US Dollar Threatens to Break Key Support Level

Currencies / US Dollar Jul 23, 2007 - 01:20 AM GMTBy: Donald_W_Dony

After over five years of relentless decline, the worlds reserve currency appears now set to break the last important price support of $0.80. This level has proven several times in the past to provide well-needed support whenever the dollar has reached that line. Since the 1980s, the dollar has hit $0.80 six times and then strongly bounced from that level. However, technical evidence now indicates that the Greenback is likely to penetrate this line-in-the-sand for the first time over the next few weeks.

After over five years of relentless decline, the worlds reserve currency appears now set to break the last important price support of $0.80. This level has proven several times in the past to provide well-needed support whenever the dollar has reached that line. Since the 1980s, the dollar has hit $0.80 six times and then strongly bounced from that level. However, technical evidence now indicates that the Greenback is likely to penetrate this line-in-the-sand for the first time over the next few weeks.

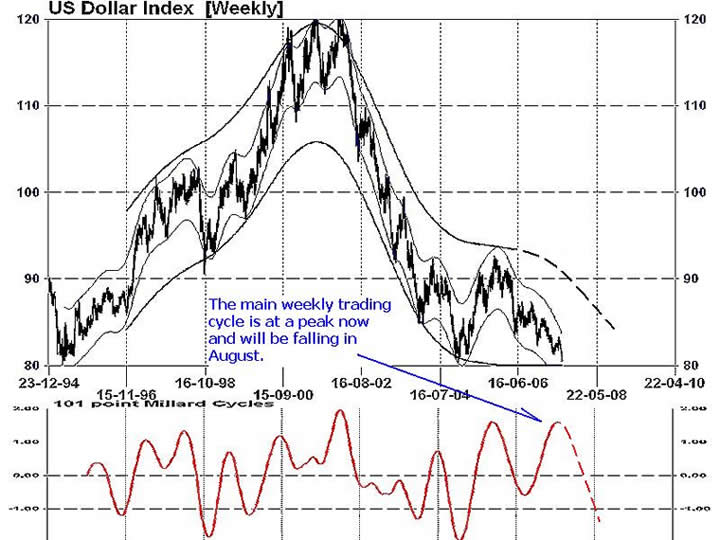

The U.S. dollar has fallen victim to increasing capital spending for over a decade which has created the largest U.S. trade deficit in history. Policy makers, both past and present since mid-1990, have remained steadfast in their fiscal approach along with stable to decreased revenue from taxation. This combination has plunged the dollar (Chart 1) from over $1.20 in 2000 to its current $0.80, a loss of over 33%.

Technically, the dollar appears very vulnerable at its present price. The lower portion of Chart 1 illustrates the long-term trading cycle of the dollar. This repeating pattern is currently rolling over which indicates a greater probability of lower numbers in the second half of 2007.

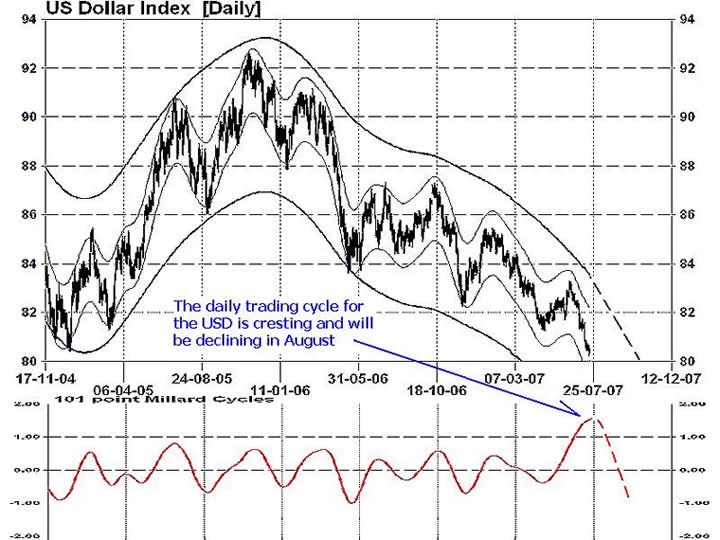

In Chart 2, the shorter-term daily view of the currency confirms the longer weekly chart. The average 14 week trading cycle (lower portion of Chart 2) has peaked in July and will decline throughout August and September. This means weakness for the dollar is expected to remain prevalent in the 3rd quarter.

Though the massive trade deficit alone will keep continued downward pressure on the currency, the Greenback now faces another enemy which are competitive interest yields. Many central banks around the world are now gradually raising their rates to help control inflation in their countries. This escalation makes other major currencies more attractive verses the U.S. dollar. The Fed, however, is not prepared to increase rates presently for fear of stalling the economy. This action maybe the final straw that pushes the worlds reserve currency to a new depth.

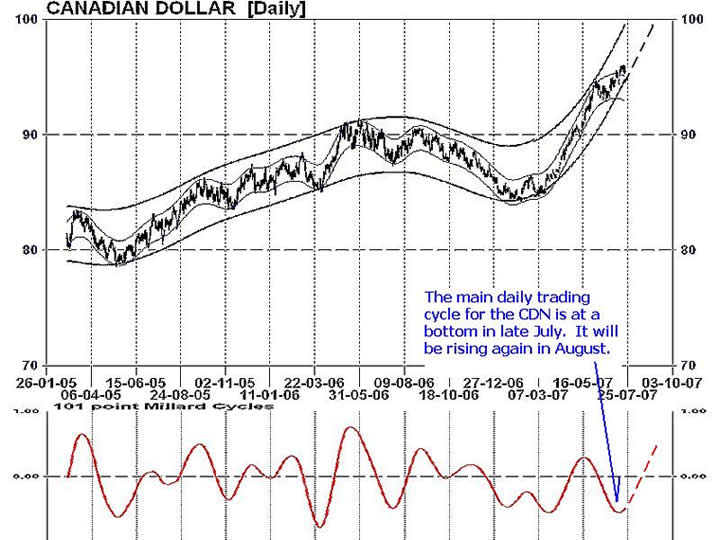

Another perspective of analysing the American greenback is by reviewing other currencies. As the U.S. dollar often trades in the opposite direction to world currencies, examining strengths or weaknesses can help forecast the future direction of the dollar.

Chart 3 of the Canadian dollar points to renewed upward pressure starting in late July with a target of $0.97. This would add to the evidence of lower values for the USD in the coming weeks.

Intermarket Perspective: Should the U.S. dollar break through the final support level of $0.08, this market action will affect the prices of commodities by increasing their value. Oil, industrial metals and particularly gold will have upward pressure on pricing as the American currency declines.

Most major currencies should also amplify against the dollar. The Euro, Swiss Franc, Pound, Australian and Canadian dollar and can be expected to continue their current rising trend.

A declining currency helps fuel inflation by increasing the cost of imports. This can range from food, clothing, automobiles and homes. Steady inflationary pressures also apply upward force to bond yields and mortgages which, over time, can impede economic growth.

My Conclusions:

Long standing fundamental evidence has pointed to weakness with the American currency since 2000. Technical data now suggests that the last key price support line of $0.80 is likely to be broken soon. As there are no established price support levels below $0.80, the percentage of decline maybe unpredictable.

Your comments are always welcomed. More research is available in the latest July newsletter. Go to www.technicalspeculator.com and click on member login.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.