Bernanke Blames Congress for Financial Crisis

Politics / Credit Crisis 2010 Jan 04, 2010 - 02:39 AM GMTBy: Mike_Shedlock

Fed chairman Ben Bernanke is back at it again, pointing the crisis finger at everyone but himself. To be sure there are plenty of congressional clowns deserving of a Babe Ruth style "big point", but the biggest point belongs straight at himself.

Fed chairman Ben Bernanke is back at it again, pointing the crisis finger at everyone but himself. To be sure there are plenty of congressional clowns deserving of a Babe Ruth style "big point", but the biggest point belongs straight at himself.

Please consider Bernanke Blames Weak Regulation for Financial Crisis.

Regulatory failure, not lax monetary policy, was responsible for the housing bubble and subsequent financial crisis of the last decade, Ben S. Bernanke, the Federal Reserve chairman, said in a speech on Sunday.

“Stronger regulation and supervision aimed at problems with underwriting practices and lenders’ risk management would have been a more effective and surgical approach to constraining the housing bubble than a general increase in interest rates,” Mr. Bernanke, whose nomination for a second term awaits Senate confirmation, said in remarks to the American Economic Association.

Technical models based on historical trends in United States housing prices and monetary policy show that home prices rose much faster than interest rates alone would have predicted, Mr. Bernanke said.

He also argued that trends in other countries demonstrated a “quite weak” connection between housing price appreciation and monetary policy.Monetary Policy and the Housing Bubble

If you want to wade through 36 pages of self-serving claptrap, please consider Monetary Policy and the Housing Bubble by Ben Bernanke.

U.S. Monetary Policy, 2002-2006

The aggressive monetary policy response in 2002 and 2003 was motivated by two principal factors. First, although the recession technically ended in late 2001, the recovery remained quite weak and "jobless" into the latter part of 2003. Real gross domestic product (GDP), which normally grows above trend in the early stages of an economic expansion, rose at an average pace just above 2 percent in 2002 and the first half of 2003, a rate insufficient to halt continued increases in the unemployment rate, which peaked above 6 percent in the first half of 2003.

Second, the FOMC's policy response also reflected concerns about a possible unwelcome decline in inflation. Taking note of the painful experience of Japan, policymakers worried that the United States might sink into deflation and that, as one consequence, the FOMC's target interest rate might hit its zero lower bound, limiting the scope for further monetary accommodation. FOMC decisions during this period were informed by a strong consensus among researchers that, when faced with the risk of hitting the zero lower bound, policymakers should lower rates preemptively, thereby reducing the probability of ultimately being constrained by the lower bound on the policy interest rate.

...

All efforts should be made to strengthen our regulatory system to prevent a recurrence of the crisis, and to cushion the effects if another crisis occurs. However, if adequate reforms are not made, or if they are made but prove insufficient to prevent dangerous buildups of financial risks, we must remain open to using monetary policy as a supplementary tool for addressing those risks--proceeding cautiously and always keeping in mind the inherent difficulties of that approach. Clearly, we still have much to learn about how best to make monetary policy and to meet threats to financial stability in this new era. Maintaining flexibility and an open mind will be essential for successful policymaking as we feel our way forward.You will have to read the full text to see, but amazingly Bernanke is sticking with his Savings Glut theory as the reason for the housing bubble as if massive credit expansion in the US and monetary printing in China somehow constitutes a "savings glut".

Please see Bernanke Blames Saving Glut For Housing Bubble for a rebuttal of Bernanke's thesis. Bear in mind it is absolutely impossible to have too much savings.

Also bear in mind that "Two weeks into the job, Bernanke testified before Congress that it was a positive that the nation's homeownership rate had reached nearly 70 percent, in part because of subprime loans." (See Anatomy of a Meltdown for details).

Now Bernanke blames inadequate subprime regulation for the housing bubble.

Bernanke also takes refuge in the Taylor Rule although there is considerable disagreement over what it says. My take is the Taylor Rule is fatally flawed because it fails to take into consideration housing prices (asset prices in general).

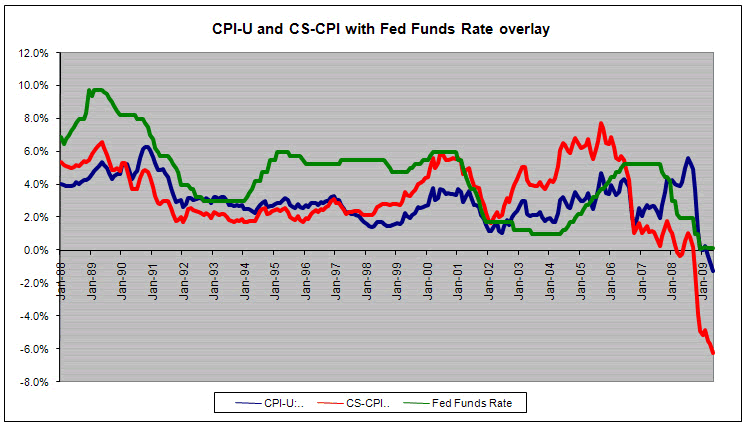

Watch what happens when the Case-Shiller Housing Index is substituted for OER in the CPI.

Case Shiller CPI vs. CPI-U

The above is from What's the Real CPI?

The Fed could have and should have acted to rein in property bubbles, but Bernanke is so dense he could not even see there was a property bubble.

Instead, Bernanke blames lack of regulation after initially praising the housing boom and subprime lending.

Fed Is The "Great Enabler"

Credit bubbles have their foundation in loose monetary policy that makes borrowing appear attractive. Those bubbles may manifest in the form of stock market bubbles as in the Nasdaq in 1997-2000 or housing in 2004-2007. Indeed the Fed is the "Great Enabler" of bubbles.

Just because bubbles do not form in the same way at the same time everywhere on the planet does not absolve the Fed from guilt.

Bernanke Incapable Of Learning

Bernanke has proven over time to be incapable of learning anything. He sticks with his theories no matter how flawed they are.

Here is a paragraph that proves it:

Is there any role for monetary policy in addressing bubbles? Economists have pointed out the practical problems with using monetary policy to pop asset price bubbles, and many of these were illustrated by the recent episode. Although the house price bubble appears obvious in retrospect--all bubbles appear obvious in retrospect--in its earlier stages, economists differed considerably about whether the increase in house prices was sustainable; or, if it was a bubble, whether the bubble was national or confined to a few local markets. Monetary policy is also a blunt tool, and interest rate increases in 2003 or 2004 sufficient to constrain the bubble could have seriously weakened the economy at just the time when the recovery from the previous recession was becoming established.

Any economist who could not see there was housing bubble brewing is straight up incompetent. That fact alone makes Bernanke incompetent. If the rest of the Fed could not see it, they are incompetent as well.

Moreover, in spite of the enormous crash we just went through, Bernanke is spouting nonsense about what might have happened if the Fed would have acted sooner in 2002 or 2003. How much damage does it take for Bernanke to admit the Fed blew it?

It is galling to read his self-serving platitudes.

Asymmetric Worries

If the Fed is so worried about using "blunt tools" then why is that worry so freaking asymmetric? Where was the concern in 1999 when Greenspan slashed rates over a ridiculous Y2K scare?

Where was the worry in 2002, 2003, 2004, 2005, 2006, or 2007?

Note how easily "blunt instrument" worries go out the window when there is a crisis or even perceived crisis. However, there is never a worry over the damage caused by holding rates too low, too long.

Bernanke, like Greenspan likes to blow bubbles. Bernanke, like Greenspan likes to blame others for his mistakes.

Bernanke's Magic Mirror

Without saying so directly, Bernanke just looked straight into the mirror, and pointed his finger not at himself, but rather at a reflection of Barney Frank for Congress' failure to regulate.

To be sure Fannie Mae and Freddie Mac made the problem much worse and we can thank Barney Frank in particular and Congress in general for that. We can also thank Barney Frank for countless other affordable housing schemes that made matters worse. Year in, year out, Barney Frank was one of the biggest congressional contributors to the mess.

Barney Frank surely deserves the finger, but not from hypocrites like Bernanke who fail to see their own bigger role in cresting this mess.

And so, with the help of Bernanke's magic mirror, this is the biggest case yet of the pot pointing the finger at the kettle, calling the kettle black.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.