Change in The Old Order Impact on Financial Markets and Gold

Politics / Gold and Silver 2010 Jan 04, 2010 - 12:19 AM GMTBy: Howard_Katz

“The old order changeth, yielding place to new,

“The old order changeth, yielding place to new,

And God fulfills himself in many ways,

Lest one good custom should corrupt the world.” Alfred Lord Tennyson, “The Death Of Arthur.”

“The Death of Arthur” takes place in the 6th century A.D., but Tennyson wrote it in the late 19th century, and the idea he expresses is a 19th century idea. It is the theme for this first article of 2010 because evidence is coming in that, in the US today, the old order is changing. If this proves correct for the US, then similar implications may apply for the remainder of the world.

The change of the old order has important implications for the financial markets in general and for the gold market in particular for the simple reason that politics affects economics. The reason that gold exploded in the 1970s is that it was suppressed in price by the US Government for 35 years. During this time, the US kept printing more and more money (more politics) thus reducing the value of its currency, and the explosion of the gold price of the 1970s was required to correct the corresponding undervaluation of gold. Similarly, recent Administrations have so increased our budget deficits that a new word is being used to describe them. The older generation remembers Everett Dirkson’s comment, “A million dollars here, a million there, pretty soon it adds up to real money. That was funny in the 1960s, but to update it to today would require substitution of “trillion.” And that is why gold is now in a second explosion which bodes big profits for gold bugs. As Jim Dines says, “Living well is the best revenge.”

As you all know, in September gold broke out above $1,000 and carried through to $1,200. It is now making a pull back and the central short term question is will the pull back carry all the way to $1,000, or will it stop short of that point? That question is being addressed in the pages of my newsletter, the One-handed Economist. However, there is a bigger picture containing slower moving events, and the current article is devoted to this longer range view.

So when I point 9ut that the old order changeth, I am referring to this bigger picture. The old order, of course, is the New Deal, which entered the US in 1933. However, this same system came to several European countries earlier and first started in Germany in 1881 (with the enactment of socialized medicine).

What is changing about the New Deal is that the coalition which has supported it for the past 77 years is breaking down. This was a coalition between intellectuals and working people under the aegis of the Democratic Party. Its declared philosophy was, “Rob from the rich to give to the poor.”

But the New Dealers had no intention to rob from the rich. The rich were their friends. The rich donated to their campaigns. So they devised another, more practical system to give to the rich. This was the system of paper money. On the night of March 9, 1933, his very first day in office, FDR rammed a bill through Congress to give the commercial bankers the privilege to create money out of nothing. There were no hearings, and members of the House of Representatives did not have printed copies of the bill to read before they voted. Nevertheless, like a bunch of blind, dumb sheep they voted, “baa, baa, baa.”

T0 understand the New Deal, it is useful to see the 1943 movie, “Woman of the Year,” starring Spencer Trace (who plays Sam) and Katherine Hepburn (who plays Tess). Sam is a sports reporter on a New York daily newspaper. Tess is a political reporter for the same paper. They meet and fall in love. Tess represents the New Deal intellectuals. . Sam represents the average Democratic voter, who is more interested in baseball or football than in who is representing him in Congress.

What the New Deal did was encourage the commercial bankers to create more and more money. The bankers then lent this money to the big corporations who were their best clients. The resulting expansion of both money and credit caused a rise in the stock market. (US stocks multiplied by over 2½ times from the campaign of 1932 to the end of FDR’s first year. They had reach a multiple of 4½ times by the end of his first term.) FDR knew exactly how the system operated. He had been the manager of a vulture fund on Wall Street in the 1920s. He had seen how the money/credit expansion of WWI had made the stock market go up and his buddies rich. (“Vulture” is Wall Street slang for those among them who adopt the least ethical and most money-hungry practices staying just barely on the right side of the law.)

The key to understanding the New Deal is in the character of Sam. Sam is a regular guy. He spends his time on sports and hardly ever thinks a thought about politics. When the New Deal intellectuals told Sam that the Democratic Party was the party of the working man, he believed. (Of course, the conservatives of that day were so stupid that they never made any effective counters. Sam did not know then and still does not know today that the Government was assisting the bankers to make prices go up and the real value of his wages go down

Indeed, this was stated quite explicitly by John Maynard Keynes, who noted that, when nominal wages went up, real wages were going down (because prices were ging up faster). Thus it was possible to rob the working man without his even knowing that he was being robbed. That game went on from 1933.

This is why it is so important to be a gold bug and to resist the lies of the political left. The people who take refuge in gold cannot be robbed by the bankers. They are immune. Meanwhile Sam’s wages have been falling in real terms. This is the first generation in American history which has seen a fall in its real wages.

If you follow the gold bug sites, then you have probably come across references to the depreciation of the German mark in 1914-23. It went a trillion for one, and the German middle class was whipped out. But all of these references miss the important point. The important lesson of the depreciation of the German mark in 1923 was that the German people took it. They did not rebel against their government. They did not even vote it out of office. They did not even demand a gold standard. They didn’t have the guts to stand up for their own rights, and soon they had set out on a great quest to violate the rights of the rest of the world.

That was the key lesson which impressed itself on the leftist intellectuals of the 1920s. The people were so docile and stupid that you could rob them blind and take all their savings, and they would bow down to you and kiss your feet. That has been the policy of the left ever since.

Furthermore, it has to be understood that the party which is against the left is not the right. There is virtually no political right in America and has not been throughout American history. The political right consists of people like Adolf Hitler. In each case, a powerful left-wing movement rises in a country and operates by provoking its opposite. In reaction to this powerful left, a powerful right emerges. Then the leftists convert over to the right, and the right wins the final battle. Hitler, for example, started out on the political left and ended on the political right. The same is true of Mussolini, Pol Pot and Jim Jones (and Napoleon Bonaparte and Augustus Caesar)

The real opposition to the left (and right) is the classical liberal movement. The word liberal has always meant someone who was in favor of liberty, and to call modern leftists (like Obama) liberals is an out and out lie. I am a liberal, and I hope you are too.

But in 2008, the New Dealers in America made a dramatic mistake. They championed legislation to rob $750 billion from the American people and give it to Wall Street and the banks. Here for the first time in the 75-year history of the New Deal they openly admitted being pro-banker.

Now the New Deal has betrayed the working man over and over through the past 76 years. But not until 2008 did the working man figure it out. The system seemed destined to go on for a long time until Henry Paulson opened his big mouth.

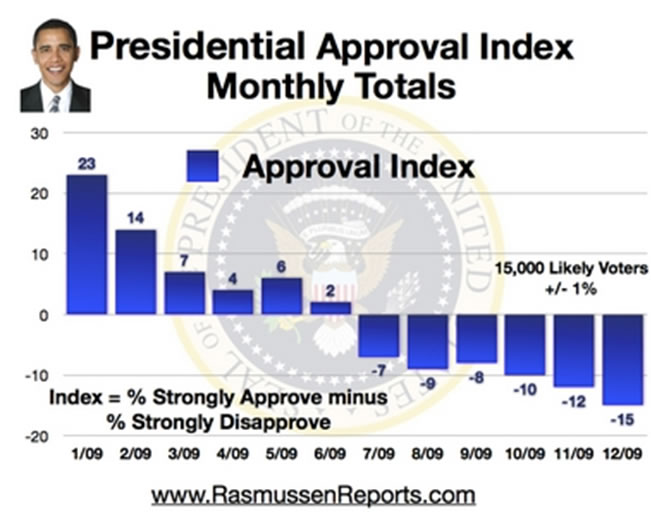

I have seen left-wing initiatives of the most inane sort past muster in American politics. In each case, the blue collar Democrats stood behind their party (which was robbing them blind). According to the Rasmussen polls, Obama’s approval rating has collapsed from +23% during the traditional honeymoon period down to -15% at the end of December (and is -18% at present). Obama’s socialized medicine proposal is running behind in public opinion by 40% (in favor) to 60% (opposed). Sen. Nelson of Nevada (who sold his vote to Obama for political favors) is running behind his likely Republican opponent 30% to 60%. (He was elected in 2006 with 64% of the vote when socialized medicine was not an issue.

What is very dramatic about these poll numbers is that they just keep getting worse. Obama is described as a good speaker, but every time he opens his mouth his standing in the polls goes down. Everyone who is associated with him suffers the same fate. As noted, in every previous case where the left would advance some absurd proposal its blue collar supporters would find excuse after excuse to keep on supporting it. But today they are deserting in droves. Furthermore, when the polls focus on intensity of feeling, they are even more anti-Obama.

The surprising thing is that, although Democratic politicians have no concept whatsoever how to run the country, they usually show good common sense as to whether an issue will work in their favor. The last time they brought up socialized medicine was in 1993-94, and they suffered a humiliating defeat. But even then the pre-election polls were not so bad. It was only during the actual campaign that voters shifted against them. This time the voters are shifting much earlier.

In sum, there is a strong possibility that we are seeing the death throes of the New Deal and that it will no longer be possible in America to base a political movement on the principle of robbery.

What this means is that, at some point in the future, gold will no longer be necessary to protect yourself from the depreciation of the currency. However, don’t try to anticipate this point in advance. The gold market has just started to discount the money which was created out of nothing in the autumn of 2008. It also has to discount the money which was created in 2009, and it is almost certain that another large block of money will be created in 2010. At the end of 2010, we will know how much money has been created and how much of a political setback has been given to the paper money forces. Right now gold has definitely not discounted the events of the past year-and-a-quarter, not by a long shot.

But big events are unfolding. The old order is changing, and a new order (hopefully a better one) looks likely to take its place. My job with the One-handed Economist is to evaluate this new situation and use it to make predictions to your financial benefit. If you are interested in subscribing via regular mail, then send $300 (1 year) to The One-handed Economist, 614 Nashua St. #122, Milford, N.H. 03055. If you want to use the computer, then visit my web site, www.thegoldspeculator.com and press the paypal button.

© 2010 Copyright Howard S. Katz - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.