German Bailout of Greece, PIIGS Would Herald Shift of E.U. Power To Germany

Politics / Euro-Zone Feb 09, 2010 - 05:22 AM GMTBy: STRATFOR

The situation in Europe is dire.

The situation in Europe is dire.

After years of profligate spending, Greece is becoming overwhelmed. Barring some sort of large-scale bailout program, a Greek debt default at this point is highly likely. At this moment, European Central Bank liquidity efforts are probably the only thing holding back such a default. But these are a stopgap measure that can hold only until more important economies manage to find their feet. And Europe’s problems extend beyond Greece. Fundamentals are so poor across the board that any number of eurozone states quickly could follow Greece down.

And so the rest of the eurozone is watching and waiting nervously while casting occasional glances in the direction of Berlin in hopes the eurozone’s leader and economy-in-chief will do something to make it all go away. To truly understand the depth of the crisis the Europeans face, one must first understand Germany, the only country that can solve it.

Germany’s Trap

The heart of Germany’s problem is that it is insecure and indefensible given its location in the middle of the North European Plain. No natural barriers separate Germany from the neighbors to its east and west, no mountains, deserts, oceans. Germany thus lacks strategic depth. The North European Plain is the Continent’s highway for commerce and conquest. Germany’s position in the center of the plain gives it plenty of commercial opportunities but also forces it to participate vigorously in conflict as both an instigator and victim.

Germany’s exposure and vulnerability thus make it an extremely active power. It is always under the gun, and so its policies reflect a certain desperate hyperactivity. In times of peace, Germany is competing with everyone economically, while in times of war it is fighting everyone. Its only hope for survival lies in brutal efficiencies, which it achieves in industry and warfare.

Pre-1945, Germany’s national goals were simple: Use diplomacy and economic heft to prevent multifront wars, and when those wars seem unavoidable, initiate them at a time and place of Berlin’s choosing.

“Success” for Germany proved hard to come by, because challenges to Germany’s security do not “simply” end with the conquest of both France and Poland. An overstretched Germany must then occupy countries with populations in excess of its own while searching for a way to deal with Russia on land and the United Kingdom on the sea. A secure position has always proved impossible, and no matter how efficient, Germany always has fallen ultimately.

During the early Cold War years, Germany’s neighbors tried a new approach. In part, the European Union and NATO are attempts by Germany’s neighbors to grant Germany security on the theory that if everyone in the immediate neighborhood is part of the same club, Germany won’t need a Wehrmacht.

There are catches, of course — most notably that even a demilitarized Germany still is Germany. Even after its disastrous defeats in the first half of the 20th century, Germany remains Europe’s largest state in terms of population and economic size; the frantic mindset that drove the Germans so hard before 1948 didn’t simply disappear. Instead of German energies being split between growth and defense, a demilitarized Germany could — indeed, it had to — focus all its power on economic development. The result was modern Germany — one of the richest, most technologically and industrially advanced states in human history.

Germany and Modern Europe

That gives Germany an entirely different sort of power from the kind it enjoyed via a potent Wehrmacht, and this was not a power that went unnoticed or unused.

France under Charles de Gaulle realized it could not play at the Great Power table with the United States and Soviet Union. Even without the damage from the war and occupation, France simply lacked the population, economy and geographic placement to compete. But a divided Germany offered France an opportunity. Much of the economic dynamism of France’s rival remained, but under postwar arrangements, Germany essentially saw itself stripped of any opinion on matters of foreign policy. So de Gaulle’s plan was a simple one: use German economic strength as sort of a booster seat to enhance France’s global stature.

This arrangement lasted for the next 60 years. The Germans paid for EU social stability throughout the Cold War, providing the bulk of payments into the EU system and never once being a net beneficiary of EU largesse. When the Cold War ended, Germany shouldered the entire cost of German reunification while maintaining its payments to the European Union. When the time came for the monetary union to form, the deutschemark formed the euro’s bedrock. Many a deutschmark was spent defending the weaker European currencies during the early days of European exchange-rate mechanisms in the early 1990s. Berlin was repaid for its efforts by many soon-to-be eurozone states that purposely enacted policies devaluing their currencies on the eve of admission so as to lock in a competitive advantage vis-à-vis Germany.

But Germany is no longer a passive observer with an open checkbook.

In 2003, the 10-year process of post-Cold War German reunification was completed, and in 2005 Angela Merkel became the first postwar German leader to run a Germany free from the burden of its past sins. Another election in 2009 ended an awkward left-right coalition, and now Germany has a foreign policy neither shackled by internal compromise nor imposed by Germany’s European “partners.”

The Current Crisis

Simply put, Europe faces a financial meltdown.

The crisis is rooted in Europe’s greatest success: the Maastricht Treaty and the monetary union the treaty spawned epitomized by the euro. Everyone participating in the euro won by merging their currencies. Germany received full, direct and currency-risk-free access to the markets of all its euro partners. In the years since, Germany’s brutal efficiency has permitted its exports to increase steadily both as a share of total European consumption and as a share of European exports to the wider world. Conversely, the eurozone’s smaller and/or poorer members gained access to Germany’s low interest rates and high credit rating.

And the last bit is what spawned the current problem.

Most investors assumed that all eurozone economies had the blessing — and if need be, the pocketbook — of the Bundesrepublik. It isn’t difficult to see why. Germany had written large checks for Europe repeatedly in recent memory, including directly intervening in currency markets to prop up its neighbors’ currencies before the euro’s adoption ended the need to coordinate exchange rates. Moreover, an economic union without Germany at its core would have been a pointless exercise.

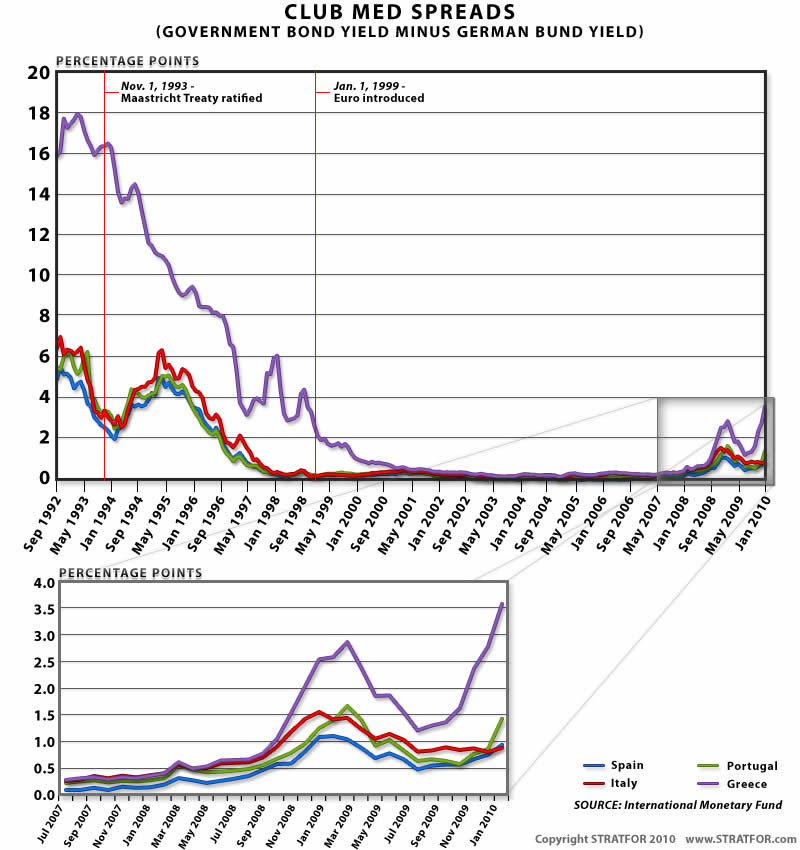

Investors took a look at the government bonds of Club Med states (a colloquialism for the four European states with a history of relatively spendthrift policies, namely, Portugal, Spain, Italy and Greece), and decided that they liked what they saw so long as those bonds enjoyed the implicit guarantees of the euro. The term in vogue with investors to discuss European states under stress is PIIGS, short for Portugal, Italy, Ireland, Greece and Spain. While Ireland does have a high budget deficit this year, STRATFOR prefers the term Club Med, as we do not see Ireland as part of the problem group. Unlike the other four states, Ireland repeatedly has demonstrated an ability to tame spending, rationalize its budget and grow its economy without financial skullduggery. In fact, the spread between Irish and German bonds narrowed in the early 1980s before Maastricht was even a gleam in the collective European eye, unlike Club Med, whose spreads did not narrow until Maastricht’s negotiation and ratification.

Even though Europe’s troubled economies never actually obeyed Maastricht’s fiscal rules — Athens was even found out to have falsified statistics to qualify for euro membership — the price to these states of borrowing kept dropping. In fact, one could well argue that the reason Club Med never got its fiscal politics in order was precisely because issuing debt under the euro became cheaper. By 2002 the borrowing costs for Club Med had dropped to within a whisker of those of rock-solid Germany. Years of unmitigated credit binging followed.

The 2008-2009 global recession tightened credit and made investors much more sensitive to national macroeconomic indicators, first in emerging markets of Europe and then in the eurozone. Some investors decided actually to read the EU treaty, where they learned that there is in fact no German bailout at the end of the rainbow, and that Article 104 of the Maastricht Treaty (and Article 21 of the Statute establishing the European Central Bank) actually forbids one explicitly. They further discovered that Greece now boasts a budget deficit and national debt that compares unfavorably with other defaulted states of the past such as Argentina.

Investors now are (belatedly) applying due diligence to investment decisions, and the spread on European bonds — the difference between what German borrowers have to pay versus other borrowers — is widening for the first time since Maastricht’s ratification and doing so with a lethal rapidity. Meanwhile, the European Commission is working to reassure investors that panic is unwarranted, but Athens’ efforts to rein in spending do not inspire confidence. Strikes and other forms of political instability already are providing ample evidence that what weak austerity plans are in place may not be implemented, making additional credit downgrades a foregone conclusion.

Germany’s Choice

As the EU’s largest economy and main architect of the European Central Bank, Germany is where the proverbial buck stops. Germany has a choice to make.

The first option, letting the chips fall where they may, must be tempting to Berlin. After being treated as Europe’s slush fund for 60 years, the Germans must be itching simply to let Greece and others fail. Should the markets truly believe that Germany is not going to ride to the rescue, the spread on Greek debt would expand massively. Remember that despite all the problems in recent weeks, Greek debt currently trades at a spread that is only one-eighth the gap of what it was pre-Maastricht — meaning there is a lot of room for things to get worse. With Greece now facing a budget deficit of at least 9.1 percent in 2010 — and given Greek proclivity to fudge statistics the real figure is probably much worse — any sharp increase in debt servicing costs could push Athens over the brink.

From the perspective of German finances, letting Greece fail would be the financially prudent thing to do. The shock of a Greek default undoubtedly would motivate other European states to get their acts together, budget for steeper borrowing costs and ultimately take their futures into their own hands. But Greece would not be the only default. The rest of Club Med is not all that far behind Greece, and budget deficits have exploded across the European Union. Macroeconomic indicators for France and especially Belgium are in only marginally better shape than those of Spain and Italy.

At this point, one could very well say that by some measures the United States is not far behind the eurozone. The difference is the insatiable global appetite for the U.S. dollar, which despite all the conspiracy theories and conventional wisdom of recent years actually increased during the 2008-2009 global recession. Taken with the dollar’s status as the world’s reserve currency and the fact that the United States controls its own monetary policy, Washington has much more room to maneuver than Europe.

Berlin could at this point very well ask why it should care if Greece and Portugal go under. Greece accounts for just 2.6 percent of eurozone gross domestic product. Furthermore, the crisis is not of Berlin’s making. These states all have been coasting on German largesse for years, if not decades, and isn’t it high time that they were forced to sink or swim?

The problem with that logic is that this crisis also is about the future of Europe and Germany’s place in it. Germany knows that the geopolitical writing is on the wall: As powerful as it is, as an individual country (or even partnered with France), Germany does not approach the power of the United States or China and even that of Brazil or Russia further down the line. Berlin feels its relevance on the world stage slipping, something encapsulated by U.S. President Barack Obama’s recent refusal to meet for the traditional EU-U.S. summit. And it feels its economic weight burdened by the incoherence of the eurozone’s political unity and deepening demographic problems.

The only way for Germany to matter is if Europe as a whole matters. If Germany does the economically prudent (and emotionally satisfying) thing and lets Greece fail, it could force some of the rest of the eurozone to shape up and maybe even make the eurozone better off economically in the long run. But this would come at a cost: It would scuttle the euro as a global currency and the European Union as a global player.

Every state to date that has defaulted on its debt and eventually recovered has done so because it controlled its own monetary policy. These states could engage in various (often unorthodox) methods of stimulating their own recovery. Popular methods include, but are hardly limited to, currency devaluations in an attempt to boost exports and printing currency either to pay off debt or fund spending directly. But Greece and the others in the eurozone surrendered their monetary policy to the European Central Bank when they adopted the euro. Unless these states somehow can change decades of bad behavior in a day, the only way out of economic destitution would be for them to leave the eurozone. In essence, letting Greece fail risks hiving off EU states from the euro. Even if the euro — not to mention the EU — survived the shock and humiliation of monetary partition, the concept of a powerful Europe with a political center would vanish. This is especially so given that the strength of the European Union thus far has been measured by the successes of its rehabilitations — most notably of Portugal, Italy, Greece and Spain in the 1980s — where economic-basket case dictatorships and pseudo-democracies transitioned into modern economies.

And this leaves option two: Berlin bails out Athens.

There is no doubt Germany could afford such a bailout, as the Greek economy is only one-tenth of the size of the Germany’s. But the days of no-strings-attached financial assistance from Germany are over. If Germany is going to do this, there will no longer be anything “implied” or “assumed” about German control of the European Central Bank and the eurozone. The control will become reality, and that control will have consequences. For all intents and purposes, Germany will run the fiscal policies of peripheral member states that have proved they are not up to the task of doing so on their own. To accept anything less intrusive would end with Germany becoming responsible for bailing out everyone. After all, who wouldn’t want a condition-free bailout paid for by Germany? And since a euro-wide bailout is beyond Germany’s means, this scenario would end with Germany leading the EU hat-in-hand to the International Monetary Fund for an American/Chinese-funded assistance package. It is possible that the Germans could be gentle and risk such abject humiliation, but it is not likely.

Taking a firmer tack would allow Germany to achieve via the pocketbook what it couldn’t achieve by the sword. But this policy has its own costs. The eurozone as a whole needs to borrow around 2.2 trillion euros in 2010, with Greece needing 53 billion euros simply to make it through the year. Not far behind Greece is Italy, which needs 393 billion euros, Belgium with needs of 89 billion euros and France with needs of yet another 454 billion euros. As such, the premium on Germany is to act — if it is going to act — fast. It needs to get Greece and most likely Portugal wrapped up before crisis of confidence spreads to the really serious countries, where even mighty German’s resources would be overwhelmed.

That is the cost of making Europe “work.” It is also the cost to Germany of leadership that doesn’t come at the end of a gun. So if Germany wants its leadership to mean something outside of Western Europe, it will be forced to pay for that leadership — deeply, repeatedly and very, very soon. But unlike in years past, this time Berlin will want to hold the reins.

By Marko Papic and Peter Zeihan

This analysis was just a fraction of what our Members enjoy, Click Here to start your Free Membership Trial Today! "This report is republished with permission of STRATFOR"

© Copyright 2010 Stratfor. All rights reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis.

STRATFOR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.