Financial Markets and Economic Crisis Outlook 2010, When Hope Turns to Fear!

Economics / Financial Markets 2010 Jan 15, 2010 - 01:41 AM GMTBy: Ty_Andros

I wish to send you my very best wishes for a Happy New Year.

I wish to send you my very best wishes for a Happy New Year.

WE WILL BEGIN THIS MULTI-PART OUTLOOK WITH A GENERAL OVERVIEW, THEN OVER THE FOLLOWING WEEKS TOUCH ON A VARIETY OF CONVENTIONAL AND UNCONVENTIONAL ANALYSES, SPANNING THE MARKETS IN GENERAL, SUCH AS STOCKS, COMMODITIES, CURRENCIES, INTEREST RATES, BOMB....ER, BOND MARKETS AND TAKE FUNDAMENTAL LOOKS AT THE DIFFERENT REGIONS, BANKING SYSTEMS ETC.

IF YOU HAVE NOT READ THE LAST TWO TEDBITS YOU NEED TO AS THEY COVER THE UNFOLDING HUMAN BEHAVIOR AND SOCIAL TRENDS DRIVING THE DEVELOPED AND EMERGING WORLDS IN OPPOSITE DIRECTIONS AND WILL BE REFERRED TO MANY TIMES OVER THE NEXT SEVERAL WEEKS, THEY ARE CRITICAL COMPONENTS OF UNDERSTANDING THE UNFOLDING CRISIS (find them in our archives: www.traderview.com/tedbits_newsletter.cfm

Hope is not an investment strategy and it certainly is not a good guide to selecting LEADERS.

To the something-for-nothing personality, hope is like the high from dope, fed by main stream media to the functionally literate (those who can read and write) and the practically illiterate (those who are told what to think rather than taught how to think.)

The world is falling into what ultimately will be an inflationary depression. This will cause the death or near death of the world's principle reserve currencies: US Dollar, UK Pounds, Euros, Swiss Francs and Yen, and it is unfolding. Insolvency, both moral and fiscal is unfolding: debt spirals on many levels of the developed world will be resolved ultimately with the printing press, this year, next year and until the rest of the world abandons the current FIAT paper and the ultimate Crack-Up Booms unfold. Opportunities abound for the prepared investor, and in fact they are BIGGER than EVER.

When the broad masses who have bought the hope realize it is a lie, and their hope turns to fear, this QE-induced high will turn into a blind panic as the G7's safety nets FAIL; many markets will crash and others will soar and the most helpless will turn into angry mobs as they have no skills and their economies no longer produce blue collar jobs that create the middle classes - those jobs have been driven offshore by public serpents, crony capitalists, trade unions and banksters.

There are three quotes from some of the greatest economists in history which summarize the G7 global economy, currency and financial systems and the societies in which they reside. Two by Ludwig Von Mises and one by John Maynard Keynes and they are:

1. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved. --Ludwig von Mises

Author's comment: G7 Central banks and governments are fully committed to restoring the expansion!!! Debt is exploding higher in government as income and revenue are in FREEFALL. It's no coincidence that the fed and UK central bank asset purchases are larger than the budget deficits. The Fed is purchasing toxic assets, MBS and agency debt and central banks are recycling the money back into another TOXIC asset: US treasuries.

Why you ask? Its because the dollar as the world's reserve currency is the FOUNDATION of the world monetary systems and is the one currency in the world where both the shorts and longs don't want it to change in value: the people storing wealth in it don't want it to go down and those printing it like toilet paper want to exchange it - basically, exchange nothing (fiat currency backed by nothing) for something (goods, services, etc.).

2. Ludwig von Mises describes the "Crack-up Boom" that marks the denouement of all great monetary inflations:

"This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

"But then, finally, the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The Crack Up Boom appears. Everybody is anxious to swap their money against "real" goods, whether he needs them or not, no matter how much money he has to pay for them. Within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.... If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last."

This is a perfect description of what is unfolding today, people are building up their cash and new mini-bubbles are appearing globally as people exchange fire hoses of hot money for tangibles and assets; and a CRACK-UP BOOM looms, as we can see in asset prices around the world -- other than the fatally-inflated MALINVESTMENTS such as real estate.

3. "By a continuous process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million can diagnose." - John Maynard Keynes, 1920

Look no further than this illustration of the loss of purchasing power by misstated inflation courtesy of John Williams of www.shadowstats.com:

Wow, the dollar has lost 80% of its purchasing power since the printing press was unharnessed at Bretton Woods II in 1971. This is the government and banksters stealing the value out of people's money, as well as deficit spending and OUT-OF-CONTROL fractional banking without SAVINGS to back them. Counterfeiting/printing money out of THIN AIR! This is the cause of the "something-for-nothing" personality.

The FINAL move from sound money to fiat currency in 1971, when Nixon closed the gold window, set the G7 on the path to where we find ourselves today: On a one-way elevator DOWN since 1971. The middle classes have been CONSUMED by the Banksters and by public serpent debasement of their incomes and that in which they store their wealth - their cash. The middle class in America is just about gone, robbed of their pay and savings by the people in whom they have placed their trust: The government.

Investors will be crushed if not properly prepared; however, If properly prepared this is the greatest opportunity in history. VOLATILITY is set to soar "Up and down" as people scramble to price in and discover the REAL PURCHASING POWER of the Oceans of FAKE money which has been created in the last year. You must learn to fix your paper currencies and then find alternative investments which have the potential to thrive in UP and DOWN markets. This is what I do, contact me if you wish (www.traderview.com/portfolio_analysis_analysis.cfm).

Economies and markets afloat on a sea of trillions of Dollars, Euros, Swiss Francs, Yen and British Pounds in which price discovery is occurring right now! But one thing we do know it is, and that is LESS:

"Currencies don't float, they just SINK at different rates" - Clyde Harrison

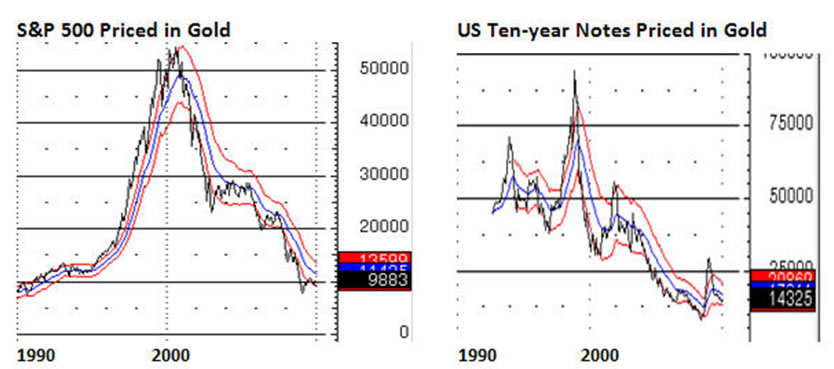

At no time in my career have so many asset classes been this mispriced. Stocks and bonds are in the ether of overvaluations, and gold and silver are massively undervalued, to name but a few. As bubbles can be seen forming around the globe in selected asset classes. We are in a period which, when completed, will have seen the greatest transfer of wealth from those who hold their wealth in paper to those that don't.

An oscillation of inflation and deflation between asset classes is to be expected. Deflation in mal-investments created over the last five decades (stocks, bonds, real estate, ethanol and now green energy, paper investments etc.) and mispriced because of always cheaper credit (easy money forever), and inflation in asset classes (production of commodities, natural resources, oil and natural gas exploration and production, nuclear power and electrical generation, infrastructure, etc.) which were neglected during this period when capital should have been directed at them and wasn't.

The fingerprints of a Crack-up Boom can be seen GLOBALLY across many asset classes. As hot buckets of money RACE around the world seeking shelter from both the powerful central bank printing presses and the poor policies of the G7 public serpents, elites, crony capitalists and trade unions as they search for a place where capital can be preserved and thrive. All the while, these same predators use the unfolding crisis to take bigger slices of the shrinking G7 economic pies.

The wealth of the world has rotated (G7 are now major debtors and the emerging world economies are their creditors), and political power is doing so, as well, as can be seen by the G7 losing leadership and the G20 taking power. The welfare states of the developed world cannot avoid the final debacle (there is only a small constituency supporting the hard choices required to POSTPONE the unfolding debacle, they are also known as the people that work for a living rather than vote for one), and the emerging world is rising on the wings of Austrian Economics -- the same formula the US used to rise to prominence.

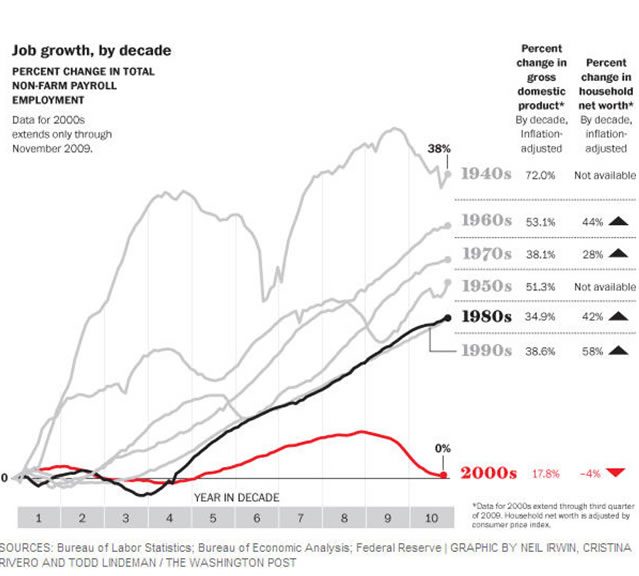

Nominally, after adjusting for consumer price inflation, there has been NO REAL GROWTH in stocks, income, bonds, employment or household net worth in over a decade (this GOVERNMENT measure understates true inflation by 1 to 4 % annually, sometimes more, see www.shadowstats.com.) In fact, it has been a DECADE-LONG debacle of inflation and theft of purchasing power by government and the banksters:

All the rallies in stocks and gains in bonds DISSAPPEAR!

If you are in BUY and HOLD stocks and bonds you have LOST ¾ of your net worth since 2000, measured in purchasing power. BUY AND HOLD is dead until the printing press and RUNAWAY debt issuance is brought under control, so don't hold your breath. Look at this recent chart of household net worth and employment going back a decade (from the Washington Post):

Now think about it adjusted for purchasing power in gold as I did above for stocks and bonds. Ouch, it's another debacle from the banksters and Capitol Hill. That loss of purchasing power was a result of central bank printing presses and deficit spending, which are spiraling out of control in a manner NEVER SEEN BEFORE! The exception would be those previous to a currency extinction event, of which this is one!

The G7 economies, stock and bond markets are in WEAK, statistically-driven, cyclical bull markets and counter-trend rallies in an unfolding secular bear market. Most of the growth is government MISSTATEMENT of economic statistics, inventory adjustments and nominal, as opposed to real, growth. The 2009 rally in the S&P 500 is an illusion; the index was up about 23% and the loss in purchasing power as measured in gold was? 23% So, in real terms YOU MADE NOTHING. The rally in the S&P was actually reflecting a 23% loss in purchasing power of the currency in which the index was priced: US DOLLARS. It was repricing higher to reflect the lower purchasing power of the currency. OUCH....

The G7 economies will peak sometime in the next year and resume their descent ultimately into a hyperinflationary depression. Afloat on a sea of almost 12 trillion Dollars, Euros, Pounds, Yen, Swiss Francs, etc. which have been printed out of thin air -- also known as Quantitative Easing (to fool the public who don't understand that this term means money printing and whose money is being stolen while it sits in the bank,) or borrowed from unsuspecting future victims (foreign central banks, institutions, private investors, etc.) of the coming money printing debacle as "political correctness" defines most G7 government borrowing as risk free.

"When a well-packaged web of lies has been sold gradually to the masses over generations, the truth will seem utterly preposterous and its speaker a raving lunatic." - Donald James

Words of wisdom.

"The danger to America is not Barack Obama but a citizenry capable of entrusting a man like him with the presidency. It will be easier to limit and undo the follies of an Obama presidency than to restore the necessary common sense and good judgment to a depraved electorate willing to have such a man for their president. The problem is much deeper and far more serious than Mr. Obama, who is a mere symptom of what ails us. Blaming the prince of the fools should not blind anyone to the vast confederacy of fools that made him their prince. The republic can survive a Barack Obama, who is, after all, merely a fool. It is less likely to survive a multitude of fools such as those who made him their president." -- Author Unknown

I call this fool the something-for-nothing personality (see Tedbits Archives www.traderview.com/tedbits_newsletter.cfm). That is precisely where we are now: Total absurdity regarded as common sense. Our leaders are a reflection of the general public, trapped in a matrix of illusions and lies and unable to see reality. The G7 economic demise IS NOT a failure of CAPITALISM, it is a failure of 50 plus years of creeping SOCIALISM masquerading as capitalism and of the G7 schools who fail to teach the differences between them; to do so would bring about the demise of those in power at the hands of the public.

"Capitalism should not be condemned, since we haven't had capitalism." - Ron Paul

Capitalism is where a entrepreneur or small businessman identifies something that a broad group of people want to BUY, and delivers more of the desired goods or services for less money, thus gathering market share and killing the previous provider who failed to do so. This is called creative destruction and is the enemy of crony capitalists, big unions and the public serpents who SELL legislation to the dinosaurs and then legislate and mandate their success. It is a natural disinflation which is great unless it is short-circuited by public-sector predators and their special-interest supporters.

Capitalism has nothing to do with ponzi finance; ponzi finance is a function of fiat currency and credit financial systems where the government creates, prints and lends funds out of thin air, where the INSIDERS get the printed money/credit first, and then inflate asset values to create the illusion of growth. Look at today's 0% interest rates; banksters and connected organizations get the money virtually free (from the FED and their DEPOSITORS) and lend it to the public at 5 to 30% rates, or to the government. Capitalism was in effect before fiat currencies and will function after this version of them fall to their EXTINCTION.

G7 economies are now defined as CENTRALLY planned, socialist corporatism, where central banks, elites, crony capitalists, public serpents and banksters conspire and legislate their way to riches and success at the expense of the publics they claim to serve. The public and small/medium size businesses are the prey to be bought and sold, their interests ignored by the PUBLIC SERPENTS who sell them to the aforementioned group of PREDATORS. Europe has suffered from this for decades, and it has crept into the US, but now it is unbridled as Chicago-trained politicians sell EVERYTHING in exchange for government FAVORS, now and in the future.

It is no different in healthcare, the military industrial complex, green energy or what have you. Isn't it interesting to see Bill Clinton and Al Gore now each worth over $100 million dollars since the end of their terms, when before being elected they were worth just a few million? Can you say "quid pro quo?"

It is no different in healthcare, the military industrial complex, green energy or what have you. Isn't it interesting to see Bill Clinton and Al Gore now each worth over $100 million dollars since the end of their terms, when before being elected they were worth just a few million? Can you say "quid pro quo?"

"We haven't had true capitalism since 1913. We live in a corporate fascist state dominated by the military industrial complex, the financial banking complex and now the healthcare industry complex. It is fascinating that the health industry has spent $396 million in 2009 on lobbying and the financial industry $334 million while Congressmen debate the future of both industries. These industries surprisingly have received a windfall in the legislation that has been put forth by Congress. The system is so corrupt and rotting from within that elections will never result in necessary reform. Corporations are spending $3 billion per year to bribe (lobby) your elected officials. Whose interest do you think Congress is looking out for?"-- Richard Lamm, www.theburningplatform.com

Not yours, that's for sure. Just look at recent bank bailouts and stimulus packages. They have not one single line that is targeted at the private sector. According to www.recovery.gov (the official tracking site), the federal government has SPENT over $400,000 for every job created and sponsored, and many will have created NO LONG TERM employment. Take a look at this list of projects assembled by Senator Tom Colburn (www.traderview.com/tedbits/StimulusCheckup-Dec09.pdf ); this is really obscene reading for anyone who has respect for the value of the dollar. Now look at the recent comments of Michael Barone on the contrasts between PUBLIC and PRIVATE sectors:

"Recent Rasmussen poll that shows that 46 percent of government employees say the economy is getting better, while just 31 percent say it's getting worse. In contrast, 32 percent of those with private-sector jobs say the economy is getting better, while 49 percent say it is getting worse.

Nearly half, 44 percent, of government employees rate their personal finances as good or excellent. Only 33 percent of private-sector employees do.

It sounds like public- and private-sector employees are looking at different Americas. And they are.

Private-sector employment peaked at 115.8 million in December 2007, when the recession officially began. It was down to 108.5 million last November. That's a 6 percent decline.

Public-sector employment peaked at 22.6 million in August 2008. It fell a bit in 2009, then rebounded back to 22.5 million in November. That's less than a 1 percent decline.

This is not an accident -- it is the result of deliberate public policy. About one-third of the $787 million stimulus package passed in February 2009 was directed at state and local governments, which have been facing declining revenues and are, mostly, required to balance their budgets.

The policy aim, say Democrats, was to maintain public services and aid. The political aim, although Democrats don't say so, was to maintain public-sector jobs -- and the flow of union dues to the public-employee unions that represent almost 40 percent of public-sector workers.

Those unions in turn have contributed generously to Democrats. Service Employees International Union head Andy Stern, the most frequent non-government visitor to the Obama White House, has boasted that his union steered $60 million to Democrats in the 2008 cycle. The total union contribution to Democrats has been estimated at $400 million. In effect, some significant portion of the stimulus package can be regarded as taxpayer funding of the Democratic Party. Needless to say, no Republicans need apply.

One must concede that there is something to the argument that maintaining government spending levels helps people in need and provides essential public services. Something, but not everything."

And from The Privateer (www.the-privateer.com):

"After the "health care plan" comes what is now being called the "Jobs for Main Street" act, a bill which through the house in a 217-212 vote (Tedbits note: party line vote )in December. The republicans have lost no time in dubbing the bill "Stimulus Two".It is a $US 154 Billion dollar package, half of which is aimed at extending "lifeline programs" for the poor and unemployed until the end of June this year. The other half of the bill is pure job creation, most being aimed at retaining "public employees" on the job. "Jobs on Main Street?"

NO. Just as the original stimulus bill was a government support and expansion act, as reported by yours truly, so is this one! Main Street be damned, as anyone knows this is the ultimate result of SOCIALISM, and it equals MISERY SPREAD WIDELY. Stimulus is only for their cronies!

Public and UNION employees are paid an estimated 150% of the private sector, and their pensions equally generous. Of course public employees don't have a requirement that they produce more then they consume, and you can say the same for unions whose employers are dropping like flies under the uncompetitive labor rates that are MANDATED and protected by government laws and regulations. Cost benefit analysis has gone the way of the extinct DO DO bird, the assumption being that government and its solutions are worth any price and never to be questioned; so the MAIN STREAM media and the something-for-nothing personality don't.

The construction projects are MANDATED to overpaid union companies, job support for state and municipal employees (UNION), credit guarantees for the biggest banks and crony capitalists such as GE, AIG, Fannie Mae and Freddie Mac, General Motors, Chrysler (transferred from public ownership and secured bondholders) to the Government and Unions, GMAC (nationalized last week: government owns 50% plus). The 19 banks which are now TOO BIG TO FAIL (now GSE's, or government sponsored enterprises) enjoy record profits. Once inside the government safety net, the risks are sent to the public at large and the profits to the elites who DONATED (couldn't use the real word: BR**ED) to the public serpents. MORAL HAZARD WRIT LARGE.

"It is well enough that the people of the nation do not understand our banking and monetary system for, if they did, I believe there would be a revolution before tomorrow morning." - Henry Ford

NO ONE knows what money is, but before this crisis is over they WILL.

MONEY is a mystery to those even at the top of society, finance and business. Most are never taught this, and if the broad public was to understand what has been done to them it would cause RIOTING in the streets. CREDIT IS NOT MONEY!

Money has five functions and if what you store your wealth in does not function in this manner you AREN'T holding money. Those functions are:

- Medium of exchange

- Store of value

- Standard of value

- Measure of value

- Moves purchasing power through time and space

An example of real versus fake money is a one dollar bill versus a silver dollar:

In 1960, dollars were backed and redeemable in silver (US CITIZENS) or gold (Foreign central banks which used them as reserves). In 1960 you could exchange the paper dollar or silver dollar for 5 gallons of gas. Today the silver dollar STILL buys 5 gallons of gas and the paper dollar buys less the ½ gallon. One is real money and the other is an illusion and only as good as the promises of the issuing government.

In today's world what masquerades as money is only a medium of exchange and an IOU. Whoever holds them has FAITH that it will be repaid; in other words, faith that the government which issues them will not print them to INFINITY. The only thing backing a fiat currency is the PRIVATE property of the citizens of the country which issued them, as it can be exchanged for either goods and services in the issuing country or, in the case of the DOLLAR, global finance and trade which have been conducted in dollars since Bretton woods mandated it as the world RESERVE currency in the mid 1940's. Tens of trillions of these IOU's, aka G7 currencies, are held by people around the world. If they ever decide to REPATRIATE them or think they will be printed infinitely, and someday they will, the CRACK-UP BOOM will commence.

This unfolding depression is the failure of FAKE, unsound IOU's (credit is not money) masquerading as sound money and of PONZI finance imploding upon itself as much of the debt has been used for CONSUMPTION, rather than used for investments which pay for themselves because they produce more than they consume. Consequently, more and more productive capacity goes to pay previous borrowing rather than investment in the future. The G7 has eaten its seed corn and spent future seed corn for generations and now the future is BLEAK.

The G7 has entered the final stages of their empires and their financial and monetary systems face their demise as all credit-based fiat currency systems have done before them. They always collapse into insolvency, without exception.

It is the battle of TITANS. The most powerful central bankers, public servants, banksters, elites and crony capitalists in the world versus Mother Nature and DARWIN in a battle to see what truth and fiction are.

Unfortunately for the former, Mother Nature is extremely hard to find and impossible to KILL, and Darwin identified Nature's order in the world. Compete or die, produce more than you consume; these are ideas which the something-for-nothing, G7 welfare states have forgotten and lost the ability to do. Like King Canute they CANNOT stop the tides from rolling over them and washing them into moral and fiscal bankruptcy throughout the developed world (see Tedbits: Something for Nothing special edition released December 23, 2009 at www.traderview.com/tedbits/tedbits-SomethingForNothing.pdf).

Incomes in the G7 are collapsing because they no longer produce more than they consume, and so wealth is manufactured through MISTATED inflation, credit creation and the printing press. This is the definition of redistribution of wealth, and misery spread widely. In the G7 they don't create middle classes, they consume them by FAILING to provide the policies necessary for the creation of wealth and rising middle classes.

Take a look at this essay from the BOND KING Bill Gross of PIMCO:

(www.pimco.com/LeftNav/Featured+Market+Commentary/IO/2009/Midnight+Candles+Gross+November.htm) as he outlines the fork in the road that was taken shortly after Breton Woods II in 1971. When public servants and BANKSTERS morally and fiscally tore the final underpinnings of sound money and redeemability in GOLD, from the world's RESERVE currency; thus, allowing them to STEAL the purchasing power of people's money while it NOMINALLY sits in the bank. If you read between the lines you see that he is talking about his own demise, as the assets he talks about are the same as those he manages.

In the emerging world they are doing the opposite, providing the conditions necessary for huge emerging middle classes which will dwarf their competitors in the west in short order.

Just as trillions have been printed or borrowed to this point, trillions will be printed and borrowed in the future. Anything you hear from ANY G7 central bank or public serpent is HOT AIR; the quantitative easing can never end, because they have RUN OUT of lenders, except for "Indirect Bidders," aka central banks, defending their reserves and reinvesting currency sterilization from intervention to stop their currencies from rising against the dollar (competitive currency devaluation raceway.)

The G7 governments are in DEBT spirals, which are when new deficits exceed GDP growth by considerable amounts and government spending and payments on previous borrowings can only be met by printing money out of thin air, because revenues are unable to meet current and future obligations.

Of course, these are government projections so the reality will be MUCH WORSE. The IMF estimates OECD budget deficits to average over 8.5% of GDP. Just this week it was disclosed that US public sector pension funds are $2 Trillion underfunded. You can just add that to the $70 + trillion of obligations ALREADY held off the books. As I outlined in the last Tedbits (Dec 31, 2009,) the treasury uncapped the losses that Fannie Mae and Freddie Mac can incur, in a fabulous article By Dr. John Hussman of the Hussman Funds entitled "Tim Geithner meets Vladimir Lenin" of how criminality and the people working without regard to the constitution loose in the beltway is fully explored (http://www.hussmanfunds.com/wmc/wmc100104.htm.)

Of course, these are government projections so the reality will be MUCH WORSE. The IMF estimates OECD budget deficits to average over 8.5% of GDP. Just this week it was disclosed that US public sector pension funds are $2 Trillion underfunded. You can just add that to the $70 + trillion of obligations ALREADY held off the books. As I outlined in the last Tedbits (Dec 31, 2009,) the treasury uncapped the losses that Fannie Mae and Freddie Mac can incur, in a fabulous article By Dr. John Hussman of the Hussman Funds entitled "Tim Geithner meets Vladimir Lenin" of how criminality and the people working without regard to the constitution loose in the beltway is fully explored (http://www.hussmanfunds.com/wmc/wmc100104.htm.)

A lot of words have been spoken about the budget deficits and the debt-to-GDP ratios of the PIIG's: Portugal, Italy, Ireland and Greece, but If you take off the rose-colored glasses, the core of the G7: the US, the UK and Japan, are FAR WORSE.

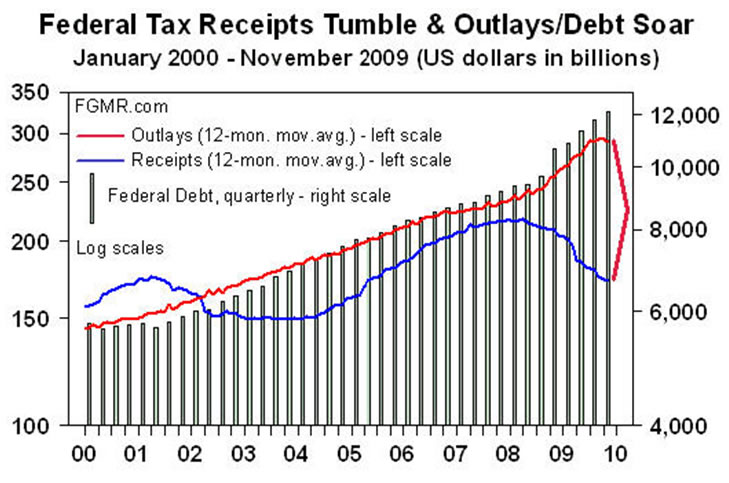

Take a look at this chart showing revenues versus expenditures going back to 2000:

The gap we see between income and expenditures is echoed THROUGHOUT the G7, and if you include the states and municipalities the budget deficits are over $2 trillion in the US. If you did the accounting according to GAAP (generally accepted account principles), rather than POLITICALLY correct methods, the US budget deficit BALLOONS to almost $9 TRILLION, as this illustration from John Williams of www.shadowstats.com illustrates:

If you think this is isolated to the US think again, Nadeem Walayat of www.Marketoracle.co.uk has done fabulous work on the similar situation in the UK and you can reference it here: http://www.marketoracle.co.uk/Article7526.html. It plainly illustrates the catastrophic drop in the real value of sterling, and the current 500% debt-to-GDP ratio, while illustrating the straight line of inflation that has been BARELY interrupted by the global financial crisis.

As Bill Buckner of www.the-privateer.com said in his November missive (I urge you to subscribe, its fabulous global macro):

"For 50 years, not one Dollar of new debt created by the US government to fund activities it does not wish to tax for has been repaid. The debt has been "re-financed" with new debt being sold to retire the existing debt."

Recall the words of Treasury Secretary Timothy Geithn@r in September when he said the debt ceiling must be raised so America's bondholders can rest assured that they will be repaid. This was a public acknowledgement that America must borrow more to repay previous obligations as income and revenue are unable to. I was shocked when he said this aloud, publically, as it underscored the complete MORAL and FISCAL bankruptcy of the US. In December when a short term increase in the debt ceiling was passed, the US was within THREE days of default, when they passed it on New Years Eve they had to RUSH a treasury auction into the last week of 2009.

The G7 financial and banking systems, as well as governments on all levels (national, state and municipal) are mostly INSOLVENT, also known as BANKRUPT, and the only thing preventing the crash is the widespread belief that the respective G7 governments will not allow them to fail. That is a grand illusion.

Think of the United States, in the beginning of 2009 there were only a few GSE's (government sponsored enterprises) such as Fannie Mae, Freddie Mac, Ginny mae, Federal Housing administration and AIG Insurance. Now there are dozens of them as all the 19 big banks now operate under quasi-government guarantees, and those banks are now making most of their money from trading activities rather than traditional banking. Not to mention Government.....er, General Motors, Chrysler, GMAC (just recently the government's stake rose to over 50%) which are ALL POLITICALLY CONNECTED or OWNED and SINKING INTO DEEPER INSOLVENCY daily AND GUARANTEED BY THE FEDERAL GOVERNMENT (the public). The one saving grace for these people is, as Helicopter Ben says:

"The U.S. government has a technology called a printing press, which allows it to produce as many U.S. dollars as it wishes at essentially no cost." - Benjamin S. Bernanke Chairman, U.S. Federal Reserve

The toxic assets that were to be taken care of with tarp (Troubled Asset Relief Program) still reside on their balance sheets due to REGULATORY forbearance. In other words, they leaned on the accounting boards to let them carry the assets at full value rather than marked to market, and trillions of dollars in losses are yet to be realized. The Federal Reserve has lowered interest rates to almost ZERO to allow them to rebuild their balance sheets and absorb the losses, but rather than doing so they are paying themselves big bonuses. The biggest banks in the world have to roll over $7 trillion of borrowing in the next two years.

Ben Bernanke made a trip to the mountaintop, aka the WHITEHOUSE, just as Greenspan did when he sought reappointment as head of the Federal Reserve under Clinton. I promise you he made the commitments necessary (MONEY PRINTING) to extend his term, if he didn't, Larry Summers would now be in line for the job. Hi ho, hi ho, off to the printing press we will go....

In conclusion: ONE QUESTION, what is the only thing standing between sovereign bankruptcy and solvency in 2010? The printing press.Why do we know they will print the money? BERNANKE'S reappointment, and the simple fact that if someone points a gun at your head you are going to duck rather than take the bullet. Public serpents, central bankers, banksters, elites and crony capitalists have a printing press at their disposal and they will duck, just as you would, and they will use it and let YOU, the public and main street, take the bullets just as they have since 1971. Quantitative Easing (money printing) in one form or another can NEVER end! The G7 economies will collapse if they do.

They WILL TRY to DEBASE the G7 currencies, economies and outstanding liabilities until their debts have been inflated away. They will be able to do so until the public, bondholders and creditors WAKE UP and TRY to EXIT by exchanging their holdings for real things. at which point the Crack-up Booms appear. Once this rally in RISKY assets ends the next leg down will commence.

State's revenues are off, on average 11-12%, sales taxes are off 9% (that is hard to understand as retail sales are supposedly climbing!) and income taxes are off 12%. How can the economy be growing with these numbers? When government borrowing and spending are counted in the Gross Domestic Product, that is how.

They can never allow interest rates to climb to neutral; negative interest rates are here to stay. But this has been the case for DECADES, and has been why every time the fed raised rates over the last three decades. The level at which the economy faltered was always lower than the previous peak in interest rates, and every low was lower than the previous lows. Malinvestments are failing at ever-lower levels of interest rates because, in order to right the economy, easy money and leverage are always increased during every slowdown.

Unadjusted for seasonality and labor force participation, unemployment is still RISING at up to 600,000 a month.

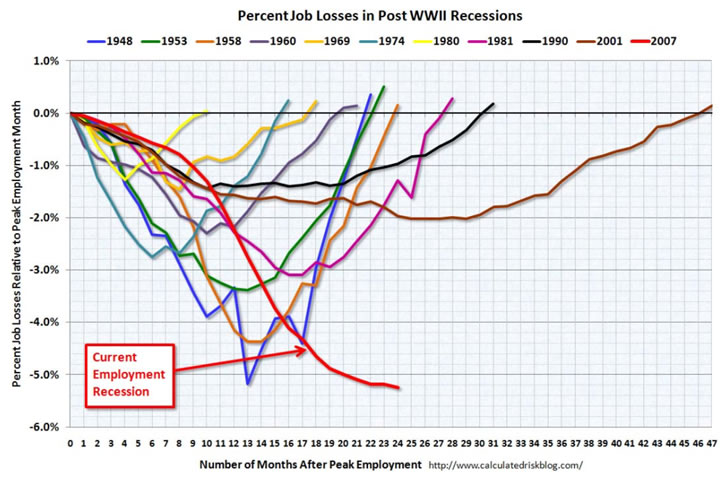

Take a look at this chart of comparisons of unemployment in past recessions and where we are now:

Until employment and REAL incomes rise the depression will not even begin to end. The government statisticians and main stream media are MANUFACTURING GOOD NEWS to fool their something-for-nothing constituents and MAIN STREET and provide COVER for their ONGOING FAILURES in restoring the economy. Subtract government borrowing and spending and GDP fell last year at least 10%. This year will be NO BETTER. Eight out of ten dollars of government spending is wasted (it's a rat hole and you know who the rats are); don't you think that that the money being borrowed or printed would be safer and better invested in the PRIVATE sector?

At no point in my career has the future held so many potholes or opportunities depending on how you approach this unfolding depression. You must learn how to fix your paper currencies to preserve the purchasing power and find investments that have the potential to thrive in up and down markets, because they will be doing plenty of BOTH. This is what I do. Contact me if you wish (www.traderview.com/portfolio_analysis_analysis.cfm)

In Part II of this 2010 Outlook we will be covering BANKS, currencies, interest rates and bonds in the as they are the epicenter of the unfolding maelstrom. PAPER is poison, as you will learn. When they fall the final debacle will be at hand for the powers that be and their something-for-nothing constituents. Don't miss it.

I will be appearing at the Freedom Fest World Economic Summit on January 31 through Feb. 2, 2010 at Atlantis Paradise Island Resort, Bahamas (www.freedomfest.com/wes/ ).

I urge you to attend as I will be doing two break-out sessions on the unfolding economics of the global financial crisis and how to assemble investments to meet its challenges

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2010 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.