Labour's 10 Year Economic Boom Evaporated into an Even Bigger Bust

Economics / Recession 2008 - 2010 Dec 28, 2009 - 10:41 PM GMTBy: Nadeem_Walayat

This article is part of in-depth analysis that will conclude in a forecast for the UK economy for 2010 and 2011 and which follows the completion of the forecast for UK CPI inflation 2010 , which will be followed by the UK interest rate forecast for 2010 later this week. The whole scenario and implications of will be published as an ebook that I will make available for FREE, ensure you are subscribed to my always free newsletter to get the completed scenario in your email box and check current analysis at http://www.walayatstreet.com.

This article is part of in-depth analysis that will conclude in a forecast for the UK economy for 2010 and 2011 and which follows the completion of the forecast for UK CPI inflation 2010 , which will be followed by the UK interest rate forecast for 2010 later this week. The whole scenario and implications of will be published as an ebook that I will make available for FREE, ensure you are subscribed to my always free newsletter to get the completed scenario in your email box and check current analysis at http://www.walayatstreet.com.

Labour's 10 Year Economic Boom Evaporated into an Even Bigger Bust

John Majors Conservative government handed the New Labour government a lean mean economic growth machine back in 1997, which during the first 2 years of the new government the Labour party managed to restrain its traditionally tendencies of wasting money by sticking to strict limits on government spending. However increasingly following these first two years, the Labour party let rip with out of control public sector spending with a vengeance on the back of North Sea Oil revenues and the Casino Banking Sector profits that ensured that Britain skipped the Dot Com / Sept 11th recession of 2001-2002 that hit many other countries including the United States.

Unfortunately both Tony Blair and Gordon Brown took this as a sign that they had acquired the midas touch, thus further escalating spending on the public sector that despite booming revenues from fictitious profits from the mark to market banking sector (for the purpose of paying huge bonuses) the Labour Government repeatedly broke its own Golden rules of balancing the countries finances over an economic cycle. If Labour had stuck to its own rules during the good times as they had repeatedly promised the electorate at each election then Britain would not now be peering over the financial abyss of an hyper-inflationary debt spiral.

NHS Spending Black Hole

This out of control public sector spending is no better illustrated than the more than tripling of the NHS budget from £37 billion to more than £120 billion, which ignited a Gordon Gecko style greed is good ethos that gripped the NHS and wider public sector that sought to not only match the private sector in terms of pay but beat when pension entitlements are taken into account.

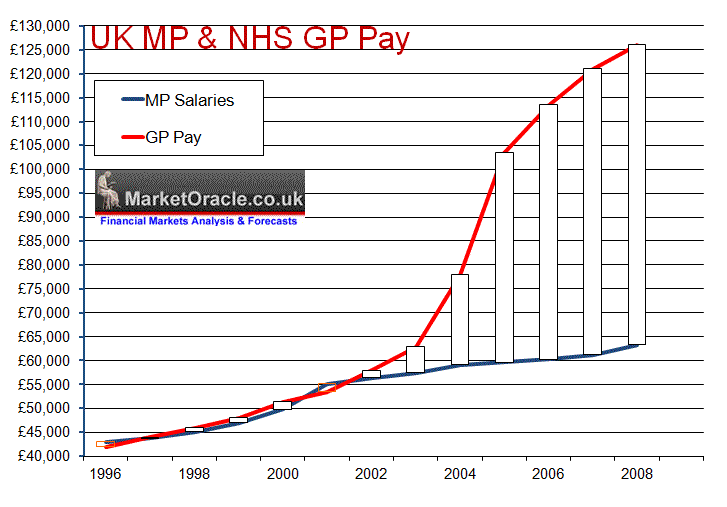

GP Pay illustrates the greed factor more than anything else that contributed towards the 2009 MP Expenses Scandal. When New Labour came to power in 1997 average MP pay was £43,722 against average NHS GP pay of £44,000, so both were inline with one another at that time. However as the below graph clearly illustrates in 2003 something started to go seriously wrong with GP Pay which took off into the stratosphere as GP's decided to award themselves pay hikes of more than 30% per annum at tax payers expense that has lifted average GP pay to over £126,000 per annum against £64,000 for MP's.

This was as a consequence of the now infamous GP contracts where basically devious greedy GP's hoodwinked a gullible incompetent Labour government health ministers into signing up to contracts which were meant to deliver greater value for money for the tax payer but were instead designed to do the opposite and resulted in GP's pay doubling whilst at the same time cutting back on hours worked. This was not only a total fiasco for the nations health and finances but also ignited jealousy amongst MP's that directly led to the adoption of the policy of claiming expenses to the maximum so as to fill the ever widening gap between MP's and NHS GP's, as MP's could NOT get away with awarding themselves pay hikes of 30% per annum without losing their seats at the next general election in response to voter outcry, therefore across the board systematic abuse of expenses started to take place which basically means real average MP pay is currently approx £98,000 per annum.

This example illustrates why the Labour party appears destined to leave office with the economy left in the worst state since any time since the Second World War. No British Government since WW2 has ran an annual budget deficit of 15% of GDP and it is this deficit as a consequence of the public sector spending black hole that the next Government will have to come to grips with which implies deep spending cuts of as much as 10% or £60 billion.

Debt Fuelled Economic Recovery

UK GDP for the 3rd Quarter was revised marginally higher to minus 0.2% from the earlier ONS estimate of minus 0.3%. The GDP trend for the UK economy for 2009 has been accurately mapped out in the in depth analysis and forecast of 17th February 2009 (UK Recession Watch- Britain's Great Depression?), that both called for severe peak to trough economic contraction of -6.3% at a time when the likes of the UK Treasury were forecasting contraction of less than half at -3%. The analysis also concluded in a strong debt fuelled economic recovery during 2010 to coincide with a summer 2010 General Election. As of the revised ONS GDP data (ABMI Chain linked at Market Prices) total peak to trough contraction is now 6.23% virtually exactly inline with the forecast for -6.3%. Annualised contraction for the third quarter is at -4.56% with trend on target for -4.75% for the fourth quarter.

The UK economy remains on track to bounce back strongly during 2010, as indicated by June's in depth analysis, however this economic recovery is based largely on debt, as the Labour government's strategy is to deliver the next Conservative government a scorched earth economy.

The UK GDP in-depth analysis will seek to update and forecast the UK economy at least 2 years forward. To ensure you the analysis and forecast in your email in-box ensure you are subscribed to my always free newsletter.

Source: http://www.marketoracle.co.uk/Article16110.html

By Nadeem Walayat

http://www.marketoracle.co.uk

Copyright © 2005-09 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis specialises on the housing market and interest rates. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 500 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.