBy: DailyWealth

It was smartest thing on silver I've heard in a long time…

It was smartest thing on silver I've heard in a long time…

Not surprisingly, Chris Weber said it.

For those of you unfamiliar with Chris Weber, he's as close to an investment oracle as you'll ever find. For 39 years, since age 16, Chris has made his living as an investor. To live this sort of life, you have to be a contrarian… you have to be willing to think and do unpopular things. Chris did just that when he told readers of his Global Opportunities Report:

If the Chinese economy falters, then it is very possible that commodities will fall as well, since China has been a huge market for them.This sort of thing drives people who hold gold and silver nuts. There's a reason gold has been used as money for thousands of years. It's easy to get attached to. And many gold and silver owners are very emotionally attached to their gold and silver holdings… much more so than, say, someone who owns 100 shares of Microsoft. Telling them gold or silver could decline in price is like saying their children are ugly.

I think gold will do better than silver under this scenario, because gold is viewed as a monetary commodity by all the major players, whereas silver is viewed as an industrial metal as well as a monetary one. In a contracting economy, silver may fall. That doesn't mean I'm going to rush to sell my silver, it means that I am prepared to see silver fall.

Chris, like me, believes the price of silver is going to be higher years from now. Governments are in a long-term trend of debasing their currencies, which will send the price of "real assets" like silver much higher. But despite Chris' bullishness, he doesn't stick his head in the sand and ignore things that might differ from his thesis.

After all, even the strongest bull markets can trend sideways, or lower, for many months… even years. And a weakening of the global economy could hurt silver because it's heavily used in industry.

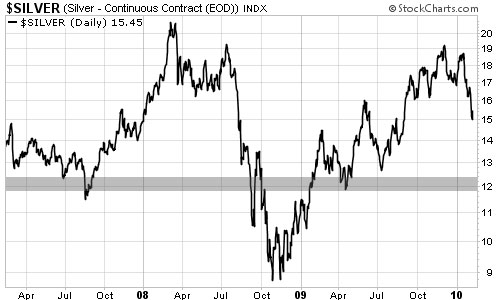

For a picture of how "hurt" silver could get in a correction – and where I expect will be a spectacular buy point – take a look at this three-year chart of silver:

Note that if you take out the crazy price action produced by the late 2008 credit crisis, you'll see that buyers tend to support silver when it trades for $11 to $12 per ounce. Silver bounced down to this area in August 2008, April 2009, and July 2009. Each time, silver stopped falling.

I believe this is the price where smart, rich investors step in to buy millions of dollars worth of silver for their "crisis portfolios." I know several extremely wealthy investors who have this area pegged as a place to buy lots of silver. They see it as the bargain price.

They know a global debasement of currencies will eventually push gold and silver higher… which will overwhelm any short-term considerations. And $12 silver is a cheap way to hedge the rest of your portfolio against currency crisis.

I'm sure Chris' comments generated some negative feedback from hard-core gold and silver fans. I'm sure this essay will generate some, too. But as investors, we always have to consider the potential risks to our holdings, rather than blindly focusing on the potential rewards. You have to be prepared to see your silver holdings decline in value.

And while I'm bullish on silver, I agree with Chris. If the magical economic recovery the U.S. and Chinese governments have engineered doesn't pan out, it could temporarily depress the price of silver…. Even down to $11 an ounce. And as you can see, this would present a terrific buying opportunity for silver bullion and silver stocks.

Good investing,

Brian

P.S. Last week, my colleague and resource expert Matt Badiali showed you how to get paid by a "gold bank." The same idea works just as well for silver. If you're looking for a conservative "sleep at night" way to hedge your portfolio with a unique gold and silver investment, click here.

P.P.S. Chris Weber is, by far, one of the best investors we know. And his Global Opportunities Report is considered a must-read in the DailyWealth office. If you're interested in finding out about Chris' personal favorite recommendations for both cash and gold, click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2010 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.