FEAR DAVOS 2010, Into The Bomb Shelter

Stock-Markets / Credit Crisis 2010 Feb 09, 2010 - 02:52 AM GMTBy: Darryl_R_Schoon

Predators and parasites recently gathered in Davos to discuss the mounting problems of their prey. All present agreed the problem needed urgent attention.

Predators and parasites recently gathered in Davos to discuss the mounting problems of their prey. All present agreed the problem needed urgent attention.

Historian David Hackett Fisher describes this passing era as the period of Victorian Equilibrium. England’s Victorian Equilibrium, however, was built on banker’s credit, a foundation of sand; and like the story of Cinderella where the carriage turns into a pumpkin at midnight, the banker’s credit has now turned into defaulting debt and the fairy-tale world it built is collapsing.

Lies, lies and more lies

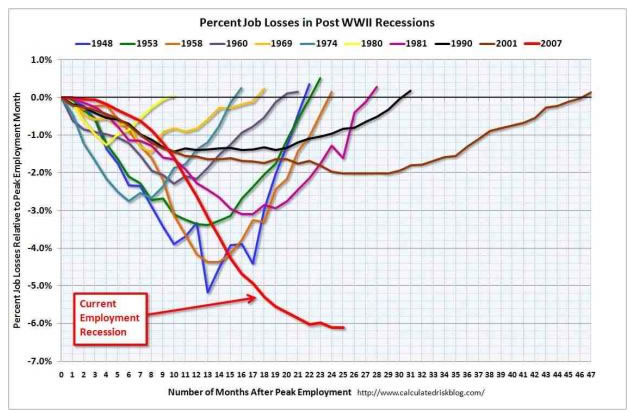

On February 5th, a Bloomberg headline reported: US Economy, Unemployment Unexpected Falls To 9.7%. Bloomberg’s headline was attempting to convey a more positive outlook for those considering additional borrowings to help restart the banker’s stalled engine of credit and debt (their credit and your debt); but the following chart tells the real story about US unemployment, a far different version than the optimistic story being spun by Bloomberg:

Note: If you still listen to, read or watch mainstream media for your news, you could believe any or all of the following: (1) the “recession” is over, (2) Iraq had weapons of mass destruction, (3) 9-11 was the work of terrorists and (4) Lee Harvey Oswald killed JFK. If you believe any of the above, you don’t need sleep aids as you are sleeping quite well on your own.

http://www.calculatedriskblog.com/..

The real US unemployment picture is one reason why the parasites and predators who gather in Davos are so concerned. Their 300 year-old system of credit and debt concocted to drain the productivity of others has succeeded beyond their wildest dreams; but it has come at a cost—their host, society, upon which their profits depend is now collapsing.

Their concern is genuine, similar to that of plantation owners whose slaves are falling prey to disease and death brought on by age and overwork. That such was inevitable did not occur to them so inured were they from living off the labor of others; and, now, while their dilemma is obvious the solution is not.

Were it not for the trillions of dollars of government aid in 2009, the global banking system would have already collapsed and the world would again be deep in the throes of another depression, where credit-driven demand sinks in an ocean of debt and settles on the bottom where it slowly drowns.

But the collapse has not been averted, it has only been delayed. The trillions of dollars spent to postpone the day of reckoning were borrowed and soon the bill will be proffered and payment demanded for having done so.

Despite the apparent resolve of those attending Davos, there is no way out except complete systemic collapse. All beginnings have endings and the end of the three hundred year system of economic slavery by credit and debt has arrived.

THE DAYS OF YORE ARE NO MORE

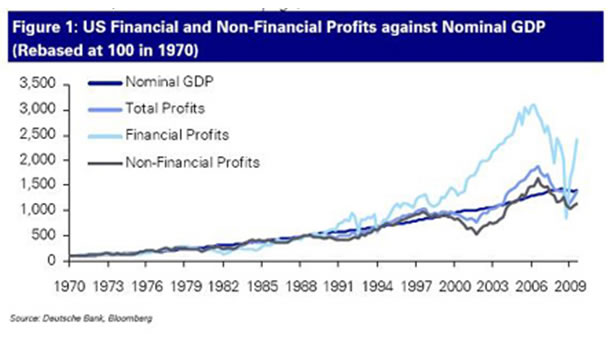

In the not too distant past, the punchbowls at Davos were overflowing with Dom Perignon, bankers were celebrating billion-dollar bonuses and tall high-priced call girls were as common as the short wealthy men who paid them The reason for such exuberant celebration is clear. The following chart shows why:

Beginning in 1990, the profits of the financial sector began to increase relative to the rest of the economy. This, of course, did not happen by accident. It happened because Alan Greenspan, the maestro of America’s demise, began to allow Wall Street more “freedom” during his tenure as Fed chairman; and, as we all know, freedom is a good thing—except, of course, when, in the name of freedom and free markets you turn the keys to the country over to thieves and robbers for ideological reasons, e.g. Republicans, and financial contributions, e g. Democrats.

This is what happened when Bill Clinton sold out America to the bankers. Because Wall Street already owned the Republicans, when Bill Clinton and the Democrats entered into their time-share agreement with the bankers, the fate of America was sealed.

Under the tenure of “Easy Al” Greenspan who never saw a problem easy credit couldn’t delay and the “welcome to the henhouse” policy extended by Bill Clinton to Goldman Sachs and their Wall Street cohorts, the stage was set for the climactic economic gang-bang of America that was to happen under Republican George Bush, Jr.

It was truly a bipartisan effort where both Republicans and Democrats united to give Wall Street carte-blanche to bet and lose the savings of Americans and allow bankers to obscenely profit no matter the outcome of their bets.

CELEBRATION DAVOS 2007

CONCERN DAVOS 2008

SHOCK DAVOS 2009

FEAR DAVOS 2010

The days of ostentatious celebration at Davos are over. Attending bankers and politicians are no longer smug and confident, their arrogance now replaced by vacillating indecision and enervating fear; and, today, if they don’t use enough deodorant, most would be politely asked to leave public areas. In Davos, despite its lofty altitude, the smell of change is in the air and it isn’t pleasant.

The present system of debt-based money and debt-based markets introduced by England’s bankers in 1694 is beyond redemption. Paul Volker, the hero of the 1980 clampdown on credit which gave capitalism one last putsch (1982-2007), has suggested reforming the banking sector in order to extend their now flagging run; and, as much as its victims would wish for it to succeed, it won’t. It’s too little, too late. The pumpkin is already waiting outside.

DO YOU KNOW WHERE YOUR CENTRAL BANKER IS?

Just five days after the bankers left Davos, the world’s top central bankers secretly reconvened in Sydney, Australia to discuss in emergency session the deterioration of global financial markets. On February 6th the Australian news media reported:

Representatives from 24 central banks and monetary authorities including the US Federal Reserve and European Central Bank landed in Sydney to meet..at a secret location…the two-day talks are shrouded in secrecy with high-level security believed to have been invoked by law enforcement agencies.

…Speculation that the chairman of the US Federal Reserve, Dr. Ben Bernanke, would make an appearance could not be confirmed…The event will be dominated by Asian delegations and is expected to include governors of the Peoples Bank of China, the Bank of Japan and the Reserve Bank of India…

The arrival of the high-powered gathering coincided with a fresh meltdown on world sharemarkets, sparked by renewed concerns about global growth and sovereign debt…Fears countries including Greece, Portugal, Spain and Dubai could default on debt repayments combined with disappointing US jobs data to spook investors.

Australia's ASX 200 slumped 2.4 per cent…echoing a sharp fall on Wall Street…Asian share markets were also pummeled, with Japan's Nikkei 225 down almost 3 per cent and Hong Kong's Hang Seng slumping 3.3 per cent…The damage was also being felt by European markets last night with London's FTSE 100 down sagging 1 per cent in early trade…Sovereign debt fears rippled through to the Australian dollar which was hammered to a four-month low of US86.43 and was trading at US86.77 cents last night.

“This does feel like '08 and '07 all over again whereby we had these sort of little fires pop up and they are supposedly contained but in reality they are not quite contained”, said H3 Global Advisors chief executive Andrew Kaleel…”Dubai should have been an isolated incident and now we are seeing issues with Greece, Portugal and Spain.”

http://www.news.com.au/..

When bankers began arriving in Sydney on Friday, one hour before markets closed in New York, US markets began to suddenly rally in the last hour of trading to close almost in positive territory, a suspicious sign of renewed market intervention by the US plunge protection team.

That western capital markets are subject to government intervention and interference has been true for decades. When the house controls the manufacture and supply of chips it matters little to the house if the gaming tables are fixed or free; but, to the punters, as long as some come out ahead, most don’t care.

When their underwear is soiled, free-market advocates often become Keynesians

THE BREAKDOWN

If you are reading this, the odds of you having been in Australia to attend the secret meetings of central bankers are remote. Nonetheless, we do share something with those who were inside eating and drinking on the public dime. Indeed, our fates are intertwined and not in a good way.

All of us, including the bankers, are in the above picture but we may not be where we think we are. Nonetheless, it is an accurate depiction of the current situation. The ship has hit an iceberg and is sinking. Only the time and manner of its demise are still unknown.

Some hope the ship can still be saved. It can’t. We are in the endgame predicted by those who warned us; and now it is too late to do what could only have been done before. We chose to do nothing and by so doing allowed the current tragedy to happen.

The dawning realization of what is happening has come too late to save the nation. The warnings by America’s founding fathers were ignored by all and the consequences are coming to pass as predicted.

America’s military, the world’s largest standing army, drained America of its once considerable wealth and private bankers have indebted the nation, its businesses and citizens beyond their ability to repay. Thomas Jefferson warned it could be so. We ignored his warnings and, now, it is too late.

The political process has proven singularly inadequate to prevent the collapse of the nation. Today, the political dialogue in America resembles a bitter domestic dispute in which the entire family will lose.

WHERE ARE YOU?

Hoping for change, Americans voted for Barack Obama and instead got more of the same, the same foreign policy, the same bankers, the same problems. If voting doesn’t lead to change, the question then becomes, what will?

Of Dingleberries*, Presidents and Things

The President to the dingleberry did say

Please stick with me the rest of the way

And you will certainly find

That all will be fine

If you stay to the end of the day

The dingleberry recalled

And indeed was appalled

That he’d heard such words before

From the right and the left

They’d left him bereft

Words that could come from a whore

There does come a time

When the light finally shines

In even the darkest of places

That no matter who wins

No matter the spin

You’re screwed by political races

So the dingleberry did think

It was beginning to stink

And began to see where he had been

He resembled a stool

Played for a fool

And saw the trouble he’s in

Unless dingleberries unite

And together do fight

The politicians and banks who own them

At the end of the day

Argue they may

They deserve the toilet that awaits ‘em

*Definition, dingleberry din·gle·ber·ry (d ng g l-b r ). n. Vulgar Slang. 1. A piece of dried feces caught in the hair around the anus. 2. An incompetent, foolish, or stupid person. ...

www.thefreedictionary.com/dingleberry

BETTER TIMES ARE AHEAD

In March, 25-29 in Szombathely, Hungary, Professor Antal Fekete, I and others will discuss the question, Is the Global Financial Crisis Really Over?; and, while the question may be rhetorical, much depends on its resolution.(to attend, contact GSUL@t-online.hu)

It is my opinion that the crisis will end in a complete breakdown of the banker’s system of credit and debt, a collapse so great that the past will become exactly that, the past; and the future, when it does arrive, will be far different than the present.

Historian David Hackett Fisher wrote that all great epochs, e.g. feudal, renaissance, enlightenment, etc. end in complete devastation and economic collapse. It will be the same with the present epoch, the age of Victorian Equilibrium. Fisher also noted that after the collapse of each era, another and, in many respects, superior era took its place.

A new era and better era can be expected; but, first, the bankers’ system of fraudulent money must collapse. The good news is that it will. The bad news is that when it does, hardship and suffering will result.

But suffering and hardship must be seen in a larger context. Just as Buckminster Fuller believed that mistakes are necessary for learning, crises are necessary for growth. Had we a choice, we would avoid all crises and all mistakes; and, as a consequence, all growth and all learning.

Emergence through emergency

Buckminster Fuller

Buckminster Fuller wrote in 1981 in The Critical Path…that mankind would soon be entering a period of unprecedented crisis, a crisis universally intended to bring about the transformation of humanity. If we could, we would resist this crisis. But we can’t and since we can’t, let us succeed.

The transformation of humanity depends on us doing so.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.