Demise of The United States of America, An American Tragedy

Politics / US Politics Jan 04, 2010 - 12:39 AM GMTBy: Darryl_R_Schoon

The demise of a nation is often at the hands of others; and, whereas the usual suspects are its enemies, allies and friends cannot be ruled out.

The demise of a nation is often at the hands of others; and, whereas the usual suspects are its enemies, allies and friends cannot be ruled out.

The 20th century will be remembered as the century when America became a world power. World Wars I and II would decimate the then great powers of the world, e.g. England, Germany, Russia, France, Japan, etc., leaving the US as the last nation standing—the world’s sole superpower.

At mid-century, in 1950 the US would be the world’s banker, its only creditor and repository of the greatest hoard of gold in history; but in only 20 years most of the gold would be gone, the remaining owed but never paid and the US would soon become the world’s largest debtor, a virtual deadbeat who could only pay its debts by borrowing more.

The 21st century would speed America’s decline. In the first decade, the US would launch an expensive war in Iraq then Afghanistan, further destabilizing its already heavily indebted balance sheet; and by 2009, China and Japan, its primary creditors, would significantly slow their purchases of US debt, forcing the US to begin borrowing from itself in order to continue spending what it did not have.

When the creditor of last resort is the borrower, economic fundamentals will inevitably reassert themselves.

Since the 1950s, Americans have serially and collectively blamed communists, socialists, hippies, feminists, Mexicans, environmentalists, gays, abortion, entitlements, Japan, China, etc. for their mounting problems; and, like the veritable alcoholic, the real cause of its problems is always assiduously avoided.

It is little wonder that as America’s serial enemies have come and gone, America’s problems have increased. This is because the real cause of America’s problems is not others—America’s real problem is itself.

AMERICA’S DEFACTO RECALL OF THE AMERICAN REVOLUTION

America, if measured by the lofty ideals of its birth, is a failed experiment. The US Constitution is but another reminder that written words are no protection against future transgressions, that the lessons of one generation cannot be passed on to the next and that the desire to dominate others is alive and well even in freedom’s birthplace.

I have never been able to conceive how any rational being could propose happiness to himself from the exercise of power over others.

Thomas Jefferson

America’s founding fathers warned of the dangers the young republic would face. Thomas Jefferson, perhaps the greatest of America’s forbearers, saw those dangers clearly—the greatest being banks and standing armies.

I sincerely believe… that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale.

Thomas Jefferson in a letter to John Taylor, 1816

Were armies to be raised whenever a speck of war is visible in our horizon, we never should have been without them. Our resources would have been exhausted on dangers which never happened instead of being reserved for what is really to take place.

Thomas Jefferson: 6th Annual Message, 1806

Two hundred years after Jefferson’s prescient warnings, America has both the word’s largest banking establishment and the world’s costliest standing army. It would be America itself, not its perceived enemies, who would betray the lofty ideals of the American Revolution.

As a consequence, the US is now broke and indebted beyond its ability to repay. These circumstances did not come about by accident; and although the consequences are clear, the cause is not; as those who profited by America’s fall do not want the truth known—but, until it is, the tragic decline of America will continue…and accelerate.

THE QUIET COUP

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time.

The above words prefaced The Quiet Coup, an article in The Atlantic Magazine, May 2009, written by Simon Johnson, in 2007 and 2008 chief economist at the IMF and currently a professor of economics at MIT.

Johnson contends that a coup has occurred in America, that a financial oligarchy has taken control of the nation’s affairs and that America’s situation will soon worsen unless the power of that oligarchy is broken.

Johnson’s article is one that should be read by all; but, unfortunately, it will not as denial is preferable to the truth, especially in America where citizens would rather believe themselves free than realize they are not. Nonetheless, for those interested, Johnson’s article is at http://www.theatlantic.com/doc/200905/imf-advice.

In actuality, the financial oligarchy seized control in America long before the current crisis. The actual coup took place in 1913; and, by virtue of that coup and the consequent consolidation of its power, America’s demise was set in motion.

Almost one hundred years later, bled dry by the financial interests who seized power in 1913, America’s fall is almost complete. The coup of 1913 gave the banking interests who profited from the rise and fall of England’s empire access to the vast productivity of America; and like England before it, America’s wealth would be completely drained by the banker’s debt-based banknotes in less than a century.

BUBKES BANKNOTES AND POWER

Mao Tse-tung’s proverb, political power grows out of the barrel of a gun, may be true in certain circumstances but it is most certainly true that since 1694, global power has come from the ability of central banks such as the Bank of England to substitute capital, bubkes, i.e. credit and debt-based paper banknotes, for gold and silver and to take advantage of countries that did not.

Central banking was the secret of England’s two hundred year reign of imperialism that peaked in 1850. The revolt of England’s American colonies in 1776 was to be its only setback after the Bank of England, England’s central bank, gave the king of England the ability to wage war on credit in 1694.

The Bank of England’s ability to do so, of course, was a quid pro quo for the king’s allowing the Bank of England to issue its debt-based paper banknotes as money. The king got to wage unlimited war provided, of course, the king (and consequently the nation) repaid the Bank of England the principle and compounding interest on the sums owing.

This England was able to do as long as its empire grew. But, in 1850, England’s empire peaked. England’s trade balances went negative in the 1870s and by the end of the century England was a power in decline.

What happened next explains why America, too, is now a declining power, why America like England is indebted beyond its ability to repay, and why the US dollar has lost over 95% of its value since 1913—and will soon lose what little left remains.

THE COUP SUCCEEDS THE US SUCCUMBS

In 1913, the US was the victim of a coup that bestowed upon it the failings of a falling empire. That coup occurred when US corporate and banking interests and President Woodrow Wilson established the Federal Reserve Bank in America, a central bank owned by private bankers that would henceforth control the nation’s money supply and, ultimately, its destiny—as Thomas Jefferson had earlier warned.

The establishment of the Federal Reserve Bank in 1913 brought England’s debt-based monetary system to the US. The Federal Reserve Bank was a carbon copy of England’s central bank, the Bank of England. Central banking lies at the core of capitalism and is both its blessing and its curse. The blessing, credit, comes first and debt, its curse, comes later.

In capitalist economies, central bank debt-based banknotes circulate as capital and are treated equally as money. Capitalism, in actuality, is any economic system where capital, i.e. credit and debt, replaces savings as the primary source of economic growth.

As Jefferson noted: The art and mystery of banks....is [that] private debts, called bank notes, become active capital, and … instead of paying, they receive an interest on what they owe from those to whom they owe; for all the notes, or evidences of what they owe, which we see in circulation, have been lent to somebody on an interest which is levied again on us through the medium of commerce.

In capitalist economies, debt-based banknotes are the accepted medium of exchange, i.e. money, and through the use of such “capital”, debt is introduced into all areas of commerce and social intercourse; thus enabling bankers to profit from the levying of interest accruing from all commercial and societal activities.

Thomas Jefferson understood that this monetary sleight-of-hand would eventually bankrupt society; and although the American Revolution was successful in banishing England’s debt-based banknotes in 1776; the coup of 1913 returned England’s debt-based banknotes to America in the form of US Federal Reserve notes and US dollars.

The rest is history—or soon will be.

THE COUP AND THE CONSOLIDATION OF POWER

The financial oligarchy that took power in 1913 has since consolidated its control in America by the subversion of the democratic process. This it did by exploiting the division that naturally exists between conservatives and liberals.

By expertly baiting each against the other, the social divide between the two has increased exponentially as have the profits of bankers. This is not by coincidence. It is by design.

As America’s attention was increasingly diverted to hot-button social issues, laws were passed during both Republican and Democratic administrations that would give the financial industry unlimited access to America’s savings with minimal oversight and virtual immunity from criminal prosecution.

Republicans loved Ronald Reagan as Democrats loved Bill Clinton and, later, Barack Obama with the same result. All three rallied their political constituencies and expertly diverted their attention as America’s financial oligarchy plundered the nation’s wealth.

Though politicians may speak with the tongues of angels, they are not

The financial industry’s consolidation of power in America began with Ronald Reagan. As Simon Johnson writes in The Quiet Coup [The rise of the financial sector] began with the Reagan years, and it only gained strength with the deregulatory policies of the Clinton and George W. Bush administrations…From 1973 to 1985, the financial sector never earned more than 16 percent of domestic corporate profits. In 1986, that figure reached 19 percent. In the 1990s, it oscillated between 21 percent and 30 percent…This decade it reached 41 percent. http://www.theatlantic.com/doc/200905/imf-advice

It was, however, during the Democratic administration of Bill Clinton, that the financial industry gained its greatest foothold in Washington DC. The nation’s capital and the nation itself would never be the same after Wall Street bank, Goldman Sachs, bought off the Democratic opposition and, along with it, the keys to the US Treasury.

AN AMERICAN TRAGEDY

Americans still do not understand the significance of what has happened. The tragedy of America is that Americans see the present crisis in material terms. Americans still believe they are facing a crisis that can be cured with more jobs, more credit, a rising stock market and perhaps, God willing, another bubble to rescue them from the last.

Today, as long as Americans qualify for a loan they believe themselves free. They also believe themselves better than those who do not qualify…at least until they no longer qualify themselves.

America long ago chose material security over liberty; but now that its material security is threatened and its liberties gone, it is clear America chose badly. Still, Americans prefer to imagine themselves as heroic, capable of understanding and overcoming life’s myriad challenges, unique in their ability to do so.

But, today, America’s founding fathers are nowhere to be found, its political process a cesspool of corruption and its treasury increasingly filled with IOUs issued to itself. Today, the America of 1776 is but a faded memory Americans use to soothe themselves in their now troubled sleep.

Dream on, America, dream on. But if you want to survive, you’d better wake up—and soon.

GOLD’S RISE PAPER’S DEMISE

Ten years ago the price of gold was $300 per ounce and the economic power of the US was unchallenged. Today, gold is $1100 per ounce and the US and global economy is on government life-support.

We are at the end of a three-hundred year era of global expansion and exploitation made possible by central banking’s fraudulent banknotes. That the fraud lasted 300 years is remarkable. That it is now ending is to be expected. Nothing lasts forever, not even a well-constructed fraud—ask Bernie Madoff.

The banker’s banknotes could not have gained a foothold had not they purported to be “as good as gold” (anyone remember the gold standard?). The banknotes were always bubkes, worthless, but as long as they were nominally convertible to gold, they were accepted.

Now, paper banknotes are no longer convertible. They are simply government-issued coupons with expiration dates written in invisible ink. The banker’s long-running confidence game that produced imperialism then globalization, however, is about to end—and the freedom from economic tyranny envisioned by America’s forefathers may again soon be possible.

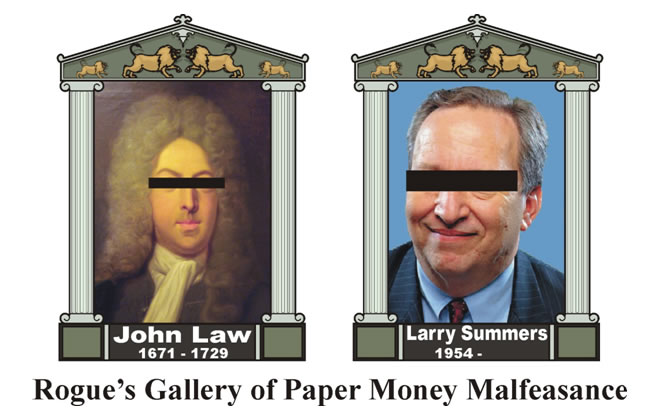

JOHN Law’s Legacy and summers’ end

John Law (1671-1729), Scottish economist and banker, is credited by some as being the “father of paper money”, a rather dubious accolade, but if John Law is to share in the paternity of paper money it is only so in the West as in the East paper money had circulated in China several centuries before it did in the West.

Nonetheless, Law did leave his mark on monetary history. In the 1700s, Law proposed to stimulate industry by replacing gold with paper credit and then increasing the supply of credit, and to reduce the national debt by replacing it with shares in economic ventures… Though they ultimately failed, [Law’s] theories were 300 years ahead of their time.

http://en.wikipedia.org/wiki/John_Law_(economist)

John Law believed that money need not possess any intrinsic value, that “money” was only a means of exchange, a view later promoted by Milton Friedman. But Law’s theories about paper money and credit would bring financial ruin to many in his lifetime just as they would in the future.

In a significant way, John Law shares many attributes with current monetary theorist and economist, Lawrence Summers. For just as Law’s theories would end in disaster in 18th century France, Summers’ theories are about to prove just as disastrous in 21st century America.

Both men were considered brilliant although clever is a far more appropriate description. Between 1715 and 1720 John Law’s paper money and issuance of credit led to the speculative Mississippi Bubble whose collapse brought the French monarchy to its knees.

Today, Larry Summers is playing a similar role in America’s finances. Summers, along with Alan Greenspan and Robert Rubin, is responsible for the toxic and explosive brew of financial derivatives that now threatens financial markets.

In addition, Summers is also currently the White House Director of the National Economic Council and a standing member of the financial oligarchy that Simon Johnson credits with being responsible for America’s financial crisis.

Summers inside high ranking position at the Obama White House insures the continued power of the financial oligarchy in America, an oligarchy that Johnson says must be removed if America is to avoid another depression.

Summer’s presence in the Obama White House is our assurance that the depression will happen; and, when it does, it is possible that such a depression will destroy not only America’s economy but the two-party system that has allowed the financial oligarchy to dominate the nation.

John Law’s destructive influence on the economy of France is credited by many with destroying the French monarchy. We should be so lucky if Larry Summers’ similarly destructive influence brings about the destruction of the financial oligarchy that has ruled America since 1913.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.