Is the Stock Market Flashing a “Sell” Signal?

Stock-Markets / Stock Markets 2010 Jan 19, 2010 - 12:58 PM GMTBy: Graham_Summers

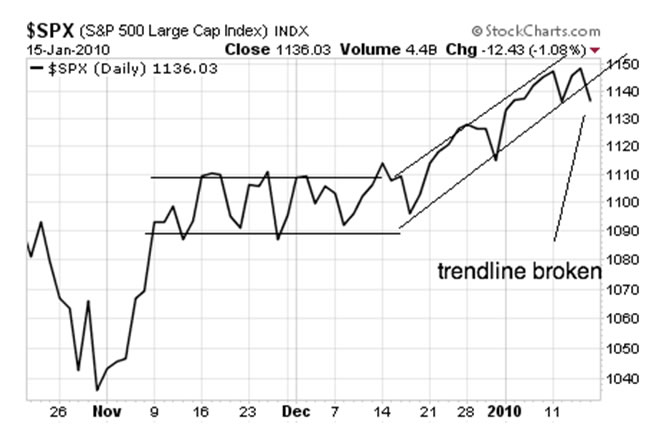

Friday’s decline has got a lot of commentators asserting that the official top is in for the rally that started March 2009. The primary reason for these assertions is that stocks look to have broken the rising channel they entered during this last leg up.

Friday’s decline has got a lot of commentators asserting that the official top is in for the rally that started March 2009. The primary reason for these assertions is that stocks look to have broken the rising channel they entered during this last leg up.

As you can see, stocks traded in a parallel range from early November to mid-December. They then began another leg up trading within a rising parallel range. Friday’s sharp down day looks to have broken this range decisively.

This certainly does not bode well for the bulls. This break, unless immediately reversed, indicates that the upward momentum of this latest up leg has been broken.

However, one has to be careful in making these kinds of assertions. The fact a trendline is broken does not ALWAYS mean that the top is in. In fact, we had a major trendline broken back in late October. I and a lot of other analysts were suckered into believing this marked the official top for stocks. However, Bernanke immediately juiced the system again and the market quickly reversed.

In defense of the bears (myself included) who viewed late October’s collapse as the “top,” stocks have struggled ever since this pattern broke. Indeed, we traded within a tight 1-2% ranged for nearly two months. And the next leg “up” occurred primarily over the holiday weekend when stocks could easily be goosed higher with very little capital.

Moreover, I should note that stocks have only risen roughly 4% above the October high: hardly what you could call a massive breakout. Indeed, the fact the market took three months to get 4% higher (compared to 13% rally that occurred in only one month following the July pullback) indicates just how tired this rally has become.

However, one has to be bluntly honest with one’s self at all times when investing. And stocks DID move to new highs following the October trendline break. For this reason, I think it’s important to be extra careful when considering proclamations that the “top is in.” We’ve already seen one major breakdown quickly reverse disproving this notion that a broken trendline means the top is in.

Also, and I want to stress this, calling a top (or a bottom for that matter) is not nearly as important as simply catching the general trends. Right now, the general trend remains “up” until we get a break below the 50-DMA at 1,110.

Undoubtedly, stocks are struggling to hit new highs (this final leg up started in late December was the weakest so far for the rally since March 2009). Additionally, volume is declining, economic data continues to worsen (the latest retail numbers were awful even compared to 2008’s terrible numbers), and there are serious signs of stress showing up in the bond markets (short-term debt continues to yield next to nothing, indicating investors are more worried about locking up their cash rather than looking for income).

So, my suggestion to anyone right now is to start preparing for what they will do WHEN the top is in, rather than trying to simply NAIL the top to a “t.” This means closing out some longs for a profit, or at least taking some money off the table. This also means considering what one would do if stocks were to stage a significant reversal. The fact that corporate insiders are selling their stakes in record numbers AND that fewer and fewer investors are participating in this rally makes a massive reversal probable rather than possible this year.

Finally, one needs to consider potentially hedging one’s bets or even going net short via some carefully placed shorts. Again, it might not be the time to “sell the farm” just yet, but you want to be ready for when that time comes. Having some shorts picked out in advance doesn’t hurt.

Again, to reiterate the primary point of this essay, it is much more important to plan ahead for “when the music stops,” than to accurately guess what the last song will be in the liquidity party dance. I’m doing exactly this with subscribers of Private Wealth Advisory. While most investors continue to believe they can eek out every last percentage point of gains from this market rally, we’re already taking steps to protect ourselves from what will happen when the top finally hits. We’ve already moved most of our money to cash and have lined up several “On Deck” trades for when the market finally rolls over.

True, it might be next week or next month, or even longer. But with the entire world extremely bullish right now, WHEN the reversal happens it will be LARGE and VIOLENT. We’re taking steps to protect ourselves. Are you?

To learn more about Private Wealth Advisory, click here.

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.