How to Buy Gold in 2010

Commodities / Gold and Silver 2010 Jan 11, 2010 - 04:02 PM GMTBy: Larry_Edelson

In just the first few trading days of the new year, gold has skyrocketed almost $35 … building up momentum for a new surge … and likely pointing the way to a far more powerful rally to new all-time highs later in 2010.

In just the first few trading days of the new year, gold has skyrocketed almost $35 … building up momentum for a new surge … and likely pointing the way to a far more powerful rally to new all-time highs later in 2010.

You can see the surge in the chart to the right. It’s a thrust higher that caught almost everyone off-guard.

But as far as I’m concerned, all of my technical and cyclical indicators tell me that we should expect many more sharp surges in gold this year.

But as far as I’m concerned, all of my technical and cyclical indicators tell me that we should expect many more sharp surges in gold this year.

Today, I’ll explain why. And I’ll give you a primer on how to use any and all price weakness you see in gold to prepare for the rallies … by using various ways to invest in gold. I’ll also show you some of the pitfalls to avoid.

It’s All about Bernanke Bullion

The primary cause of gold’s surge is fundamental and long-lasting: It’s also a major forecast of mine that not only have I been correct on for years now, but will also be a continuing major force for years to come:

The eventual recognition that Washington is financially broke beyond repair … the resulting inevitable collapse of the U.S. dollar’s purchasing power …

… the growing loss of confidence in governments, here and across the globe … the monetization of assets of all kinds to avoid deflation … and the prospects of eventual and inevitable rampant inflation instead.

And the man behind many of the above trends will be none other than Fed Chairman Ben Bernanke, who will most assuredly be reappointed to a second-term any day now.

Always keep in mind: More than any other central banker in the history of not just the U.S., but the entire world, Mr. Ben Bernanke believes in the ability — and duty — of monetary authorities to print money whenever they feel they need to. And as much fiat money as needed. Even if it’s an endless, infinite commitment to do so.

He’s from the camp that’s dreadfully afraid of deflation and prefers inflation at virtually any cost. Even if it means wiping out the value of the savings of tens of millions of innocent investors.

That’s why years ago I coined the term “Bernanke Bullion” — for gold, and how Ben Bernanke would like nothing more than to see the price of gold zoom higher.

Mind you though, you could say the same about almost any central banker today. And ultimately, it’s also why the gold standard has been banished from the world. But Bernanke’s hawkish aversion to deflation is far more severe than Wall Street seems to recognize.

How do we know?

A couple of years ago, Bernanke made it abundantly clear to the American public that, to maintain a minimum level of inflation, the Fed could virtually flood the economy with money, like “dropping money from helicopters.”

Hence his nickname “Helicopter Ben.”

To investors, this sends the message: “Never mind a collapse in the dollar! Never mind the trillions held by foreign investors that would flee the U.S. currency and rush into euros, Swiss francs, Japanese yen, gold, and other commodities! If that’s what it takes to create inflation and avoid deflation, so be it!”

Today, I may still be among the few that are talking about the dire implications of this message. But we’re certainly not the only ones who are getting it: A growing minority of smart investors see exactly what we see. And they are taking deliberate steps to protect themselves from the inevitable fall-out.

That’s why, I believe, that in the wake of the first few trading days of this year, and the prospects that Bernanke will soon be reappointed to a second term, gold looks like it can explode higher again this year, and easily reach new record highs.

I’m also continually reminded of the words penned by George Bernard Shaw …

“You have to choose between trusting to the natural stability of gold and the natural stability of the honesty and intelligence of the members of the government. And, with due respect to these gentlemen, I advise you to vote for gold.”

I agree. And in my Real Wealth Report, I have been recommending investors keep up to 6.25% of their total portfolio invested in gold bullion or the equivalent, with additional allocations to other alternatives to bullion.

For 2010, if you are not already invested in gold … or not invested in enough gold, I strongly recommend that you use any and all pullbacks in the yellow metal to get positioned for its eventual move to at least $2,300 an ounce, and quite possibly, much higher.

Here are the details …

How to Buy Gold

There are numerous ways. But let’s start with the most basic form: Physical gold bullion. The two most popular vehicles …

Gold bullion coins. Best examples: The American Eagle, Canadian Maple Leaf, and South African Krugerand.

Gold ingots and bars. Ingots are generally one ounce, but can be found in two- or three-ounce slabs as well. Bars generally come in sizes of five to 10 ounces, with the 10-ounce form the more readily available.

Either way, you can get significantly more gold for your money every time you buy simply by buying smartly!

For example, at today’s price of $1,130 per ounce, 100 ounces of gold is worth $113,000. But if you buy 100 of the one-ounce gold Canadian Maple Leafs, you’ll pay $121,124 for the same 100 ounces of gold content.

The additional $8,124 you pay for the Maple Leafs is the premium over the gold content. It’s the extra you pay essentially for the design and minting of the coin. And in this example, the premium is a hefty 7.19% ($8,124/$113,000 actual worth of gold content).

You can do better. A lot better!

Here’s how: Instead of buying 100 of the one-ounce Maple Leafs, buy a 100-ounce gold BAR for $114,050.

Then, with the money you’ve saved on the bar ($7,074), plus a few dollars extra, you can buy almost seven ounces more gold (using bullion coins or ingots).

The extra gold you get by purchasing smartly is a significant addition to your portfolio — a free bonus you get for investing intelligently.

That’s why I am one of the few who does not recommend buying gold bullion coins. They certainly can be beautiful to look at, but you pay a stiff price for the privilege.

The premiums are even worse for fractional gold bullion coins of less than one ounce, selling for a premium of as much as 35% or more over the price of gold. In general, the smaller the coin, the greater the premium.

|

| Gold bullion coins are tough to acquire. Ingots and bars are much easier to buy and store. |

Bottom line: For physical gold holdings, I recommend one-ounce ingots and 10- and 100-ounce bars. Also consider the internationally-traded 32.15-ounce kilo bars.

Moreover, bullion coins are tough to get today. So ingots and bars are much easier to buy, and easy to store (in your bank’s safe deposit box). Just make sure you are buying what is called “four nines fine” gold — the metal that’s .9999 (99.99%) pure gold.

The most common hallmarks are Johnson Matthey, Engelhard, Credit Suisse and Pamp. Most reputable dealers carry these ingots and bars in these hallmarks, or can readily acquire them for you.

Reliable Gold Dealers

Choose a dealer based primarily on the quality of the service, establishing a long-term relationship with one or two of the best, such as:

Dillon Gage, Inc. 15301 N. Dallas Parkway, Suite 200 Addison, TX 75001 1-800-375-4653 www.dillongage.com

FideliTrade 3601 N. Market Street Wilmington, DE 19802 1-800-223-1080 www.fidelitrade.com

And online, my favorite is …

www.kitco.com, phone 1-866-925-4826. No matter whom you buy from, protect yourself against the possibility, however small, that the dealer may have financial problems. There are two ways to do so, both depending on immediate delivery:

Cash-and-carry: You go to a dealer, give them cash, and pick up your gold. While they’re counting your paper, you’re counting their metal. Sight drafts: The dealer ships the gold to a bank of your choice. Once it’s delivered, you have the ability to inspect, verify authenticity, and accept or reject the shipment without qualification or explanation.

Only after you’re satisfied your banker has exactly what you ordered do you release the funds. The banker forwards the funds to the dealer and simultaneously releases the gold to you.

The specific way sight drafts are handled vary somewhat from dealer to dealer. Some don’t offer them at all. Others may require a minimum dollar order, from $5,000 to as much as $50,000. Still others may require no minimum dollar value.

How to Store Your Gold

For small purchases, I prefer the safe deposit box at my bank. It’s simple, safe and worry free. Even if the bank were to encounter financial difficulties, access to the safe deposit box would not be affected. I do not recommend storing any gold in your home or office.

For purchases beyond 100 or 200 ounces, use your dealer’s storage facility. But there are a few things you need to know …

Non-fungible storage is the best form of dealer storage — if you choose to leave your metal with a dealer.

Your bullion is labeled with your name as your specific property and stored separately from dealer assets. With non-fungible storage, your gold is not commingled with the bullion of others and I feel it’s the only type of dealer storage you can be fully comfortable with.

If your dealer doesn’t offer non-fungible storage, find another dealer who does.

Alternatives to Physical Gold

Always keep some physical gold close by. But for larger quantities, where storage is impractical, there are a number of ways to invest in gold while avoiding some of the hassles of storage and delivery:

Perth Mint Certificates (PMCs)

These are issued by Western Australia’s government-owned mint showing ownership of a certain amount of specified ounces of gold. Some advantages:

- The Perth certificate comes with a government guarantee carrying a triple-A rating from S&P

- When buying, specify you want “allocated” certificates, which is similar to the non-fungible storage I described above

- Your bullion is insured against fraud and theft by Lloyd’s of London

- There are no storage fees

- The certificates are transferable

- You can redeem your certificates at the mint

For quotes and info on Pert Mint Certificates, consider Kitco Bullion Dealers. You can get the latest on PMCs by visiting https://online.kitco.com/sellprice/selling.html and clicking on “Perth Mint Certificate” (in the middle of the brown bar near the top of the page).

Gold ETFs (Exchange-Traded Gold Funds)

Many fringe analysts are worried that gold ETFs will blow up some day in the future and not be available to deliver the gold they hold for their customers, if there’s a “gold run” on the ETF.

Ironically, the analysts who typically engage in this fear-mongering are also themselves gold dealers. So, there seems to be a huge conflict of interest in their scare tactics.

I do not worry about gold ETFs at all, and believe they are — by far and away — the best vehicle, and cheapest way, to owning gold. My two favorites …

1. The SPDR Gold Trust (GLD) 2. The iShares Comex Gold Trust (IAU)

Gold Mining Shares

Provided you pick the right ones, gold mining shares not only give you an indirect vehicle for investing in gold, they can also provide additional leverage and profit potential that goes far beyond what you can achieve with gold alone.

For example, let’s say it costs a mining company an average of $450 to produce each ounce of gold. With gold at $1,130 an ounce right now, the company’s profit margin is just $680 per ounce.

Now, watch what happens when the price of bullion rises say, 32% to $1,500 per ounce: The company’s profit margin jumps from $680 to $1,050, or by 54.4%.

This, in turn, can drive up its share price by many times more than the price of bullion. Therein lies the leverage you can achieve by buying the right shares.

One word of warning: If you own the wrong mining companies, you could be sorely disappointed.

Some will be unable to meet the gold demand, failing to capture a large portion of the profit opportunity.

Others, even now in gold’s clear bull market, continue to hedge gold prices, seeking to protect themselves from the decline by selling gold in the forward market or selling short gold futures. This could greatly reduce, or even wipe out, their profits for the year.

So to avoid disappointment, refer to my top six criteria for selecting what I believe to be the best gold mining shares. None are hard-and-fast rules. But all are critical factors to consider.

1. Low debt. I generally like mining companies that have less than 50 cents in long-term debt per dollar of stockholders’ equity.

2. Zero hedging. Stick with those that do not hedge their gold. After all, what’s the point of buying into a company’s gold to ride the bull market in the yellow metal when that same company has already sold most of its gold or production at today’s low prices, or worse, at yesterday’s even lower prices?!

3. Low cost. Conservative investors should focus on companies with production costs on the low side, less than say $500 per ounce. However, aggressive investors looking to take better advantage of the leverage I mentioned above can also consider companies with a higher production cost.

4. Healthy expansion. Companies that are expanding reserves via property acquisitions and more importantly, acquisition of junior gold miners.

5. Experienced management. I want to see management that demonstrates not only a solid track record of experience, but also talent for thinking outside the box, especially when it comes to the acquisition of hot properties.

6. Value. Don’t go strictly by P/E ratios. Mining shares should also be valued on the basis of their proven reserves. Generally, the lower the ratio of the company’s market cap compared to the value of its reserves, the better.

My 17 Favorite Mining Companies

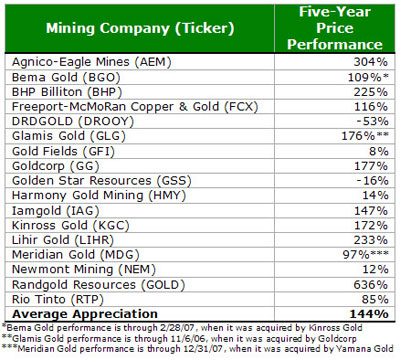

Based on these and other considerations, here are 17 mining companies that I first recommended more than five years ago … along with their five-year price performance.

|

10 of the 17 have enjoyed triple-digit gains.

Two have produced very high double-digit gains, while two others have spun off modest double-digit gains.

Average five-year appreciation, including the losers: 144%.

For specific buy, sell and hold gold recommendations, be sure to stay current with my latest issue of Real Wealth Report. (Click here if you’d like to subscribe.)

Stay tuned. 2010 promises to be a wild year for the markets, and immensely profitable for those in the know.

Best wishes,

Larry

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.