Gold Stock Bugs Need a Boost?

Commodities / Gold and Silver 2010 Jan 28, 2010 - 01:03 AM GMTBy: Adam_Brochert

Sentiment is terrible in the Gold patch right now, which is what's usually needed to form a lasting bottom. It's so bad that people are actually concerned about what Prechter is saying is going to happen to the Gold price right now (in case you don't know Prechter's track record on Gold, it's simple: he's been "big picture" bearish on Gold for the past ten years).

Sentiment is terrible in the Gold patch right now, which is what's usually needed to form a lasting bottom. It's so bad that people are actually concerned about what Prechter is saying is going to happen to the Gold price right now (in case you don't know Prechter's track record on Gold, it's simple: he's been "big picture" bearish on Gold for the past ten years).

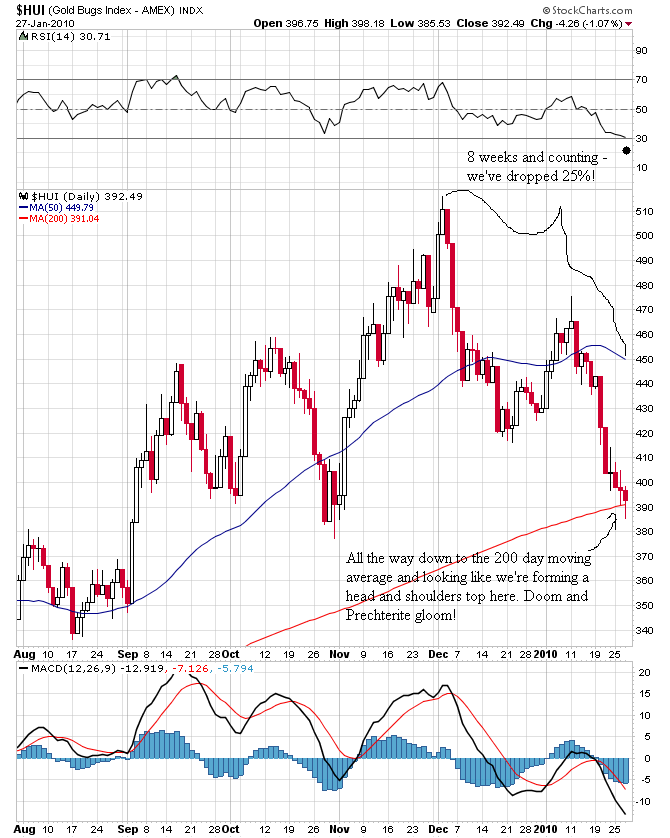

Watching each tick lower is frustrating when you pay too much attention to the daily tape (the author is guilty as charged). To give fellow Gold and Gold stock bulls a little taste of what may be coming, let's take a walk down memory lane to an earlier stage in the current secular Gold stock bull market. Here's a current 6 month chart of the $HUI unhedged Gold Bugs Mining Index thru today's close:

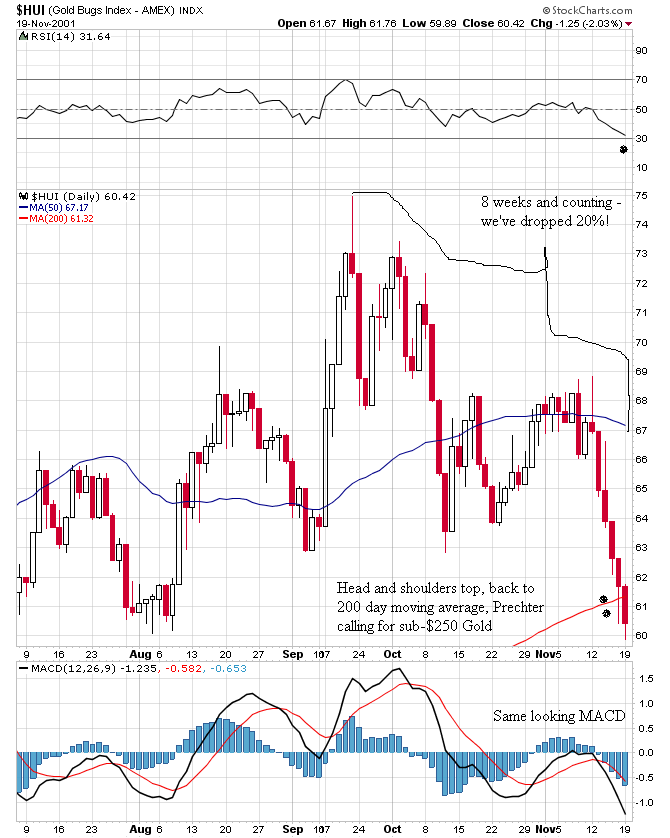

Now, here's what I think is a similar point in time from late 2001 (daily candlestick $HUI chart):

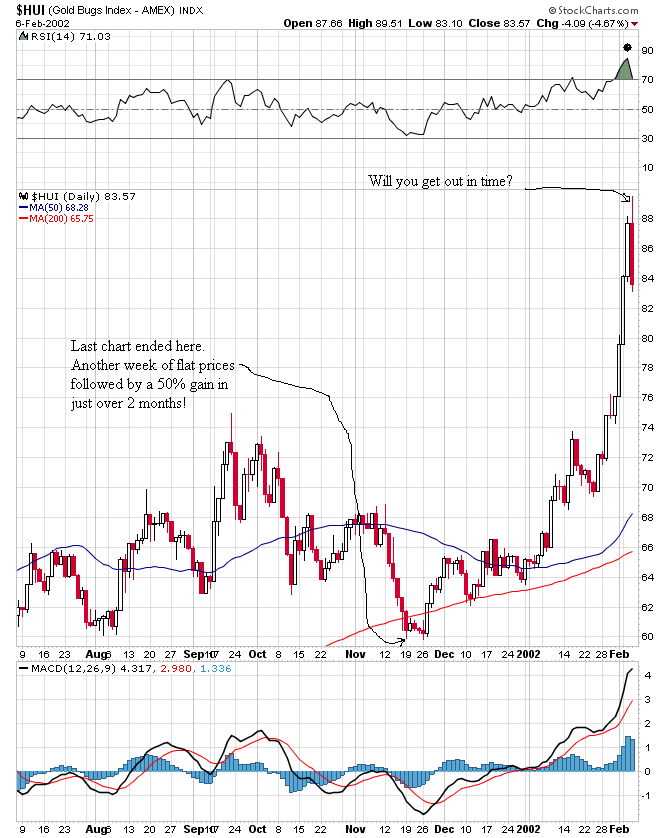

And here's what happened next in the $HUI back in late 2001:

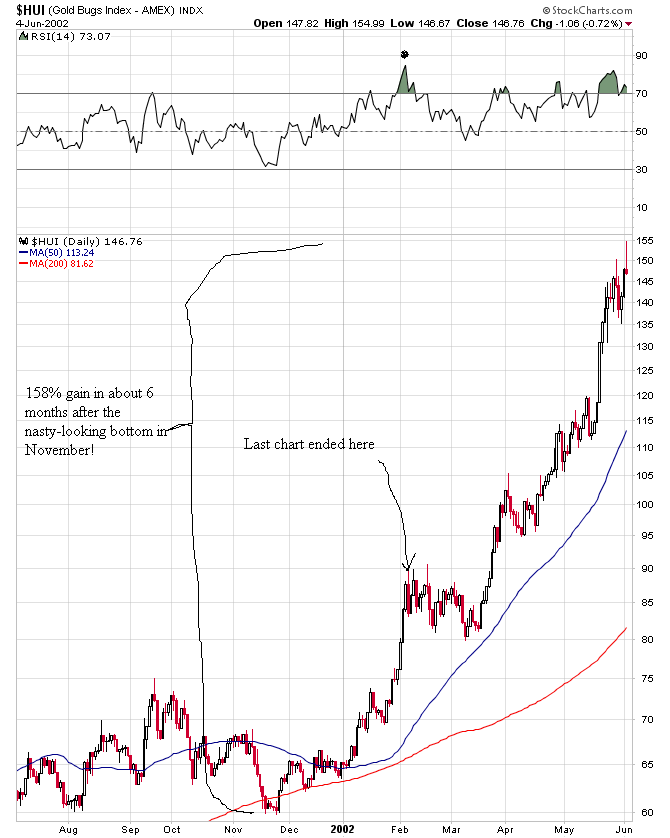

And then, here's what happened next in 2002 after this massive spike higher completed:

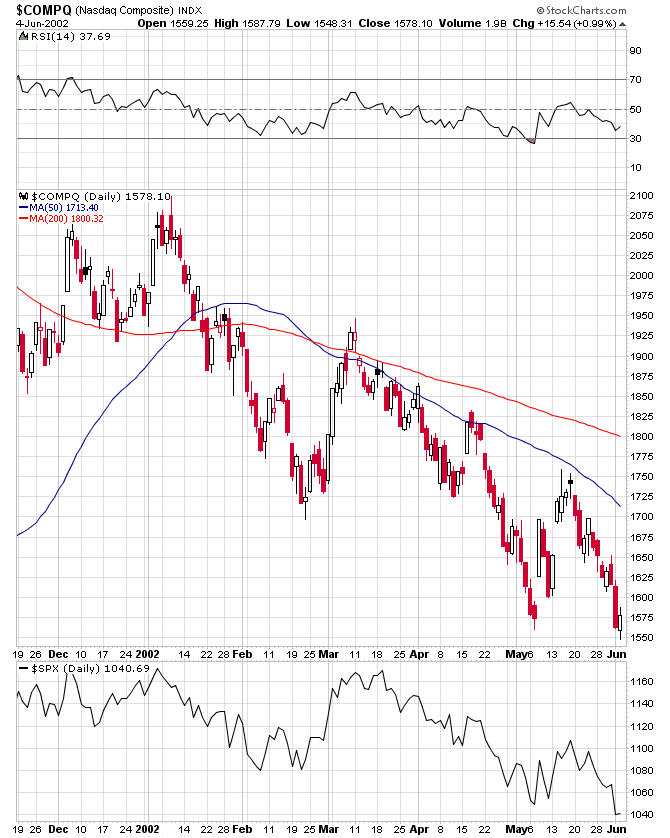

Now, since I already know the paperbugs are going to counter with "bear market means Gold stocks go lower," here's what the NASDAQ (main candlestick plot) and S&P 500 (black linear plot below) did during the 158% gain in the $HUI:

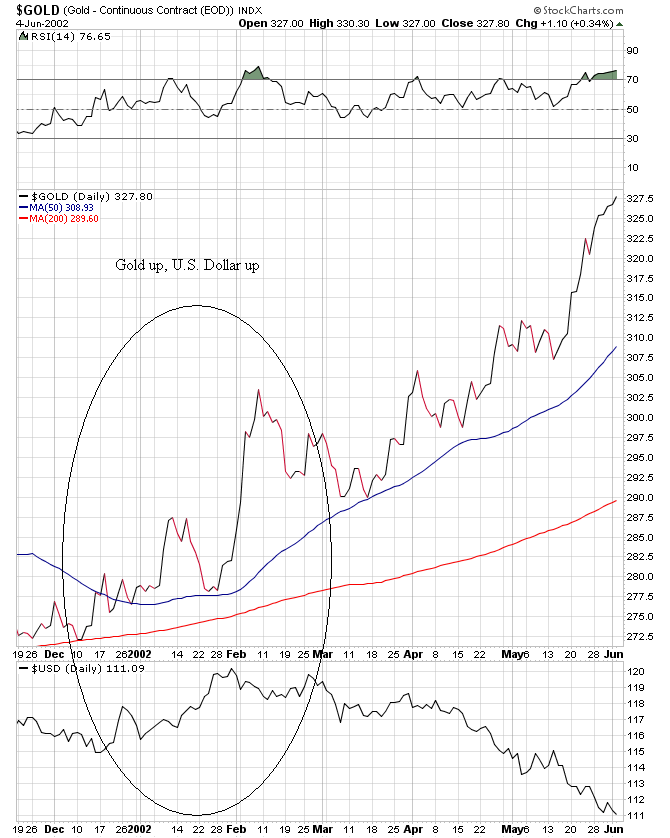

And, for the curious, here's what the Gold price (main linear plot) and U.S. Dollar Index (lower plot) did during this historic bull run:

I remain bullish on Gold and Gold stocks. I think 2010 is going to be a banner year for Gold stocks based on fundamentals (i.e. "real" price of Gold at multi-decade highs), and I think times like these are when Gold bulls should be buying hand over fist. The secular Gold and Gold stock bull market will not end until the Dow to Gold ratio gets to 2 and we could even go below 1 this cycle.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2010 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.