E.U. Government Bonds are STILL the Safest Bet

Interest-Rates / International Bond Market Feb 06, 2010 - 01:34 PM GMTBy: Vishal_Damor

Well you will not hear that too often. Will you? At a time when markets are ravaging the hapless Greece government into complete submission, PIGS as a basket is being slaughtered mercilessly in the bond markets, Euro has now tumbled a mind boggling 1500 pips from its peak of 1.524, it is important to step above the markets and take a deep breadth on where exactly are we in the much hyped sovereign bond risk.

Well you will not hear that too often. Will you? At a time when markets are ravaging the hapless Greece government into complete submission, PIGS as a basket is being slaughtered mercilessly in the bond markets, Euro has now tumbled a mind boggling 1500 pips from its peak of 1.524, it is important to step above the markets and take a deep breadth on where exactly are we in the much hyped sovereign bond risk.

I do not think it will get any more contrarian than this if someone can make a case for the EURO. Having said that I do not make that case for the sake of being a contrarian. I have been a long term bull on EURO.

Does Greece represent a larger problem in that it can spread the contagion to other healthier economies within the EU? Will Greece do a Lehman Brothers to the whole of EU and thus drag down the european financial markets and lead to the explosion of the EURO? Mind you there are far too many people out there who have called for the explosion of the EURO and some very notable analysts at that. I do not want to name them but there are few who are on the other side of this debate, who maintain EU bonds are the safest in the world. Bill Gross was on record saying: “Investors, go to Germany”. In more ways than one, that is the clarion call that I want to begin this analysis with. INVESTORS: Look to EU.

Sovereign Bonds and Risk

Source: Reuters, Haver Analytics

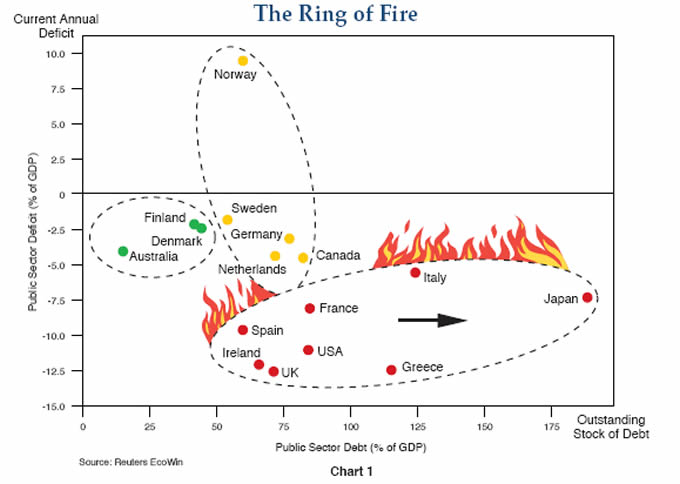

These red zone countries are ones with the potential for public debt to exceed 90% of GDP within a few years’ time, which would slow GDP by 1% or more. The yellow and green areas are considered to be the most conservative and potentially most solvent, with the potential for higher growth.

Currently the gross level of public and private debt is shown

A different study by the McKinsey Group analyzes current leverage in the total economy (household, corporate and government debt) and looks to history, finding 32 examples of sustained deleveraging in the aftermath of a financial crisis. It concludes:

- Typically deleveraging begins two years after the beginning of the crisis (2008 in this case) and lasts for six to seven years.

- In about 50% of the cases the deleveraging results in a prolonged period of belt-tightening exerting a significant drag on GDP growth. In the remainder, deleveraging results in a base case of outright corporate and sovereign defaults or accelerating inflation, all of which are anathema to an investor.

Debt situation as it stands:

Source: Mckinsey Global, Reuters, PIMCO

China, India, Brazil and other developing economies have fared far better than G-7 stalwarts. But China and Indian currency have no role in future global currency formation as they are very shallow and besought with domestic politics. One can never bet on their governments to allow their currencies to float. And that brings us to few that are left. Quite clearly Germany scores over all the remaining. In case of US, while its debt is just a shade above Germany, the future projections in case of US are scary.

EURO and GOLD

Here is my final puzzle to the dollar bulls who have called for the demise of EURO. Why has the euro and GOLD moved in lockstep, ever since the launch of EURO in 2000? Why is that euro is being clubbed together with safest asset out there which is GOLD. GOLD obviously is infeasible to be held with the current monetary base that the FED has created due to the sheer supply demand situation, and hence US bonds continue to thrive and create the illusion of being a safe asset relative to GOLD. But the fact remains that GOLD is far more rarer than US dollars.

But that still leaves the mystery on why is EURO is moving in lockstep with Gold prices. The popular answer to that is both are Anti dollar trades and hence move together. But that is the exact point. EURO and GOLD move together as they are both being viewed as elements of safety or risk (as the situation may be) to the dollar trade.

Here is a chart showing the 18 year movement of EURO index:

Now take a look at Gold chart from 1985 to Feb 5 2010:

As you can observe Gold and EURO breaks out at the same time in 2000 and they have both moved in lockstep since then. The correlation is amazing. Why is Gold dropping if there is bond risk in euro land? Which begs the question then, isnt the whole soverign bond risk a complete hog wash being played to perfection to throw of the markets since some important people can get off the DOLLAR?

Is there a contagion developing in Gold as well? What makes Gold and EURO sell off at the same time? The obvious shallow answer to these questions are that Gold Price is result of risk in the system which is cause of dollar carry. That is the exact point that I want to stress. The dollar carry is here for years and years to come due to the structural damage of the US economy. EURO and GOLD will move up in subsequent years. Far from EURO exploding, it will be the currency of choice due to its structural strength. PIGS is the first time that EURO strength has been tested and till now, it has come out with flying colors except that it has weakened from its peak which is understandable but the ECB has passed the test with flying colors as its silence is more powerful than the words it may speak. .

What happens in the short term?

Well that is the million dollar question? AshrafLiaidi makes a case for EUR/USD to drop to 1.32.

The charts in the lower frame below represent the spreads of 10-year yields of selected Eurozone nations over that of Germany (considered the safest bond in the Eurozone). Greek 10 year yields soared to as high as 400 bps above those of Germany, while Portuguese and Spanish yields hit 129 bps and 0.98 bps respectively.

Ashraf may be correct in projecting 1.32 but that was before swiss central bank intervened in Friday early hours. The actions of swiss central bank (surely on the behest of ECB) as it pumped in CHF into the market while EURO stabilized may just give the clue to the short term. I think ECB has for the first time shown signs of being uncomfortable about the EURO selling. If the ECB even twitches to defend the EURO, I can assure you, we will see the biggest bloodbath of shorts of this decade even surpassing the shorts who were massacred post Lehman when FED announced the ban of short sellers.

The reason why ECB will not make such frontal defense of EURO is that it could kill the short term confidence that has developed in the Dollar. ECB and the world needs the dollar to stabilize as the world trade hinges on it. But irrespective of that, naked selling of euro is a dangerous game and should only be played knowing the risks of the world most powerful central bank sitting behind it. My suggestion is to let the much celebrated pair EUR/USD fall to stabilise and then go long this pair for a long term opportunity.

Summary:

Please do not barrage me with abuses and scathing remarks for being a contrarian but as I said, I have put my reason and logic behind the pair. I dare the dollar bulls to make a case for the dollar for the next 5 years. It is a case that even president Obama could not make as he presented his bloated 3.4 trillion budget.

Let me at the end quote Bill Gross again:

Of all of the developed countries, three broad fixed-income observations stand out:

- Given enough liquidity and current yields I would prefer to invest money in Canada. Its conservative banks never did participate in the housing crisis and it moved toward and stayed closer to fiscal balance than any other country,

- Germany is the safest, most liquid sovereign alternative, although its leadership and the EU’s potential stance toward bailouts of Greece and Ireland must be watched. Think AIG and GMAC and you have a similar comparative predicament, and

- U.K. is a must to avoid. Its Gilts are resting on a bed of nitroglycerine. High debt with the potential to devalue its currency present high risks for bond investors. In addition, its interest rates are already artificially influenced by accounting standards that at one point last year produced long-term real interest rates of 1/2 % and lower.

By the way Bill Gross has full knowledge of the developing PIGS issue and yet made the case for selling US bonds and own EU bonds. The Canadian currency does not have the same level of depth as the EURO which is why I will favour the German bonds to even the Canadian bonds.

This is a landmark newsletter that Gross has published which I believe will be looked back in years to come when EURO will have been used as the world reserve currency and many will even point to Bill Gross and say: “He did say that in the RING OF FIRE letter” when he issued his investor cry: Go to Germany.

An interview with Scott Mather, MD, PIMCO when he was asked his choice of regional bonds to own:

What regions do you favor?

We have a fundamental favoroable view of EU bonds compared to US bonds. French and German bonds have yield similar to US bonds and yet have a far more favorable deficit structure. France and Germany do not have headwinds from declining QE as these regions never went into QE.

The full interview can be accessed here:

Scott Mather Interview

I have no doubt in my mind, that the current PIGS crisis is a superb buying opportunity of the EURO and German Bunds and short the US and UK treasury. The current crisis will be used by ECB to cleanse the problem of deficit in EU as it imposes stringent requirement on PIGS. In fact I also believe that ECB apparent silence on the whole issue is to let Greece have some more pain to let them agree to the tough terms of budget control. But once this plays out completely is the time to short US treasury as then the next focus is on US. But short term guys, be careful of even the slightest move by ECB and it is time to exit your joy ride shorting the EURO.

As and when the final bond crisis hits US and its 10 year yield start rising, the US treasury ability to reign in their own deficit will tested. I believe they will fail drastically due to the disfavor it finds with the US consumer.

There in lies the case for the EURO.

Source: http://investingcontrarian.com/global/eu-bonds-are-the-safest-bet-still/

Vishal Damor

http://investingcontrarian.com/

Vishal Damor, works for an emerging market financial consulting firm and is the editor at INVESTING CONTRARIAN, a financial analysis and reporting site covering commodities, emerging markets and currencies.

© 2010 Copyright Vishal Damor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.