Economic Stagnation, Wars, Pandemics, Welcome to the The New Dark Age

Economics / Great Depression II Jan 24, 2010 - 12:12 PM GMTBy: Elite_E_Services

Modern humans take pride in themselves and their society due to its perceived superiority. It is contrasted most starkly with a period in Europe known as the Dark Ages , a period of little documented innovation, writing, scientific discovery, and general backwardness.

Modern humans take pride in themselves and their society due to its perceived superiority. It is contrasted most starkly with a period in Europe known as the Dark Ages , a period of little documented innovation, writing, scientific discovery, and general backwardness.

The Dark Ages is a term referring to the perceived period of cultural decline or societal collapse that took place in Western Europe between the fall of Rome and the eventual recovery of learning.[1][2][3] Increased understanding of the accomplishments of the Middle Ages in the 19th century challenged the characterization of the entire period as one of darkness.[3] Thus the term is often restricted to periods within the Middle Ages, namely the Early Middle Ages, though this usage is also disputed by most modern scholars, who tend to avoid using the phrase.[1][4]

The Dark Ages is a term referring to the perceived period of cultural decline or societal collapse that took place in Western Europe between the fall of Rome and the eventual recovery of learning.[1][2][3] Increased understanding of the accomplishments of the Middle Ages in the 19th century challenged the characterization of the entire period as one of darkness.[3] Thus the term is often restricted to periods within the Middle Ages, namely the Early Middle Ages, though this usage is also disputed by most modern scholars, who tend to avoid using the phrase.[1][4]

During this time, little changed, the economy stagnated, small wars were fought, and disease spread. Sound familiar? ( Swine Flu, Credit Crisis, Iraq / Afghanistan ) What has changed in America in the last 10 years? We hear about advances in science and discoveries happening every day, how has this been implemented or impacted our daily lives? As an example, computing has advanced by leaps and bounds, 128-bit Cell processor technology enables supercomputing for the masses . Yet the total broadband penetration in the US is falling behind 20 nations including Estonia . America is not being singled out, but as a leader, it is unique in its class. If we didn’t use USA like an example, it could be argued that change is happening in China. In fact what they are doing in the rest of the world is “Americanizing” about 20 – 30 years behind the US.

Why is this significant? Because the internet was invented, designed, and implemented originally in America. Making a statement about being a leader in innovation, cannot be rebuked without hard data such as broadband penetration. It is known for a long time that the US educational system has fallen behind many countries. But it is still thought, to a large extent, that the US is a leader of innovation. Why then, is the broadband penetration declining for the first time?

This decline in society was seen as early as 1992 (and perhaps much earlier) and is documented in an article published by the Schiller Institute:

The people of North America and Western Europe now accept a level of ugliness in their daily lives which is almost without precedent in the history of Western civilization. Most of us have become so inured, that the death of millions from starvation and disease draws from us no more than a sigh, or a murmur of protest. Our own city streets, home to legions of the homeless, are ruled by Dope, Inc., the largest industry in the world, and on those streets Americans now murder each other at a rate not seen since the Dark Ages. At the same time, a thousand smaller horrors are so commonplace as to go unnoticed. Our children spend as much time sitting in front of television sets as they do in school, watching with glee, scenes of torture and death which might have shocked an audience in the Roman Coliseum. Music is everywhere, almost unavoidable—but it does not uplift, nor even tranquilize—it claws at the ears, sometimes spitting out an obscenity. Our plastic arts are ugly, our architecture is ugly, our clothes are ugly. There have certainly been periods in history where mankind has lived through similar kinds of brutishness, but our time is crucially different. Our post-World War II era is the first in history in which these horrors are completely avoidable. Our time is the first to have the technology and resources to feed, house, educate, and humanely employ every person on earth, no matter what the growth of population. Yet, when shown the ideas and proven technologies that can solve the most horrendous problems, most people retreat into implacable passivity. We have become not only ugly, but impotent.

The above is from “The New Dark Age” by Michael Minnicino. To keep things in economic perspective, we will look at this from perspective of energy and the markets, drivers of the economy (vs. a political or philosophical viewpoint which is difficult to quantify.).

The above is from “The New Dark Age” by Michael Minnicino. To keep things in economic perspective, we will look at this from perspective of energy and the markets, drivers of the economy (vs. a political or philosophical viewpoint which is difficult to quantify.).

The following ‘hockey stick’ chart of inflation-adjusted S&P earnings illustrates that we are in a ‘new’ market. Previous fluctuations were relatively stable, while they were in an overall uptrend since 1935, there were periods of decline but the overall trend was up. This chart is earnings, not stock price.

What are the implications of this chart? Inflation adjusted earnings on the S&P 500 are nearly $1, compared with a near $100 only 5 years ago. The same hockey stick chart has been used as an argument by climatologists suggesting we are entering a new ice age (or global warming) the point is, this chart indicates a ‘game changer’ – in other words, we are entering a new economy which is not connected to the previous 100 years at all. In this light, we can say, economically speaking, we are in the beginning process of entering “The New Dark Age.”

Comparison

The contemporary historians of science David C. Lindberg and Ronald Numbers discuss the widespread popular belief that the Middle Ages was a "time of ignorance and superstition", the blame for which is to be laid on the Christian Church for allegedly "placing the word of religious authorities over personal experience and rational activity"

In the last 10 years, a similar trend has been forming. More and more decisions are being made in public based on personal opinion instead of policy or law. For example, the previous Bush administration created the “Reality Based Community”:

... "That's not the way the world really works anymore," he continued. "We're an empire now, and when we act, we create our own reality. And while you're studying that reality—judiciously, as you will—we'll act again, creating other new realities, which you can study too, and that's how things will sort out. We're history's actors…and you, all of you, will be left to just study what we do."

Ignorance and stupidity is also a trend, as explained in a recent documentary “Stupidity,” which espouses the view that very few studies have been done on Stupidity, and very little is understood about the topic, while it is possibly the largest threat to man’s existence (personally and as a whole), and possibly the largest impediment to innovation and progress. The documentary finishes with an expose of the popular show Jackass , a show where the participants perform humiliating and self-injuring stunts such as running into a wall while sitting in a cart at high speeds. In previous times, such behavior would have been an embarrassment, now we are proud to display who can hit themselves in the head with a larger, heavier object.

Olduvai

The Olduvai theory states that industrial civilization (as defined by per capita energy consumption) will have a lifetime of less than or equal to 100 years (1930-2030). The theory provides a quantitative basis of the transient-pulse theory of modern civilization. The name is a reference to the Olduvai Gorge in Tanzania. Industrial Civilization is defined in Duncan's paper as the time approximately from when energy production per capita rises from 37% of the peak value to when it falls to below 37% of its peak value (1930-2030)[3] i.e. the peak in energy production per capita is in between these two endpoints and these two endpoints have values of 37% of the peak value.

The Olduvai theory claims that exponential growth of energy production ended in 1979, that energy use per capita will show no growth through 2008, and that after 2008 energy growth will become sharply negative, culminating, after a Malthusian catastrophe, in a world population of 2 billion circa 2050. [5] The Olduvai Theory divides human history into three phases. The first "pre-industrial" phase stretches over most of human history when simple tools and weak machines limited economic growth. The second "industrial" phase encompasses modern industrial civilization where machines temporarily lift all limits to growth. The final "de-industrial" phase follows where industrial economies decline to a period of equilibrium with renewable resources and the natural environment.[4] The decline of the industrial phase is broken into three sections:

The Olduvai theory claims that exponential growth of energy production ended in 1979, that energy use per capita will show no growth through 2008, and that after 2008 energy growth will become sharply negative, culminating, after a Malthusian catastrophe, in a world population of 2 billion circa 2050. [5] The Olduvai Theory divides human history into three phases. The first "pre-industrial" phase stretches over most of human history when simple tools and weak machines limited economic growth. The second "industrial" phase encompasses modern industrial civilization where machines temporarily lift all limits to growth. The final "de-industrial" phase follows where industrial economies decline to a period of equilibrium with renewable resources and the natural environment.[4] The decline of the industrial phase is broken into three sections:

• The Olduvai slope (1979–1999) - energy per capita 'declined at 0.33%/year'

• The Olduvai slide (2000–2011) - 'begins ... with the escalating warfare in the Middle East... marks the all-time peak of world oil production'.

• The Olduvai cliff (2012–2030) - 'begins ... in 2012 when an epidemic of permanent blackouts spreads worldwide, i.e. first there are waves of brownouts and temporary blackouts, then finally the electric power networks themselves expire'

This theory implies that all of our recent ‘advancement’ is actually man simply burning a big oil-fire. We have convinced ourselves that this is not the case, actually man is smarter and has developed significant technology which is the cause of our economic success. However studies show that the human brain has not evolved much for the last 100,000 years.

Functional Illiteracy

There are college graduates who ‘don’t read’, an anecdotal observation. Someone said, “It’s great that they made a movie about this topic for people like me who don’t actually read.” It’s easy to brush off statement like this as individual dumb statements, off the cuff remarks with no meaning. But what if this is part of a larger trend? What if there is a growing mass of college graduates who ‘don’t read’? We can see this trend on sites like Fark.com, here:

http://www.fark.com/topic/dumbass

In a recent movie “Idiocracy,” Mike Judge dramatizes the ‘dumbing down’ of modern man:

A narrator (Earl Mann) explains that in modern society, natural selection has become indifferent toward intelligence, so that in a society in which intelligence is systematically debased, stupid people easily out-breed the intelligent, creating, over the course of five centuries, an irredeemably dysfunctional society. Demographic superiority favors those least likely to advance society.[2] Consequently, the children of the educated élites are drowned in a sea of sexually promiscuous, illiterate, alcoholic, degenerate peers.

People who cannot read are illiterate. What do we call those who choose not to read, especially those warning labels on batteries “Do Not Eat”.

The Breakdown

What signs would we find that are tangible, not ‘theory’? Spelling mistakes in professional, completed projects. The below is from Microsoft Server 2003:

Devo

The concept that man is declining is not a new concept, it was popularized in pop-culture by rock band Devo:

The name "Devo" comes "from their concept of 'de-evolution' - the idea that instead of evolving, mankind has actually regressed, as evidenced by the dysfunction and herd mentality of American society."[3] This idea was developed as a joke by Kent State University art students Gerald Casale and Bob Lewis as early as the late 1960s. Casale and Lewis created a number of art pieces in a vein of devolution satirically. At this time, Casale had also performed with the local band 15-60-75. They met Mark Mothersbaugh around 1970, who introduced them to the pamphlet Jocko Homo Heavenbound, which includes an illustration of a winged devil labeled "D-EVOLUTION" and would later inspire the song "Jocko Homo".

Is modern society collapsing? Or are humans simply de-evolving?

Evolutionary theorist Oliver Curry of the London School of Economics expects:

a genetic upper class and a dim-witted underclass to emerge. The human race would peak in the year 3000, he said - before a decline due to dependence on technology. People would become choosier about their sexual partners, causing humanity to divide into sub-species, he added. The descendants of the genetic upper class would be tall, slim, healthy, attractive, intelligent, and creative and a far cry from the "underclass" humans who would have evolved into dim-witted, ugly, squat goblin-like creatures .

Economic Collapse

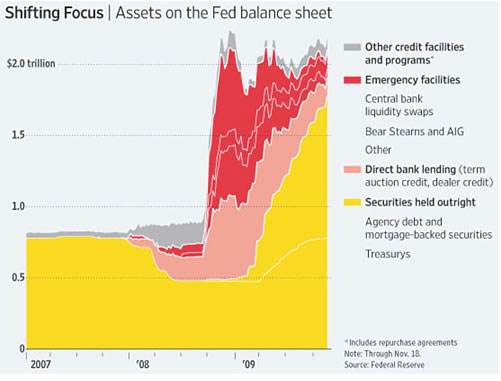

The Wall Street Journal gives some color:

At the Joint Economic Committee, a couple of House Republicans called for the resignation of Mr. Geithner, who, as president of the Federal Reserve Bank of New York, played a major role in last fall's moves to prevent the collapse of the financial system. "The public has lost all confidence in your ability to do the job," said Rep. Kevin Brady, Republican of Texas. Mr. Geithner, in an unusual public display of pique, fired back. "What I can't take responsibility is for the legacy of crises you've bequeathed this country," he told Mr. Brady. Although several Democrats defended Mr. Geithner at the hearing, some liberal Democrats have been complaining that the Obama administration isn't doing enough to combat unemployment.... "Quite frankly, all the gambling on Wall Street is doing nothing to put people back to work in America and rebuild our economy," said [Rep. Peter DeFazio (D., Ore.), who earlier this week urged Geithner to resign].

At the Joint Economic Committee, a couple of House Republicans called for the resignation of Mr. Geithner, who, as president of the Federal Reserve Bank of New York, played a major role in last fall's moves to prevent the collapse of the financial system. "The public has lost all confidence in your ability to do the job," said Rep. Kevin Brady, Republican of Texas. Mr. Geithner, in an unusual public display of pique, fired back. "What I can't take responsibility is for the legacy of crises you've bequeathed this country," he told Mr. Brady. Although several Democrats defended Mr. Geithner at the hearing, some liberal Democrats have been complaining that the Obama administration isn't doing enough to combat unemployment.... "Quite frankly, all the gambling on Wall Street is doing nothing to put people back to work in America and rebuild our economy," said [Rep. Peter DeFazio (D., Ore.), who earlier this week urged Geithner to resign].

What does economic collapse really mean? Economies seem to be constantly collapsing throughout history, yet new ones pop up. Is this collapse really any different? It is for those of us who have grown accustomed to a relatively safe and certain life. An economic collapse that involves the collapse of the USD as a world reserve currency will produce a lot of instability and uncertainty. What will that economic future look like?

“There is no new model” – no one has a model now that works. In the traditional model-building, observers would monitor economic data and build a model. In a new world, data is limited and it’s quality questionable, as the collapse will take decades to happen, and in the process of collapsing it will cause other events to happen which would not otherwise have happened, making the data not pure. A traditional problem of economics (which many do not believe is a serious science) is that there is no control, no sugar pill. In other words, there isn’t another Earth in a parallel universe that use state controlled planning vs. totally unregulated free markets. It’s not fair to say that America’s decline is due to capitalism, just as it is unfair to say Russia collapsed because of Communism as a system. It could be, in both cases, a combination of factors such as bad leadership, environmental factors (such as lack of resources), demographic changes, or bad luck.

In a book titled creatively “Collapse,” author Jared M. Diamond points to factors causing the collapse of societies.

Diamond lists eight factors which have historically contributed to the collapse of past societies:

1. Deforestation and habitat destruction

2. Soil problems (erosion, salinization, and soil fertility losses)

3. Water management problems

4. Overhunting

5. Overfishing

6. Effects of introduced species on native species

7. Overpopulation

8. Increased per-capita impact of people

Further, he says four new factors may contribute to the weakening and collapse of present and future societies:

1. Human-caused climate change

2. Buildup of toxins in the environment

3. Energy shortages

4. Full human utilization of the Earth’s photosynthetic capacity

Diamond also writes about cultural factors, such as the apparent reluctance of the Greenland Norse to eat fish.

An economy is a measure of resources, by some measures a metric by which to analyze a civilization. At least, it provides data points, whereas culture is less precise (how do we compare the value of Shakespeare vs. Norman Mailer?)

Investors are losing money simply by following the old model, and not being willing to accept that the world has changed. Interest rate parity theory doesn’t work, the Chicago school has collapsed, GDP doesn’t have meaning like it had when a currency can inflate and deflate an economy by the press of a button, while official statistics are ‘revised’ months after (meaning you can never trust any release for face value).

For the smart and informed, there is no doom and gloom. For those willing and capable to adapt, this change presents many opportunities and exciting challenges. Fund manager John Paulson made billions by realizing the credit bubble was a house of cards . Many success stories abound, mostly relating to thinking different, technology, the internet, and alternative investing.

How does this pertain to Forex?

Many ask for a ‘dumbed down’ explanation of what is Forex, what is a strategy. Finally, when you boil it down that it cannot be simplified to a lower level, an automated Forex system is a ‘money making machine’. Of course if an investor was told we are selling a money making machine they would either laugh, leave the meeting, or think we are crazy. Money managers and those in finance deal with this regularly: explaining the differences between investing and gambling. It’s like explaining the differences between reading Plato vs. The National Enquirer at the checkout stand. It could be argued that the reason that bankers rule the world, and the reason for the crisis, and the reason that more families are struggling to make ends meet, is largely due to financial illiteracy. This is not to blame them, there are few places one can obtain unbiased information about finance. So they think it’s like gambling, like playing cards – and when banks collapse or the market goes down, it’s the government, it’s corrupt executives, it’s never the investors fault.

Let’s imagine the scenario where the financial literacy in the world was tripled overnight, what impact would that have on the crisis and the economy in general? Any bubble requires participants. Obviously, without cheap and available money, the real estate bubble and credit derivatives bubble would have not existed, or at least been mild. However we agreed to take the money, with no plan for any consequences if the bubble burst.

Unfortunately, this crisis will teach many a lesson in finance the hard way, and many are learning.

Forex Extended

Every currency is backed by a central bank, which is usually backed by a country (with rare exceptions such as the Vatican central bank ). A country determines the rules and modus operandi which its central bank operates. Any central bank is backed by its countries resources, the sum of it’s economy.

Automated strategies are evolution in its purest form. The financial environment is similar to an electronic testing ground, as it is artificial.

All financial transactions end up in the Forex markets, in some sense Forex is a description of our entire global society. Forex is the Matrix, described by Morpheus in the movie “The Matrix” – it is a constant flux of changes and reflects the events in the real world, as much as can be defined and recorded. Seeing the decline or rise of society as a whole or individual nations can be seen in the Forex markets, for example the recent rise in the Norwegian Crone, related to Norway’s stable banking system and comparatively stable economy.

The Euro has been presented as a seemingly natural opposite of the US Dollar – but this is inaccurate. It is like the choices of Coke vs. Pepsi, Democrat vs. Republican. There is even talk that the Euro could collapse if the economic situation deteriorates further, seen as early as 2006 . Holding Euros as a US Dollar alternative is not an alternative at all. Europe is highly connected to the US and the Euro as a currency is very similar to the US Dollar in that it is controlled by bankers and backed by nothing tangible.

Negative Selection

Jim Rogers recently stated in an interview “Money is being taken from the competent and given to the incompetent.”

What happens to a democracy when participants are not capable of making decisions for themselves? Parents watch children to protect them from serious hazard, a parent will let his child explore the world in the safety of their home, but even in the home danger exists such as a hot stove, a filled bathtub, and household poisons such as Windex could prove dangerous to a child that doesn’t know the difference between ‘fun experimenting’ and ‘creating a highly explosive chemical mix’.

A parent will allow a child to make a mistake but not one that will injure him severely, such as walking into traffic or playing with matches. Should not, in the same spirit of care and concern, the more capable intelligent humans protect the less enlightened from creating a situation that could prove catastrophic for billions, and endanger the survival of the human race?

In Government, and in many corporations, it is not easy to fire someone for various reasons. So the easiest way a team can get rid of an incompetent and inefficient manager is simple: you promote them. Or else, in the famous movie ‘Office Space’ – you may face an angry Dilbert who finally burns down the building.

There is a big difference between slavery and hiring an incompetent manager to run the business. Human rights should not be confused with effective leadership. Giving all human beings the right to life, liberty, property, and the pursuit of happiness doesn’t imply that any human is qualified to be President or CEO of a bank.

Conclusion

We are entering a world that no longer follows rules of logic and order. Things that simply should not happen are happening on a regular basis. The 100-year storms are happening every year. Anomaly is the norm.

In our modern definition of the ‘new dark age’ – many cannot see the obvious paradox defining our age: Hurry up and wait. Save by buying a second item and get 50% off. We need to save the economy by bailing out the banks (who were responsible for the crisis). Information has never been historically more accessible, yet literacy and education rates are declining.

Unlike the previous Dark Age, we have abundant technology and widespread communications systems (computers and the internet) so we have a front row seat for the greatest movie ever produced.

http://en.wikipedia.org/wiki/Dark_Ages

http://en.wikipedia.org/wiki/Dark_Ages

http://en.wikipedia.org/wiki/Cell_(microprocessor)

http://arstechnica.com/tech-policy/news/2009/06/us-20th-in-broadband-penetration-trails-s-korea-estonia.ars

http://www.schillerinstitute.org/fid_91-96/921_frankfurt.html

http://en.wikipedia.org/wiki/Dark_Ages#Modern_popular_use

http://www.nytimes.com/2004/10/17/magazine/17BUSH.html?_r=1&ex=1255665600&en=890a96189e162076&ei=5090&partner=rssuserland

http://www.imdb.com/title/tt0399704/

http://en.wikipedia.org/wiki/Jackass_(TV_series)

http://en.wikipedia.org/wiki/Idiocracy

http://news.bbc.co.uk/2/hi/uk_news/6057734.stm

http://en.wikipedia.org/wiki/John_Paulson

http://en.wikipedia.org/wiki/Institute_for_Works_of_Religion

http://www.moneyweek.com/investments/is-the-euro-set-to-collapse.aspx

By Elite E-Services

http://eliteeservices.net/ Elite E Services FX Systems See more articles at www.eliteforexblog.com

Elite E Services is an electronic boutique brokerage specializing in currency trading, intelligence, and technology surrounding foreign exchange markets. EES offers FX trading systems for clients and investors, FX consulting, technology and tools for trading, system development, custom programming, and FX solutions for businesses.

© 2010 Copyright Elite E-Services - All Rights Reserved

DISCLAIMER: This article is for educational purposes only. It is not a solicitation to invest or a recommendation for investing. Foreign Exchange Trading is extremely risky and is for the sophisticated investor only. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should only invest risk capital that you can afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.