Gold Rises Strongly as its Long Term Inverse Correlation to Equities Asserts Itself

Commodities / Gold and Silver 2010 Feb 02, 2010 - 07:32 AM GMTBy: GoldCore

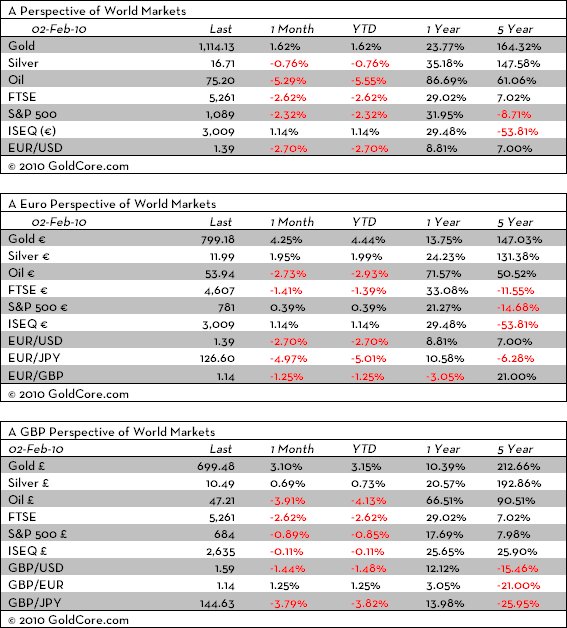

Gold had a strong run in US trading yesterday closing above the psychological $1,100/oz at $1,103.60/oz. It moved sideways in Asian trading so far this morning prior to rising to $1,114/oz at the London AM Fix. Gold is currently trading at $1,114.50/oz and in euro and GBP terms, gold is trading at €794/oz and £694/oz respectively.

Gold had a strong run in US trading yesterday closing above the psychological $1,100/oz at $1,103.60/oz. It moved sideways in Asian trading so far this morning prior to rising to $1,114/oz at the London AM Fix. Gold is currently trading at $1,114.50/oz and in euro and GBP terms, gold is trading at €794/oz and £694/oz respectively.

Gold and silver rose 2% and 2.5% respectively yesterday as the dollar weakened on concerns of the massive record post World War II budget deficits and long term inflation concerns.

And the US is not alone in facing significant fiscal challenges, eurozone states have taken on record debt levels (eurozone governments have borrowed a record €110bn from the markets so far this year) which is forcing up debt servicing costs for countries with poor public finances who are now paying a the price of surging debt levels. This bodes well for the euro price of gold which is again challenging the €800/oz mark.

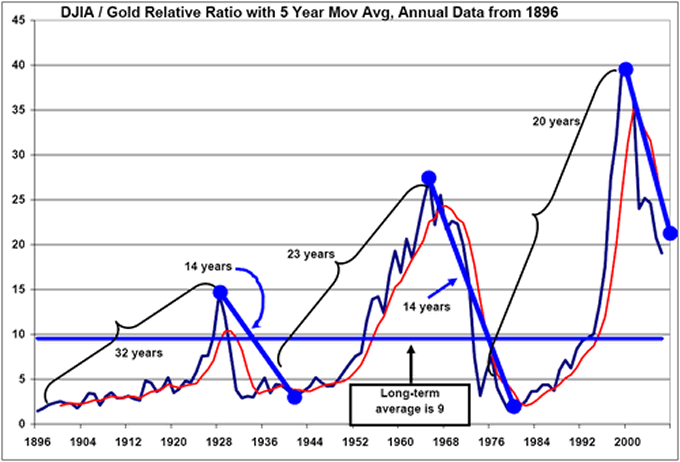

Gold s medium and long term inverse correlation with major equity indices (such as the FTSE and S&P500) is again being seen with gold now up 1.6% year to date (in USD terms and up 4.44% in euro terms and in GBP terms 3.15%) and equity markets down (see performance table).

Despite yesterday s strong bounce in gold it is too soon yet to decide whether the recent sharp selloff is coming to a close. Gold will need to close higher on the week and for the month of February before the animal spirits of a few weeks ago return to the market.

Silver

Silver had a quiet morning in Asia range trading from $16.54/oz to $16.68/oz. Silver is currently trading at $16.61/oz, €11.92/oz and £10.42/oz.

Platinum Group Metals

Platinum is trading at $1,545/oz and palladium is currently trading at $430/oz. Rhodium is at $2,475/oz.

News:

Asian stock markets were mixed with the Nikkei up 1.6% but markets in Shanghai and Singapore down.

Australia s central bank surprised markets today by keeping interest rates on hold. The Reserve Bank of Australia kept the overnight cash rate target at 3.75% after three increases, it said in Sydney today.

Southern European debt markets have recovered somewhat from their recent sharp sell offs. The yield spread between 10-year Greek government bonds and equivalent German bunds continued to narrow Tuesday, ahead of Wednesday's European Commission decision on the Greek plan to reduce its massive government budget deficit. The spread on 10-year Greek government bonds over bunds dipped below 330 basis points, down from the 400-basis-point peaks seen at the end of last week.

Oil prices rose again this morning, building on strong gains seen yesterday in the wake of robust US manufacturing activity and fresh unrest in Nigeria's key oil-producing region. New York's main futures contract, light sweet crude for delivery in March, was up 27 cents at $74.70 a barrel, while Brent North Sea crude for delivery in March gained 29 cents to $73.40.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.