Cheap Crude Oil is Gone, and That's Good News

Commodities / Crude Oil Jan 15, 2010 - 04:21 PM GMTBy: Casey_Research

Marin Katusa writes: Over the next year or two, you will likely find yourself paying a LOT more at the gas pump. Big changes are taking place in the oil industry. With increased global demand and declining supply, easy oil is not so easy anymore.

Marin Katusa writes: Over the next year or two, you will likely find yourself paying a LOT more at the gas pump. Big changes are taking place in the oil industry. With increased global demand and declining supply, easy oil is not so easy anymore.

Everything is about to get more expensive. From gasoline to anti-freeze, life jackets to golf balls, and eye glasses to fertilizer. There are very few things in the modern world that aren't made from oil, made by machines dependant on oil, or shipped by vehicles powered by oil.

The implications, at first glance, appear to be the opposite of good news. In fact, it's enough to strike panic in the hearts and wallets of the average consumer.

And that's exactly why the International Energy Agency just released its annual World Energy Outlook, clearly rejecting the possibility that crude output is now in terminal decline. Their attitude seems to be, what you don't know won't hurt you. For now that is.

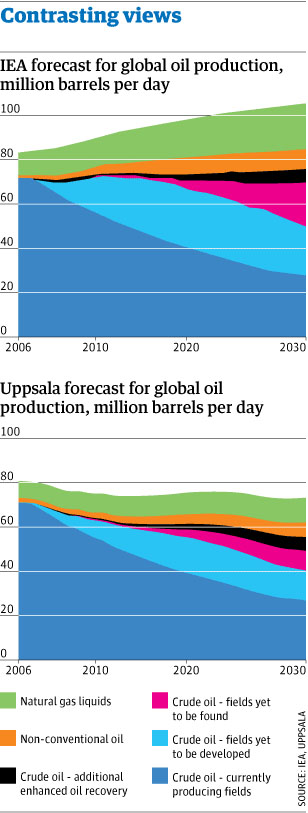

The truth however, is beginning to surface, and from an investor's perspective, the truth can mean money in the bank. Right now, the IEA's claim that oil production will be ramped up from its current level of 85 million barrels per day to 105 million barrel per day by 2030 is receiving harsh criticism.

The Guardian reports, "The world is much closer to running out of oil than official estimates admit."

This comes from a whistleblower inside the International Energy Agency who states the fear of triggering panic buying has caused them to intentionally underplay the inevitable shortage.

Kjell Aleklett, professor of physics at the Uppsala University in Sweden, and co-author of a new report 'The Peak of the Oil Age', states "oil production is more likely to be 75m barrels a day by 2030 than the 'unrealistic' 105m used by the IEA."

According to Professor Aleklett's research, they are making a dangerous and unjustified assumption. One that is dependent upon the oil industry's ability to ramp up production to levels never before achieved.

Are you beginning to see the opportunity here?

Whistleblowers and scientists are not the only ones disputing the IEA's report. The folks who pump oil aren't buying its rosy scenario either.

- Total SA, the French oil giant, that is making its move into the Alberta oil sands, doesn't accept the IEA's optimistic claims. The company runs on the belief that oil production won't surpass 95 million barrels.

- Former chief executive officer of Canada's Talisman Energy, Jim Buckee, agrees the IEA prediction is nonsense.

- Sadad al Husseini, energy consultant and the former exploration and production chief of the world's largest oil company, Saudi Aramco, recently said, "Oil supplies have reached a capacity plateau and will not meet a growth in demand over the next decade."

The Globe and Mail recently joined the debate stating, "New [oil] fields, generally smaller, are less productive than old ones - note the virtual freefall in production rates from the North Sea fields, which reached peak output in 2000. Another reason [for the decline] is development pace, or lack thereof. The yet-to-be-developed reserves in the WEO report cover 1,874 fields of various sizes that would have to come into production in the next 20 years."

That works out to almost eight new fields being brought to production each month. A realistic target? Only time will tell. Even if the oil exists, the next question becomes one of money, and where it will come from in order to keep this pace of development on target.

When you add in professor Aleklett's conclusion that production will shrink to 75 million barrels per day by 2030 — almost one-third less than the IEA's figure and 10 million barrels less than current production, it's easy to see why investors need to take notice.

Shrinking supply and ever-growing global demand are creating the perfect storm for oil prices.

The current price of crude could be the bargain of the century. Understand this and every increase at the pump will give you reason to smile.

If you're looking for the best way to capitalize on the end of cheap oil, there's no better time to sign up for my advisory service, Casey's Energy Report.

Subscribers have been handed 19 consecutive winning stock picks in 11 months. Now you have the opportunity to learn which stocks I believe will profit from the looming oil shortage. For more information click here.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.