Small Business Trends Suggest No Economic Recovery On Horizon

Economics / Recession 2008 - 2010 Jan 14, 2010 - 12:07 PM GMTBy: Mike_Shedlock

The National Federation of Independent Business (NFIB) Small Business Economic Trends for January 2010 is filled with 23 pages of graphs and text that suggest there is no recovery on the horizon.

The National Federation of Independent Business (NFIB) Small Business Economic Trends for January 2010 is filled with 23 pages of graphs and text that suggest there is no recovery on the horizon.

Let's take a look at a summary and some of the graphs. Charts and text with permission of and copyright of the NFIB Research Foundation. Highlights in red are mine.

OPTIMISM INDEX

It has been a very difficult year and 2009 did not end on an uplifting note. The Index of Small Business Optimism lost 0.3 points, falling to 88.0 (1986=100), 7.0 points higher than the survey’s second lowest reading reached in March 2009 (the lowest reading was 80.1 in 1980). But optimism has clearly stalled in spite of the improvements in the economy since the first quarter of 2009.

LABOR MARKETS

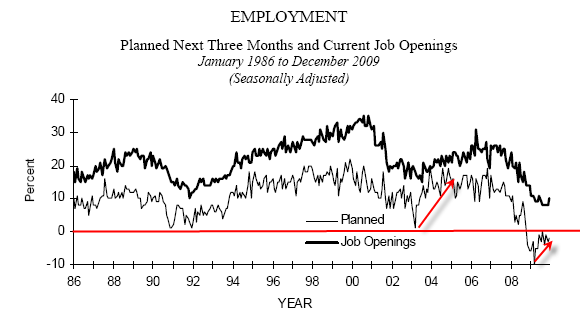

The “job generating machine” remains in reverse, jobs are being lost and new hiring is very weak. Ten percent of the owners increased employment, but 22 percent reduced employment (seasonally adjusted). While the trend for increased employment is going in the right direction, there is no indication that job growth will be strong enough to dramatically reduce the unemployment rate. Ten percent (seasonally adjusted) reported unfilled job openings, up two points from November, a good sign. Over the next three months, 15 percent plan to reduce employment (down two points), and eight percent plan to create new jobs (up one point), yielding a seasonally adjusted net negative two percent of owners planning to create new jobs, a one point improvement from November.

CAPITAL SPENDING

The frequency of reported capital outlays over the past six months was unchanged at 44 percent of all firms, holding at a record low level (data first collected in 1979). Capital spending is on the sidelines. Spending on capital projects remained at historic low levels, as did the demand for credit to finance such projects.

INFLATION

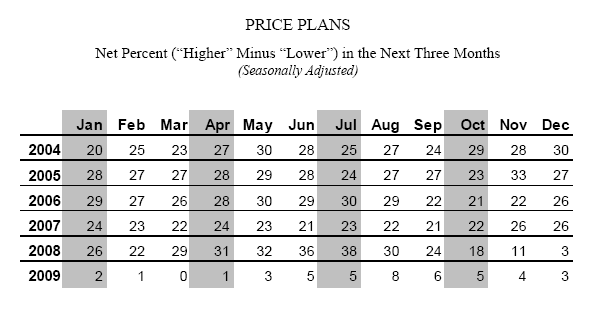

The weak economy continued to put downward pressure on prices. Ten percent of the owners reported raising average selling prices, but 33 percent reported price reductions. Widespread price cutting contributed to the reports of lower nominal sales. Plans to raise prices fell one point to a net seasonally adjusted three percent of owners, 35 points below the July 2008 reading. On the cost or input side, the percent of owners citing inflation as their number one problem (e.g. costs coming in the “back door” of the business) fell two points to two percent and only three percent cited the cost of labor, so neither labor costs nor materials costs are pressuring owners.

PROFITS AND WAGES

Reports of positive profit trends were unchanged at a net negative 43 percentage points. The persistence of this imbalance is bad news for the small business community.

CREDIT MARKETS

Regular borrowers (accessing capital markets at least once a quarter) continued to report difficulties in arranging credit at the highest frequency since 1983. A net 15 percent reported loans harder to get than in their last attempt, unchanged from November. Still that is not nearly as severe as the financial distress reported in the pre-1983 period. Twenty-four months of recession have sapped the financial strength of many small firms.

COMMENTARY

For small business owners, 2009 ended with a thud. The Optimism Index fell and finished just seven points ahead of March which was the second lowest reading in 35 years of survey history, even though the economy posted positive growth in the second half of the year.

Interest rates are at historically low levels, inflation virtually non-existent and real hourly earnings have held up well. ...

So why hasn’t owner optimism soared like it usually does at the end of a recession, especially one that cut so deeply into our economic fabric? The answer is “hope and change.” There is little hope and the change that is being delivered is far from encouraging.

Washington is offering nothing but higher taxes and fines and fees and more regulation. Congress is passing bills with thousands of pages of hidden bombs that will go off as the legislation is passed and implemented. Federal spending has soared amazingly, yet been ineffective except at pushing the federal deficit to incomprehensible heights, promising to double our national debt in just a few years. The interest burden this will place on average Americans is astounding. Uncertainty is the enemy of economic growth and investment, and Washington, D.C., the usual source of uncertainty, is delivering plenty of it. Confidence in our political leadership has tanked. ....

Now for some charts.

Commentary on the charts and annotations on the charts in red are mine.

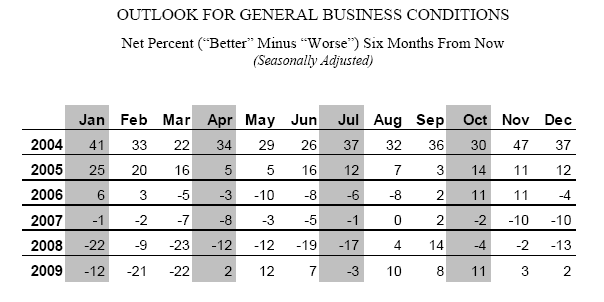

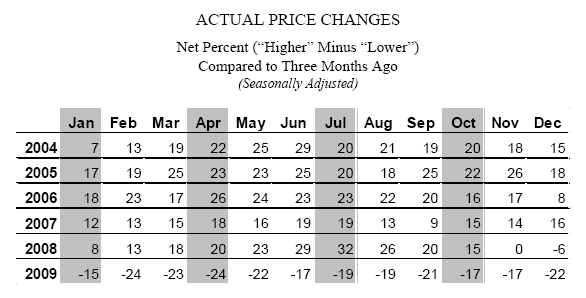

Compare 2009 with 2004. Also note how the persistent, dramatic weakness in 2006 and 2007 signaled the coming recession. Compare and contrast to A Look at ECRI's Recession Predicting Track Record.

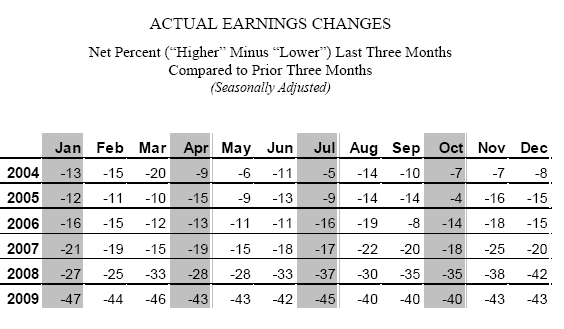

Even in the last recovery small business earnings did not recover. Looking for a reason for a jobless recovery? There you go. And if the last recovery was jobless what does this one look like? Remember that 2009-2009 was the first job loss decade ever.

Does that graph give small businesses any reason to expand? Indeed not. And tack on uncertainty and business unfriendly legislation from the Obama Administration and there is little hope for change.

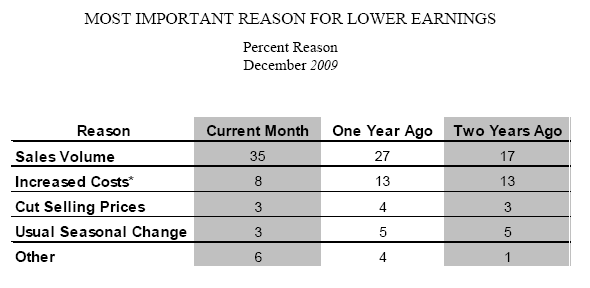

Consumers have thrown in the towel. There is no reason to believe they are about to go on a spending spree. Indeed there is every reason to believe they wont, starting with boomer demographics, secular attitude changes towards frugality and saving, and the high unemployment rate.

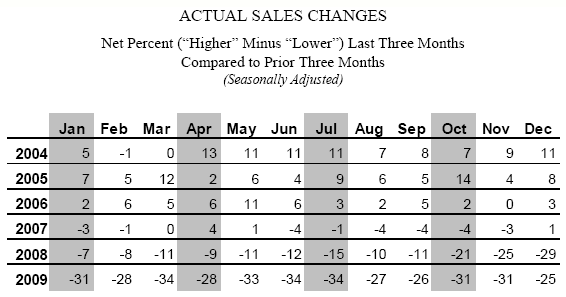

Once again note how trends in small business sales were a nice leading indicator for the recession starting late 2007. Sales are still miserable.

Inflation? Where?

Inflating expectations? Where?

Pricing power? Where?

Increasing Profitability? Where?

Notice the sharp rebound in employment and hiring in 2003. Planned hiring in 2010 while upsloping is still negative.

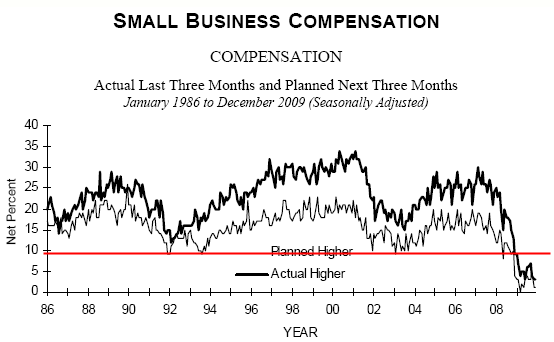

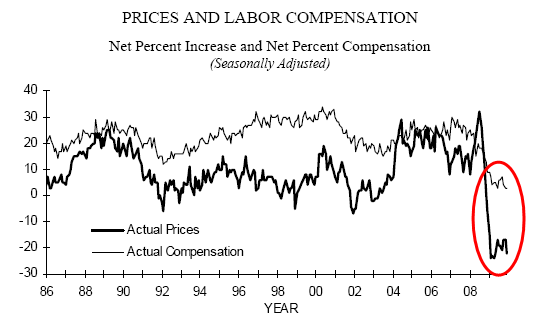

This trend is unprecedented. Never before have compensation plans been so low for so long. The following chart will help explain.

Wage pressures are enormous. Looking at the chart it is a wonder aggregate wages are not dropping.

There are 23 pages of charts saying the same thing.

- Wages are low

- Prices are low

- Pricing power is nonexistent

- Optimism is low

- Inflation is not a problem

If someone is looking for leading economic indicators, many of those charts quality.

In spite of what people think about the stock market, it is not a leading indicator of anything but investor optimism. Investor optimism can rise for many reasons including businesses slashing expenses, or Congress throwing money around.

Small businesses are the economic driver. However, big businesses get the peanuts, small businesses get the shells, and taxpayers get the shaft.

Small business conditions are as bad as they have ever been in terms of taxes, fees, regulation, and uncertainty over what inane thing Congress will do next. Such conditions do not lay the groundwork for any recovery, let alone a sustainable one.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Small business planning

13 Apr 10, 06:08 |

Small Business Trends

An excellent presentation. Clear. Practical. Insightful. Shows a depth of experience. Thank you. I learned a great deal. |