Greece Part of Unfolding Global Sovereign Debt Crisis 2010

Interest-Rates / Global Debt Crisis Feb 03, 2010 - 12:19 AM GMTBy: John_Mauldin

I wrote about Greece in last week's letter. Then I ran across this column in the Financial Times by my friend Mohammed El-Erian, chief executive of Pimco, and someone who qualifies to be introduced as one of the smartest men on the planet. It is short and to the point. ( www.pimco.com)

I wrote about Greece in last week's letter. Then I ran across this column in the Financial Times by my friend Mohammed El-Erian, chief executive of Pimco, and someone who qualifies to be introduced as one of the smartest men on the planet. It is short and to the point. ( www.pimco.com)

Then, somehow my London partner, Niels Jensen of Absolute Return Partners found the time to write a letter while we were running around Europe. As we had a lot of conversations with some very key players, and a lot of debate, the letter reflects a lot of what we learned, as well as further documents the serious straits that European nations face in the coming years due to their debt and deficits. It is not just a US or Japanese problem. I have worked closely with Niels for years and have found him to be one of the more savvy observers of the markets I know. You can see more of his work at www.arpllp.com and contact them at info@arpllp.com.

And finally, many of you are probably familiar with TED Talks. If you are not, you should be. They basically get very smart, creative people to come in and do short talks Tiffani just sent me one of their latest videos. 13 minutes. It blew me away. The world of Minority Report is here, 40 years ahead of schedule. All I could do was just say "Wow!" Its young men like this that should make us all optimists that

somehow we will figure out how to get through all this. http://www.ted.com/talks/view/id/685

John Mauldin, Editor

Outside the Box

Greece part of unfolding sovereign debt story

By Mohamed El-Erian

Global investors worldwide are starting to pay more attention to what is unfolding in Greece. Yet most still think of Greece as an isolated case, just as they did for Dubai a few months ago.

With time, they will see Greece as part of a much larger investment theme that is a direct outcome of the global financial crisis: the 2008-09 ballooning of sovereign balance sheets in advanced economies is consequential and is becoming an important influence on valuations in many markets around the world.

As realisation spreads of this key sovereign investment theme, it is important to be clear about what Greece is, and what it is not.

At the simplest level, think of Greece as Europe's big game of chicken, with the operational question for markets being two-fold: who will blink first, the Greek authorities, donors or both; and will they blink in time to avoid truly disorderly debt and market dynamics that also entail significant contagion risk.

Let us start with Greece where, under any realistic scenario, a meaningful internal adjustment is needed.

There is no solution to the country's debt issues without a deep and sustained policy effort. Yet, given the initial conditions (including the size and maturity profile of its debt) and the existing policy framework (anchored on adherence to a fixed exchange rate via the euro), such adjustment is difficult and not sufficient.

If unaccompanied by extraordinary external assistance, it would entail such contractionary fiscal measures as to raise legitimate socio-political problems.

External assistance is needed to support the meaningful implementation of internal policies. And it has to be consequential in scale and durability, as well as timely and well-targeted.

Understandably, such assistance faces headwinds on account of donors' moral hazard concerns (vis-à-vis Greece and beyond); of donors' understanding that a Greek bail-out would not be a one-shot deal; and of donors' own domestic budgetary considerations.

Because of this, I suspect that at least three of the following four conditions are needed to force the hand of European donors, and that is assuming that Greece provides them at least with the fig leaf of commitment to meaningful internal policy actions.

First, evidence that Greek markets are being severely impacted by funding concerns. With the recent surge in borrowing costs and the disruptions in the normal functioning of government and corporate markets, this condition is clearly already met.

Second, evidence that other peripherals in Europe – such as Ireland, Italy, Portugal and Spain – are also being impacted. This is happening, as signalled by the gradual widening in market risk spreads.

Third, evidence that other providers of capital are sharing the burden of financing Greece. Tuesday's €8bn bond issuance to private creditors is consistent with this.

Fourth, evidence that the Greek financial disruptions are starting to undermine core European countries. Evidence here is limited to the weakening of the euro, which, as yet, cannot be viewed as disruptive (indeed, some view it as helpful for Europe).

Notwithstanding this last condition, we are much closer today to the point where donors' hands will be forced. Yet investors should remain wary, as this would offer, at best, only a short-term tactical opportunity. Greater clarity as to what Greece can deliver in internal adjustment should remain the primary driver for long-term investment opportunities.

Investors should also remember that "market technicals" remain tricky and now constitute a meaningful marginal price setter. The shift in the investment characterisation of Greece, from being primarily an interest rate exposure to a credit exposure, has happened in such a way as to allow for little orderly repositioning. Many investors are trapped and the phenomenon has been accentuated by the recent evaporation of market liquidity.

Where does all this leave us?

Over the next few days, we are likely to get some combination of Greek and European donor announcements aimed at calming markets, reducing volatility, and reducing contagion risk. But the impact on markets is unlikely to be sustained as both sides face multi-round, protracted challenges which contain all the elements of complex game dynamics.

No matter how you view it, markets in Greece will remain volatile and more global investors will be paying attention. In the process, this will accelerate the more general recognition that sovereign balance sheets in many advanced economies are now in play when it comes to broad portfolio positioning considerations.

And now to Niels Jensen's piece.

If PIIGS Could Fly

By Niels Jensen

The Absolute Return Letter - February 2010

"A democracy is always temporary in nature; it simply cannot exist as a permanent form of government. A democracy will continue to exist up until the time that voters discover that they can vote themselves generous gifts from the public treasury. From that moment on, the majority always votes for the candidates who promise the most benefits from the public treasury, with the result that every democracy will finally collapse due to loose fiscal policy..." - Alexander Fraser Tytler, Scottish lawyer and writer, 1770

Travelling with John Mauldin

It was always naïve to believe that a crisis so deep and profound was going to go away with a whimper; however, an increase of more than 50% in global equity prices can be very seductive, and nine months of virtually uninterrupted gains have led many to believe that the problems of 2008-09 are now largely behind us.

Well, not quite everybody. Friend and business partner John Mauldin remains a sceptic. I have had the pleasure of travelling across Europe with John over the past week or so and, as the week progressed, my mood swung decisively towards a state where Prozac would probably be the most appropriate remedy.

Now, John and I do not agree on absolutely everything. For example, I believe – and have believed for a while – that he is too bearish on equities. But, before we go there, allow me to share with you the essence of John's views which can be summed up quite nicely by two charts, courtesy of BCA Research.

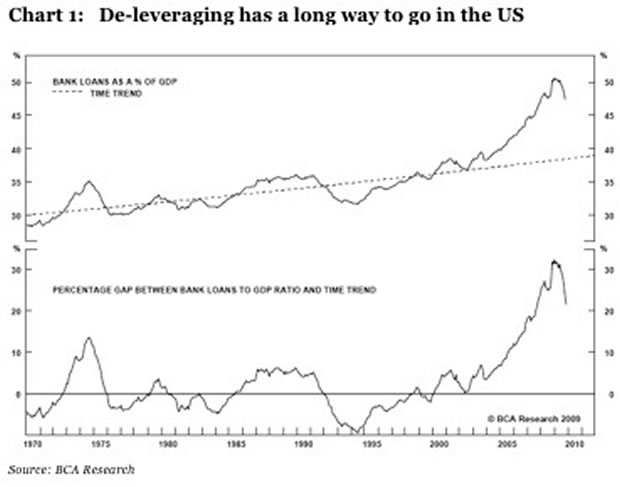

In John's opinion – and I do not disagree – we are still only in the second or third innings of the de-leveraging process (chart 1). Years of excessive debt accumulation cannot be reversed in 18 months, and it will take at least another 5-6 years to play out, possibly longer.

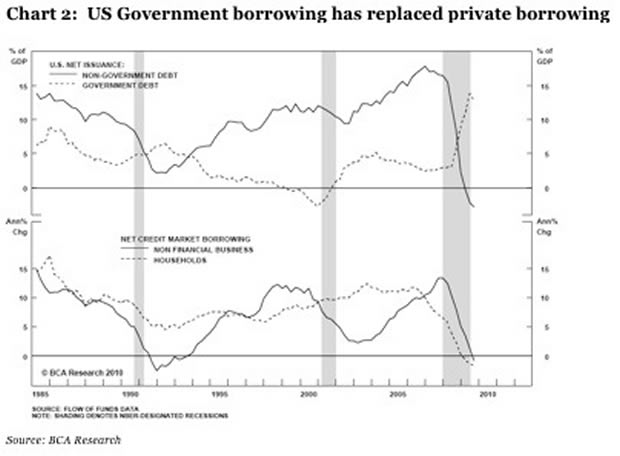

The other part of John's argument – and again it is hard to disagree – is that it remains an open question how much de-leveraging has in fact taken place. As you can see from chart 2, US sovereign debt has risen as fast as private debt has declined (and the picture is similar in many other countries), providing support for the argument that all we have achieved so far is to move liabilities from private to public balance sheets, effectively burdening tomorrow's taxpayer.

The basket case named Greece

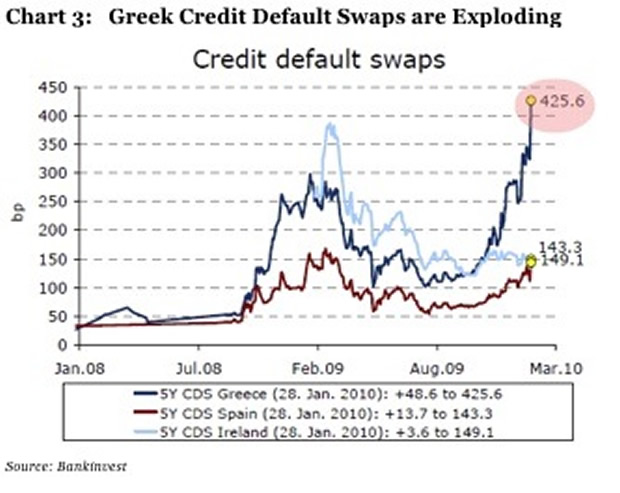

In the last few days, developments in Greece have totally overshadowed other events. As I write these lines, the 10-year Greek government bond trades a shade under 7%, now yielding a whopping 370 basis points more than the corresponding Bunds. At the same time, and not at all surprisingly, Greek credit default swaps – measuring the cost of insurance against a Greek sovereign default – have exploded (chart 3).

When I was in Zurich with John last week, I bumped into the famous Swiss investor, Felix Zulauf, who pointed out to me that Greece has in fact been in default in 105 of the last 200 years, so never say never. Having said that, Greece cannot be allowed to default, as the implications would be catastrophic. Bond investors would immediately pick apart the next country in line, and it is almost certainly going to be one of the other PIIGS – Portugal, Italy, Ireland or Spain. Bailing out Greece is just about manageable, but having to save all of them would overwhelm the EU. Swift action must therefore be taken, moral hazard or not.

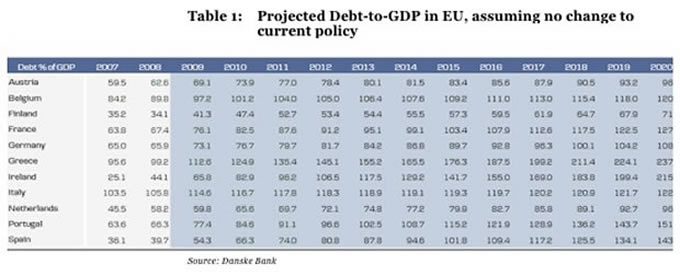

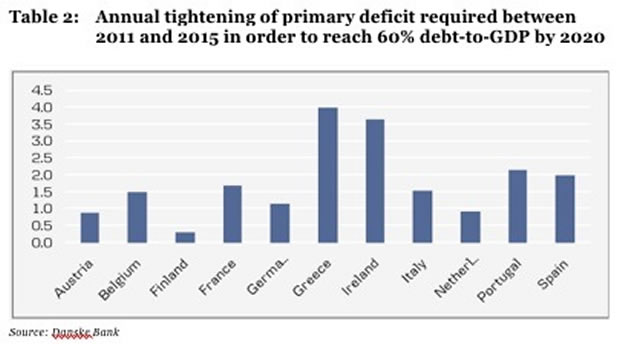

Back in early January, the research team at Danske Bank in Copenhagen produced a most interesting research paper[1], revealing how desperate the fiscal outlook is for many EU members. Table 1 illustrates the path of debt-to-GDP between now and 2020, assuming no change to current policy.

Now, we all know what cannot happen, will not happen. There is a reason the EU, via its stability pact, set the debt-to-GDP ceiling at 60% for its euro zone members. Obviously, with the low interest rates we currently enjoy, one could argue that a higher debt-to-GDP ratio could be sustained, and that is essentially correct as long as interest rates remain low; however, you leave yourself seriously exposed, should rates rise which they almost certainly will as sovereign debt increasingly becomes junk. .

Danske Bank then went one step further in its analysis. In order to illustrate the magnitude of the problem, they calculated how aggressive the fiscal tightening would have to be in order for the euro zone member states to comply with the stability pact by 2020. Table 2 below indicates how much the deficit must be reduced every year for the next five years in order to bring debt-to-GDP to 60% by 2020. Greece, being in the most precarious position, would need to shave 4% off its budget every year. We all know that is not going to happen because that would spell depression.

In the short term, Greece needs to find over €50 billion before the end of the year to refinance debt which is about to mature. The question is not so much whether it will fail in its endeavour but what price it will have to pay. An already fragile Greek fiscal situation could be further undermined, if Greece is forced to pay 7% going forward which it can hardly afford.

Is Spain next?

Towards the end of last week it became apparent that there might be some appetite for rescuing Greece, although few details are currently available. However, I am not convinced that there is a strong consensus in favour of a rescue package. Most of the positive vibes have come from Spain, whereas Germany and France have been decidedly less forthcoming. It is perhaps not surprising that it is the Spanish who seem most eager to bail Greece out, considering that they could very well be the next victim of the bond market's invisible hand.

In the last few days, Spain has gone out of its way to demonstrate its commitment to greater fiscal discipline in general and to the stability pact in particular. The government has just proposed for the retirement age to be increased from 65 to 67 (to be introduced gradually from 2013), and a fiscal programme designed to reduce the annual deficit to 3% of GDP by 2013 has been presented. The problem for Spain is that words are cheap. Few commentators believe that 3% is a realistic target given the depth of Spain's problems at the moment. Don't hold your breath.

The outlook is very grim

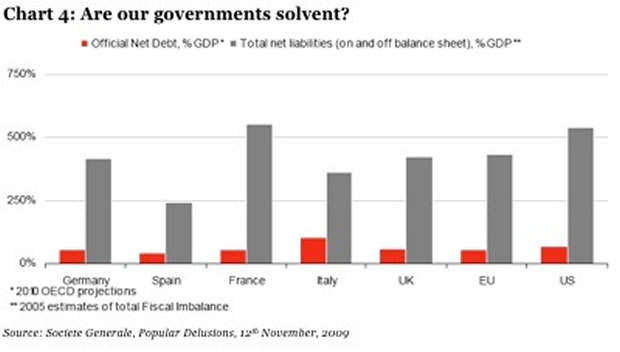

The outlook goes from murky to unbelievably grim, if one includes off-balance sheet items such as social security, pension and health liabilities, which have been promised to us over the years by well meaning but financially inept governments (see chart 4).

As Societe Generale's Dylan Grice puts it:

"I don't see how our governments can pay these liabilities. EU and US net liabilities add up to around $135 trillion alone. That is four times the capitalization of Datastream's World equity index of about $36 trillion, and forty times the cost of the 2008 financial crisis."[2].

I also note that Greece, not included in the chart, stands at 875% debt-to-GDP when including off-balance sheet items!

The bond market will ultimately determine when enough is enough. As President Clinton's campaign strategist James Carville once put it:

"I used to think if there was reincarnation, I wanted to come back as the President or the Pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everyone."

It can play out in a couple of different ways. Either bond investors will go on strike until they feel that they are being sufficiently rewarded for the higher risk associated with sovereign debt following the credit crunch or governments will implement budget curtailments designed to bring the debt escalation under control again, but that will be detrimental to economic growth. My bet is that the latter outcome will ultimately prevail but not until the bond market forces the hand of our governments.

The end game for Japan?

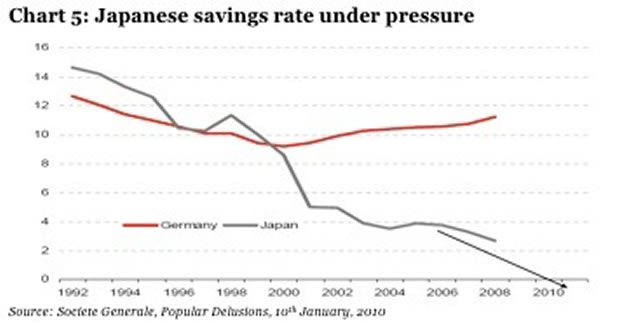

The first country to really feel the pinch could very well be Japan; in the bigger context, Greece is just the appetizer. Japan's debt-to-GDP ratio has grown from 65% in the early 1990s when their crisis began in earnest to over 200% now. Fortunately for Japan, the high savings rate has allowed shifting governments to finance the deficit internally with about 93% of all JGBs held domestically[3]. This is the key reason why Japan gets away with paying only 1.3% on their 10-year bonds when other large OECD countries must pay 3-4% to attract investors.

Now, predicting the demise of Japan has cost many a career over the years. Despite the ever rising debt, and contrary to many expert opinions, the yen has been rock solid and bond yields have remained comparatively low. I often hear the argument from the bulls that the Japanese situation is sustainable because they, unlike us, are a nation of savers. Wrong. They were a nation of savers.

Looking at chart 5, it is evident that the demographic tsunami has finally hit Japan. The savings rate is in a structural decline and the Ministry of Finance in Tokyo may soon be forced to go to international capital markets to fund their deficits. I very much doubt that non-Japanese investors will be as forgiving as the Japanese, and that could force bond yields in Japan in line with US and German yields. Herein lies the challenge. Japan already spends 35% of its pre-bond issuance revenues on servicing its debt. If the Japanese were forced to fund themselves at 3.5% instead of 1.3%, the game would soon be up.

Why stock markets go up

Despite the grim outlook, the world's stock markets have produced brilliant returns over the past nine months. This has provoked some of the best and brightest in our industry (most recently Mohamed El-Erian, CEO of Pimco[4]) to declare that there is a dis-connect between the economic reality and the picture painted by Wall Street.

I am not convinced. Firstly, global equities reached extremely depressed levels back in February 2009, and the recovery, however muted it may ultimately turn out to be, has stopped the bleeding in most large companies, giving investors an excuse to accumulate stocks again (smaller companies is a different story altogether, but that is a story for another day). What matters to the likes of Coca Cola, Rolls Royce and Volkswagen is not so much how the domestic economy performs, because the leading lights of industry today are becoming increasingly detached from the domestic economy. Ever more important to those companies is the global stage, and the global outlook is considerably more upbeat than, say, the US, UK or German growth prospects.

Secondly, equities usually do very well in the very late stages of recession and early stages of recovery. I refer to our July 2006 Absolute Return Letter for an in-depth analysis of this, which you can find here.

Thirdly, valuations are not prohibitively high. Many bears refer to the stock market (whether European or US) as being very expensive at current levels, but that is plainly untrue. Based on 2010 projected earnings, most OECD markets are either in line with or 10-20% below historical averages (see table 3). Only in emerging markets can you reasonably argue that current P/E levels are not cheap relative to the long term average.

In 2009 there have been massive flows of capital towards emerging markets – and towards Asia in particular – and valuations have been driven up as a result. It is hard to argue that those markets are yet in bubble territory, if one uses the valuations in table 3 as a benchmark; however, by pegging their currencies to the US dollar, Asian countries have effectively adopted a monetary policy which is entirely unsuitable for economies growing as fast as they do. That is how bubbles have been created in the past and why Asian equity markets should be monitored closely for signs of overheating in the months to come.

Conclusion

Summing it all up, the fate of global equity markets is very much in the hands of bond investors. Under normal circumstances, this is the best time to be in equities. But these times are not normal, so do not expect that the outstanding performance of 2009 will be repeated in 2010. If international bond markets calm down again – and that may happen, at least temporarily – equities can probably post further (but modest) gains in 2010; however, the end game is approaching. If bond investors do not revolt in 2010, they probably will in 2011, so playing the economic recovery through equities is a dangerous game.

As far as the bond market is concerned, as often pointed out by Martin Barnes at BCA Research, if you want to know where the next crisis will be, then look at where the leverage is being created today. And nowhere is there more leverage being created at the moment than on sovereign balance sheets. What is happening is an experiment never undertaken before. As John Mauldin puts it, we are operating on the patient without anaesthesia.

The big challenge will be to get the timing right. These situations can run for longer than most people imagine. Japan's crisis has been widely predicted for almost a decade now, and the ship appears to be as steady as ever. As I suggested earlier, the key to predicting the timing of Japan's demise – because there will be one – may very well be embedded in the savings rate, which could quite possibly turn negative in the next few years.

The Dubai crisis taught us that markets are in a forgiving mode at the moment and, before long, Greece could very well find some respite from its current problems. But then again, ultimately, governments will find – just like millions of households have found over the years – that you cannot spend more then you earn in perpetuity. The enormous debt levels being created at the moment will haunt us for many years to come and we may have to wait a long time to see the PIIGS fly again.

Footnotes:

[1] 'Debt on a dangerous path', 4th January, 2010, by Danske Bank. You can find the entire report here.

[2] 'Popular Delusions', Societe Generale, 12th November, 2009

[3] Source: http://econompicdata.blogspot.com/2009/12/real-lost-decade-japanese-gdp-edition.html

[4] Source: http://www.investmentpostcards.com/2010/01/16/el-erian-markets-not-facing-reality-of-slow-economy/

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.