Stock Market Final Trading Hour Price Action Study

Stock-Markets / Stock Index Trading Jan 10, 2010 - 05:20 AM GMTBy: Piazzi

Once upon a midnight dreary, while I pondered, weak and weary,

Once upon a midnight dreary, while I pondered, weak and weary,

Over many a quaint and curious volume of forgotten lore--

While I nodded, nearly napping, suddenly there came a tapping,

As of some one gently rapping, rapping at my chamber door.

"'Tis some visitor," I muttered, "tapping at my chamber door--

Only this, and nothing more." -The Raven - Edgar Allan Poe

--------------------

I saw an owl up in a tree,

I looked at him, he looked at me;

I couldn't tell you of his size,

For all I saw were two big eyes;

As soon as I could, I made a dash

Straight home I ran, quick as a flash!

-Mr. Owl – Edna Hamilton

--------------------

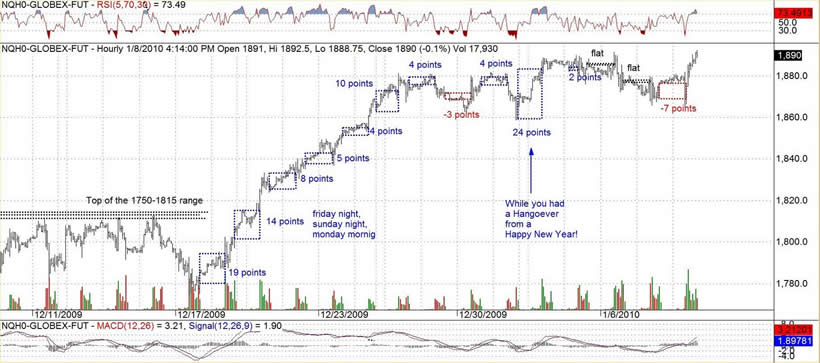

A lot of recent activity has happened in the off-hour sessions of the future markets. Some may say that those hours do not count for they lack volume. Well, let’s see how they count in terms of points

This is a 60-min chart of NDX March Minis

How about S&P 500 futures?

Not as wild, probably because NDX led the way out of the consolidation range and S&P just followed. Still, two good price expansions of 9 and 11 points happened off hours, and they both were jump starts of following rallies

There are all sorts of theories and claims as to who is bidding what, and my only comment is: So the Hell What?

If I am playing the market, a change in price, regardless of how it happens, affects me. So, for the sake of argument, assuming that what some say is correct and some group of elite traders are bidding the tape up on behalf of this or that political/financial entity, will that not imply that, to have the slightest chance of success, a short term trader may need to pay attention to the activities of those hours?

In the same vein, I am not quite sure how day traders who only use ETFs like QQQQ during regular NDX market hours deal with the situation of facing gaps all over the place. Even more mysterious to me is how a short term trader may take a market ETF home overnight without any chance of dumping it at 2:00 am NY time if need be.

I am not trying to say how the market should be played by anyone. I do not tell others what to do, never (read the disclaimer at the bottom of the main page of my blog). That is for the individual to decide. I am merely pointing out market conditions and asking some questions, that’s all.

It is what it, and, now that I wrote about it, it may be time for the market to change its behavior :-)

By Piazzi

http://markettime.blogspot.com/

I am a self taught market participant with more than 12 years of managing my own money. My main approach is to study macro level conditions affecting the markets, and then use technical analysis to either find opportunities or stay out of trouble. Staying out of trouble (a.k.a Loss) is more important to me than making profits. In addition to my self studies of the markets, I have studied Objective Elliott Wave (OEW) under tutorship of Tony Caldaro.

© 2010 Copyright Piazzi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.