Had the Fed Stopped Buying Stocks and Can we trust the U.S. Economic Statistics?

Stock-Markets / Financial Markets 2010 Feb 06, 2010 - 02:35 PM GMT The unemployment rate fell from 10.0 to 9.7 percent in January, and nonfarm payroll employment was essentially unchanged (-20,000), the U.S. Bureau of Labor Statistics reported today. Employment fell in construction and in transportation and warehousing, while temporary help services and retail trade added jobs. In January, the federal government added 33,000 jobs, including 9,000 temporary positions for Census 2010. Employment in state and local governments, excluding education, continued to trend down.

The unemployment rate fell from 10.0 to 9.7 percent in January, and nonfarm payroll employment was essentially unchanged (-20,000), the U.S. Bureau of Labor Statistics reported today. Employment fell in construction and in transportation and warehousing, while temporary help services and retail trade added jobs. In January, the federal government added 33,000 jobs, including 9,000 temporary positions for Census 2010. Employment in state and local governments, excluding education, continued to trend down.

In accordance with usual practice, BLS will not revise the official household survey estimates for December 2009 or earlier months. To show the impact of the population adjustment, however, differences in selected December 2009 labor force series based on the old and new population estimates are shown in table B. The adjustment decreased the estimated size of the civilian noninstitutional population in December by 258,000, the civilian labor force by 249,000, and employment by 243,000; the new population estimates had a negligible impact on unemployment rates and other percentage estimates.

Did you catch the sleight-of-hand? The total labor force is being reduced while they are adding 33,000 census takers to the rolls as full-time employees, thus they are getting their (statistical) improvement. Discouraged workers are nowhere to be found. Table A shows the reduction of total non-farm employees in 2009. While reducing the number of (427,000 fictitious) jobs, they reduced the number of total workforce, which gave a statistically lower percentage of unemployed, after counting part-time census takers as full-time employees.

When you run into headlines like "Payrolls fall in January, jobless rate at 5-month low" don't stop and ask "If 20,000 jobs are going away, how can the unemployment rate drop?" If you are scratching your head, you're not supposed to understand any of this stuff...isn't everything clear? The BLS should be abolished. It serves no useful function.

Has the Fed stopped buying stocks?

-- The S&P 500 Index may be finishing its third consecutive down week. We have speculated that the Federal Reserve or the U.S. Treasury could be allowing a "buyer" to accumulate stock index futures to boost stock prices. Perhaps the "buyer" has stopped buying. We know that the S&P 500 has dropped 6.6% since the close on January 20, the day before President Obama announced a plan to restrict proprietary trading by banks. Moreover, the S&P 500 fell on seven of those 11 trading days.

-- The S&P 500 Index may be finishing its third consecutive down week. We have speculated that the Federal Reserve or the U.S. Treasury could be allowing a "buyer" to accumulate stock index futures to boost stock prices. Perhaps the "buyer" has stopped buying. We know that the S&P 500 has dropped 6.6% since the close on January 20, the day before President Obama announced a plan to restrict proprietary trading by banks. Moreover, the S&P 500 fell on seven of those 11 trading days.

Are treasury bonds a safe haven or a trap?

-- Treasuries climbed yesterday, pushing 30-year bond yields down the most in four months, as investors sought the safety of U.S. debt on concern some European countries face difficulty financing budget deficits. The U.S. Treasury will sell a record-tying $81 billion of notes and bonds next week: $40 billion in 3-year securities, $25 billion of 10-year debt and $16 billion in 30-year bonds. The auctions will be held over three days starting Feb. 9.

-- Treasuries climbed yesterday, pushing 30-year bond yields down the most in four months, as investors sought the safety of U.S. debt on concern some European countries face difficulty financing budget deficits. The U.S. Treasury will sell a record-tying $81 billion of notes and bonds next week: $40 billion in 3-year securities, $25 billion of 10-year debt and $16 billion in 30-year bonds. The auctions will be held over three days starting Feb. 9.

Gold’s decline is causing chaos with traders.

-- Gold fell to a three-month low in London as the dollar’s rally cut bullion’s appeal as an alternative investment. Other precious metals slid. Gold liquidation continues along with other “risk” assets. The Reuters-Jefferies CRB Index of 19 raw materials fell 2.6 percent yesterday, the most since Aug. 14. After reaching a 14-month high in January, the gauge ended the month down 6.3 percent, the most since November 2008.

-- Gold fell to a three-month low in London as the dollar’s rally cut bullion’s appeal as an alternative investment. Other precious metals slid. Gold liquidation continues along with other “risk” assets. The Reuters-Jefferies CRB Index of 19 raw materials fell 2.6 percent yesterday, the most since Aug. 14. After reaching a 14-month high in January, the gauge ended the month down 6.3 percent, the most since November 2008.

The Nikkei turns south, again.

-- The Nikkei 225 Stock Average fell, sending the Japanese Stock Average to its lowest close in almost two months, after the yen gained, commodity prices slid and U.S. jobless claims rose, hurting confidence in a global recovery. It is becoming more apparent that the U.S. economy won’t rebound any time soon, raising the anxiety level of Japanese investors who are dependent upon the U.S. for exports.

-- The Nikkei 225 Stock Average fell, sending the Japanese Stock Average to its lowest close in almost two months, after the yen gained, commodity prices slid and U.S. jobless claims rose, hurting confidence in a global recovery. It is becoming more apparent that the U.S. economy won’t rebound any time soon, raising the anxiety level of Japanese investors who are dependent upon the U.S. for exports.

Shanghai deals with overheated economy.

-- China’s Shanghai Index fell, sending the benchmark index to its longest weekly losing streak since October, on concern faltering global economic growth will prevent the nation’s exports from sustaining a recovery. Chinese regulators have been tightening access to credit to slow down their overheated economy. Even a declining market won’t cause officials to relax because of already existing overcapacity issues.

-- China’s Shanghai Index fell, sending the benchmark index to its longest weekly losing streak since October, on concern faltering global economic growth will prevent the nation’s exports from sustaining a recovery. Chinese regulators have been tightening access to credit to slow down their overheated economy. Even a declining market won’t cause officials to relax because of already existing overcapacity issues.

The dollar is up on increased risk aversion.

The dollar gained against the yen after a government report showed the U.S. unexpectedly lost jobs last month while the unemployment rate declined. “People are saying the labor market looks a bit weak,” said James Shugg, a senior economist at Westpac Banking Corp. in London. “That’s consistent with this concern that the global economy is going to lose some momentum and budget deficits are going to be a problem and there’s going to be an increase in risk aversion.”

The dollar gained against the yen after a government report showed the U.S. unexpectedly lost jobs last month while the unemployment rate declined. “People are saying the labor market looks a bit weak,” said James Shugg, a senior economist at Westpac Banking Corp. in London. “That’s consistent with this concern that the global economy is going to lose some momentum and budget deficits are going to be a problem and there’s going to be an increase in risk aversion.”

FHA facing a crush of foreclosures.

-- The share of borrowers who are falling seriously behind on loans backed by the Federal Housing Administration jumped by more than a third in the past year, foreshadowing a crush of foreclosures that could further buffet an agency vital to the housing market's recovery. About 9.1 percent of FHA borrowers had missed at least three payments as of December, up from 6.5 percent a year ago, the agency's figures show.

Gasoline prices are easing, but slowly.

The Energy Information Agency weekly report suggests, “For the third week in a row, the U.S. average price for regular gasoline declined. Settling at $2.66 per gallon, the average fell more than four cents but was $0.77 above last year. On the East Coast, the price slipped almost four cents to $2.69 per gallon. The average in the Midwest dropped the most of any region, tumbling six cents to $2.56 per gallon.”

The Energy Information Agency weekly report suggests, “For the third week in a row, the U.S. average price for regular gasoline declined. Settling at $2.66 per gallon, the average fell more than four cents but was $0.77 above last year. On the East Coast, the price slipped almost four cents to $2.69 per gallon. The average in the Midwest dropped the most of any region, tumbling six cents to $2.56 per gallon.”

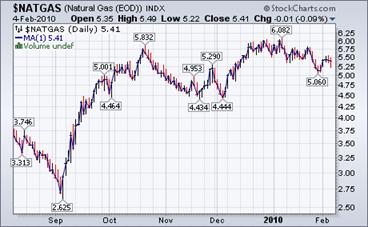

NatGas prices still feeling the winter effect.

The Energy Information Agency’s Natural Gas Weekly Update reports, “Since last Wednesday, January 27, natural gas spot prices posted relatively modest increases at most market locations amid continued cold temperatures. Cold winter temperatures throughout most of the lower 48 States and rising crude oil prices likely contributed to rising natural gas prices. On the week, price increases were generally less than 10 cents per MMBtu at most markets.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “Since last Wednesday, January 27, natural gas spot prices posted relatively modest increases at most market locations amid continued cold temperatures. Cold winter temperatures throughout most of the lower 48 States and rising crude oil prices likely contributed to rising natural gas prices. On the week, price increases were generally less than 10 cents per MMBtu at most markets.”

“Fear the Boom and Bust” rap is gaining public attention.

The beauty of new media is its capacity for showing us what we otherwise might miss. Fear the Boom and Bust, a YouTube video made by producer John Papola and economist Russ Roberts, and backed by the Mercatus Center of George Mason University, turns this advantage to the point of genius, pitting Keynes and Hayek against each other in a rap that captures a reality few have fully understood until now.

For more commentary, click here.

Congresswoman Marcy Kaptur exposes Tim Geithner.

Video: Congresswoman Marcy Kaptur questions Turbo on AIG, Goldman Sachs, and NY Federal Reserve actions regarding AIG counterparty payouts at PAR. Kaptur: A lot of people think that the president of the New York Fed works for the U.S. government, but in fact, you work for the private banks that elected you. Can you provide — Geithner: No, that is not true. Kaptur: Can you provide for the record the names of the bankers that elected you in 2002? Geithner: That is a matter of public record, and of course we can do that. Hmmm…

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.