No Worry about US Consumer Spending So Long As Jobs/Income Are Growing?

Economics / US Economy Jul 31, 2007 - 09:14 AM GMTBy: Paul_L_Kasriel

That's the rallying cry of the economic bulls. Aside from the fact that jobs and personal income are coincident indicators, not leading indicators, and that labor compensation as a percent of consumer spending tends to rise just before the onset of recessions (see Payroll Growth = Consumer Spending Growth?), will jobs and income growth alone be enough to sustain real consumption growth going forward? That is, with mortgage equity withdrawals drying up and corporate buybacks and private equity buyouts slowing down, suppose that consumer spending relative to disposable income reverts to its mean. What rate of growth in real consumer spending could we look forward to in 2007?

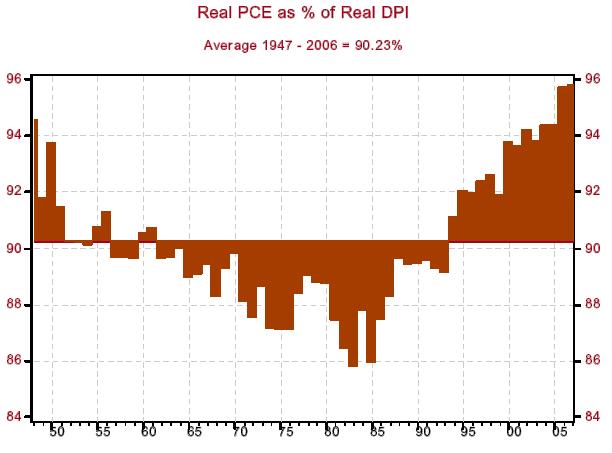

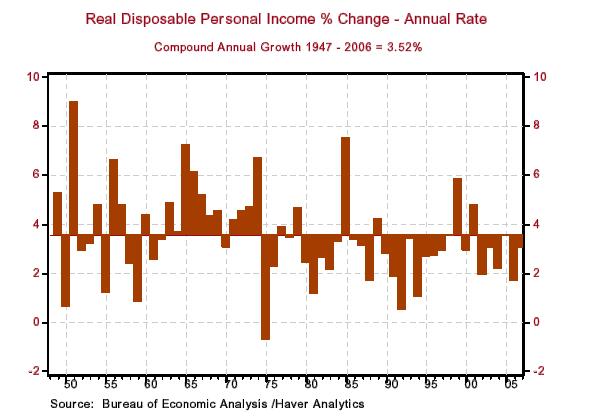

Chart 1 shows real personal consumption expenditures (PCE) as a percent of real disposable (after-tax) personal income (DPI). For the years 1947 through 2006, the average percentage was 92.3. From 1993 on, consumption as a percent of disposable income has been above average. In 2006 it was 95.80%. Chart 2 shows the year-to-year change in real DPI. The compound annual rate of growth real DPI from 1947 through 2006 was 3.52%. In the six years ended 2006, year-to-year DPI growth has been below 3.52% except for 2004 (3.61%).

Chart 1

Chart 2

Remember that Hewlett-Packard commercial of a few years ago, "What if?" What if in 2007 real DPI grew at 3.52% -- faster than its 2.75% compound annual growth in the past five years -- but real PCE fell back to its long-run average of 90.23% of real DPI? What would growth in real PCE be in 2007 vs. 2006? Growth? There would be no growth. Instead, under this "what if scenario," real PCE would contract by 2.5%.

There is little doubt, in my mind anyway (see Wealth Effect or Borrowing/Asset Sales Effect? ), that the higher ratio of consumer spending relative to disposable personal income has been the result of increased household borrowing using residential real estate as collateral and the sale of household direct and indirect holdings of corporate equities to corporations and private equity syndicates. If households had to depend only on their income from employment and other sources to fund their consumer spending, we would observe much slower growth in consumption expenditures. So, those who keep harping that "the consumer" will be just fine so long as there is job and income growth ought to do some "what ifs."

By Paul L. Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2007 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.