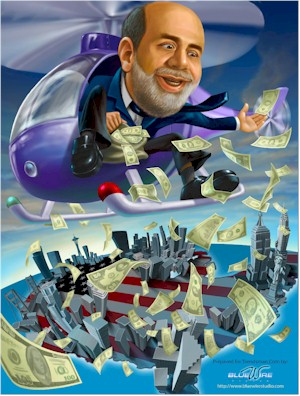

Helicopter Ben Bernanke, Understanding the Chairman

Politics / Central Banks Jan 27, 2010 - 12:54 AM GMTBy: Dr_Jeff_Lewis

When it comes to precious metals investing, there is no entity as important as the Federal Reserve. The Federal Reserve, which sets monetary policy and has a direct impact on the purchasing power of the greenback, has virtually complete control over inflation, deflation and the price of your metals. In the coming weeks, Ben Bernanke, the current Fed chairman, will be up for reappointment by the Senate of the United States.

Bernanke’s Reappointment

Bernanke’s Reappointment

Bernanke's reappointment is virtually guaranteed, with enough lawmakers on either side of the aisle willing to give him a second term. Many lawmakers, happy with his swift actions following the financial crisis, have said they will absolutely vote to reappoint him as head.

However, other lawmakers are upset with the Fed’s dramatic quantitative easing programs, as well as the bank bailout bill and the stimulus package – all of which Bernanke supported. Despite having his fair share of critics, those on Capitol Hill expect the vote to be close; however, none expect that Bernanke will have to find a new job.

His Great Depression Philosophy

Of all the big-government Keynesians who have chaired the Federal Reserve, none are as trigger-happy with monetary policy as Bernanke. Before his initial appointment as chairman, Bernanke was recommended heavily as a student of the Great Depression. Having spent years studying the economic implications and the role of government in extreme recessions or depressions, he believed that the Great Depression was largely the failure of government, later saying in his academic writings that the Federal Reserve and the US government did not do enough to calm the crisis.

Of course, many economic viewpoints contrast this stance, with the Austrian School pointing out that government spending actually prolonged the crisis, although neither philosophy has been independently proven in academic circles.

Bernanke's Big Spending

For precious metals investors, there is no one better to have as Chairman of the Federal Reserve than Ben Bernanke. His solutions for economic calamity are all straight from the Keynesian textbook: higher government spending and credit infusion via artificially low interest rates. In fact, Bernanke even earned the title “Helicopter Ben” from critics who latched onto his quote regarding the printing press to reverse recessions. He famously said, “The U.S. government has a technology, called a printing press, that allows it to produce as many U.S. dollars as it wishes at no cost.”

The Chairman's Importance

Only one Fed chairman in history has made it his premier task to fight inflation rather than create it: Paul Volcker. As many people can remember, Volcker took the prime rate to a sky-high 19% to reduce inflation and encourage savings. However, Fed Chairmen with the principles of Volcker are few and far between, as he was the only one to take inflation seriously when it came to his years as Fed Chairman.

Ultimately, it is of little importance who becomes the Fed Chairman, as they all share the same ideology. Of course, for precious metals investors, there is no one better for their wealth than Helicopter Ben.

By Dr. Jeff Lewis

Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com and Hard-Money-Newsletter-Review.com

Copyright © 2010 Dr. Jeff Lewis- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.