Stock Market Unfinished Business From 2009 For 2010

Stock-Markets / Stock Markets 2010 Jan 29, 2010 - 03:41 PM GMTBy: Doug_Wakefield

In March 2009, the Dow bottomed at 6470 and the S&P 500 hit a low of 666. On January 19th we released a report titled, Desperation, which – if this nascent decline continues – will mark the top in the markets, with the Dow at 10,729 and the S&P 500 basically triple-topping on the 11th, 14th, and 19th at 1150. So, in less than one year’s time, the Dow gained 66 percent while the S&P 500 gained 73 percent. And, these numbers are as dubious as they are amazing.

In March 2009, the Dow bottomed at 6470 and the S&P 500 hit a low of 666. On January 19th we released a report titled, Desperation, which – if this nascent decline continues – will mark the top in the markets, with the Dow at 10,729 and the S&P 500 basically triple-topping on the 11th, 14th, and 19th at 1150. So, in less than one year’s time, the Dow gained 66 percent while the S&P 500 gained 73 percent. And, these numbers are as dubious as they are amazing.

Since the 19th, equity markets have dropped sharply and then went sideways this past week. For this reason, I thought we it would be beneficial to examine various events that have taken place since last March, to see what light can be shed on markets for 2010.

On March 27, 2009, in our report, We Are Driven: Taken for the Ride of Our Life, we stated:

“Let’s examine the Dow on Wednesday, March 18th, 2009.

No rocket science here. On this day, Bernanke simply announced that the Fed would hand out fistfuls of dollars. A CNN Money article, Fed Buying $300 Billion in Treasuries, states:

‘The Federal Reserve announced Wednesday it would buy $300 billion of long-term Treasuries over the next six months in order to try and get credit flowing more freely again.

The Fed also announced plans to buy an additional $750 billion in mortgage-backed securities; a move designed to lower mortgage rates.’ ”

So, in the early stages of this rally, the Federal Reserve, whose mandate is to provide the US with a “safe, flexible, and stable monetary and financial system,” started swapping out financial institutions’ toxic assets for newly minted U.S. Treasuries and ensured banks that they would provide still more assistance. The same report continues:

“The reason presented for the explosive, 6.8 percent rally three trading days later, on Monday, March 23, 2009, was much the same.

After weeks of handwringing over a plan to purchase toxic assets from banks to help get credit flowing through the financial system again, Geithner and the Treasury presented a $1 trillion bailout program. Geithner’s March 23rd, 2009 article in the Wall Street Journal was titled, My Plan for Bad Bank Assets. In it Geithner states:

‘Today, we are announcing another critical piece of our plan to increase the flow of credit and expand liquidity. Our new Public-Private Investment Program will set up funds to provide a market for the legacy loans and securities that currently burden the financial system.

The Public-Private Investment Program will purchase real estate related loans from banks and securities from the broader markets. Banks will have the ability to sell pools of loans to dedicated funds, and investors will compete to have the ability to participate in those funds and take advantage of the financing provided by the government.

The new Public-Private Investment Program will initially provide financing for $500 billion with the potential to expand up to $1 trillion over time. Over time, by providing a market for these assets that does not now exist, this program will help improve asset values, increase lending capacity by banks, and reduce uncertainty about the scale of losses on bank balance sheets. The ability to sell assets to this fund will make it easier for banks to raise private capital, which will accelerate their ability to replace the capital investments provided by the Treasury.” (Italics Mine)

In case you haven’t been reading on this lately, let me go over the moving parts. The Public-Private Investment Program used to be called the Public-Private Partnership, but “a rose by any name would smell as sweet.” In this “partnership,” the public, that is, the average American citizen, pays 92 percent of the bill to make the banks whole on some bad investments they made. The U.S. “government” loans these investors 85 percent (from my table and yours) and “invests” 7 percent out of all of the “surplus money they have on their balance sheets,” or through the hidden tax of inflation upon its citizens. Of course, private investors put up 8 percent and get to split profits with the government. And for all this, the average person gets to keep the banking system afloat for one more day.’ ”

In that same piece, Joan Veon, founder of the Women’s International Media Group, talked about the history of Public Private Partnerships:

“A Public-Private Partnership is exactly what it says it is. First, it is a partnership that is business arrangement, and it is for profit…Historically, such deals were considered glaring conflicts of interest, and as such, not in the best interest of the people…When you marry government and business, all existing rules of law and government change as the checks and balances of our Constitution no longer pertain…The door is open for anything – politically, socially, and economically. Plunder is tyranny.” (The United Nations Global Straightjacket (1999) Joan Veon, pp83-86)

Then, the markets moved lower in early July. Perhaps people were waking up to the fact that the policies enacted to initiate the “recovery” were the same ones that created the enormous speculative environment that led to the 2000 and 2007 equity bubbles and the 2005 real estate bubble. At that time, we discussed the fact that banks were accumulating massive reserves, a sign that the hundreds of billions they received from the bailouts were not going into the economy, but staying on the balance sheets of these giant banks. In our July 10, 2009 article, Whose Line (of Credit) Is It Anyway, we noted:

“As Paul Kasriel's recent article states, 98 percent of the increased reserves sits on the books of banks:

‘Reserves created by the Fed have increased by a staggering $858 billion in the 12 months ended May. But excess reserves on the books of depository institutions have increased by almost as much, $842 billion. So, in the 12 months ended May, 98% of the increase in reserves created by the Fed has simply ended up as idle reserves on the books of depository institutions.’ ”

And, with the continuing decline in private sector lending, the numbers only got larger as the year progressed. Three weeks ago, in our January 8, 2010 article, Financial Lessons of the Ages, we wrote:

Because of the “serendipitous” murkiness of some of our markets and banking institutions, we cannot prove exactly where and how this money was being used. However, since late May of 2009, professional traders’ commentaries have continued to warn market participants of large swift swings in various markets at “unique” times. Their topics of discussion include the enormous amount of proprietary trading that has been taking place in firms like Goldman Sachs and the power that high speed program trading systems has given to an infinitesimally small number of players in the largest capital markets in the world.

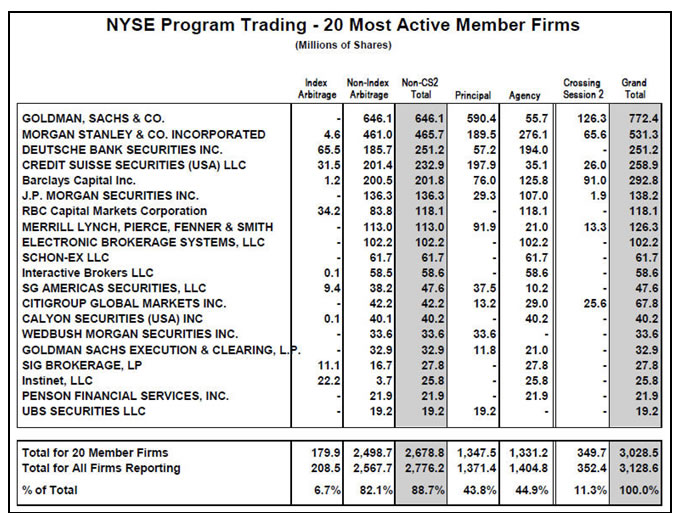

In our July 15, 2009 report, Banksters’ Rigged Roulette Wheels, we illustrated the frequency of high frequency program trading to market prices:

“The truth is, with the advent of high-frequency program trading, unless we are in position when the computer programs change direction, it is nigh unto impossible for investors to win in this brutally rigged game. A tip of the hat to John Mauldin as we open with his assessment of the situation:

‘First, I want to direct the attention of those in the US finance industry to a white paper written by Themis Trading, called “Toxic Equity Trading Order Flow on Wall Street.” Basically, they outline why volume and volatility have jumped so much since 2007; and it’s not due to the credit crisis. They estimate that 70% of the volume in today’s markets is from high-frequency program trading. They outline how large brokers and funds can buy and sell a stock for the same price and still make 0.5 cents. Do that a million times a day and the money adds up. Or maybe do it 8 billion times. It requires powerful computers, complicity of the exchanges (because the exchanges get paid a lot), and highly proximate computer connections. Literally, the need for speed is so important that to play this game you have to have your servers physically at the exchange. Across the river in New Jersey is too slow. Forget Texas or California. This is a game played out in microseconds.

The retail world doesn’t get to play. This is a game only for big boys who can afford to pay for the “arms” needed to fight this war. But the rest of us pay for the game…

Frankly, this is outrageous. The more I read the madder I got. And it is going to get worse as computers get faster and software more intelligent. We need rules to level the playing field. Themis suggests one simple one: just make it a rule that all bids have to be good for at least one second. That would cure a lot of problems. One lousy second! In a world of microseconds, that is an eternity.

Goldman Sachs went after an employee who stole some of their latest and greatest software this last week. The US assistant attorney general said in the courtroom that the software had the potential to manipulate the market. Imagine that. I am shocked. There is gambling going on in the back room? Gee, commissioner, I had no idea.’ ”

In that same piece, we transcribed part of a June 30 2009 Bloomberg interview of Joe Saluzzi, owner of Themis Trading:

“Saluzzi: I am here to talk about the markets, and trading and volume and how fictitious they are…The volume (in shares) that you see in the markets right now, some days as high as 12 billion across all exchanges, is fictitious. It is not real. Sixty to seventy percent of this volume that you’re seeing coming across – it’s volume – but it is done by high frequency traders. These are machines. The biggest machine out there wins the game nowadays. And, these people deal in sub-seconds. Fifty milliseconds is a huge amount of time. If you are anything over that, you are a dinosaur in this business.

So what they do all day long is buy and sell, all day, and try to collect liquidity rebates from the exchanges, which are basically in partnership with them, and they trade for no apparent fundamental reason, and this is my problem…

By the way, principally related program trades is a way to get the markets to go in your direction. What happens is, since we are all electronically linked, the algorithms chase the programs and artificially inflate the prices. But here is the trick. They can run for the trap door tomorrow, and if everybody becomes a seller, they will all just go the other way. They don’t care about the prices any more.

The trick to the market is that the high frequency guy does not add liquidity. He adds volume. There is a big difference between liquidity and volume. Volume is 12 billion shares…who cares? But … if a news event occurs and there is no liquidity there anymore, the trap door opens and there is no one left to buy.

I feel that one day that the door is going to close…everybody is going to be running for the exits…there will be a major move in the markets… and everyone will wonder, ‘What happened? What about that guy on Bloomberg talking about those high frequency guys?’ There is a problem structurally in the equity markets that nobody wants to talk about…there is intervention, manipulation going on… no one has exact proof of what is going on…but it is out there. And the real liquidity has been gone for a while when we got whacked down 40% last month. It never came back. Liquidity never came back.’

With this type of trading advantage, is it any wonder that, as the largest program trader, Goldman Sachs reported their largest quarterly profit in history, at $3.44 billion between April and June of 2009?’ ”

(This chart is from the December 2009 issue of The Investors Mind)

Last, we examine the extreme imbalance in our banking system in our October 9, 2009 report, My Therapy. The Office of the Comptroller of the Currency, charged with “ensuring a safe and sound national banking system for all Americans,” lists various measures in their quarterly derivatives report.

“I turn to page 17 of the Q2 ‘09 Derivatives Report, and see that our financial markets are in ‘good hands’ with Goldman Sachs. It would appear that as long as their high frequency program trading platforms can continue to dominate our capital markets, there really is no need to believe in a downside to equity markets.

But remember, Goldman can find its opportunities on the short side of equity markets. On September 20, 2007, CBS MarketWatch released an article, Goldman Pulls Off Profit Despite Subprime Woes, which is posted on the Weekly page of our site:

‘In a season where brokers have been digesting huge write-downs and trading losses, Goldman has produced a stellar quarter. Profit rose 79% to $2.85 billion, or $6.13 a share -- $1.78 more than the analyst consensus estimate. Goldman’s success was due in a large part to its hedging strategy. The broker absorbed $1.5 billion in credit write-downs, but its mortgage exposure was more than covered by hedging positions. In other words, Goldman made a profit on the mortgage collapse by betting it could happen.’

Frankly, I don’t know of any global financial player trading in our markets that has been able to achieve this feat when looking back over the last 2 years. Think about it: Goldman’s trading profits were seven times that of its nearest competitor, JP Morgan.”

So, we close with three recent charts. Many mainstream media and financial establishments continue to present a positive (if manic) recovery story. I will always continue to look for something deeper than today’s headlines.

(This chart is from our January 19, 2010 Short Report.)

(This chart is from our January 12, 2010 Short Report.)

(Chart from Weekly page of www.bestmindsinc.com, January 27, 2010.)

If the ever- expanding role of the state in our “free” markets in any way lures you into believing that political leaders can give you any insights as to the timing of your investment decisions, you’ll want to consider Bill Moyers’ recent piece, The Financial Lobby Owns Washington:

The nonpartisan Center for Responsive Politics, an indispensable source for information on money’s role in politics, reported in November that “The finance, insurance and real estate sector has given 2.3 billion dollars to candidates, leadership PACs and party committees since 1989.” You heard me right: Billions. A sum that eclipses every other sector — including the defense and health care lobbies.

If you know people who, unlike you, have yet to start learning about the casino we depend on, I strongly encourage you to share this article, and those like it, with them. The months ahead will prove extremely painful to those who buried their heads in the sand.

By Doug Wakefield with Ben Hill

President

Best Minds Inc. , A Registered Investment Advisor

3010 LBJ Freeway

Suite 950

Dallas , Texas 75234

doug@bestmindsinc.com

phone - (972) 488 -3080

alt - (800) 488 -2084

fax - (972) 488 -3079

Copyright © 2005-2010 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.