Forecast Trends for Gold, Silver, Dollar and Dow Still in Check

Stock-Markets / Financial Markets 2010 Jan 06, 2010 - 03:32 AM GMTBy: J_Derek_Blain

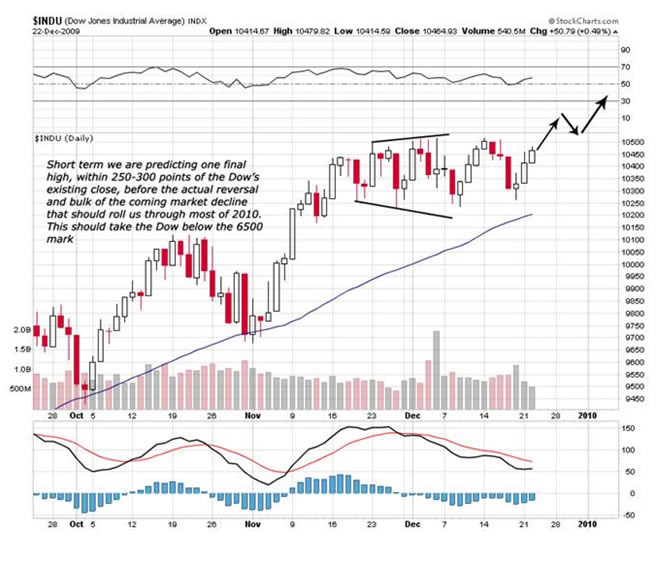

We posted the following chart in our last article:

We posted the following chart in our last article:

So far, the Down has indeed made a nominal move higher, followed by a shallow correction. Here is the updated chart, following roughly our projected timing:

Another final push in the Dow should mark the top of this bear-market rally's strength. Once the next major leg down in the market resumes, expect it to be strong and swift as all of the positive sentiment built since March 2009 quickly unwinds and becomes negative.

As per gold, the downtrend correction could take it as high as $1180 before a resumption of the major downtrend should eventually carry gold to around the $650/oz mark. Silver should also continue its downtrend within the next several trading days. The rapid near-$.40 spike intraday today could have marked the top for this correction. The major trend is down and we suggest trading with the trend - treat corrections as opportunities for entry points. We are not short any silver but are excited for the market low to accumulate the metal on the cheap and pick up some top producers at depressed price levels. We will keep you posted on our top pics as their price becomes attractive.

Gold's recent price action is a reversal of a 14-month uptrend:

Silver is exhibiting similar price action, with the compellingly-bearish non-confirmation of a higher-high on the recent price action relative to gold. Silver's high for the decade still stands at just under the $21.50 peg, its most recent high at just under $19.50.

The Bottom Line:

- The USD should finish its correction at our near the 77.00 level and resume its predominant uptrend

- Silver should finish its correction around the $18.00 - $18.50 mark and resume its predominant downtrend

- Gold should correct to $1,150 at most and resume its predominant downtrend

- The Dow should make its final high for this bear market rally sometime in January. We are anticipating another upward surge on a final wave of renewed optimism before a resumption of the long-term bear market. The secondary US markets should follow the Dow down to new lows for the bear market.

The trading potential here is fantastic, being at the forefront of major trends in almost every asset in North America. One must have nerves of steel to trade against the predominant optimism out there these days - but to possess those nerves and discipline can produce the utmost profits. Remember trade WITH the trend that has been established and look for corrections as a means of re-evaluating and possibly adding to positions, or making a later entry.

Look for exhaustive signals (similar to recent USD and Gold sentiments) to indicate an expiring trend, and get out while the getting is good.

Have a fantastic 2010, and may you be rewarded all that you deserve.

By: J. Derek Blain

© 2010 Copyright J. Derek Blain - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.