China Funds FXI, GXC, PGJ, HAO Rolling Over

Stock-Markets / Chinese Stock Market Jan 27, 2010 - 10:04 AM GMTBy: Richard_Shaw

This article is about four exchange traded funds (FXI, GXC, PGJ, HAO) and four closed-end funds (CHN, JFC, CAF, GCH), and the deteriorating price performance of those funds and the China indexes.

This article is about four exchange traded funds (FXI, GXC, PGJ, HAO) and four closed-end funds (CHN, JFC, CAF, GCH), and the deteriorating price performance of those funds and the China indexes.

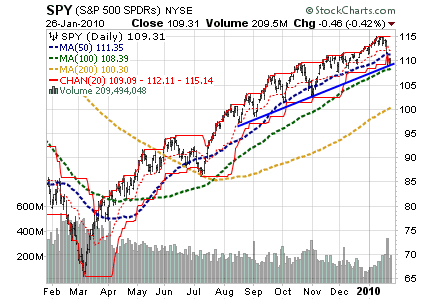

Putting the bottom line at the top, we think China is rolling over, at least in the short-term, and we are short FXI as of last Thursday, but still long the S&P 500 (proxy: SPY) for the time being.

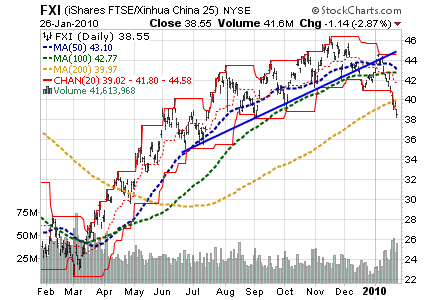

FXI is below its price channels, Bollinger Bands, and moving averages, including its 200-day moving average. SPY may be rolling over, but the pattern is sudden and may not be persistent. FXI, however, has been faltering for months, and finally broke through key support and technical levels to the downside.

FXI is the most heavily traded of the China funds, and even though it is concentrated, we seek liquidity in our investments so that as our trailing stop loss orders are triggered (becoming market orders), we can make a quick and clean exit. Exits in thinly traded securities can be costly with market orders.

BACKROUND INFORMATION:

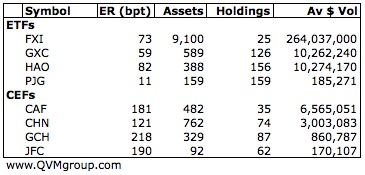

The China ETFs:

The funds are based on quite different indices, as follows:

FXI — FTSE/XINHUA China 25 Index: This market-cap based index consists of 25 companies representing the largest 25 Chinese companies comprising H Shares and Red Chips, ranked by total market capitalization. Index constituents are capped at 10% of the total index.

PGJ — Halter USX China Index: This modified market-cap Index consists of 100+ companies whose common stock is publicly traded in the United States and the majority of whose business is conducted within the People’s Republic of China. The market-cap modification uses a formula that fundamentally prevents the largest market-cap companies from becoming too large a component of the index.

GXC — S&P Citigroup BMI China Index: This market-cap weighted index consists of 300+ companies which are publicly traded and domiciled in China, but legally available to foreign investors.

HAO — Alpha Shares China Small Cap Index: This market-cap weighted index is a small-cap subset of the S&P Citigroup BMI China Index, with market-cap between USD 200 million and 1.5 billion for initial eligibility.

The China CEFs:

CAF — active management - The Fund seeks capital appreciation through investment in Chinese companies listed on the Shanghai and Shenzhen stock exchanges in China A shares.

CHN – active management — The Fund seeks long term capital appreciation through investment in the equity securities of companies engaged in a substantial amount of business in the Peoples Republic of China.

GCH – active management — The Fund seeks long term capital appreciation through investment in equity securities and debt obligations of Chinese companies.

JFC – active management — The Fund seeks long term capital appreciation through investment in equity securities issued by firms domiciled in the China region.

Some important fund statistics:

Share Class Type Definitions:

(source: FTSE Xinhua)

A-Shares: Securities of China incorporated companies that trade on the Shanghai or Shenzhen stock exchanges, quoted in Chinese Renminbi [RMB]. Traded by residents of the People’s Republic of China [PRC] or international investors under the China Qualified Foreign Institutional Investors [QFII] regulations.

B-Shares: Securities of Chinese incorporated companies that trade on the Shanghai Stock Exchange (quoted in US Dollars) or the Shenzhen Stock Exchange (quoted in Hong Kong Dollars – HKD). Traded by both non-residents of the PRC and residents with appropriate foreign currency dealing accounts.

H-Shares: Securities of companies incorporated in the PRC and nominated by the Chinese Government for listing and trading on the Hong Kong Stock Exchange, quoted and traded in HKD. Those from the PRC are not allowed to trade H shares however there are no restrictions on international investors.

Red Chip Shares: Securities of Hong Kong incorporated companies that trade on the Hong Kong Stock Exchange, quoted in HKD. The constituents are substantially owned directly or indirectly by the Chinese Government. Those from the PRC are not allowed to trade H shares however there are no restrictions on international investors.

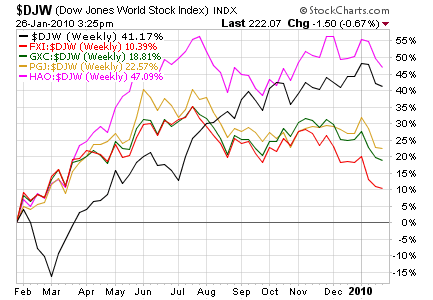

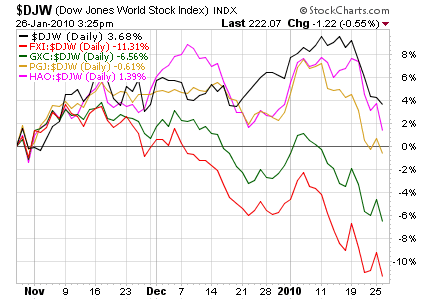

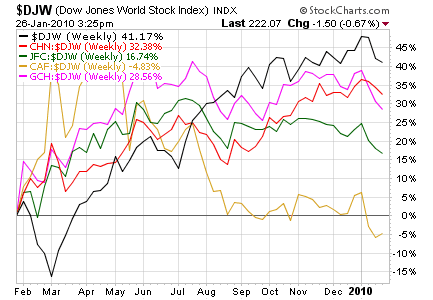

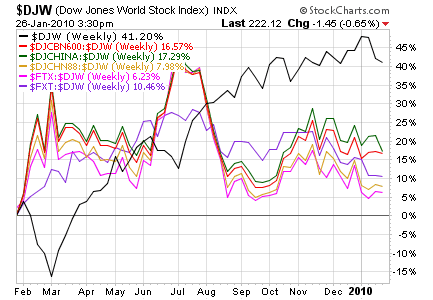

China ETF Performance Relative to Dow Jones World Stock Index:

1 Year

3 Months

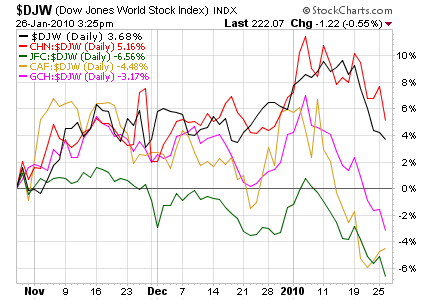

China CEF Performance Relative to Dow Jones World Stock Index:

1 Year

3 Months

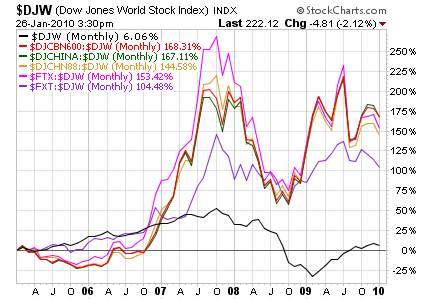

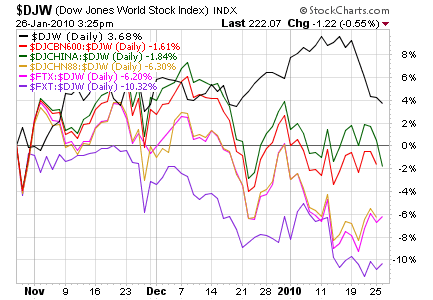

China Indexes Performance Relative to Dow Jones World Stock Index:

- $DJW is the Dow Jones World Stock Index

- $DJCHINA covers 95% of China free-float market-cap and consists of 1202 stocks traded on the Shanghai and Shenzen exchanges

- $DJCBN600 covers 80% of China free-float market-cap and consists of 60 stocks traded in Shanghai and Shenzen

- $DJCHN covers 33% of the China free-float market-cap and consists of 88 stocks traded in Shanghai and Shenzen

- $FTX consists of the largest 50 China A shares

- $FXT consists of the largest 25 Hong Kong and Red Chip China shares.

5 years

1 Year

3 Months

Compliance Disclosure:

Opinions expressed in this material and our disclosed positions are as of January 26, 2010. Our opinions and positions may change as subsequent conditions vary. As of that date, we have long positions in SPY and short positions in FXI in some but not all managed accounts, and do not have positions in any other securities discussed in this material. We are a fee-only investment advisor, and are compensated only by our clients. We do not sell securities, and do not receive any form of revenue or incentive from any source other than directly from clients. We are not affiliated with any securities dealer, any fund, any fund sponsor or any company issuer of any security. All of our published material is for informational purposes only, and is not personal investment advice to any specific person for any particular purpose. We utilize information sources that we believe to be reliable, but do not warrant the accuracy of those sources or our analysis. Past performance is no guarantee of future performance, and there is no guarantee that any forecast will come to pass. Do not rely solely on this material when making an investment decision. Other factors may be important too. Investment involves risks of loss of capital. Consider seeking professional advice before implementing your portfolio ideas.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.