Gold Price Crash on Sovereign Debt Contagion and Economic Growth Risk

Commodities / Gold and Silver 2010 Feb 05, 2010 - 04:36 AM GMTBy: GoldCore

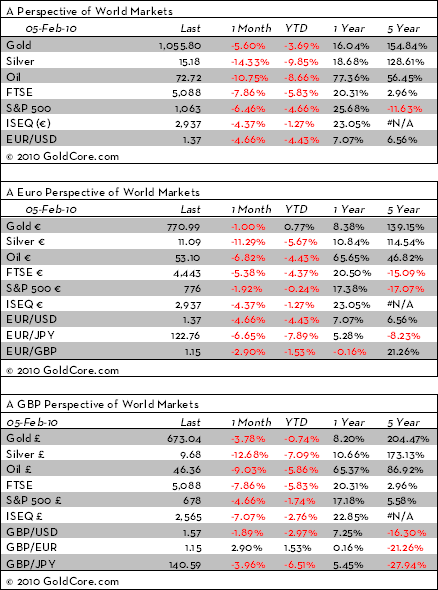

Gold fell sharply yesterday and is trading at $1,052/oz. In Euro and GBP terms, gold is trading at €770/oz and £673/oz. Support for gold is currently seen at $1,025/oz to $1,030/oz and resistance at $1,115/oz.

Gold fell sharply yesterday and is trading at $1,052/oz. In Euro and GBP terms, gold is trading at €770/oz and £673/oz. Support for gold is currently seen at $1,025/oz to $1,030/oz and resistance at $1,115/oz.

Equity markets internationally are tumbling amid sovereign debt default risk and global recovery doubts. Gold sold off yesterday as traders liquidated positions en masse and large stop loss positions were triggered. Gold was down 4% in US dollar terms but by much less in other currencies as the dollar strengthened considerably. Risk aversion has spread from Asia to Europe this morning as markets sold off following Thursday's sharp losses on Wall Street and in Europe. Investors eagerly await the non-farm payroll numbers in the US later today to give guidance.

The selloff in gold will come as no surprise as in recent years gold has exhibited a strong correlation with equities in the short term. Traders in the futures market will quickly get out of all positions and go to cash in order to protect leveraged positions. However, gold's long term inverse correlation with equities remains in place. What has happened in recent years is that gold falls in unison with equities initially but does not keep falling as much as equity markets and then has recovered from its selloff quicker than equities.

Given the degree of physical demand seen internationally and particularly in Asia this pattern is likely to be repeated as bargain hunters use this sell off to enter the market. Given the degree of macroeconomic risk in the world and particularly the real risk of a major sovereign default, gold will be seen by some as attractive at these levels. Support is at the 200 day moving average at $1,018/oz and at previous very strong resistance at $1,030/oz.

Silver

Silver is trading at $15.15/oz In euro and GBP terms silver is trading at €11.07/oz and £9.66/oz.

Platinum Group Metals

Platinum is trading at $1,477/oz while rhodium and palladium are trading at $2,450/oz and $430/oz respectively.

News:

Oil prices fell below $73 a barrel Friday in Asia today after a major sell-off the previous day as investors dumped stocks and commodities amid doubts about the global economic recovery.

G-7 officials gather to discuss the myriad of challenges facing the global financial system and economy. Issues to be discussed include Chinese currency revaluation, global regulation, massive US debt levels and sovereign debt risk in Greece and elsewhere.

Job losses from the Great Recession are about to get worse as the US government revises employment data. The number of jobs lost in the year that ended in March 2009 is expected to rise by roughly 800,000, raising the number of jobs shed during the recession to around 8 million.

The risk of growing protectionism (which contributed to a deepening of the Great Depression) remains pronounced as China announced anti-dumping steps on US chicken and China complained to the WTO over the EU's treatment of Chinese footwear.

Geopolitical tension between China and the US has increased with the ongoing Tibet tension and now the Google censorship and Taiwan arms deal increasingly contentious issues.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.