Electric Cars Materials and Resources Demand

Commodities / Metals & Mining Feb 08, 2010 - 09:25 AM GMTBy: Richard_Shaw

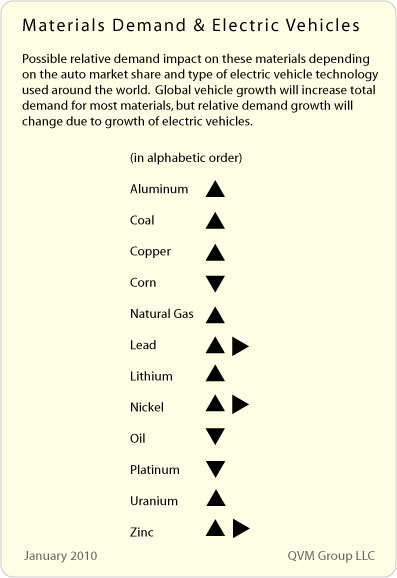

If electric cars are adopted by the market in the US and abroad, there will be a shift in the relative demand growth rate for certain basic materials.

If electric cars are adopted by the market in the US and abroad, there will be a shift in the relative demand growth rate for certain basic materials.

While global population growth and average global standard of living increases will raise overall materials demand across the board, a move toward electric cars, particularly plug-in electric cars, will change the composition of basic materials demand growth.

What are some of those materials that will be impacted and in what direction will the relative demand growth shift?

Aluminum relative demand may increase in the drive to create lighter vehicles to increase battery driving range.

Coal relative demand may increase due to the increased demand for electric power plant output for plug-in electric vehicles (coal being a major energy source for electricity generation).

Copper relative demand may increase due to the high copper content of electric motors used to power the wheels of electric cars.

Corn relative demand may decrease due to the reduced use of liquid fuels, of which ethanol is a component, and for which corn is an important feedstock.

Natural gas relative demand may increase due to increased demand for electric power plant output for plug-in electric vehicles (gas being a major energy source of electricity generation).

Lead relative demand may increase due to possible increased use of lead-based batteries in some electric vehicles, but may be relatively flat if other metals are the battery base of choice.

Lithium relative demand may increase due to the use of lithium in some percentage of electric car battery systems.

Nickel relative demand may increase due to the use of nickel-based batteries in some percentage of electric car battery systems, but may be relatively flat due to possible preference for other battery materials.

Oil relative demand may decrease due to lower demand for gasoline for which electricity would be the substitute.

Platinum relative demand may decrease due to smaller catalytic converters, or due to a lower rate of replacement, as a result of lower average gasoline consumption per driven mile per vehicle.

Uranium relative demand may increase due to the increased demand for electric power plant output for plug-in electric vehicles (uranium being a significant energy source for electricity generation, particularly in some countries).

Zinc relative demand may increase due to the use of zinc-based batteries in some percentage of electric car battery systems, but may be relatively flat due to possible preference for other battery materials.

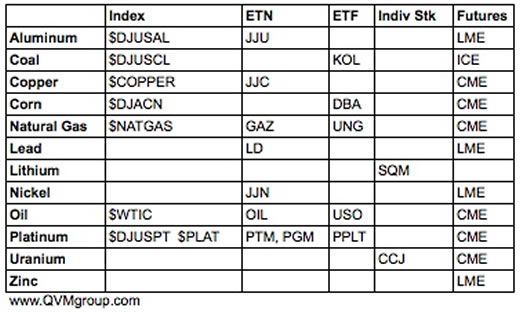

These materials can be reached by investors through one or more of futures contracts, exchange traded funds, exchange traded notes, and individual stocks. This chart shows the markets on which the futures are traded, the symbol for closely related ETFs or ETNs, the symbol for related indexes available at StockCharts.com, and the symbol for a closely related individual stock, in those cases where futures, ETFs or ETNs are not available.

None of the above are recommendations for purchase or sale at this time. They are merely reference indexes, securities or futures markets for long-term consideration of the electric car theme and its impact on relative demand growth for certain basic materials. This article also makes no representation as to the timing or degree of market adoption of electric vehicles. That is a separate consideration. This is about a possible long-term electric vehicle theme and what may happen to basic materials relative demand growth rates IF electric vehicles gain wide acceptance and use.

Holdings Disclosure: As of January 28, 2010, we do not have positions in any securities discussed in this document in any managed account.

Disclaimer:

Opinions expressed in this material and our disclosed positions are as of January 28, 2010. Our opinions and positions may change as subsequent conditions vary. We are a fee-only investment advisor, and are compensated only by our clients. We do not sell securities, and do not receive any form of revenue or incentive from any source other than directly from clients. We are not affiliated with any securities dealer, any fund, any fund sponsor or any company issuer of any security. All of our published material is for informational purposes only, and is not personal investment advice to any specific person for any particular purpose. We utilize information sources that we believe to be reliable, but do not warrant the accuracy of those sources or our analysis. Past performance is no guarantee of future performance, and there is no guarantee that any forecast will come to pass. Do not rely solely on this material when making an investment decision. Other factors may be important too. Investment involves risks of loss of capital. Consider seeking professional advice before implementing your portfolio ideas.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.