Fannie and Freddie, Another American Taxpayer Nightmare

Politics / Credit Crisis Bailouts Jan 15, 2010 - 03:03 PM GMTBy: Michael_Pollaro

It’s official.

It’s official.

Fannie and Freddie are now full wards of the state, departments of the U.S. government. And their obligations are now the obligations of the American taxpayer.

That’s right, Fannie and Freddie’s obligations are not just implicitly guaranteed by the U.S. Treasury, as they were before Fannie and Freddie were taken into conservatorship by the U.S. government in September of 2008, nor are they just temporarily guaranteed, with a $400 billion cap, as they were under conservatorship. Now, Fannie and Freddie’s obligations are explicitly guaranteed, without limit by the U.S. Treasury for 3 years, and as needed thereafter.

That’s right, Fannie and Freddie’s obligations are not just implicitly guaranteed by the U.S. Treasury, as they were before Fannie and Freddie were taken into conservatorship by the U.S. government in September of 2008, nor are they just temporarily guaranteed, with a $400 billion cap, as they were under conservatorship. Now, Fannie and Freddie’s obligations are explicitly guaranteed, without limit by the U.S. Treasury for 3 years, and as needed thereafter.

Who made this decision? The Obama administration. When did it happen? Interestingly, on December 24th, after everyone had gone home for Christmas. Even more interestingly, by playing Santa before the New Years’ ball was dropped, the Obama administration dodged the need to bring the decision to Congress.

Whatever spin is sure to come from the Obama administration over the next several months, this makes Fannie and Freddie’s obligations indistinguishable from the U.S. government’s obligations. And it puts the American taxpayer on the hook for Fannie and Freddie for the foreseeable future.

Merry Christmas Fannie and Freddie. Please make sure you include every American taxpayer on your Christmas list next year.

So, how big an obligation is this for the American taxpayer? In a word, big.

To start, according to the Federal Reserve’s Third Quarter Flow of Funds Accounts, Fannie and Freddie have a combined debt load of $2.8 trillion, meaning the U.S. Treasury just increased the U.S. government’s gross debt burden by 23%, from $12.3 trillion to $15.1 trillion.

But there’s more. Fannie and Freddie guarantee $5.3 trillion in mortgage-backed securities. A contingent guarantee, yes, but given the fact that this obligation is of the toxic variety, its quite likely that Fannie and Freddie will be making good on many of these guarantees over the next several years.

How big is many?

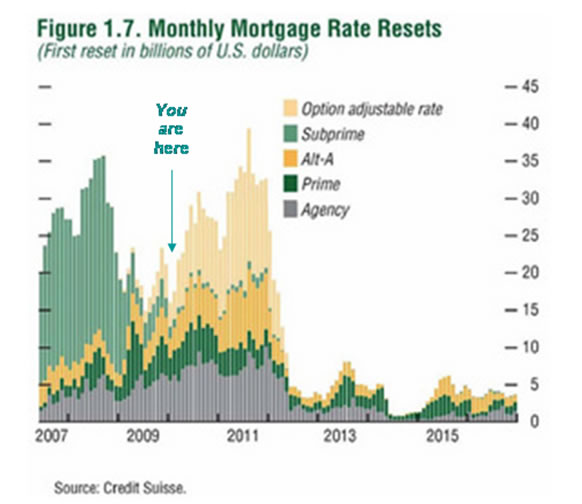

There is another wave of mortgage resets afoot, and it’s as large as that experienced during the sub-prime crisis. Just take a look at the mortgage rate reset chart below, courtesy of Credit Suisse.

On top of that, this rate reset wave is coming with a clutch of Alt-A and Option ARM mortgages, and that’s not good. Alt-A mortgages, which typically require little or no proof of a borrower's income, may prove to be as sub-prime as sub-prime mortgages, maybe worse. As for Option ARMs, the reset features on these mortgages make them even more toxic than sub-prime and Alt-A mortgages. According to some estimates, homeowners holding Option ARMs will be paying anywhere from 40% to 80% more per month on their mortgages upon reset.

Combine these facts with the fact that the unemployment rate is about twice what it was during the sub-prime crisis, the fact that savings nest eggs are not exactly overflowing, and the fact that a substantial number of homeowners with Alt-A and Option ARM mortgages are underwater, and one can only wonder how big the mortgage losses will be on this next reset wave.

Now, the negative impact that a new wave of defaults and foreclosures will have on the real estate market, and therefore Fannie and Freddie’s book of business, is obvious. But there’s nothing like being in the direct line of fire. According to Fannie’s Third Quarter Credit Supplement, Alt-A and Option ARM mortgages represent about 15% or $450 billion of its guaranty book. I could not find Freddie’s exposures in a similar format, but from what I have gathered, I suspect it’s not that much different. Using 15% as a proxy for the combined entities, that’s about $800 billion of guarantees in the direct line of fire. And while it’s true that not all these mortgages will be resetting on this next reset wave, Credit Suisse’s mortgage reset chart implies that the majority of these mortgages will.

Yes indeed, the American taxpayer is yet again stepping up to bail out the incompetent, this time with $8.1 trillion on the line.

To underscore the size of these obligations, consider this. Before the Obama administration dressed up as Santa and jumped down Fannie and Freddie’s chimneys, the U.S. government’s debt burden was an already huge 85% of 3rd Quarter U.S. GDP. Adding Fannie and Freddie’s $2.8 trillion of direct obligations to the U.S. government’s debt burden takes that ratio to 105%. Adding Fannie and Freddie’s $5.3 trillion in guarantees to that, admittedly a worst case scenario, takes that ratio to a whopping 140% of GDP.

If that’s not enough to give you pause, read on. It gets worse. There is a reason the Obama Administration wanted to play Santa.

Fannie and Freddie, along with the other government run lenders - Federal Housing Administration, Ginnie Mae and the Federal Home Loan Banks, ARE the home mortgage market. Without Fannie and Freddie in that mix and under government control, the home real estate market would likely tank, and with it, Obama’s so called recovery.

According to the Federal Reserve’s Third Quarter Flow of Funds Accounts, since the peak in home mortgage debt in the 1st Quarter of 2008, home mortgage debt has shrunk by $328 billion, a decline of 3%. Over that same time period, Fannie and Freddie have provided $675 billion in net new financing, an increase of 14%. While housing was imploding, Fannie and Freddie took their share of the home mortgage market from 44% to 51%.

As private lenders were either going bankrupt or heading for the exits, Fannie and Freddie were sucking up mortgages that no private lender would touch. Fannie and Freddie, along with all the other government lenders became THE lenders in the home real estate market.

You see, private lenders are not willing, without a government subsidy, to lend to income challenged borrowers at record low mortgage rates when the underlying collateral; i.e., people’s homes, are still overpriced, in the face of record high, and still mounting defaults and foreclosures. Simply stated, why lend if you are guaranteed to lose money.

But if you are a lender backed by the U.S. government, making money is a secondary matter. In fact, like all government programs, making money means almost nothing.

The numbers prove it. While they were growing their market share, Fannie and Freddie still lost money. According to a recent Bloomberg article, in the last 9 quarters they showed a combined loss of $188 billion. That may not sound like a lot of money, but it comes despite the fact that Fannie and Freddie, owing to government debt guarantees, get to fund their operations at below market rates, despite the fact that they get preferential tax treatment from the government, and, most important, despite the fact that they, because of today’s newly implemented (read flexible) mark-to-market accounting rules, get to present the value of their portfolios and hence their profit and loss accounts in a better light.

The fact is, as long as borrowers remain challenged, mortgage rates remain low, homes remain overpriced, and default and foreclosure rates remain high, it is highly probable that Fannie and Freddie, along with all the other government lenders will not just be THE lenders in the home real estate market, but THE ONLY lenders in the home real estate market.

What does all this say about Fannie and Freddie's future borrowing requirements? To me, it's obvious.

Fannie and Freddie are in a horribly unprofitable business in which they are increasingly becoming the primary lender. Add in the increasingly horrible profit dynamics of the business and it’s safe to say that they will be losing money for sometime to come. This guarantees larger and larger borrowing needs for Fannie, Freddie and the U.S. government, to not only fund the growth of Fannie and Freddie, but to pay for all the ensuing losses.

My bet is the Obama administration is thinking the exact same thing, or why would they be providing unlimited funds to Fannie and Freddie, while at the same time relaxing another mandate of the 2008 conservatorship, the timeline for Fannie and Freddie to shrink their portfolio of retained mortgages. No shrinkage is now required in 2010. Want to bet there will be none required in 2011 too?

In my opinion, $8.1 trillion is just the opening salvo.

One last, and important point. The government assumption of Fannie and Freddie’s debt obligations, indeed all government debt obligations is not just a problem for the American taxpayer. It’s a problem for any holder of U.S. dollars, American and foreign holders alike. That’s because all this government debt cannot possibly be paid off by taking it from the income of Americans alone. It will eventually require the Federal Reserve and its printing press to make good, at least nominally, on these obligations.

Indeed, the Federal Reserve has already bought $1.1 trillion of Fannie and Freddie's debt obligations since September of 2008, that’s 13% of total outstandings, simply by writing a check on itself.

I will have more to say about the U.S. government’s fiscal situation, the Federal Reserve and how that impacts the financial markets and the economy in future posts.

I would like to thank Robert Pergament for his helpful comments

By Michael Pollaro

http://trueslant.com/michaelpollaro/

Email: jmpollaro@optonline.net

I am a retired Investment Banking professional, most recently Chief Operating Officer for the bank's Cash Equity Trading Division. I am a passionate free market economist in the Austrian School tradition, a great admirer of the US founding fathers Thomas Jefferson and James Madison and a private investor.

Copyright © 2010 Michael Pollaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pollaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.