Financial Markets Outlook 2010, When Hope Turns To Fear

Stock-Markets / Financial Markets 2010 Feb 02, 2010 - 11:51 AM GMTBy: Ty_Andros

Currencies, Bombs... er, Bonds and Banks are ALL Rotten to their Core.

Currencies, Bombs... er, Bonds and Banks are ALL Rotten to their Core.

This is the epicenter of the unfolding financial crisis and inflationary/deflationary depression. The developed world is BANKRUPT and the policies of INSOLVENCY are entrenched in its leaders and citizens in such a way as to make the final destination of financial system destruction UNAVOIDABLE. The "something for nothings" in the developed world are firmly in control of the electoral process and their constituencies continue to grow as the global financial crisis crushes their incomes and future prospects. Taxes are headed far higher, thus transferring capital from the private economies (where jobs and incomes are created and where production exceeds consumption) to the public sector which has no idea what cost-benefit analysis is and consumes much more than it produces.

Author's note on another subject: There is no sugar coating this; virtually every chart I look at (outside down bars on weekly and monthly charts) is set to CRASH -- stocks, many bonds, commodities, crude oil, grains and many industrial metals. They look like the 1st wave down in an impulse wave into the next down wave of the unfolding depression, they better turn on the money printing (re-flation trade) or it will be curtains sooner rather than later.

This unfolding maelstrom and crisis is nothing but an opportunity for absolute-return managers with the potential to make money in rising or falling markets and learning how to restore the functions of money. This is what I do and if you wish to learn more and get a free subscription to Tedbits www.traderview.com/tedbits_newsletter_subscribe.cfm

Today, money is a mystery to the common man who has never been taught what it is or what functions it must perform to preserve its wealth through time and space. To teach him would send the existing central bankers, public serpents, banksters, crony capitalists and elites to their demise at the hands of the public they have betrayed.

The only currencies/money currently in circulation are Gold and Silver. The rest of the world's currencies (US, Canadian and Aussie Dollars, British Pounds, Japanese Yen, Euro, Swiss Franc, etc.) are credit masquerading as money. CREDIT IS NOT MONEY. It is only a medium exchange and a system of wealth confiscation. Money in the G20 has no intrinsic value; it is only a promise to pay or an IOU. So, its value is determined by the issuer's ability to pay.

"Holding dollars today represents risk without reward." -- Joseph Stiglitz, Nobel Prize Winning Economist

AT THIS POINT NOT ONE ECONOMY IN THE DEVELOPED WORLD IS GROWING AFTER PROPERLY ADJUSTING FOR INFLATION, BUT THEIR DEBTS AND OBLIGATIONS ARE CLIMBING AT 10-20%. This is the definition of insolvency and bankruptcy. Ultimately their printed money will go to its intrinsic value...... NOTHING.....

"Currencies don't float; they just SINK at different rates" -- Clyde Harrison

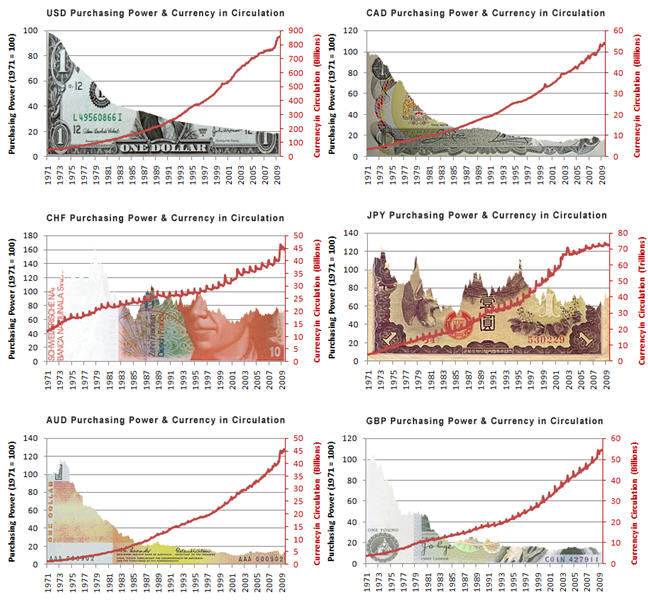

An illustration of this is provided to us from Mike Hewitt at www.dollardaze.org:

The value will ALWAYS fall equal to the rate of currency debasement, deficit spending and to the issuer's ability to pay. In the advanced economies, the ability to pay is crashing by the day as their economies do not produce more than they consume and they NO LONGER have the ability to do so without critical restructuring. Furthermore, it would require the undoing of the tax regulations and mandates which have ROBBED these economies of their ability to create wealth, of incentives to produce and to service their promises to pay. This is something the powers that be will fight at any cost, otherwise they would have to support themselves.

As www.the-privateer.com says in this month's edition "a global economy based upon credit creation cannot survive unless it continually expands to maintain the ability to service existing debt." The idea that the quantitative easing can be removed is false; debt issuance is at record highs as well the requirement of rolling existing debt; debt is extremely deflationary and for the G7 and the advanced economies they must INFLATE or DIE.

"The current crisis is not only the bust that follows the housing boom; it's basically the end of a 60-year period of continuing credit expansion based on the dollar as the reserve currency." - George Soros, Investor and Author

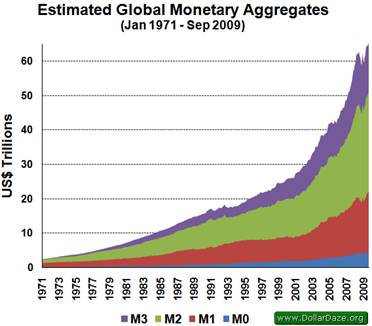

The developed world is in debt spirals where debasement is ASSURED because it is the only means of repaying the unpayable and inextinguishable debts and obligations which have amassed since Bretton woods II. Inflate them away one way or another. Take a look at money and credit creation through Sept 2009 (remember, this is not money but IOU's, also known as promises to pay):

WOW, just look at that. That is one hell of a pile of IOU's, just like a plane that tries to fly straight up, money and credit creation are now going VERTICAL, when it stalls the only thing that will hold it up is printing new money to replace that which disappears off the lender's balance sheets.

WOW, just look at that. That is one hell of a pile of IOU's, just like a plane that tries to fly straight up, money and credit creation are now going VERTICAL, when it stalls the only thing that will hold it up is printing new money to replace that which disappears off the lender's balance sheets.

"The U.S. government has a technology, called a printing press, which allows it to produce as many U.S. dollars as it wishes at essentially no cost." - Benjamin S. Bernanke Chairman, U.S. Federal Reserve

That will work for a while until the public wakes up, and we will be looking at hyperinflation and the Crack-up Boom, just like Zimbabwe, Argentina and soon Venezuela.

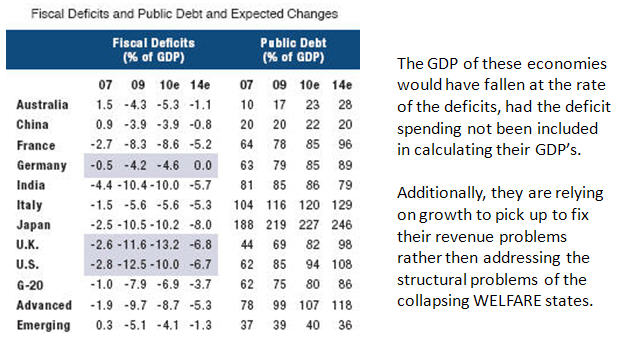

Now let's take a look at the amount of debt which needs to be created in the world over the next several years to support the global government's EXISTING commitments:

Incomes are COLLAPSING and the unfolding depression has been MASKED by accounting shenanigans. Forth quarter, year-over-year US treasury, state and municipal receipts are off approximately 10.9%, but the debts and new obligations are growing at almost double the rate of the collapse in receipts and they are mushrooming like a nuclear blast. All this as politicians and their special interests mandate benefits, bailouts and business to themselves through new legislation (health care, cap and trade green technology, bank bailouts, AIG, Fannie Mae and Freddie Mac, mushrooming support for Government Motors, and the 19 banks now known as too-big-to-fail, which actually means: government-sponsored enterprises, etc.) and send the bill to the public they claim to serve. Every day the debts and obligations grow and the existing currencies in circulation take on an equal amount of lost purchasing power.

Remember the quote from Von Mises from the last edition?

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved. -- Ludwig von Mises

We may not know the ups and downs that the economies, markets and societies may travel before arriving at that destination, but we do know the final STOP: Systemic meltdowns as the insolvencies overwhelm the ability to pay. In the United States the destruction is deliberate as the big government PROGRESSIVES on both sides of the aisle work hard to create the final collapse of the economy which will allow them to bury the free republic which was handed to us by the founding fathers.

To understand what is being implemented you need only to study the playbooks of the Cloward-piven strategy (www.Cloward-piven.com or) or the teachings of Saul Alinsky. Look no further than the CZARS, (www.traderview.com/tedbits/Czars.pdf) who have been put into place by the powers that be on Capitol Hill. PROGRESSIVES are relentlessly expanding those on welfare or who are dependent on government for business, thus creating the biggest constituency for ACTION after the CRASH of the economy. Congress has REFUSED to supervise them in contradiction to their oaths to UPHOLD the constitution. Do web research on this, it is frightening and true.

They are in place to assume power when the collapse that the progressives, the President and Congress are crafting becomes REALITY. What do you think the value of the dollar will be when the economy collapses and the ability to pay PLUMMETS? Every time the beltway and European governments attack the private sectors (populous rhetoric, new taxes, mandates and new regulations) the further away becomes recovery in the G7 economies.

The new taxes from all levels of government are set to skyrocket; these economic nitwits don't understand that taxes grow with income generation, not the destruction of it. They REFUSE to cut spending hoping for the GOOD OLD DAYS of unlimited consumer confidence and a credit bubble. Extend and pretend and it will end badly, as pretend is something a child does, adults don't have the luxury of doing so. Just ask Hugo Chavez how well that tactic works. The G7 and developed world are nothing more than collapsing WELFARE STATES and banana republics, and what we are waiting for is the RECOGNITION of it.

"Fiscally, we are in uncharted territory." "No one can know the precise level of net debt...at which the United States will lose its reputation...but a few more years like this one and we will find out." - Warren Buffet, 2009

The Global experiment with increasingly UNSOUND money began in 1913 with the creation of the Federal Reserve, and was then inflamed with Bretton Woods I, and ultimately degraded at Bretton Woods II when all pretense of reserve-backed money was SEVERED. At that point, the pendulum of wealth creation through real things like production, manufacturing and adding value (thereby creating RISING profits and wages) began to swing in the other direction, where wealth was, and still is, created by inflating paper (asset-backed economies).

This de-industrialization combined with the introduction of UNSOUND money short circuited the virtuous rise of the middle classes and wealth creation in the developed world, also known as the G7. In its place, wealth creation became the province of INFLATION and credit creation (printing money in one form or another).

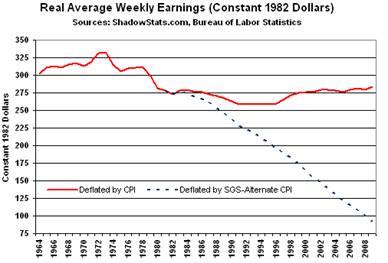

For the G7 middle classes it has been a downhill slide ever since, as it now takes TWO incomes to support a family, whereas it took one to do so at that time. The destruction of the family and civil society also began as REAL INCOMES began their collapse under MISSTATED inflation numbers and fiat currency and credit creation. To illustrate the decline, take a look at this chart of incomes that have been properly adjusted for REAL purchasing power from John Williams of www.shadowstats.com:

Notice how REAL earnings peaked during Bretton woods II. Remember the quote from the last edition:

Notice how REAL earnings peaked during Bretton woods II. Remember the quote from the last edition:

"By a continuous process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million can diagnose." - John Maynard Keynes, 1920

The demise of the middle class began at that time. The policies of government switched from capitalism, wealth creation, sound money, savings and private property to equal opportunity and the growth of the middle classes.

The progressive majorities in congress (republicans and democrats who hold these beliefs) reordered the United States economy and legislative agendas with the policies of socialism, unsound money, redistribution of wealth through money printing and deficit spending (which is the same thing as currency and credit/borrowing as BOTH are IOU's), in addition to increasing regulations and taxes, crony capitalism and centrally-planned economies. At the hands of that era, thanks to the banksters, crony capitalists, public serpents and central banks, came the misallocation of capital from where it produced the most wealth to those who were the BEST CONNECTED and paid the most RENTS to those in power!

Most blue-collar, middle-class people owned their own homes, had savings accounts and rising wages, paid for most purchases and education with cash, only borrowed for mortgages or big ticket items such as cars and had very little debt. The federal debt in 1971 ($436 billion) was 3% of what it is today.

Now they incur that much NEW debt in 4 MONTHS and hand the BILL to future generations. As of this writing, each man, woman and child's share of the US debt is $347,000 dollars. My son was born in May 2009, at birth he had this amount of debt handed to him by WASHINGTON DC when they issued him his social security card, or should I say social insecurity card. On January 28th the progressives in congress passed a debt ceiling extension of $1.9 trillion dollars, a new $45,000 dollars of debt per person incurred between now and the next election. Obscene, corrupt and immoral.

Now these debts and promises of future benefits have grown to grotesque size and scope and are inculcated throughout the developed world. The private sectors and the blue-collar middle classes are DEBT, TAX and REGULATORY SLAVES to the banksters, crony capitalists, public serpents and government.

Captive victims are what I call them; of course I am one of them. Very few own their home free and clear and 25% are underwater, their savings accounts are preyed upon by the money and credit creators preying on the purchasing power of the currency while it sits in the bank (how do you get ahead when banks pay 2% and inflation is compounding at almost triple that), and financing education has become a lifelong drag on the earnings it is supposed to raise. The public has been impoverished and is desperate for CHANGE back to the policies which allow everyone to have RISING standards of living now and for future generations, but they won't find them in the capitols of the DEVELOPED/ADVANCED economies.

Captive victims are what I call them; of course I am one of them. Very few own their home free and clear and 25% are underwater, their savings accounts are preyed upon by the money and credit creators preying on the purchasing power of the currency while it sits in the bank (how do you get ahead when banks pay 2% and inflation is compounding at almost triple that), and financing education has become a lifelong drag on the earnings it is supposed to raise. The public has been impoverished and is desperate for CHANGE back to the policies which allow everyone to have RISING standards of living now and for future generations, but they won't find them in the capitols of the DEVELOPED/ADVANCED economies.

There are taxes on virtually EVERY activity in which humans engage. Their prospects for entrepreneurism and an expanding economy have been trampled by regulations, fees, permits, and mandates which basically prohibit their challenging the crony capitalists (in fact the regulators prey on the small entrepreneur and almost never challenge the entrenched crony capitalist) and their government partners. They pay usurious rates of interest of up to 40% on consumer credit (this was illegal for centuries) and when currency debasement is included they should be considered "confiscatory" tax rates. If they want to buy almost any big ticket item, the only way to do so is to enter the clutches of the banking and lending communities. The ability to get ahead and the notion of private property are GONE!!! Stolen from them by the people in whom they have placed their trust!

The developed world has been turned on its head and consumed by the policies of creating middles classes and accumulating wealth. As Keynes put it, they are "debauching" society and the virtues of saving, thrift, ingenuity, entrepreneurism, self restraint and the work ethic. The rewards for these behaviors have diminished YEAR after YEAR till we find ourselves where we are today: Punished for these activities with the rewards CONSUMED by the "something for nothing" people whose wages and savings are stolen by the banksters, elites and public serpents who exploit them.

In 1971 the economic policies of the G7 switched from creating wealth and producing more than you consume, generating the wealth and savings needed to fund capital investment and jobs to meet the future needs of a growing populous (the Austrian recipe for wealth creation) to consuming more than you produce and borrowing from the future to fund today's consumption. This and misallocation of capital to growth of government, as well as political determination of who is successful by PUBLIC SERPENT mandates and regulation, which insulated the crony capitalist from having to compete. In order to thrive, you must pay RENTS to the political classes rather than compete in the market place of consumers.

It is interesting to note that the emerging world has embraced Capitalism to save their socialist governments, and in the developed world Capitalists are embracing Socialism to save themselves. Socialism is misery spread widely as crony capitalists increasingly rely on government support and mandates to be successful; while Capitalism is providing more for less for consumers and, in a rational world, GROWS. Which approach do you think will yield the greatest results?

As to what the dollar will do versus foreign currencies? Commercials, also known as the banks and who are rarely on the wrong side of extreme markets, are as heavily short the dollar as anytime in the last 5 years, as illustrated by Postcards from Capetown:

Notice the last time the banks were this short halfway through 2008. The dollar continued to rally for almost 6 months, and in 2005 they nailed the top, which tells us a rally can occur for up to 6 months, or turn very soon. If the crash occurs sooner rather than later, the world will run into the dollar as they are conditioned to do so like "Pavlov's dogs." My bet is that the progressives in congress and the European capitols push the economies over the ledge INTENTIONALLY!

Notice the last time the banks were this short halfway through 2008. The dollar continued to rally for almost 6 months, and in 2005 they nailed the top, which tells us a rally can occur for up to 6 months, or turn very soon. If the crash occurs sooner rather than later, the world will run into the dollar as they are conditioned to do so like "Pavlov's dogs." My bet is that the progressives in congress and the European capitols push the economies over the ledge INTENTIONALLY!

The World's largest banks are INSOLVENT and they are operating in a world of regulatory forbearance and accounting fictions. The 5 biggest banks in the United States control over 2/3rd of the nation's deposits and have written OVER THE COUNTER DERIVATIVES with nominal values of OVER 200 TRILLION DOLLARS (16 times the size of the US economy and 3 times the size of the WORLD economy); they are making markets in naked credit default swaps, interest rate swaps, toxic CDO's (collateralized debt obligations) and securitized debt of all types.

The 19 banks deemed too big to fail are now MUCH, MUCH more insolvent than when they were RESCUED by the US Government, ditto for the largest banks in the UK, Switzerland and the Euro Zone. They are now guaranteed by the public who assumes the risk, and the profits flow to the elites who have been rescued. If the public ever gets the idea they are not guaranteed by government they would fail in short order. As the Bank of England governor, Mervyn King, says too big to fail is impossible to regulate to safety, and he is right.

Their liabilities are endless and their assets and capital are a function of impossibly opaque and indecipherable accounting. The biggest banks in the world must ROLL over nearly $7 Trillion of debt in the next 2 years, and without the government guarantees which allowed them to issue debt during the crisis, their costs of borrowing is set to soar.

To understand why they are still standing you must understand two concepts which apply to every central bank in the world, which I will bring to you as quotes. One from the founder of the Rothschild's dynasty:

"Let me issue and control a nation's money supply, and I care not who makes its laws." -- Mayer Amschel Rothschild, Founder of Rothschild Banking Dynasty

The other is from Gary North:

"The Federal Reserve System is not about making money at the expense of the government. It is about using a government-granted monopoly over money to regulate the economy to the benefit of a handful of large banks. This has always been its primary function. The banking system is a cartel. The Federal Reserve System is the cartel's protector and enforcer". - Gary North

One more thing they have agreed to for their monopoly on a nation's money is that the governments and public serpents that protect them will have as much funding as they require. It does not matter which nation you chose, the system is the same.

"The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government-a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF's staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we're running out of time." -- "The Quiet Coup" by Simon Johnson, former Chief Economist of the IMF (www.theatlantic.com/doc/print/200905/imf-advice)

I urge you to read the above-referenced article, "the quiet coup," it sheds light on the current state of affairs. Most of these big institutions are owned in one form or another by what are called the Illuminati, or multi-generational elites such as the Rockefeller's, Kennedy's, Rothschild's, Warburg's, House of Morgan, etc. which have created a multiplicity of holding structures to hide their dealings and holdings from the public. They control the money and they control the lawmakers, PERIOD.

During periods of asset deflation, such as we are in currently, they consolidate parts of the banking systems which they do not control. Look no further than JPMorgan Chase's sweet- heart deals to take over Bear Stearns and Washington Mutual for pennies on the dollar with the Federal Reserve taking the risk on the liability side of the transaction by guaranteeing them from further losses. This is what was done during the GREAT DEPRESSION and it is repeating NOW. Thomas Jefferson said in 1802:

"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered.."

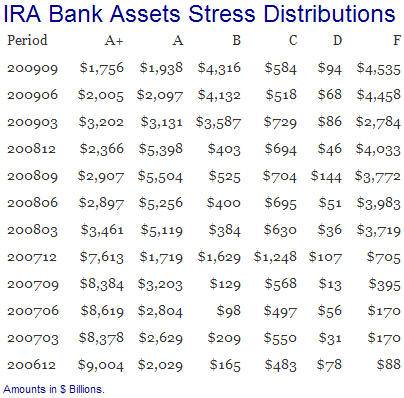

And of course we are staring this right in the FACE. Take a look at the DETERIORATING FINANCIAL conditions of the nation's banks as the crisis has unfolded creating the opportunity for further consolidation of the United States banking system (2nd quarter 2006 through 3rd quarter 2009), courtesy of www.institutionalriskanalytics.com:

Wow, in June 2006 most of the nation's banks where the picture of HEALTH, and now just 3 short years later almost half have fallen to grades of C, D or F. This is illustrated in any developed/advanced economy in the WORLD. Thousands of banks and their ASSETS are poised to fail, teetering on bankruptcy and poised to be absorbed by the elite's financial systems' holding companies for PENNIES on the dollar, and those same institutions are the OWNERS of the Federal Reserve. Institutional risk management rates JPMorgan Chase as an F; how is it that they can absorb these bankrupt brethren? The answer is clear.

Wow, in June 2006 most of the nation's banks where the picture of HEALTH, and now just 3 short years later almost half have fallen to grades of C, D or F. This is illustrated in any developed/advanced economy in the WORLD. Thousands of banks and their ASSETS are poised to fail, teetering on bankruptcy and poised to be absorbed by the elite's financial systems' holding companies for PENNIES on the dollar, and those same institutions are the OWNERS of the Federal Reserve. Institutional risk management rates JPMorgan Chase as an F; how is it that they can absorb these bankrupt brethren? The answer is clear.

This is being repeated throughout Europe as weak banking institutions are passed to the cartels sponsored by the respective governments. Even though the cartels are MORE insolvent than those they absorb, they will never fail; this is set to continue as they are "too big to fail" which is a code word for controlled by untouchable elites who control the governments in the countries in which they OPERATE.

Up to 40% of the banks in the developed world are insolvent and bankrupt. Trillions of Dollars, Yen, Euros, Pounds and Swiss Francs will have to be printed in the next few years to underpin and unwind these financial behemoths that are not politically connected!

The bomb....er, bond markets are where the final blast will occur when the developed countries' currency and credit-creation systems FAIL and when people holding IOU's masquerading as money WAKE UP. They will not SURVIVE the decade, but my estimate for ultimate failure is 2012 to 2015. Hopelessly OVERPRICED IOU's, the bonds themselves are denominated in hopelessly OVERPRICED IOU's of the developed world's (welfare states) currencies: US Dollars, UK Pounds, Euros, Swiss Francs, etc.

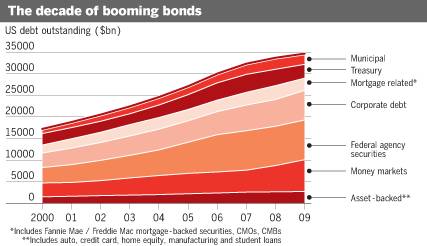

Let's take a look at the mounds of bonds that reside in the United States the need to be serviced out of current INCOME:

WOW, this pile of PAPER has increased 130% since 2000, but the incomes to service it properly have not increased at all. This picture is echoed throughout the developed world. A recent Forbes article (thank you Dennis Gartman for this info www.thegartmanletter.com) put the debt-to-GDP ratios (each nation's sovereign and bank's debt combined) of the developed world at: Iceland 1,200%, UK 1,000%, Ireland 850%, Switzerland 750%, Belgium 550%, France 475%, Netherlands 450%, Austria 425%, US 400%, Denmark 400%, Germany 400%, Sweden350%, Italy 300%, Greece 300%. These are the pictures of insolvency; is it any wonder the Euro is weak? The Pound? Switzerland? This does not include other categories of debt we see in the chart above, nor does it include unfunded liabilities such as public pension benefits which can be several hundred percent to the above figures; for example, it is $75 billion in the US or another 500% to the total and it is the same everywhere.

WOW, this pile of PAPER has increased 130% since 2000, but the incomes to service it properly have not increased at all. This picture is echoed throughout the developed world. A recent Forbes article (thank you Dennis Gartman for this info www.thegartmanletter.com) put the debt-to-GDP ratios (each nation's sovereign and bank's debt combined) of the developed world at: Iceland 1,200%, UK 1,000%, Ireland 850%, Switzerland 750%, Belgium 550%, France 475%, Netherlands 450%, Austria 425%, US 400%, Denmark 400%, Germany 400%, Sweden350%, Italy 300%, Greece 300%. These are the pictures of insolvency; is it any wonder the Euro is weak? The Pound? Switzerland? This does not include other categories of debt we see in the chart above, nor does it include unfunded liabilities such as public pension benefits which can be several hundred percent to the above figures; for example, it is $75 billion in the US or another 500% to the total and it is the same everywhere.

"The problem with socialism is that sooner or later you run out of other people's money." -- Margaret Thatcher

It does not matter which class of bonds you look at: Sovereigns, State, Municipal, Investment- grade Corporate, or Junk bonds. All are hopelessly overpriced and are clear illustrations of how much money in the world is chasing too few opportunities for yield in a LOW GROWTH world. Many of the issuers operate in technical bankruptcy but enjoy the ability to roll their obligations due to politically-correct credit ratings and regulatory mandates.

International hot fire hoses of money desperate for returns in a developed world where growth has ceased. Buying has become indiscriminate and the public DOES NOT understand the risks; they are and have been piling in and they are in imminent danger!

The parasites of BIG GOVERNMENT -- progressive public servants, crony capitalists and banksters have short circuited wealth creation and capitalism, and have substituted socialist corporatism. There will be very little increased economic activity to service the debts, and massive defaults loom to those that cannot be rescued by public serpents or print the money. The PARASITES have and are continuing to KILL the private sectors and DESTROY the conditions and incentives for the private sectors to produce. Go back to Cloward-piven and Saul Alinsky to see what our public serpents are implementing. So, wealth creation is now dead and substituted in its place is FIAT CURRENCY and credit creation. IN PLAIN WORDS: THEFT.

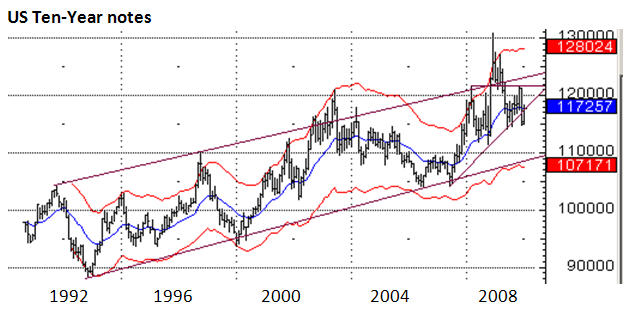

Let's take a look at monthly charts of sovereign bonds first, it is a picture of multi-decade bull markets and massive TOPS created over the last several years:

You can see a massive head-and-shoulders top (not active yet) with a breakdown of the most recent trend line off the June 2007 low. The longer-term trend channel is still intact. The Federal Reserve and its children at the primary treasury dealers can read charts as well, the latest rally is probably engineered by them and it will be interesting to see if they can get through resistance at the trend line and stay above it.

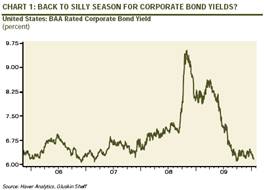

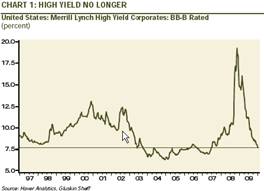

Now let's peek at Investment-grade and Junk bonds with illustrations from David Rosenberg and www.gluskinscheff.com:

Wow, yields back to levels BEFORE the world economy fell off a cliff; do you really think their ability to service their debts is anywhere near that level, and for that matter, 50 cents of every dollar the federal government now spends is borrowed. This is a picture of trillions and trillions of dollars, yen, pounds, euros, Swiss francs etc., desperately seeking yield in a developed world economy which IS NOT GROWING.

Wow, yields back to levels BEFORE the world economy fell off a cliff; do you really think their ability to service their debts is anywhere near that level, and for that matter, 50 cents of every dollar the federal government now spends is borrowed. This is a picture of trillions and trillions of dollars, yen, pounds, euros, Swiss francs etc., desperately seeking yield in a developed world economy which IS NOT GROWING.

Overpaying for yield of any kind, a 2-year note pays less than 9/10th of 1 percent, that is 9 dollars a year for the privilege of lending them $1,000 dollars, a 6-month note yields about 75 cents on $1,000, for 5 years approximately $23.40 cents on $1,000 and the 10-year $36 a year on $1,000. Everything else, muni's, corporate and junk bonds are similarly mispriced and the downside is quite large; are you going to risk 20-30% if rates rise to make these meager amounts? Risk $300 dollars to make $20-$75 depending on the bond you buy... the risk reward is upside down. Absurd... reckless...

Interest rates on all maturities stand at record lows and sovereign debt is basically an interest-free loan to bankrupt G7 governments, who only roll existing obligations and borrow new money; they never retire their debt. A ponzi scheme of unheard of proportions, and in comparison, the Madoff affair was a rounding error. Recently, bond king Bill Gross of Pimco WITHDREW from the UK gilt market remarking that they are sitting on NITRO Glycerin. Forth quarter GDP in the UK came in at up 1/10th of one percent, and the bank of England bought virtually all of last year's budget deficit; what do you think the odds are of rolling the old debt and funding new deficits in the private sector in 2010?

I can't emphasize enough how purely toxic the Municipal bond market is. Hundreds of billions of dollars of deficits loom on the horizon, and the unfunded liabilities are maybe a trillion dollars or more. For example, Illinois has almost $90 billion of unpaid bills and unfunded pension liabilities. NO ABILITY TO PAY. This is only one state and it is a story nationwide. NEW TAXES and FEES loom as they will bury their economies even deeper.

Year over year 4th quarter 2008-2009 US treasury receipts at all levels of government have declined 10.9% or more, yet today it was reported that GDP rose 5.7%; how can that be? During the great depression there were a number of quarterly periods where the economy grew. Unfortunately now, as then, it grew because government deficit spending was counted as GDP. Government spending is NOT growth; it is misallocation of precious capital to unproductive uses, aka government expansion, and support of crony capitalist bailouts.

I will go no further, the point is made, caveat emptor, play with paper and you could get burned as it is a house on fire. Bonds are bombs, banks are broke and currencies are toilet paper. Remember, never in 1,000's of years of history have fiat currency and credit financial systems endured, they have ALWAYS fallen under hands of the men that control them. Looking at the current crew does not lend confidence that this time history will be proved wrong.

In conclusion: PAPER IS POISON, PAPER IS POISON! Keep this in mind. This is not a liquidity crisis; it is a solvency crisis, both moral and fiscal. Bankruptcy looms and that means people do not honor their promises. Or they will do as Adam Smith outlined in the Wealth of Nations -- they will use the soft default of the printing press as they have for hundreds of years. The "something for nothings" will drive us to this, locusts that will eat everything until there is nothing left (see Tedbits Archives for December 23rd, 2009).

Public serpents, crony capitalists, central and big banks are DOOMED, their demise is on the horizon. The idea that paper currencies printed limitlessly by governments can gain value against the true currencies of gold and silver except for short periods is absurd. When central banks and the hedge funds known as BIG banks try to kill the canary in the coal mine consider buying pullbacks.

The worm has turned, there are trillions of dollars, yen, Euros, Swiss Francs and UK pounds which are promises to pay by bankrupt borrowers, while gold and silver are timeless money and no one's liability. Exchange an empty promise for a reliable one. The indirect exchange can be seen in many BUBBLICIOUS markets, as investors try and flee paper assets which contain no value and provide little return for the risks involved. Huge bubbles in paper assets and real ones are quite easily seen.

This unfolding maelstrom and unfolding crisis is nothing but an opportunity, absolute-return managers with the potential to make money in rising or falling markets and learning how to restore the functions of money can add an important diversification. This is what I do; if you wish to learn more and get a free subscription to Tedbits, click here: www.traderview.com/portfolio_analysis_analysis.cfm

The Fed is trying to shrink its balance sheet and withdraw, it will FAIL. To do so will collapse the economy. The reconfirmation of Bernanke was made ONLY after the explicit agreement to print the money, on that you can rely. The partners in crime known as the Federal Reserve and US Government: Evil twins. It's also an election year. Spend, borrow, tax and print, then do it again. The Fed has trillions of dollars of toxic assets yet to absorb on the way to hyperinflation and the Crack-up Boom. So...

The "when hope turns to fear" moment may be at hand. YOU CANNOT IGNORE the message that was sent in many markets in January. OUTSIDE down bars, key reversals, Cambridge hooks, call them what you will but it is a powerful chorus of FIREs burning, in the economy and in the markets. As Dennis Gartman says, "attention must be paid". Many Grains, some industrial metals such as Dr Copper with a doctorate of economics. Stock indexes, you name it and it is UGLY, put on your stops if you are long.... I will pick up this story in the next edition of Tedbits, don't miss it!

The election of Scott Brown to Senator from Ted Kennedy's seat in Massachusetts is sweet irony that his seat stops socialized healthcare, god does work in strange ways. This cry from Main Street following the Virginia and New Jersey Governor's defeats and the Massachusetts Senate upset are falling on DEAF ears in the beltway. The site of the UNIONS carving out $60 billion of tax breaks for themselves and government workers before the health care bill was DELAYED was such naked corruption as to beggar belief, but I guess that describes the whole effort.

The st@te of the union address signals BIG trouble -- we saw a BLIND ideologue and Hitler-like populous POISON, blaming his opponents, calling out the Supreme Court and refusing to hear the message of NO MORE BIG CORRUPT government.

The obscenity of government running up NEW debts of $45,000 PER PERSON by next November, an inconceivable number to people who earn less than that. Did you get $45,000 dollars worth of government? I know I didn't. Don't you think the press should report that in language and terms we all understand? No wonder no one reads the main stream press. Somebody will pay; unfortunately it is you and me. I shudder for my family, your family and our children's futures; it is insane. Criminals are destroying our futures. Their special-interest supporters are accomplices to high crimes and misdemeanors and sociopaths all.

Thank you for reading Tedbits. If you enjoyed it...

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2010 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.