Do NOT Trade Against This Indicator

Stock-Markets / Stock Index Trading Jan 06, 2010 - 10:39 AM GMTBy: Marty_Chenard

Increasing Product Demand, Higher Product Prices ...

Increasing Liquidity in the Market, Higher Stock Market Prices ...

Both are true if Supply remains the same or less. Some things like stock buyback programs reduce supply because shares are re-absorbed into their respective companies. We searched for on-going stock Buyback programs in effect for December and found 52.

This is not a huge number, but none-the-less, a good number. So the question is, "what is happening to Liquidity levels in the stock market?" Is Liquidity flowing in, or out?

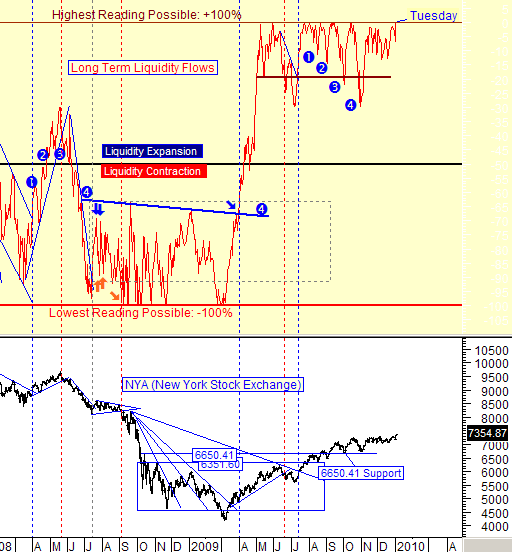

The answer is found in today's chart ... shown below.

The first two basics are: If Liquidity is in Expansion, the market goes up. If Liquidity is in Contraction, the market goes down.

The second two basics are: If Liquidity is moving up, stock prices have to increase. If Liquidity is moving down, stock prices have to decrease.

Common sense isn't it? Now, with those basics, take a look at today's chart and draw your own conclusion relative to "what Liquidity is doing in the market right now".

(Out of respect for our paid subscribers, today's chart is only shown occasionally as a courtesy to our free members. This chart is posted everyday on our paid subscriber site.)

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.