Gold and Financial Markets Await Bernanke Re-Nomination

Commodities / Gold and Silver 2010 Jan 25, 2010 - 06:50 AM GMTBy: GoldCore

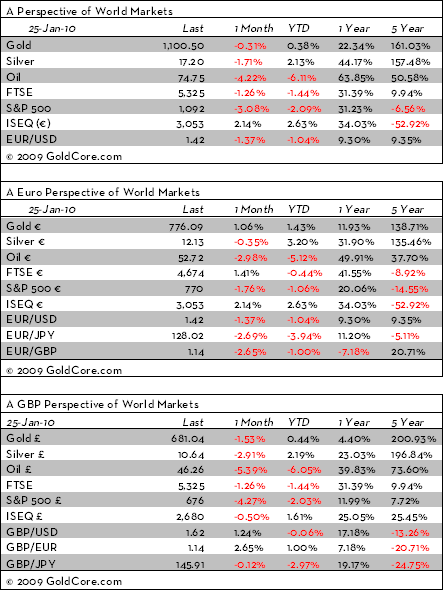

Gold is trading at $1,102/oz. In euro and GBP terms gold is trading at €777/oz and £682/oz. Support for gold is currently seen at $1,076/oz and resistance at $1,115/oz. Some calm has returned to markets in Europe after the sell off on Wall Street Friday and in Asia overnight.

The re-emergence of risk aversion seen last week is being blamed on President Obama's proposals to reform the US banking system. While this is undoubtedly a factor in the increased volatility and falling prices seen in some markets - other important factors were disappointing earnings reports (overnight Swedish telecom giant Ericsson's announced net profits fell by 92% in the fourth quarter), Chinese monetary tightening concerns and continuing sovereign debt risk. An additional important factor was the uncertainty regarding Ben Bernanke's re-nomination as Federal Reserve Chairman.

Bernanke looks likely to be re-confirmed in tomorrow's Senate vote despite growing opposition. Any surprise would likely see a marked increase in risk aversion and equity markets and the dollar coming under pressure again - thus providing support for gold. There would appear to be strong support near the $1,080/oz mark with buyers emerging on this latest dip below $1,100/oz.

Silver

Silver is trading at $17.17/oz In euro and GBP terms silver is trading at €12.11/oz and £10.62/oz.

Platinum Group Metals

Platinum is trading at $1,544/oz while rhodium and palladium are trading at $2,475/oz and $440/oz respectively.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.