Top 10 Personal Finance Tips For Students by Moneyfacts.co.uk

Personal_Finance / Student Finances Jul 25, 2007 - 09:10 AM GMTBy: MoneyFacts

Lisa Taylor, analyst at Moneyfacts.co.uk – the money search engine, comments:“With only a few weeks to go before the long awaited A’ Level results are published, some school leavers will be excitedly preparing to go off to university. As part of their new lifestyle, it may be the first time they have full control over their own finances, receiving lump sums, and having to pay bills. So getting it right financially can be one step towards surviving those student years.

Lisa Taylor, analyst at Moneyfacts.co.uk – the money search engine, comments:“With only a few weeks to go before the long awaited A’ Level results are published, some school leavers will be excitedly preparing to go off to university. As part of their new lifestyle, it may be the first time they have full control over their own finances, receiving lump sums, and having to pay bills. So getting it right financially can be one step towards surviving those student years.

“Even before the ink has dried on your A-Level certificates, students can expect to be targeted by the big banks to sign up for one of their student accounts. No wonder, really, given the earning potential that the average graduate can have - you’re hot property!

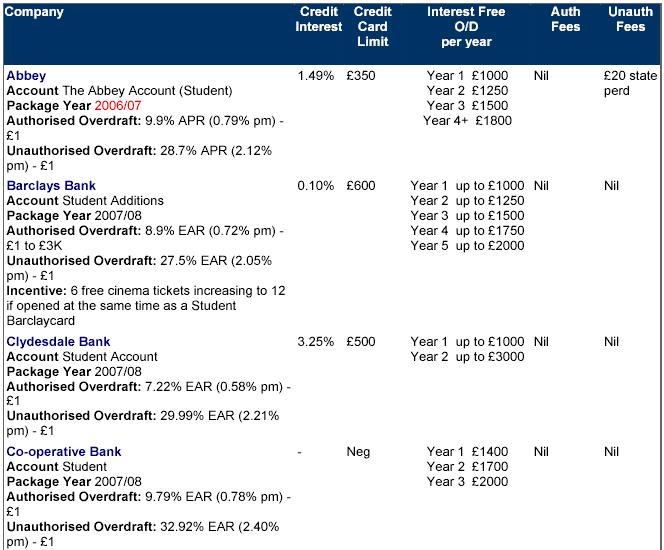

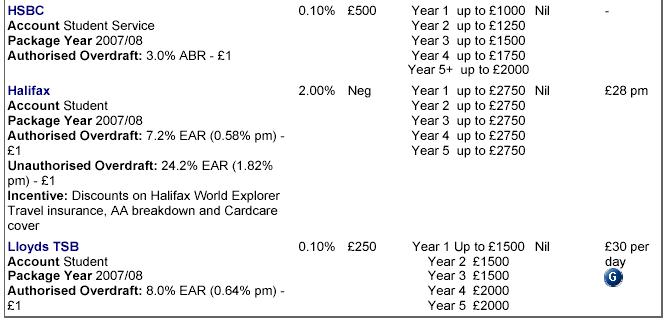

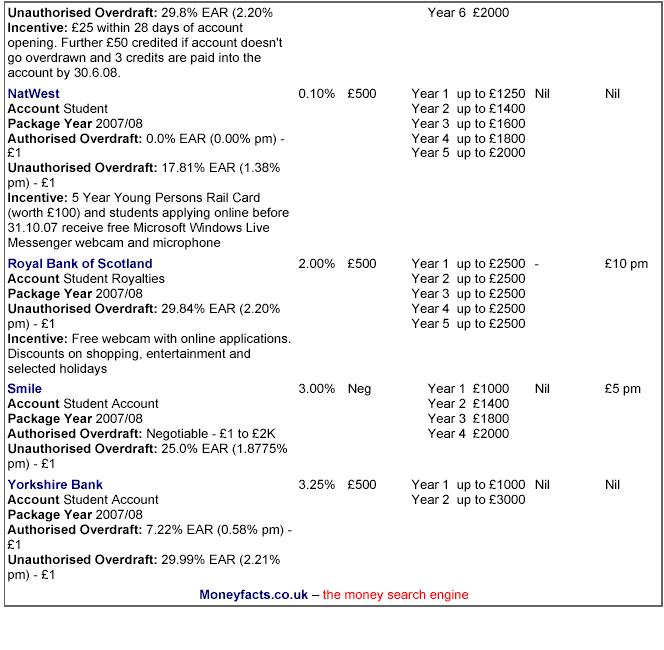

“In total 11 providers offer Student banking, all offering interest free overdrafts. But don’t be fooled into thinking that all student accounts are the same; this is definitely not the case.

Here are the Moneyfacts.co.uk top 10 financial tips for students :

1. Don’t be fooled by account incentives

“As a rule of thumb don’t be fooled by incentives, for most students your overdraft will be your lifeline, so make sure you get the best deal to help you survive, rather than some shiny new gadget. While free cinema tickets or discounted CDs may sound great, the offer of a rail card (NatWest) could save you a fortune if you intend using the train to get to and from

“Discount offers or incentives such as cinema tickets will last only five minutes or will only give you any benefit if you buy another one of the banks products. However once equipped with a NUS card, you will already have access to numerous student discounts and freebies.

“The cash incentive of up to £75 from Lloyds may also sound appealing, but £50 of this is tied up by some pretty stringent conditions. To qualify for the extra £50 you cannot go overdrawn and must pay in three credits to the account by 30.6.08. A good number of students, who would love to benefit from this small windfall, simply won’t be able to afford not to use their overdraft for three months.

2. Get the best student account for you

“So once you have steered away from the incentives, what should you be looking for in a student account?

“Of course this will vary from person to person, a handful of lucky students will be interested in the credit rate of interest, but for most it will be the overdraft facility which is the overriding factor.

“Halifax offers by far the highest overdraft facility, with up to £2,750 available from year one, compared with many others which tier upwards offering £1K in year one, but still not reaching £2,750 even in the fourth of fifth years of study.

“What must be remembered that the higher limits are often quoted as ‘up to’, so when you come to apply, if your credit rating is not A1 or you don’t match Halifax’s ‘perfect student’ score card, you may be offered a somewhat lower limit.

“The new structure of Lloyds TSBs overdraft may prove a little restrictive for the first year, with incremental rises up to a maximum of £1500 in three stages. Surely the first few months will make a major dent on your finances, with fresher’s week, books to buy and perhaps deposits to pay. You will also need to keep a close eye on your account, and remember when your limit is due to increase.

“Another important consideration is how near is your bank branch to your university or new home. Specialist student advice can be invaluable, and with a branch close at hand it’s that much easier to manage your money and speak with your bank.

3. Try to save some money this summer

“If you get to the opportunity to work this summer, try to put aside a little of your earnings for your future. Having even a small amount of savings will leave you in good stead for the start of university life. Especially as you won’t normally receive your first student loan payment until your first day at university.

“If you have not already invested your ISA allowance, a mini cash ISA can be a great place to hold your savings. Rates over 6% can easily be found – and remember this is tax free. Alternatively internet ‘no strings’ accounts from IceSave or Sainsbury’s Bank also offer very competitive rates at 6.20% and 6.25% respectively.

4. Set a budget

“It can be easy to let your spending run away with you, the odd twenty or thirty pounds here and there can soon mount up. And remember your overdraft limit is not bottomless and will also need to cover your bills too.

“This is possibly the first time you will need to manage household bills, and the easiest way is to write out a budget plan. Take into account all guaranteed income, and set this against your bills. Once you know exactly what your living costs are you will know how much ‘fun’ money you have to spend.

5. Spend your student loan wisely

“Remember your income from your student loan payments will have to last you several weeks, if not months. So spend this wisely, don’t blow it all in fresher’s week, and then only have thin air and own brand baked beans to live on for the rest of the semester.

“What can be more embarrassing than embarking on your independent student life, then having to grovel at the feet of ‘bank of mum and dad’ only a few weeks after leaving the nest.

6. Take care when opting for a credit card

“Most student banks will offer you a student credit card, with a limit typically around £500. However tempting a credit card can be – take it with caution. While the limits may be small, with no regular income even a few hundred pounds can be a struggle to repay, especially when the interest rates tend to be higher than average.

“If you do choose to take a credit card, use it to get the most competitive deals online, when travelling or in case of emergency – but don’t spend on it what you don’t have.

7. Check on your bank account regularly

“Make sure you keep a regular eye on your finances, it’s only too easy to lose track of your spending. The easiest way is to set up online banking, but do take care to ensure that when you are using a shared computer it’s a secure site and that you sign off fully when finished.

8. Don’t bury your head in the sand

“It’s not uncommon for students to face financial difficulties, but you should never bury your head in the sand. Specialist advisors in branch or even at your university can help with hardship advances and give you advice and guidance.

“If you are nearing your overdraft limit, then speak to your bank as soon as you can. Unauthorised borrowing can be expensive and may impact on their decision to help you in the future.

“If you let things get out of control, you must remember financial mistakes at university are not wiped clean, and they can come back to haunt you later in life.

9. Don’t put your finances at risk of fraud

“A Moneyfacts.co.uk survey in conjunction with the University of East Anglia, showed an alarming trend for students to be putting their finances at risk, by not following simple steps to protect their identity and money. Almost 70% insufficiently destroyed their card receipts or bank statements and almost half allowed other people to use their card and PIN.

“Living in shared accommodation you need to take extra precautions to protect your finances from fraud. Following a few simple steps can elevate the risk.

o Always destroy any mail, which includes your bank details. A shredder is a simple and cost effective solution.

o Don’t give your pin or card to anyone! If you are subjected to fraud in the future you will have to declare (and this can be taken to the police), that you are the only person with knowledge of your pin.

o Never write down your pin number, use your banks ATM to change it to a number you can remember.

o Have your cards, chequebooks and other banking information sent to your home address, especially if your mail is delivered to a pigeonhole in a communal area.

10. Make sure your are properly insured

“Specialist cover is available for students living in halls or shared accommodation, to protect your contents. Make you’re your level of cover is sufficient, and think about whether you need cover for other items such as bikes, which will be left on campus.”

Here is what’s on offer this year:

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.